travel insurance advisor

travel insurance advisor

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

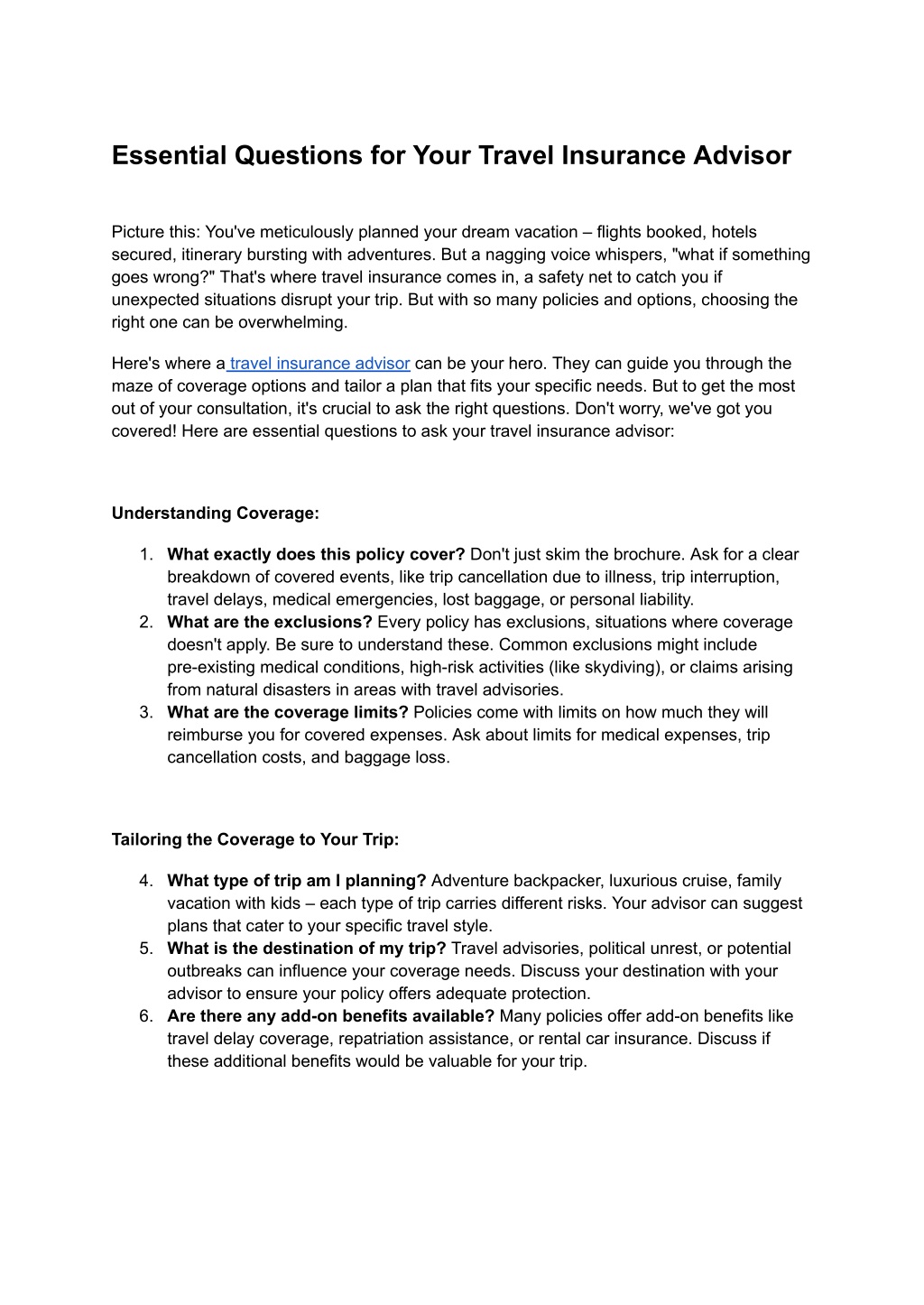

Essential Questions for Your Travel Insurance Advisor Picture this: You've meticulously planned your dream vacation flights booked, hotels secured, itinerary bursting with adventures. But a nagging voice whispers, "what if something goes wrong?" That's where travel insurance comes in, a safety net to catch you if unexpected situations disrupt your trip. But with so many policies and options, choosing the right one can be overwhelming. Here's where a travel insurance advisor can be your hero. They can guide you through the maze of coverage options and tailor a plan that fits your specific needs. But to get the most out of your consultation, it's crucial to ask the right questions. Don't worry, we've got you covered! Here are essential questions to ask your travel insurance advisor: Understanding Coverage: 1. What exactly does this policy cover? Don't just skim the brochure. Ask for a clear breakdown of covered events, like trip cancellation due to illness, trip interruption, travel delays, medical emergencies, lost baggage, or personal liability. 2. What are the exclusions? Every policy has exclusions, situations where coverage doesn't apply. Be sure to understand these. Common exclusions might include pre-existing medical conditions, high-risk activities (like skydiving), or claims arising from natural disasters in areas with travel advisories. 3. What are the coverage limits? Policies come with limits on how much they will reimburse you for covered expenses. Ask about limits for medical expenses, trip cancellation costs, and baggage loss. Tailoring the Coverage to Your Trip: 4. What type of trip am I planning? Adventure backpacker, luxurious cruise, family vacation with kids each type of trip carries different risks. Your advisor can suggest plans that cater to your specific travel style. 5. What is the destination of my trip? Travel advisories, political unrest, or potential outbreaks can influence your coverage needs. Discuss your destination with your advisor to ensure your policy offers adequate protection. 6. Are there any add-on benefits available? Many policies offer add-on benefits like travel delay coverage, repatriation assistance, or rental car insurance. Discuss if these additional benefits would be valuable for your trip.

Understanding Costs and Claims Process: 7. What is the total cost of the policy? Compare quotes from different providers, but prioritise comprehensive coverage over just the cheapest option. 8. What is the deductible? This is the amount you'll have to pay out of pocket before the insurance kicks in. Understand how deductibles work and choose an amount you're comfortable with. 9. What is the claims process like? In case of an emergency, you'll want to know how to file a claim quickly and easily. Ask your advisor about the process and what documentation is typically required. Additional Considerations: 10. What is your cancellation policy for the trip itself? Knowing your cancellation options for flights, hotels, and tours is crucial. Your travel insurance should ideally complement your trip cancellation policies, not overlap them. 11. What if I have a pre-existing medical condition? Don't shy away from disclosing pre-existing conditions. Your advisor can help you find plans that offer coverage for these conditions, often with additional premiums. 12. What happens if I change my travel plans after purchasing the insurance? Life happens! Ask your advisor if the policy can be adjusted to cover any changes you might make to your itinerary. Building Trust and Expertise: 13. Are you licensed and accredited? It's important to work with a reputable advisor. Ask about their credentials and experience in the travel insurance industry. 14. Can you provide me with some client testimonials? Reading positive feedback from past clients can give you peace of mind and assurance in your advisor's expertise. 15. Do you have any resources I can refer to for further information? A good advisor will encourage you to research and understand your options. Ask for resources like policy brochures or helpful websites. Remember, choosing travel insurance is about peace of mind. By asking insightful questions and collaborating with your advisor, you can secure the right coverage and embark on your adventure with confidence, knowing you're prepared for the unexpected. Now, go forth, explore, and create lasting travel memories! pen_spark tuneshare more_vert