Understanding Substitution Power in Trusts: A Comprehensive Analysis

This document delves into the intricacies of substitution power in trust administration, discussing its significance, typical features, and implications. It covers the structure of substitutions, fiduciary duties, valuation considerations, documentation requirements, and scenarios involving refusal to comply. The discussion includes legal aspects, case studies, and practical insights for effective trust management.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

CURING BASIS DISCREPANCY: EXERCISE OF SUBSTITUTION POWER Matthew S. Beard, J.D., LL.M. Matthew S. Beard, P.C. 3838 Oak Lawn, Suite 1220 Dallas, Texas 75219 (214) 434-1813 mbeard@mbeardpc.com

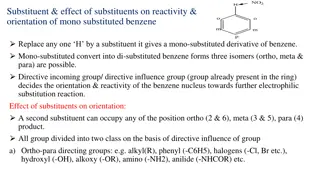

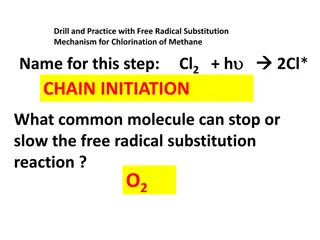

INTRODUCTION Discrepancy Testamentary transfers I.R.C. 1014: Step up basis I.R.C. 102: Nonrecognition of gain Lifetime transfers I.R.C. 1015: Carryover basis I.R.C. 102: Nonrecognition of gain

INTRODUCTION I.R.C. 675(4)(C) The grantor shall be treated as the owner of any portion of a trust in respect of which a power of administration is exercisable in a nonfiduciary capacity by any person without the approval or consent of any person in a fiduciary capacity Power of administration includes the power to reacquire trust corpus by substituting other property of an equivalent value Typical substitution power Notwithstanding any other provision herein to the contrary, the grantor shall have the power, exercisable in a nonfiduciary capacity without the approval or consent of any person in a fiduciary capacity, to reacquire trust corpus by substituting other property of an equivalent value

SUBSTITUTION STRUCTURE Initial considerations Fiduciary duties of the trustee Valuation

SUBSTITUTION STRUCTURE Unsecured promissory note Rev. Rul. 85-13, Rothstein, Condiotti: Indirect borrowing of trust corpus Secured promissory note Benson: Substitution

SUBSTITUTION STRUCTURE Substitution documents Written exercise of power of substitution Documentation of transfer of title Secured promissory note Security agreement Appraisal

SUBSTITUTION STRUCTURE Effective date Benson: Time lag exists

SUBSTITUTION STRUCTURE Refusal to comply Schinazi: Court agreed with trustee who refused to comply Benson: Court disagreed with trustee who refused to comply Anticipate refusal Direction to trustee on how to proceed with substitution following exercise of power Power to remove and replace trustee

SUBSTITUTION STRUCTURE Benson example Notwithstanding any other provision of this agreement to the contrary, the Grantor hereby reserves the right and authority exercisable in a nonfiduciary capacity and without the approval or consent of any person in a fiduciary capacity, to reacquire or exchange any property of the Trust created hereunder by substituting other property of an equivalent value; however, if this power of substitution is exercised, the Grantor shall certify in writing that the substituted property is of equivalent value to the property for which it is substituted and the Trustee has a fiduciary obligation independently to verify that the properties acquired and the properties substituted by the Grantor are in fact of equal value. Any dispute regarding the value of the substituted property may be resolved in an appropriate court. This power is intended to create grantor trust status under section 675(4) of the Code.

TAX Formula Time lag King, Benson: Valuation adjustment clause Wandry: Defined value clause

TAX King example However, if the fair market value of The Colorado Corporation stock as of the date of this letter is ever determined by the Internal Revenue Service to be greater or less than the fair market value determined in the same manner described above, the purchase price shall be adjusted to the fair market value determined by the Internal Revenue Service.

TAX Grantor trust status Reporting Form 1040: Income tax return Form 1041: Income tax return for trust Form 709: Gift tax return Adequate disclosure Form 8275 I.R.C. 6662: Accuracy-related penalty I.R.C. 6501: Statute of limitations

TAX Death of grantor Termination of grantor trust status Deemed transfer of property from grantor to trust Uncertain tax implications Nonrecognition of gain, but no step-up basis Nonrecognition of gain, and step-up basis

TAX Change in tax law Proposal: Transfer of appreciated property at death as recognition event Proposal: Transfer of property into or distribution from trust as recognition event Substitution power provides flexibility for addressing future changes in tax law