Overview of Current Regulatory Issues in Derivatives Markets

The document discusses the current state of OTC derivatives markets, focusing on rulemaking progress and remaining tasks for regulatory bodies such as CFTC and SEC. It covers areas like margin requirements, position limits, clearinghouse resiliency, and cross-border harmonization. The SEC's actions on SBS regulation and what is left to be addressed are also highlighted.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Cadwalader, Wickersham & Taft LLP www.cadwalader.com www.cadwalader.com Cadwalader, Wickersham & Taft LLP The Outlook for OTC Derivatives The Outlook for OTC Derivatives Steven Lofchie (212-504-6700) Jeffrey Robins (212-504-6554) Nihal Patel Cadwalader, Wickersham & Taft LLP (212-504-5645) May 5th, 2015 32747888.4

TITLE VII RULEMAKING: WHERE ARE WE TODAY? Cadwalader, Wickersham & Taft LLP 2

CFTC / Swaps: Whats Left to Be Done? Proposals to be Finalized o Initial and Variation Margin for Uncleared Swaps Significant differences between EU and U.S. proposals Significant differences between U.S. Prudential and CFTC re- proposals, as well as SEC proposal o Position Limits for Swaps (re-opened comment period has now ended) o Reporting and Recordkeeping for trade option counterparties End users need only comply with select provisions of Part 45 Anticipated New Rulemakings o Clearinghouse resiliency, recovery and resolution; o Capital for SDs Cadwalader, Wickersham & Taft LLP 3

CFTC / Swaps: Whats Left to Be Done? Areas Needing Fine Tuning (in the words of Chairman Massad): o International and domestic harmonization Margin for uncleared swaps (e.g., eligible collateral) Cross-border CCP recognition (e.g., EU and U.S. CCPs) o Lighter regulatory burdens for end users Volumetric optionality Standard re-proposed to consider eliminating requirement that exercise of option be primarily based on factors outside the control of the counterparties Position limits Scope of hedge exemption; Aggregation requirements o Reform of SEF trading architecture and MAT process Name give-up (or post-trade anonymity); CFTC to initiate MAT determinations Cadwalader, Wickersham & Taft LLP 4

SEC / SBSs: What Has Been Done? The SEC adopted Reg SBSR governing regulatory reporting (to SDRs) and public dissemination of SBS data. o Compliance date for most provisions is over a year away The SEC also adopted rules to govern the registration, duties and core principles applying to SBSDRs. Regarding the cross-border application of SBS rules, the SEC has: o Adopted a final cross-border definitions rule; and o Proposed a rule applying certain SBS regulations to swap transactions involving non-U.S. persons operating from the United States; The SEC adopted Rule 17Ad-22 governing risk-management standards for clearing agencies Cadwalader, Wickersham & Taft LLP 5

SEC / SBSs: What Is Left? What is left? o Registration and regulation of SBSDs and MSBSPs o Registration and regulation of SBSEFs o (Re-)Proposal of revised margin requirements for uncleared swaps for non-prudentially regulated SBSDs o Anti-manipulation rules for SBSs o Mandatory clearing and related exemptions o Oversight of systemically-important clearing agencies o Orderly liquidation of broker-dealers and investment advisers o External business conduct requirements o Finalization of the proposed cross-border rule and Reg SDR Cadwalader, Wickersham & Taft LLP 6

CLEARING ISSUES Cadwalader, Wickersham & Taft LLP 7

Central Clearing: What do YOU Think? Clearinghouses have functioned both in clear skies and during stormy times through the Great Depression, numerous bank failures, two world wars, and the 2008 financial crisis to lower risk to the economy. Importantly, centralized clearing protects banks and their customers from the risk of either party failing. (Former) CFTC Chairman Gary Gensler (Nov. 2011) [The 2008 Financial Crisis] confirmed my unwavering support for . . . increased central counterparty clearing of swaps. CFTC Commissioner Christopher Giancarlo (Jan. 2015) [N]ow that we are requiring more clearing, we must make clearinghouse supervision a top priority. We must make sure that clearinghouses themselves do not pose risk to the stability of the financial system. CFTC Chairman Timothy Massad (Jan. 2015) Cadwalader, Wickersham & Taft LLP 8

