European Commission's Proposal for Carbon Border Adjustment Mechanism

The European Commission's proposal for a Carbon Border Adjustment Mechanism aims to address carbon leakage and reduce emissions through a comprehensive industrial policy known as the European Green Deal. The Fit For 55 Package under the EU Climate Law sets ambitious targets for emission reduction and renewable energy sources. The CBAM involves a 4-step process and covers goods at high risk of carbon leakage from non-EU countries. The methodology includes verifying embedded emissions and specific rules for different sectors.

- European Commission

- Carbon Border Adjustment Mechanism

- EU Climate Law

- Fit For 55 Package

- Emissions Reduction

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

The European Commission's Proposal for a Carbon Border Adjustment Mechanism October 26, 2021

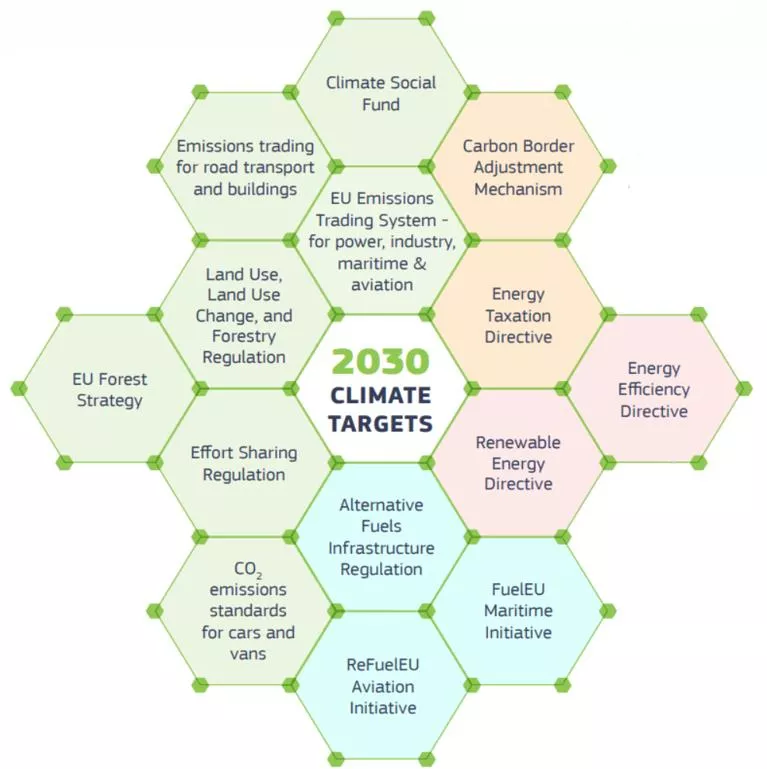

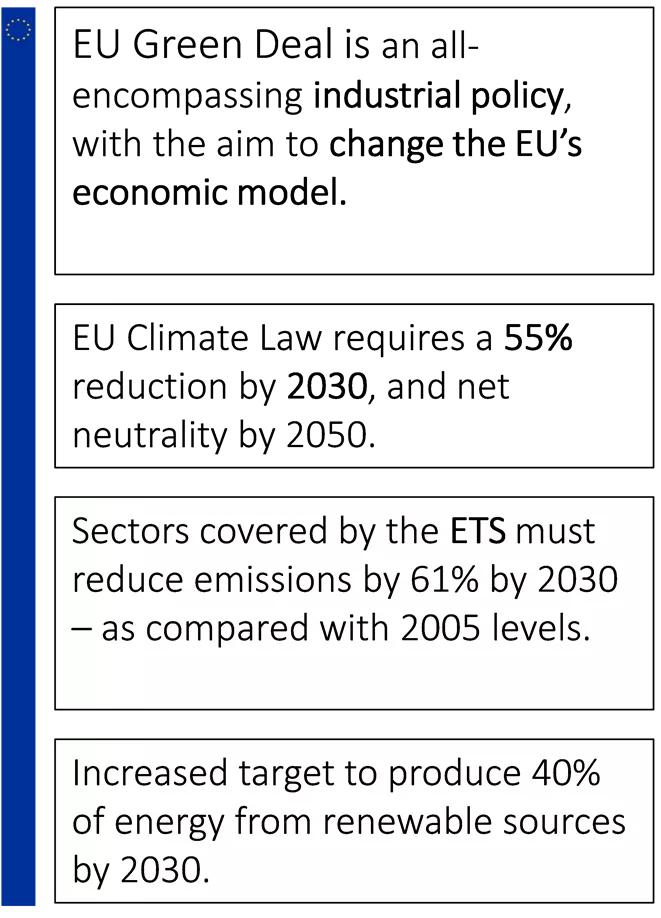

The European Green Deal, EU Climate Law, and Fit For 55 EU Green Deal is an all- encompassing industrial policy industrial policy, with the aim to change the EU s change the EU s economic model. economic model. Fit For 55 Package EU Climate Law requires a 55% reduction by 2030 2030, and net neutrality by 2050. 55% Sectors covered by the ETS reduce emissions by 61% by 2030 as compared with 2005 levels. ETS must Increased target to produce 40% of energy from renewable sources by 2030. 2

The EUs Stated Motivation for the CBAM CBAM is a climate measure (CBAM Proposal, Recital 13.) Paris Carbon Leakage Agreement Climate Change Art. 192 TFEU COP 26 (in Nov. 2021) 3

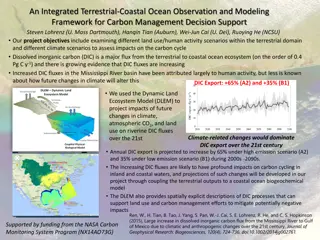

Basic Idea & Timing Timing Timing Full entry into force January 2026; transitional regime with only reporting obligations as of January 2023 The The CBAM s CBAM s 4 Steps 4 Steps 1 Registration of Authorized Declarants 2 Import Covered Goods 3 Purchase of CBAM Certificates 4 CBAM Declaration & Surrender of CBAM Certificates 4

Covered Goods & Countries Covered Goods Covered Countries Goods considered at high risk of carbon leakage All non-EU countries other than EEA and Switzerland Steel & Iron Commission may exclude third countries from CBAM if they: Aluminum are fully integrated into the EU ETS, or Cement Certain Fertilizers link their cap-and-trade system to the EU ETS Electricity Special rules for countries with electricity market integrated into the EU ( market coupling ) 5

Embedded Emissions Scope & Methodology 1 Direct emissions resulting from the production process (not indirect emissions) For complex goods, also embedded emissions of input materials. European Commission to define system boundaries Default Values For products (other than electricity) declarants may use product methodology, otherwise use default values 2 Default values can be country- (even region-) specific Embedded emissions can be country, region, and company specific Default values for electricity unless declarant decides to use specific methodology Verification Authorized declarants must have the embedded emissions of their imported products verified, or 3 Operators of industrial installations in third countries may register with the Commission and get their emissions verified (and share embedded emissions information with authorized declarants) 6

CBAM Certificates Price based on weekly average price of ETS allowance Issued by Member State Competent Authority Limited Buy Back Options (No Trade) 7

Discounts & Adjustments Adjustments for EU ETS Free Allowances Amount of CBAM certificates to surrender must be adjusted to take account of free ETS allowances granted to competing domestic industry Proposed Amendment of ETS includes phase- out of free allowances with an annual reduction of 10 percentage points between 2026 and 2035 Discounts for Carbon Price Only for goods originating in countries with carbon price on embedded emissions: as a tax or as part of cap-and-trade scheme EU may conclude agreements with third countries recognizing their carbon prices 8