Understanding Financial Markets in India

Financial markets play a crucial role in connecting lenders and borrowers, providing avenues for investment and capital generation. In India, the financial system includes money markets and capital markets, offering diverse financial products and opportunities for investors. Money markets deal with

2 views • 106 slides

Understanding Continuity and Differentiability in Mathematics for Grade XII

Derivatives play a crucial role in engineering and science, helping analyze the behavior of dynamic systems. This unit delves into the concept of continuity and differentiability, exploring the geometric interpretation of derivatives, the chain rule, differentiation of algebraic functions, and the s

1 views • 18 slides

Understanding Numerical Methods for Approximating Analytic Equations

Introduction to approximating solutions to analytic equations, focusing on differential equations, integral equations, and integro-differential equations. Exploring ordinary and partial derivatives, differential and integral equations, and the involvement of unknown functions and their derivatives a

2 views • 15 slides

Food Grade Magnesium Derivatives Market Size & Share | Growth Outlook 2032

The food grade magnesium derivatives market size was valued at around USD 876.3 Mn in 2022 and is estimated to reach USD 1443.1 Mn by 2031, expanding at a CAGR of 6.5% during the forecast period, 2023 \u2013 2031.

0 views • 5 slides

Understanding Markets and Economic Structures

Markets play a crucial role in bringing buyers and sellers together for transactions. This article discusses the concept of markets, different types of markets in a capitalist economy, focusing on perfect competition. It outlines the features and conditions of perfect competition, emphasizing the im

2 views • 42 slides

Understanding Mortgage Derivatives and Risk Management

Mortgage derivatives such as Interest Only (IO) and Principal Only (PO) strips, as well as Collateralized Mortgage Obligations (CMOs), offer investors a way to manage risk more precisely than traditional mortgage-backed securities. By allowing control over interest rate and default risks, these soph

0 views • 80 slides

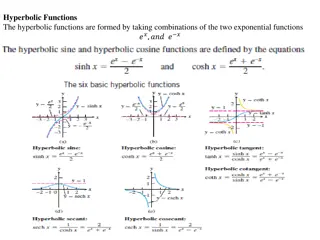

Understanding Hyperbolic Functions and Their Inverses

This content delves into the world of hyperbolic functions, discussing their formation from exponential functions, identities, derivatives, and inverse hyperbolic functions. The text explores crucial concepts such as hyperbolic trigonometric identities, derivatives of hyperbolic functions, and integ

0 views • 9 slides

Understanding the Importance of Money Markets and Bond Markets

Money markets play a crucial role in the financial system by providing short-term, low-risk, and liquid investment options. Participants include institutional investors and dealers who engage in large transactions. Money market securities have specific characteristics, such as large denominations, l

0 views • 23 slides

Synthesis of Salicylic Acid: Theory, Derivatives, and Applications

Salicylic acid is synthesized from methyl salicylate through ester hydrolysis with aqueous alkali. It is a versatile compound used in organic synthesis, as a plant hormone, and derived from salicin metabolism. The derivatives of salicylic acid can minimize gastric disturbances and enhance therapeuti

4 views • 12 slides

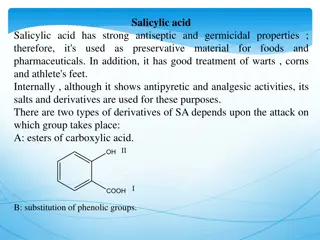

Overview of Salicylic Acid and its Derivatives

Salicylic acid is known for its antiseptic, germicidal, and analgesic properties, used in various applications such as preservatives, wart treatments, and pain relief. Different derivatives of salicylic acid are developed to minimize side effects and enhance efficacy. Acetyl salicylic acid (ASA), co

0 views • 15 slides

Insights into Covariant Derivative in Financial Markets & Quantum Field Theory

Explore the applicability of covariant derivatives in differential geometry, financial markets, and QCD. Understand the concept of fibre bundles, connections, and related structures through insightful examples and discussions. Discover the role of covariant derivatives in moving between neighbouring

0 views • 16 slides

Understanding International Financial Markets: Key Insights and Considerations

International Financial Markets play a crucial role for Multinational Corporations (MNCs) in accessing foreign exchange, money, credit, bond, and stock markets. MNCs leverage the international money market for various purposes like borrowing short-term funds in foreign currencies and investing for h

