A Comprehensive Approach to Assessing Organizational Worth

Business valuation entails determining the financial value of an organization through assessing various factors to estimate its worth in the marketplace. Understanding a businessu2019s value is crucial for purposes such as mergers and acquisitions, capital raising, taxation, financial reporting, and estate planning.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

Presentation Transcript

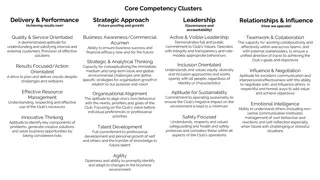

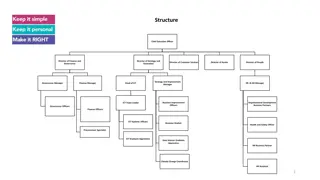

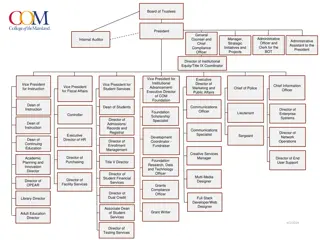

A Comprehensive Approach to Assessing Organizational Worth Business valuation entails determining the financial value of an organization through assessing various factors to estimate its worth in the marketplace. Understanding a business s value is crucial for purposes such as mergers and acquisitions, capital raising, taxation, financial reporting, and estate planning. Valuation methods can vary based on industry, company size, and the purpose of the valuation. Typically, it involves a blend of quantitative analysis, examining financial metrics and market comparisons, and qualitative assessment, considering factors such as the company s competitive advantage, management team, and growth prospects. Business valuation is a nuanced process, combining both art and science, which endeavors to evaluate the intrinsic worth of a company beyond mere numbers on a balance sheet. It encompasses strategic decisions, market positioning, operational capabilities, and future potential. The valuation process often encompasses various aspects, including: Asset-based approach: Evaluates the company s assets and liabilities, considering tangible and intangible assets to determine net worth. Income approach: Determines value based on the company s ability to generate income and cash flow, often using techniques like discounted cash flow analysis. Market approach: Analyzes the business relative to comparable companies, using market indicators such as price-to-earnings ratios to estimate value. Accurate valuation requires a tailored approach considering the unique characteristics and circumstances of each business, along with factors like industry trends, economic conditions, competitive landscape, and financial forecasts. Effective management, strategic decision-making, and operational efficiency are crucial factors influencing a company s value. Evaluating leadership vision, operational effectiveness, risk management practices, and marketing strategies all contribute to assessing a company s worth. Marketing perspective in business valuation emphasizes the importance of brand strength, customer acquisition, and market positioning. Assessing brand recognition, consumer loyalty, marketing effectiveness, and competitive advantages provides insights into the company s value within its industry. Skills perspective involves evaluating the workforce s capabilities, intellectual property assets, innovation culture, and operational efficiency. A skilled workforce, coupled with effective resource utilization and adaptation to market changes, enhances the overall value of the business. Integrating marketing skills and management perspective into valuation illustrates the firm s potential and intrinsic worth. Effective marketing strategies and visionary leadership drive future earnings potential and competitive advantage, positively impacting valuation.

Overall, business valuation is a multifaceted process, blending quantitative analysis, qualitative assessments, and future projections to determine an organization s worth. It extends beyond financial metrics, influencing critical decisions and shaping the future trajectory of companies.