CCP Risk The percentage of CFTC-regulated swaps cleared has increased from approximately 15% in December 2007 to approximately 75% today. In 2013, the CFTC adopted additional requirements for systemically important clearinghouses consistent with international agreement (in the Principles for Financial Markets Infrastructures of 2012, or PFMIs). Recently, regulators and market participants have more openly expressed concerns as to the systemic risks associated with CCPs. Worries have been expressed with respect to: o adequacy of clearinghouse recovery plans; o adequate capitalization of clearinghouses; o liquidity crunches resulting for clearinghouse margin calls; o procedures for clearinghouse resolution in failure; and o CFTC s conduct of oversight activities, given budgetary constraints. Cadwalader, Wickersham & Taft LLP 9

Other Clearing Issues Basel Capital Treatment o Legally-segregated cash margin is treated as a bank asset for purposes of the Basel leverage ratio and supplementary leverage ratio, requiring capital to be held against it o Effect: Strong disincentive for clearing by banks Banks are required to hold additional capital for off-limits cash o Chariman Massad has urged prudential regulators to reconsider this issue. Non-Deliverable Forwards ( NDFs ) o The CFTC has put on hold a proposal to make a mandatory clearing determination for non-deliverable foreign exchange forwards; o EU has also (for now) delayed its determination on NDF clearing. Cadwalader, Wickersham & Taft LLP 10

Other Clearing Issues CCP Recognition Across Borders o Under EU law, banks must hold extra capital if they clear trades through any jurisdiction not deemed equivalent to EU standards. o ESMA has made two equivalency determinations to date Includes CCPs in Japan, Hong Kong, India, Singapore, Australia No U.S. CCPs have been included in equivalence determinations EU officials have publicly expressed concern that U.S. regulations are too lenient Perception that this may reflect hostility to CFTC s cross-border guidance o Without EU equivalence recognition, U.S. clearinghouses will be unable to clear EU-mandated derivatives Effect: Competitive disadvantage for U.S. clearinghouses o EU has granted three six-month grace periods from capital rule Current extension expires in June, 2015. Cadwalader, Wickersham & Taft LLP 11

SWAP EXECUTION Cadwalader, Wickersham & Taft LLP 12

What Happens if I Trade on a SEF? Among other requirements, SEF participants are required to: o Agree to be bound by the relevant SEF rulebook May include, e.g., financial reporting, books and records requirements, as well as SEF inspection rights (for the SEF) o Submit to the SEF s enforcement/regulatory jurisdicton o Be an eligible contract participant under the CEA o Comply with CFTC recordkeeping requirements Cadwalader, Wickersham & Taft LLP 13

Current SEF Regulatory Relief Off-SEF Block Trades: Letter No. 14-118 o Conditional relief from the SEF trading requirement is available for block trades, defined as those that occur away from SEF platform o Relief expires on Dec. 15, 2015 Intended To Be Cleared Swaps ( ITBCs ): Letter No. 13-70 o Provides relief to SDs and MSPs from certain business conduct and documentation requirements for swaps intended to be cleared o Relief varies depending on whether (i) SD or MSP knows the identity of the counterparty; (ii) the trade is executed on a SEF or DCM; (iii) the trade is accepted for clearing as of the letter date; and (iv) the trade is one that is required to be cleared as of the date of execution. Cadwalader, Wickersham & Taft LLP 14

Current SEF Regulatory Relief Clerical / Operational Errors: Letter No. 15-24 o Grants relief for clerical and operational errors (subject to conditions) in connection with: swaps re-submitted for clearing after initial rejection; and errors discovered after a swap has been cleared. o Relief expires on June 15, 2016 Contract Documentation: Letter No. 15-25 o Relief (subject to conditions) permits SEFs to incorporate terms from previously-negotiated agreements that are not in the SEFs possession o Relief expires on March 31, 2016 Cadwalader, Wickersham & Taft LLP 15

