Understanding Financial Ratios for Business Analysis

Financial ratios like current ratio, quick ratio, inventory turnover ratio, asset turnover ratio, and profit margin ratio are crucial tools for assessing a company's financial health and performance. Current ratio measures short-term debt-paying ability, quick ratio assesses liquidity, inventory turnover ratio indicates efficiency in managing inventory, asset turnover ratio evaluates asset utilization for revenue generation, and profit margin ratio shows profitability. Investors use these ratios to make informed investment decisions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

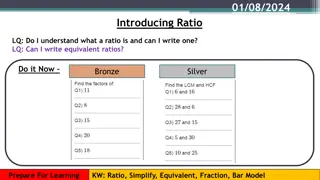

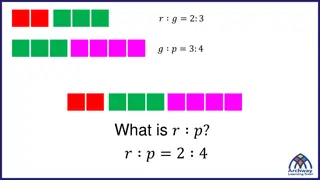

Classification of Ratio Classification of Ratio

Current ratio Current ratio The current ratio determines the ability of a company or business to clear its short-term debts using its current assets. This makes it an important liquidity measure because short-term liabilities are due within the next year. The current ratio will show how easily the company can change its quick assets to cash to pay current debts. The current ratio is also a good indicator for investors on whether or not it is wise to invest in a given company.

Quick ratio Quick ratio The quick ratio, also referred to as the acid test ratio, is a liquidity ratio that measures the ability of a company to pay off its short-term liabilities with quick assets that can be converted into cash within 90 days. The quick ratio measures how much money a business could raise from selling its near cash assets in order to pay current liabilities. Any business will have short term, as well as long term, assets that it can turn into cash on a short term or long-term basis. Long-term assets are things like buildings, stock inventory, and vehicles. They are used to run the business and can t be converted to cash easily (or quickly).

Inventory turnover ratio Inventory turnover ratio Inventory turnover is an efficiency ratio that shows how many times a company sells and replaces inventory in a given time period. Put simply, the ratio measures the number of times a company sold its total average inventory dollar amount during the year.

Asset turnover ratio Asset turnover ratio The asset turnover ratio is a way to measure the value of a company s sales compared to the value of the company s assets. It s an efficiency ratio that lets you see how efficiently the company uses its assets to generate revenue.

Profit margin ratio Profit margin ratio The profit margin ratio, also referred to as return on sales ratio or gross profit ratio, is a profitability ratio that determines the percentage of a company s sales that has been turned into profit. It measures whether a company or a business is generating profits from its business activities.

Gross profit margin Gross profit margin Gross profit margin is a profitability ratio that determines the difference between the total sales of a company and the cost of goods sold. The ratio highlights a company s remaining profits after meeting its direct production cost also known as the cost of goods sold (COGS). A gross profit margin is a vital measure for investors as well as management as it enables them to easily make decisions about a company without having to necessarily research much about them.

Debt to Equity Debt to Equity Debt to equity is a financial liquidity ratio that measures the total debt of a company with the total shareholders equity. It shows the percentage of financing that comes from creditors or investors (debt) and a high debt to equity ratio means that more debt from external lenders is used to finance the business. It is very common for a company to use debt to grow and they can do this by using creditor financing (a bank loan) or investor financing (selling shares in the company). The debt and equity of a company can be found on the balance sheet and, in business terms, are often referred to as liabilities (debt) and total stockholder s equity (equity).