0 views • 25 slides

Understanding Derivatives Trading in Stock Market Operations

Derivatives in stock market operations are financial contracts derived from underlying assets like stocks, bonds, and commodities. Learn about the meaning of derivatives, how to trade in the derivative market, features of derivatives, players involved, and types of derivative contracts like forwards

0 views • 14 slides

Understanding Continuity and Differentiability in Calculus

This module covers the concepts of continuity and differentiability in calculus, including the definition of derivatives, differentiability criteria, the Chain Rule, and derivatives of implicit functions. The content discusses the relationship between continuity and differentiability, previous knowl

0 views • 12 slides

Understanding Financial Instruments and Markets

Explore asset classes like fixed income securities, money market instruments, and capital market instruments. Learn about different financial instruments in various markets including money market, bond market, equity markets, and derivative markets. Dive into money market instruments like Treasury b

0 views • 47 slides

Understanding Geometric Algebra and Calculus: A Deep Dive into Vector Derivatives and Maxwell Equations

Explore the world of geometric algebra and calculus through topics such as vector derivatives, Cauchy-Riemann equations, Maxwell equations, and spacetime physics. Unify diverse mathematical concepts to gain insights into analytic functions, differential operators, and directed integration.

0 views • 20 slides

Livestock Economics and Marketing: Understanding Markets and Classification

Livestock markets are essential for the buying and selling of livestock and related products. Markets can be classified based on various factors such as location, nature of commodities, time span, and more. Understanding the essentials of markets, livestock market components, and classification help

0 views • 18 slides

Economic Applications of Single-Variable Calculus Derivatives in Economics

In economics, derivatives play a crucial role in analyzing various economic phenomena such as marginal amounts, maximization, minimization, graphing, elasticity, and growth. This involves understanding derivatives of single-variable functions, slopes, instantaneous slopes, and the applications of de

0 views • 75 slides

Calculus Derivatives and Rules

Explore the fundamental concepts of calculus involving product and quotient rules, derivatives of trigonometric functions, higher-order derivatives, and applications in position, velocity, and acceleration. The homework assignments provided further reinforce learning and mastery of these topics.

0 views • 8 slides

Understanding Foreign Exchange Markets and Risks

Financial managers need to grasp the operations of foreign exchange markets for global business success. These markets allow participants to trade currencies, raise capital, transfer risk, and speculate on currency values. Transactions expose businesses to foreign exchange risk, where fluctuations i

0 views • 40 slides

Understanding Derivatives Markets and Risk Management

Explore the history of derivatives, the role of derivatives in insurance and risk management, underlying assets, derivative instruments, derivative markets, and the significant notational outstanding of OTC derivatives. Discover key players and exchanges in the derivative markets and the vast scale

0 views • 41 slides

Understanding Derivatives for Managing Interest Rate Risks in Indian Insurance Industry

Exploring the use of derivatives in hedging interest rate risks and their significance in the Indian insurance sector. The seminar delves into interest rate risk management, derivatives market dynamics, challenges, and the impact on insurers. Insights are provided on the investment strategies of ins

0 views • 45 slides

Advancements in Electricity Markets and Regulation: Focus on Integration of Distributed Energy Resources

This article highlights the ongoing activities and discussions within the C5 Committee on Electricity Markets and Regulation, emphasizing the impacts of market approaches, regulatory roles, and emerging technologies in the electric power sector. Key areas of attention include market structures, regu

0 views • 14 slides

Implementing Voluntary Residual Capacity Markets for Clean Energy Policies

Explore the concept of voluntary residual capacity markets to support the implementation of state clean energy policies. Learn how these markets allow load-serving entities to meet capacity obligations outside traditional markets, respecting state goals and methods. Discover the workings and design

0 views • 9 slides

Understanding Derivatives and Swaps: A Comprehensive Overview

Explore the concepts of derivatives and swaps, including their types, features, and the swap market. Delve into the details of how derivatives are used as contracts based on underlying financial assets, while swaps involve the exchange of financial instruments between parties. Learn about different

0 views • 20 slides

Understanding Financial Derivatives: An Overview of Forward Contracts, Futures, Options, Swaps, and Credit Derivatives

Financial derivatives play a crucial role in managing risk and speculation in financial markets. This overview covers the definitions and characteristics of forward contracts, futures contracts, options (calls and puts), swaps, and credit derivatives. Swaps involve exchanging payments over time, whi

