Understanding Tax Tables, Worksheets, and Schedules for Federal Income Taxes

Explore the concept of tax tables, worksheets, and schedules for calculating federal income taxes. Learn how to express tax schedules algebraically and compute taxes using IRS resources. Examples featuring single and married taxpayers provide practical insights into determining taxable income and calculating tax obligations accurately.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

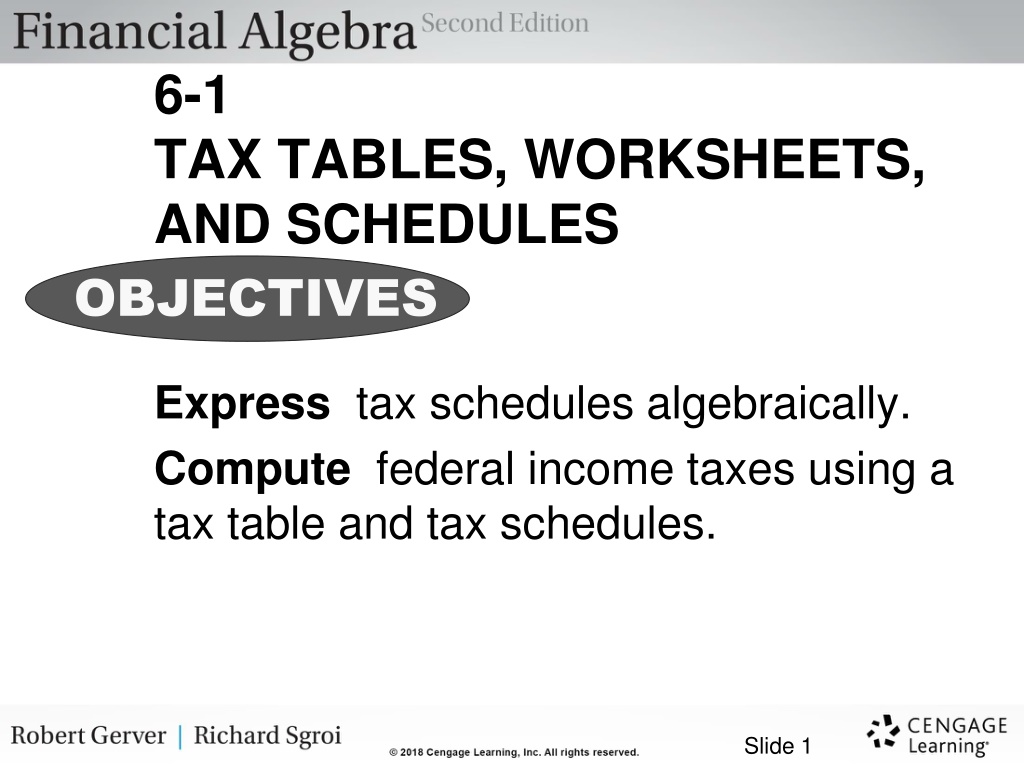

6-1 TAX TABLES, WORKSHEETS, AND SCHEDULES OBJECTIVES Express tax schedules algebraically. Compute federal income taxes using a tax table and tax schedules. Slide 1

Key Terms property tax sales tax taxable income income tax taxable income Internal Revenue Service (IRS) single married filing jointly qualifying widow(er) married filing separately head of household Slide2

Who pays taxes? Who are the taxpayers? What type of taxes Do you pay? Do your parents pay? What does the statement Your annual tax changes as your annual income changes mean? Slide 3

Example 1A Ron is single. He is using an IRS tax form and calculates that his taxable income is $51,482. The instructions tell him to use the tax table to determine his taxes. How much does Ron owe in taxes? Slide 4

Example 1A Ron is single. He is using an IRS tax form and calculates that his taxable income is $51,482. The instructions tell him to use the tax table to determine his taxes. How much does Ron owe in taxes? $9213 Slide 5

Example 1B Maria and Don are married taxpayers filing a joint return. Their combined taxable income is $153,900. The IRS offers a tax schedule so that taxpayers can calculate their tax. Use the tax schedule below for married taxpayers filing jointly to calculate Maria and Don s tax. Slide 6

Example 1B Slide 7

Example 1B Slide 8

Example 3 The IRS includes the tax schedule for information purposes only. For taxable incomes over $100,000, taxpayers must use the tax worksheet. Here is a portion of the worksheet for married taxpayers filing jointly. Calculate Maria and Don s tax using this worksheet. Slide 9

Example 3 The IRS includes the tax schedule for information purposes only. For taxable incomes over $100,000, taxpayers must use the tax worksheet. Here is a portion of the worksheet for married taxpayers filing jointly. Calculate Maria and Don s tax using this worksheet. Slide 10

Example 3 The IRS includes the tax schedule for information purposes only. For taxable incomes over $100,000, taxpayers must use the tax worksheet. Here is a portion of the worksheet for married taxpayers filing jointly. Calculate Maria and Don s tax using this worksheet. Slide 11

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)