Understanding Freight Planning and Infrastructure Trends in Iowa

Explore the evolution of freight planning and infrastructure trends in Iowa through key initiatives such as ISTEA, TEA-21, and SAFETEA-LU. Discover population, employment, and demand growth projections alongside the extensive roadways, railways, waterways, and pipelines network in the state.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Craig ORiley & Adam Shell Office of Systems Planning Wednesday, December 1, 2010 1

Introductions FHWA Video: Planning for Progress Freight Planning Where have we been? Where are we going? Stakeholders Freight Modeling Overview Data Sources & Methods Application Conclusion Wednesday, December 1, 2010 2

Majority of freight moves on facilities owned by State and Local governments Prior to 1970 s All interstate transportation subject to Federal economic regulation 1980s Deregulation Aviation Deregulation Act 1978 Motor Carrier Act 1980 Staggers Rail Act 1980 Ocean Shipping Act 1984 Wednesday, December 1, 2010 3

Intermodal Surface Transportation Efficiency Act (ISTEA) Added freight as a factor for states and MPOs to consider during their transportation planning efforts Transportation Equity Act for the 21st Century (TEA-21) Encouraged states and MPOs to include shippers and freight service provides in the transportation planning process Safe, Accountable, Flexible, and Efficient Transportation Equity Act of the 21st Century (SAFETEA-LU) Works to enhance the freight planning efforts in ISTEA and TEA-21 Wednesday, December 1, 2010 4

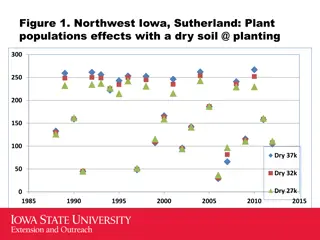

Iowa Population and Employment Trends 4.0 3.5 3.0 2.5 Millions 2.0 1.5 1.0 0.5 0.0 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 2040 2045 2050 Year Source: REMI Population Employment Wednesday, December 1, 2010 5

Growth in Demand Outpacing Population and Employment 600 500 400 1990 = 100 300 200 100 0 1990 1995 2000 2005 2010 2015 2020 2025 2030 2035 2040 2045 2050 Year Population Employment Demand Source: REMI Wednesday, December 1, 2010 6

114,740 miles of roadways 3,947 miles of railways 491 miles of navigable waterways 29,489 miles of pipelines Wednesday, December 1, 2010 7

Growth of Iowa Freight Traffic 450 400 350 Index 1985 = 100 300 250 200 150 100 50 0 Year Air Cargo Tonnage Rail Tonnage Truck VMT Water Tonnage Wednesday, December 1, 2010 8

Mode 2009 2025 2040 Trend 87.4 87.7 88.6 Truck 8.4 8.3 7.8 Rail 1.5 1.6 1.4 Water > 0.0 > 0.0 > 0.0 Air 1.7 1.5 1.4 Multi Modes & Mail 0.9 0.7 0.6 Pipeline 0.2 0.2 0.2 Other & Unknown Wednesday, December 1, 2010 9

Public Sector Federal, state, local transportation planning agencies Economic development and trade organizations Federal, state, local law enforcement Non traditional federal, state agencies Private Sector Shippers and receivers of freight (businesses) Freight transportation service providers Owners and operators of freight facilities Neighborhoods and communities affected by freight transportation Wednesday, December 1, 2010 13

Infrastructure Condition and Capacity Funding Federal Livability Initiative Climate Change / Air Quality State s Smart Planning Initiative Wednesday, December 1, 2010 14

Iowa Roadway Mileage versus Truck VMT 200 175 Index 1985 = 100 150 125 100 75 1985 1987 1989 1991 1993 1994 1995 1996 1997 Year 1998 1999 2000 2002 2004 2006 2008 1986 1988 1990 1992 2001 2003 2005 2007 2009 Truck VMT Road Mileage Wednesday, December 1, 2010 15

The economic competitiveness of our state is directly linked to how, why and where our businesses move their goods. Understanding these freight movements enables us to target policies and resources at highway, rail, water, and air corridors that will improve the State s competitive position. - Elwyn Tinklenberg , MN DOT Commissioner of Transportation Wednesday, December 1, 2010 18 Source: 2000 MN DOT Statewide Multimodal Freight Flows Study

