Strategic Analysis and Potential Solutions for Pepperfry

Pepperfry, the largest furniture e-retailer, faces challenges such as incoming competition, high costs, and scalability issues. Through a SWOT analysis and Porter's Five Forces assessment, potential solutions like M&A are explored to enhance profitability, dominate the market, and drive innovation in an evolving industry landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

PEPPERFRY University of Rochester Simon Business School Haotian Gong Gengfei Li William Trigg Minjia Zhan

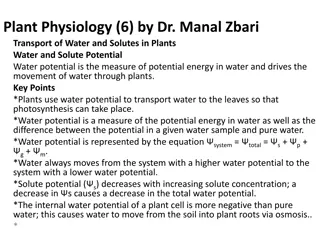

GOAL Profitability: Increase overall gross merchandise value over seven-fold; be EBITA positive in 12 18 months Dominate market: Retain its leading position in the fierce competition Innovation: Strength its position as an omnichannel powerhouse that appeals to young and tech-savvy consumers

ISSUES Incoming competition: Domestic vs. International; Online vs. Offline High cost and poor scalability: Earning less revenue per item sold over time

SITUATION ANALYSIS - SWOT Strength: Largest furniture e-retailer A curated marketplace: offer carefully selected products Offline experience Strong supplier and logistics ecosystem Broad reach to customers Weakness: Most popular items are low margin Opportunities: Brand recognition: House brands Furniture rental business Threats: Competition: Domestic vs. International Online vs. Offline

SITUATION ANALYSIS Porters Five Forces Suppliers: Local businesses Unorganized SMEs (over 250) which have manufacturing mindsets New to online retail Supported by Pepperfry Competition: Growing online retail: Urban Ladder, Livspace Offline: Ikea and domestic retailers Buyers: B2C Target customer: Tech-savvy young professionals who need self-expression Market size: 25 30 million Substitutes: Rentals Physical stores Carpenters (made to order) Used furniture Threat of Entry: Medium Easy to enter market Hard to manufacture Quality and distribution channel are the key differentiators

Analysis I: Revenue per Sale Revenue/GMV 80% 70% 68% 60% 59% 50% 45% 40% 40% 39% 30% 20% 10% 0% 2013 2014 2015 2016 2017

Analysis II: Pepperfry Customer Analysis Customers Analysis 0.35 0.3 0.25 0.2 0.15 0.1 0.05 0 2013 2014 2015 2016 2017 D cor Furniture

POTENTIAL SOLUTIONS NO.1 M&A Livspace: expand Pepperfry s clients base to interior designers Market of 1400 architects and designers Potential of 10000 partners in 2018 Challenges: Large investment Unclear scalability

POTENTIAL SOLUTIONS NO.2 Furniture Rental Launch a furniture rental business Target younger demographic Market is estimated to be worth $3 billion Challenges: Will need a larger distribution network delivery & pickup Invest in repair & maintenance services

POTENTIAL SOLUTIONS NO.3 House Brand Stores Transform offline studios into a selling point Exclusively sell in-house brands Improve margins, sales volume, and brand recognition Challenges: Redesign stores to hold inventory Potentially upset suppliers whose inventory is removed

SOLUTION: House Brand Stores Benefits: Improved point of sale Brand loyalty exposure 10% higher margins on goods sold More competitive against growing offline competition $9.3 billion growth in sales expected offline ($700 million online)

Analysis III: Cost Breakdown 2017 Marketing 20% Delivery 9% Other 71%

Analysis IV: Financial Projection 1 2013 2014 2015 2016 2017 2018 2019 2020 Revenue 341 439 992 2001 2580 6272.5 15054 34000 Cost -883 -801 -2247 -4993 -5066 -3772.5 -11854 -30000 Profit -542 -362 -1255 -2992 -2486 2500 3200 4000

Analysis V: Financial Projection 2 Growth Rate 300% 250% 243% 200% 150% 143% 140% 133% 126% 126% 102% 100% 99% 100% 93% 50% 29% 27% 29% 10% 0% 2014 2015 2016 2017 2018 2019 2020 Revenue Growth GMV Growth

RISK MANAGEMENT: House Brand Stores Risks Mitigation: 1. Introductory discounts and advertise original product availability online 2. Offer featured promotions in-store for brand partners 3. Delivery will be localized, reducing time and mileage 1. Change in store offering may lower demand 2. Other brand partners may lose visibility, online traffic 3. Cost may increase by holding inventory locally

IMPLEMENTATION PLAN Short-term: 12 18 months Transform stores to brand-exclusive Open 35 new stores to increase revenue by 15% - 20% Long-term: 5 years Expand in-house brands to d cor and utilities Design and develop more house brands to improve variety and accommodate more styles

MARKETING STRATEGY Earlier access to new release product Maintain Customer Loyalty Referral discount Open day experiences Rent Apps Social Media TV Commercials Marketing Channels

Cost Introduce 7091 Shelves in 2018 and label systematic methods Strategic alliance with other furniture companies to help delivery Promote recycling boxes plans to get discounts Change portfolios of marketing to 20:80

Conclusion In-house brands increase margins Stores will help earn more of expected $9.3 billion industry growth Grow customer loyalty through exclusive brands Compete more effectively against incoming competitors (i.e IKEA) Reduce costs in supply chain and marketing