MAT: Background Made Available to Trade (or MAT ) o Any swap that is the subject of a mandatory clearing determination must be traded on a SEF or DCM, if a SEF or DCM has made the swap available to trade. o Currently applies only to interest rate swaps and certain credit index swaps o Exemptions are generally limited to: Swaps that are exempt from mandatory clearing (e.g., swaps involving commercial end users); and Block trades (subject to limiting conditions of CFTC Rule 43.6) Cadwalader, Wickersham & Taft LLP 16

SEF Issues MAT Drought o Five MAT determinations to date (last one in March 2014). o Should CFTC initiate a MAT determinations? Market Fragmentation o The CFTC has (informally) indicated that (non-registered) SEFs with U.S. person participants are required to register with the CFTC. Clear evidence has emerged that liquidity has fragmented along geographic lines, coinciding with [the introduction of the SEF regime]. - ISDA Research Note (Apr. 2015) Block Trades o Possibility that CFTC will eliminate off-SEF execution requirement for block trades prior to expiration of No-Action relief under Letter 14-118 on December 15, 2015 Name Give Up (or post-trade anonymity) o CFTC is currently reconsidering, due to potential effects on liquidity and decreased SEF participation by market participants Cadwalader, Wickersham & Taft LLP 17

Whats Next for SEFs? The CFTC SEF framework has come under increasing criticism, including from multiple CFTC Commissioners: Where we can fine tune our rules so that we can create a framework for markets to thrive, we should do so. Timothy Massad (Nov. 18, 2014) There is regulatory fragmentation today, and those of us responsible for overseeing the derivatives markets should not be satisfied with it. Mark Wetjen (Nov. 14, 2014) I believe [the CFTC s swaps trading rules] are fundamentally flawed for a number of reasons . . . . Christopher Giancarlo (Jan. 29, 2015) Cadwalader, Wickersham & Taft LLP 18

SEF Changes But What Changes? Proposals of CFTC Commissioner Mark Wetjen (Nov. 14, 2014): o Rethink no-action letter on qualifying multilateral trading facilities to impose its conditions only on swaps involving at least one U.S. person, and not on all trading done through the platform; o Accelerating the CFTC s consideration of a foreign SEF rulemaking and expediting approval of the FBOT applications; o Proposing a clarifying interpretation concerning the so-called de- guaranteeing of trades; o Bringing to an end name give up occurring in the context of anonymous trading protocols on SEFs; o Seeking public comment on the registration of multilateral swap-trading venues facilitating the execution of swaps that are not subject to the trading mandate; and o Revisiting the existing made-available-to-trade ( MAT ) process currently done via rule filing. Cadwalader, Wickersham & Taft LLP 19

SEF Changes But What Changes? Highlights of White Paper by CFTC Commissioner Christopher Giancarlo (Jan. 29, 2015): o SEF framework, as implemented by CFTC, does not reflect distinction between dealer-to-customer [D2C] and dealer-to-dealer [D2D] marketplaces Episodic liquidity of swaps market necessitates trade execution flexibility o Two Pyramids Generalized Comparison of OTC Swaps Market to Exchange-Traded Futures Market Characteristic Listed Futures OTC Swaps Trade Size Small Very, very large Tradable Products 1,000s 100,000s Daily Trading Volume 100,000s 100s Trading Counterparties 100,000s (Including Retail) Dozens (no retail) Cadwalader, Wickersham & Taft LLP 20

SEF Changes But What Changes? Highlights of White Paper by CFTC Commissioner Christopher Giancarlo (Jan. 29, 2015): Segmentation of swaps into required transactions and permitted transactions with different methods of execution also lacks statutory support o Proposal: Follow statute by permitting SEFs to offer swaps trading through any means of interstate commerce. [The lack of a SEF principle similar to DCM Core Principle 9] reflects Congress s understanding that swaps naturally trade through a variety of execution methods in the global marketplace given their episodic liquidity. Proposal: Eliminate requirement that block trades must be executed off-SEF o MAT process lacks statutory authority and fails to effectively guard against inadequate trading o Void Ab Initio Applies to SEF-executed swaps not accepted for clearing o CFTC has provisionally acted on Giancarlo s proposal to eliminate this requirement by issuing Letter No. 15-24, which provides a safe harbor from Void Ab Initio for swaps rejected from clearing due to operational or clerical errors Cadwalader, Wickersham & Taft LLP 21

