The Next Decade: Trends and Shifts in Trust and Estate Planning

Delve into the evolving landscape of trust and estate planning over the past three decades, exploring concerns of the past and emerging trends for the future. From regulatory changes to AML policy developments and international declarations, the presentation highlights key shifts impacting the industry. Discover the journey from discreet offshore structures to a focus on transparency, tax compliance, and beneficial ownership disclosures, reflecting a paradigm shift towards accountability and global cooperation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

The next decade whats coming up? A presentation to STEP Cayman John Riches TEP and Samantha Morgan RMW Law LLP, UK 20 January 2021 1

What did we worry about 10 years ago? Increasing regulation and openness? A question of good jurisdictions vs bad jurisdictions? Drive or need for increasing sophistication? 3

10 years ago Very little disclosure about offshore structures or their beneficial owners to tax authorities unless or until a tax charge arose Tax advisers in offshore and onshore jurisdictions devising new ways to hold assets and mitigate tax Ability to use offshore structures to take advantage of double tax treaties and different tax rules in different jurisdictions Typically, sophisticated onshore tax rules impose taxes on settlors but tax on beneficiaries as and when they received a distribution But in the last 10 years 4

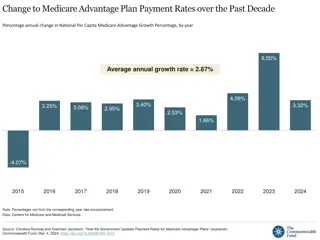

AML POLICY TIMELINE 5 2001: 2nd AMLD 2018: 5th AMLD 2015: 4th AMLD 1991: 1st AMLD 2005: 3rd AMLD 2017: Money Laundering Regulations 2007: Money Laundering Regulations 2018: 2003: Money Laundering Regulations 2002: Proceeds of Crime Act Revised FATF Risk-Based Approach Guidelines 2012: FATF 1990: FATF 40 Recommendations 2017: Criminal Finance Act Recommendations 2003: 2008: Revised FATF 40 Recommendations FATF Risk-Based Approach Guidelines Key: FATF Red EU Purple UK - Green

June 2013 - Lough Erne Declaration (G8) Seminal moment Introduction reads Private enterprise drives growth, reduces poverty, and creates jobs and prosperity for people around the world. Governments have a special responsibility to make proper rules and promote good governance. Fair taxes, increased transparency and open trade are vital drivers of this. But in the last 10 years 6

June 2013 - Lough Erne Declaration (G8) (2) First three action points 1. Tax authorities across the world should automatically share information to fight the scourge of tax evasion. 2. Countries should change rules that let companies shift their profits across borders to avoid taxes, and multinationals should report to tax authorities what tax they pay where. 3. Companies should know who really owns them and tax collectors and law enforcers should be able to obtain this information easily. But in the last 10 years 7

In the last 10 years Disclosure International bodies adopt programmes to improve KYC and encourage disclosure of beneficial owners adopted internationally (FATF 2012 R 10, 24 and 25) FATCA ( 2010) and CRS (2014) requires disclosure of beneficial owners internationally UK pressed ahead in 2016 with its PSC regime EU regulations impose adoption of public registers of beneficial owners of companies and registers for beneficial owners for trusts (4 and 5 AMLD) 8

In the last 10 years Intermediarie s devise new tax schemes OECD encourages jurisdictions to adopt mandatory disclosure rules EU adopts DAC6 requiring intermediaries to report cross-border arrangements or arrangements designed to conceal beneficial owners. Aim is to Identify new arrangements early; and Discourage intermediaries from designing such arrangements Roots of DAC6 are in the corporate tax arena but has morphed into a tool which impacts HNWIs materially 9

In the last 10 years Offshore arrangements take advantage of double tax treaties and differing tax rules OECD encourages jurisdictions to adopt rules to prevent base erosion and profit shifting Rules introduced internationally to cover (for example): substance for offshore entities Limitation on ability to rely on double tax treaties Limitation on ability to take advantage of differing rules dealing with the taxation of profits and deductibility of interest Supported by disclosure under DAC6 in the EU Another example of crossover from the corporate world 10

