Understanding CGE and DSGE Models: A Comparative Analysis

Explore the similarities between Computable General Equilibrium (CGE) models and Dynamic Stochastic General Equilibrium (DSGE) models, their equilibrium concepts, and the use of descriptive equilibria in empirical modeling. Learn how CGE and DSGE models simulate the operation of commodity and factor markets, incorporating dynamic optimization and intertemporal utility functions in DSGE models for forward-looking analysis.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

CGE and DSGE Models: Reconciliation? Sherman Robinson Peterson Institute For International Economics (PIIE) PIIE-UCB Macro Workshop, February 2020

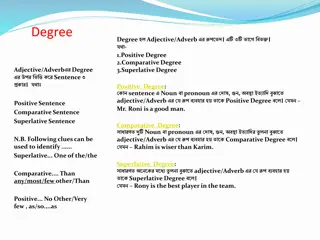

Introduction: CGE and DSGE models Computable General Equilibrium (CGE) models Multi-agent, multi-market. Optimizing producers and households interact across product and factor markets to determine equilibrium prices and factor returns. Patron saint: Walras Dynamics: multi-sector growth model. Patron saint: Solow-Swan Dynamic Stochastic General Equilibrium (DSGE) models Dynamic neoclassical growth models with forward-looking optimizing agents. Few agents and markets. Optimal saving behavior. Patron saint: Ramsey 2

CGE/DSGE: Similarities General equilibrium: simulate operation of commodity and factor markets Equilibrium conditions are descriptive in that they are assumed to describe the results of agent interaction across markets in actual economies CGE: profit-maximizing producers and utility-maximizing consumers: DSGE: add dynamic optimization with intertemporal utility functions, endogenous savings behavior, and perfect foresight 3

Descriptive Equilibria Equilibrium concept: very powerful in an empirical model Describes the results of a process that need not be specified in the model Need not describe or specify disequilibrium behavior. Need only solve for equilibrium. Need not discuss how individual agents interact to achieve equilibrium Descriptive if it can be validated empirically for the domain of applicability of the model Behavioral, theoretical, and statistical validation 4

Descriptive Equilibria Use of equilibrium concepts greatly simplifies model specification and, often, solution Enhances model clarity and transparency: model behavior consistent with economic theory Facilitates validation: predictable empirical results from shocks Compare with System Dynamics models that specify rules of motion but no equilibrium very hard to tell what is going on or to validate the model Models written as difference equations, but no validation of behavior or dynamic adjustment process 5

Equilibria: Forward-Looking Dynamic CGE/DSGE Models DSGE models variants of the Ramsey model Single household maximizes discounted utility Optimizes savings rates over time Producers maximize present value of discounted profits All agents have perfect foresight Models specified to have steady-state solutions Multisectoral dynamic CGE models Recursive dynamic models: common, no perfect foresight Neoclassical optimal growth models Roe et al., Multisectoral Growth Models: Theory and Application Existence/stability of steady state solutions 6

Macroeconomics: Keynesian Short to medium-run focus: widen the domain of applicability of simulation GE simulation Capital fixed by sector: Marshallian short run Want to analyze macro shocks : Asian and other financial crises Structural adjustment programs (World Bank) Impact of stabilization programs (IMF) Changes in trade policy: trade wars Issue: Can factors be involuntarily unemployed? Old and new Keynesian models 9

CGE/DSGE: Macro Flows All economywide models include macro aggregates: C, I, G, E, M Macro flow equilibrium in CGE/DSGE models requires: S-I balance G-T balance E-M balance DSGE/CGE models: loanable funds market Convert financial markets (assets, money) in a macro model into a shock on the flow equilibrium in the loanable funds market in the CGE/DSGE model 10

CGE/DSGE: E-M balance All trade focused CGE/DSGE models have a functional relationship between the trade balance (E-M) and the real exchange rate (relative price of traded/non-traded goods) Armington specification implies that all goods are imperfectly tradable, so non-traded share is large (D = GDP E). In practice, CGE/DSGE models will solve for 2 out of 3 variables: trade balance (E-M), nominal exchange rate (EXR), and an anchor price index (P). Specify (E-M) and P, model solves for R Specify R and P, model solves for E-M Specify R and E-M, model solves for P 11

Global CGE/DSGE Models: E-M Balance Global CGE/DSGE models determine world prices that clear world markets for commodities and determine real exchange rates that equilibrate trade balances Same mechanisms as in single-country models, but addition of a global clearing requirement: Sum of E-M globally must be 0. All CGE/DSGE models are Walrasian: only relative prices Numeraire choice for countries: P or R are common Global numeraire: $US is common, but also a basket of OECD currencies Choice matters for valuing E-M by countries. They represent a claim on the exports of the numeraire countries. 12

GTAP Model: Questions Does the GTAP model use CET functions for export supply? This is an extension of Armington in CGE models. Are the national trade balances (E M) endogenous or fixed? A standard version of GTAP endogenizes international capital flows, and hence the trade balances. What are the national numeraires? A version of GTAP uses a wage as the national numeraire (which is Keynes in the General Theory, but odd in CGE models). Issue of defining the real exchange rate Is GTAP using uniform CES elasticities for all countries? 13

Macro Closure: S-I, G-T, E-M How to achieve macro balances Walras Law: determine 2, the 3rd must balance A K Sen article on macro closure in the 1960s Heated debates in the 1970s in the CGE literature Neoclassical, Structuralist, Johansen, Keynesian, Kaldorian S-I balance: S determines I; I determines S G-T balance: G or T adjust; G-T financed by borrowing E-M balance: E-M exogenous, R adjust; R fixed, E-M adjusts Issue: Is there involuntary unemployment? Old and New Keynesian models 14

Full Employment Closures Compositional macro Factor markets clear, ensuring full employment and essentially fixed GDP Closure rules affects macro aggregates (C, I, G, E, and M), but not aggregate GDP Will affect welfare if E-M adjusts Absorption (welfare) = GDP + M - E Minimal strain on the neoclassical paradigm, but inadequate for any Keynesian model 15

Unemployment Closures Links between demand aggregates and real supply (GDP) Must assume non-neoclassical factor markets Must stretch the neoclassical paradigm for a Keynesian model Common approach: fix wage/rental rate, model will respond with quantity adjustment on employment/capital utilization Factor markets do not clear by wages. Two common variants: Firms on demand curve for labor Firms not on demand curve for labor Introduce a wage curve into the CGE model Reduced form, but strong empirical support Unemployment equilibrium imposed: consistent with Keynesian view 16

Conclusion Keynesian macro closure is more difficult in a DSGE model Endogenous optimal saving mechanism makes it difficult to implement a Keynesian multiplier link between aggregate demand and the factor markets CGE models are more flexible in macro closure mechanisms, but DSGE models are catching up Both CGE and DSGE models involve flow equilibria in macro balances, less treatment of asset market Essentially a flow-of-funds model Standard CGE models do not take account of asset holdings of various agents. Financial CGE models do. More asset action in DSGE models? 17