SEF Changes But What Changes? Highlights of White Paper by CFTC Commissioner Christopher Giancarlo (Jan. 29, 2015): Proposal: Eliminate (or reduce) trade confirmation requirements o CFTC has provisionally acted on Giancarlo s proposal by issuing Letter No. 15-25, which provides SEFs with relief from obtaining certain contractual documentation Proposal: Eliminate Embargo Rule o The Embargo Rule requires SEFs to wait until after transmission of swap transaction and pricing data to a SDR to disclose data to market participants The delays in transaction and pricing data disclosure caused by the embargo rule inhibit the long-established work-up process, whereby counterparties buy or sell additional quantities of a swap immediately after its execution on the SEF at a price matching that of the original trade. Proposal: Re-think of Name Give-Up o [T]here are important policy considerations on both sides of the issue that must be carefully considered before taking any action. Proposal: Anti-prescriptive re-think of SEF Core Principles o Cadwalader, Wickersham & Taft LLP 22

CROSS-BORDER ISSUES: REFRESHER Cadwalader, Wickersham & Taft LLP 23

The CFTC Cross-Border Guidance (a.k.a., the Casual Friday of Regulations ) In July 2013, the CFTC published final guidance interpreting Section 2(i) of the CEA and indicating to market participants when it would generally expect to assert jurisdiction over swaps activities (the Guidance ). Whether CFTC regulations apply depends on whether the counterparties to the swap are generally U.S. persons, conduit affiliates, guaranteed affiliates or foreign branches of U.S. banks. Requirements divided into Transaction-level and Entity-level Non-Registrant Requirements also apply to swaps between non- SD/MSPs, e.g.: o Clearing; trade execution; real-time public reporting; large trader reporting; SDR reporting; swap data recordkeeping Cadwalader, Wickersham & Taft LLP 24

Application of Non-Registrant Requirements Counterparty U.S. Person Affiliate Other Non-U.S. Person (Guaranteed or Conduit) SD/MSP (below) U.S. Person Apply Apply Apply Affiliate (Guaranteed / Conduit) Apply Apply; Substituted Compliance potentially available (except for large trader reporting) Does not apply (except for large trader reporting) Other Non-U.S. Person Apply Does not apply (except for large trader reporting) Does not apply (except for large trader reporting) Cadwalader, Wickersham & Taft LLP 25

CFTC Open Issues Registered SDs continue to encounter difficulties in convincing non-U.S. parties to provide cross border representations (esp. collective investment vehicles) CFTC Staff Advisory (Nov. 2013) asserted that non-U.S. SDs must comply with all transaction-level requirements, even for trades with non-U.S. persons, if the trades were arranged, negotiated or executed by personnel located in the United States. o Guidance put on hold by CFTC with a request for public comment o Recent SEC guidance re arranged, negotiated or executed has not been adopted by the CFTC In response to litigation, the CFTC has solicited comment on what costs and benefits of its swaps regulations are unique to the cross-border context o Comment period ends May 11, 2015. Will the CFTC expand substituted compliance beyond the EU, Hong Kong, Japan, Australia, Canada and Switzerland? Cadwalader, Wickersham & Taft LLP 26

SEC Definitional Rule The SEC adopted a final Cross-Border Definitional Rule, and (recently) re- proposed a rule regarding application of SBS regulations to dealing transactions by non-U.S. persons with a U.S. jurisdictional nexus Differences between CFTC Guidance and SEC Definitional Rule: o SEC definition of U.S. Person is (potentially) narrower Omits express inclusion of pension plans and U.S. majority-owned investment vehicles and unlimited liability entities Account associated with a U.S. person must be of a U.S. person, not beneficially owned by a U.S. person [Not clear if of significance?] o SEC definition of guarantee is narrower Guarantee must be made by commonly-controlled affiliate Counterparty must have right of recourse under guarantee Cadwalader, Wickersham & Taft LLP 27