1 views • 23 slides

Overview of Current Regulatory Issues in Derivatives Markets

The document discusses the current state of OTC derivatives markets, focusing on rulemaking progress and remaining tasks for regulatory bodies such as CFTC and SEC. It covers areas like margin requirements, position limits, clearinghouse resiliency, and cross-border harmonization. The SEC's actions

0 views • 63 slides

Understanding Credit Derivatives and Managing Credit Risk

This chapter delves into credit derivatives, exploring their purpose, types such as credit default swaps and total return swaps, and the development of the market over the years. It discusses credit risk, problems associated with it, methods for estimating credit risk, and the role of credit derivat

0 views • 35 slides

Understanding the Significance of Financial Markets and Institutions

Studying financial markets and institutions is crucial as it facilitates the efficient transfer of funds, promotes economic growth, impacts personal wealth, influences business decisions, and plays a significant role in determining interest rates. Debt markets, including bond markets, enable borrowi

0 views • 15 slides

Understanding Money Markets and Their Role in the Economy

Money markets are financial markets where short-term, low-risk securities are traded. Unlike banks, they offer distinct advantages such as liquidity, active secondary markets, and cost efficiency in providing short-term funds due to lower regulations. Despite the presence of banks, money markets pla

0 views • 33 slides

Understanding Currency Derivatives and Exchange Rate Movements

Explore the history and significance of currency derivatives in global and Indian markets. Learn about currency appreciation, depreciation, and the impact on foreign exchange rates. Discover how to interpret changes in currency values and their implications for trading. Gain insights into the functi

0 views • 85 slides

Understanding Dynamics of Perfect Markets in Microeconomics

Explore the dynamics of perfect markets in microeconomics through this presentation by Mrs. L. Booi. Learn about the short and long run production, cost and revenue curves, and the concepts of perfect markets and imperfect markets. Gain insights into how things behave and affect other markets in the

0 views • 23 slides

Potential of Derivatives in Indian Electricity Sector

The Indian electricity sector, post the enactment of EA 2003 and unbundling, has relied heavily on long-term power purchase agreements and bilateral contracts. However, limitations exist, such as lock-ins and default risks. Introducing derivatives could mitigate these risks, provided the necessary c

0 views • 7 slides

Understanding Power Markets in Nordic Countries: Insights into Day-ahead and Intraday Markets

Delve into the intricate workings of power markets in Nordic countries, exploring key terms, market pricing strategies, vRES impact, and the significance of day-ahead and intraday markets. Discover how the merit order and bidding zones influence pricing and system operations, ensuring efficient elec

0 views • 11 slides

Evolution of Markets and Peddlers in New York City

Early markets in New York City date back to the 17th century, with the establishment of public markets and the emergence of peddlers playing a significant role in the city's history. The evolution of markets, corruption issues, the importance of peddlers to immigrants, and the challenges they faced,

0 views • 17 slides

Understanding Financial Markets: Mechanisms and Efficiency

Financial markets play a crucial role in connecting borrowers and lenders, facilitating the flow of funds for optimal allocation. Different financial phases involve borrowing, saving, and investing. Transfers of funds occur directly or through intermediaries. Efficiency in financial markets ensures

0 views • 15 slides

Understanding Stable Matching Markets in Unbalanced Random Matching Scenarios

In the realm of two-sided matching markets where individuals possess private preferences, stable matchings are pivotal equilibrium outcomes. This study delves into characterizing stable matchings, offering insights into typical outcomes in centralized markets like medical residency matches and decen

0 views • 49 slides

Comprehensive Guide to Derivatives: Study Plans, Exam Tips, and Risk Management

Delve into the world of derivatives with this comprehensive guide covering course outlines, study plans, exam preparation tips, and risk management strategies. Learn about futures, options, profit and loss profiles, as well as forwards and Contracts for Differences (CFDs). Understand the exam proces

0 views • 128 slides

Understanding International Finance: Scope, Importance, and Challenges

International finance explores interactions between countries, including currency exchange rates, foreign direct investment, and risk management. The scope includes foreign exchange markets, MNC financial systems, and international accounting. It raises questions on liberalizing financial markets, I

0 views • 52 slides

Exploring Overseas Markets for Beauty Looks Jewellery Business

The case study revolves around a Delhi-based partnership business, Beauty Looks, involved in the making and marketing of artificial jewellery. Partners Kunal and Gaurav consider venturing into the export market after being prompted by a regular international client. They send their marketing manager

0 views • 14 slides