In the last 10 years Taxation of settlors and beneficiaries The onshore taxation of offshore structures has not changed materially in the last 10 years in sophisticated jurisdictions But tax authorities now (through FATCA and CRS) have a great deal more information about offshore structures - limited apparent use of that data so far in tax policy (as opposed to tax enquiry) Disclosure under DAC6 may provide them with more 11

In the last 10 years Migration of HNWIs Golden passports on the increase (Malta/Cyprus) Competition for UK non-dom rules Italy Portugal Greece Challenges to becoming a fiscal nomad are greater 12

Today Agenda setting Will the high tax, high disclosure EU continue to vie with OECD to set the agenda? Will the inequality debate fuel demands for higher inheritance taxes and new wealth taxes? Will high tax countries continue to compete for mobile HNWIs? Will Asia take a different route to Europe? Will new US administration be more supportive of transparency initiatives? Clients appetite for aggressive planning is markedly less pronounced than 10 years ago 13

In the next 10 years CRS and FATCA are here to stay It is likely that the trend for public registers for companies (and possibly trusts) will increase internationally Signs the US will slowly fall into line with at least centralised registers but perhaps not public ones - federal system has an impact here Essential to understand these rules and bear them in mind when drafting trusts and creating governance arrangements - look in particular at the FATF 2019 risk-based guidance for TSCPs and the definition of controllers Interplay between AML and tax disclosure is set to continue CRS imports the AML rules directly Disclosure 14

In the next 10 years Publicly and politically there appears to be little difference in public and policymakers perspectives between aggressive tax avoidance and tax evasion - we are all judged in this area by hindsight Artificial tax arrangements and arrangements designed to hide beneficial owners are to be avoided Will the DAC6 model be copied outside the EU? Will the emphasis for clients be more about avoiding extra tax than minimising tax? (court of public opinion a material driver in a more transparent world) Devising new tax arrangement s 15

In the next 10 years Offshore arrangements to take advantage of double tax treaties and different tax rules Entities in offshore jurisdictions will likely continue to be viewed with suspicion Offshore structures may find it harder to avoid paying tax on investments in onshore jurisdictions through the use of complex structures Onshore jurisdictions may look to impose higher tax rates on entities established in offshore jurisdictions without substance or business purpose 16

In the next 10 years Likely to increase sophistication of tax rules applicable to offshore structures Possibility of introduction of tax on deemed attribution to beneficiaries (e.g. wealth tax in France or income taxation in Germany) Increased taxes in onshore jurisdictions where assets held in offshore structures UK Treasury Select Committee is looking at post COVID-19 taxes Unwise to assume that discretionary trusts will be a complete shield to all onshore taxes for their non-settlor beneficiaries Tax on settlors and beneficiaries 17

Crystal ball gazing Public perception of offshore structures as designed for tax avoidance unlikely to improve Move away from typical offshore jurisdictions to midshore structures (including those with special tax regimes) Asian/EU Trust jurisdictions such as Malta and Liechtenstein may benefit here Political pressure likely to be brought on jurisdictions which provide low tax regime and tax breaks Increase of information about trusts and companies available in the public domain 18

Planning for the future Review current structures Are they fit for purpose? What are the tax and disclosure risks associated with them now? What are the tax and disclosure risks in the future? Are they overly complex ? Can they be defended ? Reduce the number of jurisdictions - the demise of the BVI company Consider steps which can be taken now to ensure that structure can adapt if required and be made simpler the jurisdictional footprint Consider taking steps to restructure as necessary and ensure appropriate substance and governance arrangements are in place 19

Planning for the future Can we persuade international and tax authorities that trusts are not simply used for tax evasion and to hide assets? Can we persuade the public that trusts are a good thing? STEP has a project to promote this 20