U.S. Person [Definition] CFTC SEC Natural Person Natural person residing the U.S. Same Estate Estate of decedent who was a U.S. resident at time of death Same Legal Entity E.g., LLC organized or incorporated the U.S. or having its principal place of business in the United States Same Pension Plan For the benefit of employees/officers of a Legal Entity, unless primarily for the benefit of foreign employees. N/A Trust Governed by U.S. law, provided a U.S. court is able to exercise primary supervision over trust administration N/A Majority-Owned Investment Vehicle E.g., Commodity pool majority-owned by U.S. Person, unless exclusively offered to non-U.S. persons N/A Majority Owned Unlimited Liability Entity E.g., LLC majority-owned by U.S. Person that bears unlimited responsibility for liabilities N/A Discretionary or Other Account Individual or joint account beneficially owned by U.S. person Account of a U.S. Person N/A E.g., the IMF. Int l Org. Exclusion Cadwalader, Wickersham & Taft LLP 28

SEC Re-Proposal In the Proposal of the Definitional Rule, the SEC suggested expanding its jurisdiction to all transactions conducted within the United States, including transactions between two non-U.S. counterparties; o Language was omitted from the final rule in response to commentators. The Reproposal applies to transactions arranged, negotiated or executed ( ANE ): o through personnel located in a U.S. branch or office; or o through an (affiliated or unaffiliated) agent located in the U.S. ANE Transactions must: o Involve market-facing activity (i.e., sales and trading communications) o Conducted through a permanent location in the U.S.; No need to consider location of counterparty s trading personnel How might sales practice duties be imposed on sales agents, affiliated or not? Cadwalader, Wickersham & Taft LLP 29

MARGIN FOR UNCLEARED SWAPS Cadwalader, Wickersham & Taft LLP 30

What Has Happened So Far: Proposals G-20 leaders agreed to develop regulatory margin requirements for uncleared swaps. No G-20 country has adopted final requirements for uncleared swaps as of yet. In September 2013, the Basel Committee on Banking Supervision and the International Organization of Securities Commissions published a framework for margin requirements for non-centrally cleared derivatives ( BCBS-IOSCO Framework ) that is intended to be used by G-20 regulators in adopting their own rules. Europe: In April 2014, the European Supervisory Authorities published draft regulatory technical standards to govern margin requirements for uncleared derivatives ( EU RTS ), based primarily on the BCBS-IOSCO Framework. The comment period on the EU RTS has closed. United States: o Prudential Regulators: On September 3, the US prudential regulators proposed rules to govern margin requirements for uncleared swaps and security-based swaps. o CFTC: On September 17, the CFTC proposed rules to govern margin requirements for uncleared swaps. o SEC: The SEC initially had published proposed rules in December 2012 i.e., prior to the publication of the BCBS-IOSCO Framework. It has not issued a reproposal. Cadwalader, Wickersham & Taft LLP 31

What Has Happened So Far: H.R. 26 H.R. 26 signed into law on January 12, 2015 (also known as Pub. L. 114-1 or the Terrorism Risk Insurance Program Reauthorization Act of 2015) Title III of the law exempts the following swaps from the CFTC s and Prudential Regulators margin requirements: o Swaps that would qualify for the end-user clearing exception (i.e., swaps entered into by a non-financial entity to hedge or mitigate commercial risk); o Swaps in which a counterparty is an affiliate acting on behalf of, and as agent for, an end-user that qualifies for the end-user clearing exception; or o Swaps in which a counterparty qualifies for the clearing exemption for cooperatives. Cadwalader, Wickersham & Taft LLP 32