Factors affecting freight demand Freight Transportation Modes Air: cargo jets Road: commercial vehicles (CV) or semi-trucks Rail: freight trains Water: barges and ships (Compare Graphic) Data Sources & Methods Application (Modal Characteristics Graphic) Wednesday, December 1, 2010 19

Wednesday, December 1, 2010 20 Source: 2007 QRFM II: Incorporating Freight into Four-Step Travel Forecasting

Factors affecting freight demand Freight Transportation Modes Air: cargo jets Road: commercial vehicles (CV) or semi-trucks Rail: freight trains Water: barges and ships (Compare Graphic) Data Sources & Methods Application (Modal Characteristics Graphic) Wednesday, December 1, 2010 21

Factors affecting freight demand Economy (volume of goods produced vs. consumed) Industrial Location Patterns (spatial distribution) Globalization of Business Just-in-Time (JIT) Inventory Practices (Inventory and Production in sync) Centralized Warehousing (Increased use of 3PLs) Fuel Prices Truck Size & Weight Limits (Increased payload requires less trips and in return lowers operating costs) Congestion Technology Wednesday, December 1, 2010 22 Source: Quick Response Freight Manual. FHWA. 1996. pp. 2-3 to 2-10.

Data Sources (many available.sort of! ) Carload Waybill Sample Commodity Flow Survey (CFS) Freight Analysis Framework (FAF) LTL Commodity and Market Flow Database National Transportation Statistics (NTS) Limitations Emphasis toward national and statewide Frequency of data Potential bias due to survey methods, unreliable estimates, or lack of freight modal coverage Wednesday, December 1, 2010 23

Methods Simple Growth Factor Incorporating Freight into Four-Step Model Process Commodity Models Hybrid Approaches Economic Activity Models Wednesday, December 1, 2010 24 Source: Quick Response Freight Manual II. FHWA. 2007.

Truck sub-model Trip Generation Stratify Employment by Industry Classes (NAICS) Agriculture, Mining, & Construction Manufacturing, Transportation, Communication, Utils, &Trade Retail Trade Office & Services Determine appropriate truck classes (Small, Medium, & Heavy) Calculate attractions by TAZ and set productions equal Wednesday, December 1, 2010 25

Truck Trips Rates Trip Generation Trip Rates Wednesday, December 1, 2010 26 Source: Quick Response Freight Manual. FHWA. 1996. p. 4-4.

Trip Distribution Gravity Model Friction Factors (shortest path time adjustment) Wednesday, December 1, 2010 27

Traffic Assignment Preload with All-or-Nothing method Model Validation Many tests similar to auto model validation. Each step of process (Trip Gen, Distro, etc) Compare observed data to modeled output Compute statistics . And compare to other regions of similar size By varying levels of area type, geography, or truck type Scenario Tests & Performance Measures Wednesday, December 1, 2010 28

FHWA Talking Freight Seminars http://www.fhwa.dot.gov/freightplanning/talking.htm Freight Model Improvement Program (FMIP) http://www.freight.dot.gov/fmip/index.cfm Freight Analysis Framework (FAF) http://ops.fhwa.dot.gov/freight/freight_analysis/faf/index.htm Quick Response Freight Manual II http://ops.fhwa.dot.gov/freight/publications/qrfm2/index.htm Wednesday, December 1, 2010 29

Iowa DOT Projects FRA Grant to update the Iowa Statewide Model Rail Plan Update Internal Freight Working Group Iowa DOT/Iowa DED Moving Iowa Forward Conference Freight Report Freight Plan Freight Performance Measures Iowa DOT Freight Advisory Committee Multi-state Corridor Planning NASCO Mid-America Freight Coalition (MAFC) Wednesday, December 1, 2010 30

Craig ORiley Adam Shell craig.oriley@dot.iowa.gov adam.shell@dot.iowa.gov Office of Systems Planning Iowa Department of Transportation Wednesday, December 1, 2010 31

undefined

undefined