Understanding Subrecipient Monitoring and Management under the Uniform Guidance for HHS Awards

The content provides information on subrecipient monitoring and management under the Uniform Guidance for HHS Awards, including definitions of subrecipient, contractor, pass-through entity, and subaward. It also outlines characteristics of subrecipients and how to determine if a provider is a subrecipient or a contractor. Understanding these distinctions is crucial for organizations receiving federal funding.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Subrecipient Monitoring & Management THE UNIFORM GUIDANCE FOR HHS AWARDS: 45 CFR PART 75.351-353

Subrecipient Monitoring & Management Determine whether your provider is a subrecipient or a contractor.

Definitions - Subrecipient Subrecipient: A non-federal entity that receives a subaward from a pass-through entity to carry out part of a Federal program. Does not include an individual that is a beneficiary of such program. May also be a recipient of other federal awards directly from a federal awarding agency.

Definitions - Contractor Contractor means an entity that receives a contract as defined in Contract. Contract means a legal instrument by which a non-Federal entity purchases property or services needed to carry out the project or program under a Federal award. The term as used in this part does not include a legal instrument, even if the non-Federal entity considers it a contract, when the substance of the transaction meets the definition of a Federal award or subaward ( 75.2).

Definitions Pass-through entity Pass-through entity means a non-Federal entity that provides a subaward to a subrecipient to carry out part of a Federal program.

Definitions - Subaward Subaward means: an award provided by a pass-through entity to a subrecipient for the subrecipient to carry out part of a Federal award Does not include payments to a contractor or payments to an individual that is a beneficiary of a Federal program. Provided through any form of legal agreement.

Subrecipient Monitoring & Management Subrecipient Characteristics General Subrecipient Characteristics 1) Uses federal funds to carry out a program for a public purpose 2) Determines federal assistance eligibility 3) Provider performance is measured in relation to program objectives 4) Has responsibility for programmatic decision making 5) Responsible for adherence to applicable federal program requirements of the award

Subrecipient Monitoring & Management Contractor Characteristics General Contractor Characteristics 1) Provides goods/services within normal business operations 2) Provides similar goods/services to many different purchasers 3) Operates in a competitive environment 4) Provides goods/services ancillary to the operation of the federal program 5) Not subject to program compliance requirements

Subrecipient Monitoring & Management Subrecipient vs. Contractor Use good judgement in determining who is a subrecipient and who is a contractor and appropriately manage your subrecipients. All the characteristics may not be present in all cases. Substance is more important than form of agreement

Subrecipient Monitoring & Management Requirements for pass-through entities There are specific requirements for pass-through entities in the code of federal regulations that starts with: All pass-through entities must (emphasis on must not optional) ( 75.352)

Subrecipient Monitoring & Management Requirements for pass-through entities (a) Clearly identify all subawards to subrecipients as subaward ( 75.352(a)) 1. Federal award ID, etc. (13 different items listed) 2. All requirements imposed by the pass-through on the subrecipient 3. Any additional requirements in order for the pass-through to meet its own responsibility 4. Approved federally recognized indirect cost rate 5. Requirements that the pass-through and auditors have access to records and financial statements 6. Appropriate close-out terms/conditions

Subrecipient Monitoring & Management Requirements for pass-through entities (b) Evaluate subrecipients risk of non-compliance ( 75.351(b)). Factors to consider may include: Prior experience with same or similar program Results of previous audits How often the award was audited as a major program New agency personnel or substantially changed systems Any federal agency monitoring results (if subrecipient is receiving direct federal award)

Subrecipient Monitoring & Management Requirements for pass-through entities (c) Consider imposing specific subaward conditions ( 75.352(c)): must notify the applicant or non-Federal entity as to: (1) The nature of the additional requirements; (2) The reason why the additional requirements are being imposed; (3) The nature of the action needed to remove the additional requirement, if applicable; (4) The time allowed for completing the actions (if applicable) (5) The method for requesting reconsideration of the additional requirements imposed. ( 75.207(c)) Any specific conditions must be promptly removed once the conditions that prompted them have been corrected ( 75.207(d)).

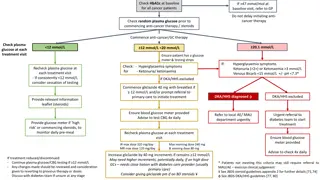

Subrecipient Monitoring & Management Requirements for pass-through entities (d) Monitor the activities of the subrecipient as necessary ( 75.352(d)). Monitoring activities must include: Review of financial and performance reports required by the pass- through entity Issue a management decision for audit findings pertaining to the Federal award provided to subrecipient Perform a risk assessment and additional monitoring that may include: Provide training and technical assistance to subrecipients Perform on-site reviews of subrecipient program operations Arrange for agreed upon procedures Verify every subrecipient is audited as required by Subpart F

Association of Government Accountants Association of Government Accountants (AGA) Toolkits Reduce Improper Payments - Subrecipient vs. Contractor checklist Risk Assessment Monitoring AGA website - www.agacgfm.org

Appendix Topics Sub Recipient Monitoring: Part 75 - 75.342, 75.351, 75.352 (based on) 1) 2) Impose specific sub award conditions (catered to your program goal) Monitoring activities MUST include: - Review of Financial AND performance reports (could be program) oExamples: Budgets, Expense Reports, Program specific reporting (goals and accomplishments) oExternal audit if required (who is reviewing them, how do you train them, how do you keep up with regulatory changes/updates) Follow up to ensure subrecipient takes timely action on all deficiencies oExternal audits oOnsite Reviews oOther? Issue a management decision oWas the external audit sent in appropriate (all required elements present, unqualified opinion, etc.) oDo you have a process for issuing a management decision? What does that look like and how are you documenting it? oWho is performing the management decisions for your agency? Risk Assessment oPerform annually, document and retain oOngoing training and/or support to your subrecipients oOnsite Reviews (Program and Financial) oAgreed Upon Procedures oGet their audit Helpful items to think about for your particular agency from the Fiscal Integrity & Audit Section regarding sub-recipient monitoring. - - - Click on the word document icon below to open. Other questions to think about- What type of follow up are you doing to acknowledge external audit findings for your programs/subcontracts? - Multiple audit findings (significant deficiency vs. material weakness) - Repeat audit findings - Common audit findings like segregation of duties or auditor compiles financial statements what is possible with regard to addressing common audit findings when thinking about subrecipient monitoring? - Disallowed costs and recalculating allowable profit (for profits vs. nonprofits are you getting the right report from the external auditor?) - Corrective actions do you have a process? Is it documented? Onsite reviews (financial or program) What might this look like for your agency? Risk Assessments What tools do you use to assess risk? Do you know who, of your sub award recipients is high risk? How can both the financial areas and program areas within your agency work together to address overall program performance to ensure best possible outcomes? Please e-mail any questions you may have to dcfauditors@wisconsin.gov

Questions & Answers Thank you! Please contact us at dcfauditors@wisconsin.gov