What Has Happened So Far: Compliance Dates CFTC, US Prudential Regulators, European proposals all have compliance dates based on BCBS-IOSCO Framework: o December 2015 for VM requirements. o Starting in December 2015, rolling compliance for IM requirements based on notional amount of derivatives activity during measuring period. On March 18, 2015, BCBS and IOSCO published a revised timeline: o VM requirements for most in-scope counterparties by March 2017. o Rolling compliance for IM requirements starting in September 2016. o Regulators have yet to implement the revised BCBS-IOSCO timeline. Cadwalader, Wickersham & Taft LLP 33

U.S. and EU Proposals U.S. EU Separate CFTC rules for swaps and SEC rules for security-based swaps ( SBSs ) applicable to non-banks Rules cover non-centrally cleared derivatives, but only VM for certain FX trades o Consolidated rules for banks Grandfathering historical trades may require use of a separate master agreement Grandfathering historical trades applies regardless of use of same master agreement Rules apply to SDs/SBSDs and MSPs/MSBSPs. Rules cover FCs and NFC+s o Covered entities must collect from other FCs/NFR+s, as well as all third country entities (absent an additional regulatory exemption order) o Covered entities must both collect and post VM and IM o Non-U.S. transactions may be partly or fully exempted Cadwalader, Wickersham & Taft LLP 34

U.S. and EU Proposals U.S. EU Two-way IM required when both parties above USD 3 BN (initially 4 trillion) notional on an aggregate basis with 25% affiliates IM collection required when both parties above EUR 8 BN (initially 3 trillion) notional on a consolidated group basis Aggregate IM collateral threshold permitted up to EUR 50 MM Aggregate IM collateral threshold permitted up to USD 65 MM o Aggregate all 25% affiliates on both sides o Aggregate all group members on both sides Minimum transfer amounts up to $650,000 Minimum transfer amounts up to 500,000 Cadwalader, Wickersham & Taft LLP 35

U.S. and EU Proposals U.S. EU Daily IM, model or standardized approach Event based IM, model or standardized approach IM netting within asset class IM netting within asset class IM must be segregated and a third- party custodian IM must be segregated in a legally effective manner Daily VM, based on: Daily VM, based on: o objective criteria (to the extent practicable) o marks to actual market to the extent practicable VM may be netted and rehypothecated VM may be netted and rehypothecated Cadwalader, Wickersham & Taft LLP 36

U.S. and EU Proposals U.S. EU VM eligible collateral limited to USD and currency matching settlement currency For either VM or IM, eligible collateral includes: o currencies IM eligible collateral includes: o gold o major currencies o government debt o U.S. Treasuries and agencies o local government debt o GSE debt o multilateral bank debt o Certain sovereign and multilateral bank debt o corporate bonds o equities o corporate bonds o UCITS o certain public equities Cadwalader, Wickersham & Taft LLP 37

U.S. and EU Proposals U.S. EU Conditionality applies for some IM collateral types; Conditionality applies for most collateral types: o fully backed by U.S. government o credit ratings o investment grade internal or credit agency as defined by regulators, not rating agencies o no wrong-way risk o concentration limits o non-affiliated issuers Haircuts by schedule or model Haircuts by schedule Additional 8% haircut applies for VM and IM denominated in a currency that does not match the derivative Additional 8% haircut applies for IM denominated in a currency that does not match the derivative Cadwalader, Wickersham & Taft LLP 38

MARGIN: PREPARATION AND DOCUMENTATION Cadwalader, Wickersham & Taft LLP 39

Preparation Steps Determine own status for U.S. and other rules o Party type (financial entity, non-financial entity) o Aggregate notional volume Types of counterparties o Swap Dealers, FCs, others? o Geography Analyze operational needs and capabilities o Daily calculations and deliveries o Ability to run multiple CSAs and collateral flows o Ability to deliver and receive margin o IM modeling Cadwalader, Wickersham & Taft LLP 40

Preparation Steps Assess current margin documentation against rules o CSA in place? o Custody documentation Analyze need to re-document o Counterparties where no margin is required o Counterparties where margin is required Do I need a new ISDA Master? Do I need a new CSA? Eligible Master Netting Agreement? Treatment of historical trades Collateral netting across CSAs Segregation of IM Cadwalader, Wickersham & Taft LLP 41

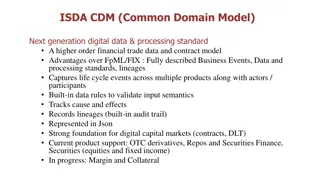

Documentation What is Being Done? The ISDA Working Group on Margin Requirements ( WGMR ) has several workstreams in place to help the market prepare for the implementation of uncleared derivatives margin requirements. o Data Utility for identification of parties. o Operational build out. o New collateral documentation (in process). Templates to address new initial and variation margin requirements. Protocols to provide scalable solutions for industry transition to regulatory VM. Cadwalader, Wickersham & Taft LLP 42

Documentation New CSAs New York, English and Japanese Law Versions Designed to operate side-by-side with existing CSAs under a single ISDA Master Scope provision setting default rules for which CSA will govern a trade. Modified Terms for Regulatory Compliance o Calculation methodologies o Collection timing o Dispute resolution o Collateral eligibility o Initial margin mechanics consistent with segregation requirement Cadwalader, Wickersham & Taft LLP 43

Documentation New CSAs ISDA Master Agreement Existing CSA General Terms New CSA(s) Separate VM & IM CSAs Scope provision to work with existing CSA. Integrated Para. 3 for initial and variation margin. Additional terms w/ elections for collateral. Elections in Para. 13. Cadwalader, Wickersham & Taft LLP 44

Documentation Protocols Protocol strategy yet to be determined: o Locating parties for purposes of selecting appropriate documentation o Use of new templates or existing negotiated documents o Importing from existing CSAs vs. a more standardized approach Issues that require greater clarity o Cross-border applications and substituted compliance o Cross-currency haircuts o Treatment of unregulated IA and historical trades o Eligible collateral and eligibility conditions. Cadwalader, Wickersham & Taft LLP 45

END-USER REGULATORY RELIEF? Cadwalader, Wickersham & Taft LLP 46

End Users Recordkeeping and Reporting Recordkeeping and Reporting o CFTC No Action Letter No. 14-147 Issued on December 16, 2014 Provides relief from: Recording of oral communications by CTAs; and Form and manner of records of swap trading oral communications Relief expires on Dec. 21, 2015 o CFTC Proposed Rule re non-SD/MSP trade option counterparties Elimination of Form TO annual notice reporting requirement for otherwise unreported trade options [re CFTC Rule 32.3(b)] Non-SDs/MSPs need only provide notice to CFTC within 30 days after entering into (reported or unreported) trade options having an aggregate notional value in excess of $1 Billion [U]nder no circumstances [will non-SDs/MSPs] be subject to Part 45 reporting requirements in connection with their trade options Cadwalader, Wickersham & Taft LLP 47

End Users Position Limits and Volumetric Optionality Position Limits o Re-proposed (multiple times) for comment on expansion of bona fide hedging exemption o Last opened to ensure commentators had sufficient time to respond to issues resulting from Open Meeting with Energy and Environmental Markets Advisory Committee on Feb. 26, 2015 Comment period closed on March 28, 2015 o Certain commissioners are pressing for approval of final rule by year end Volumetric Optionality o Test for when forwards with embedded optionality qualify as swaps (under CFTC s further definition of such term) re-submitted for comment; o Last prong of original test may be eliminated, i.e.: Under final test, counterparties will not necessarily have to exercise optionality in response to events that are outside of their control Cadwalader, Wickersham & Taft LLP 48

SECURITY-BASED SWAP RECORDKEEPING Cadwalader, Wickersham & Taft LLP 49

Reg. SBSR Reg SBSR was issued by the SEC on February 11, 2015 o Accompanied by Reg SDR Market participants generally required to report creation and life-cycle data for SBS transactions o Waterfall approach for determining who is required to report o Financial entity determination is irrelevant As adopted, Reg SBSR does not address reporting of cleared and on-platform SBS. o Such transactions were addressed in the Reg. SBSR Proposal Pre-Enactment and Transition SBS must be reported Cadwalader, Wickersham & Taft LLP 50