Navigating Home Mortgages in San Diego: Your Path to Homeownership

Discover the detailed DSCR loan requirements essential for real estate investors to secure financing and maximize returns in San Diego's competitive market.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

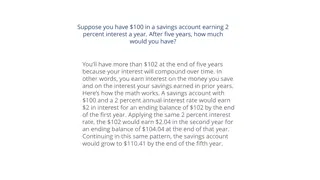

Navigating Home Mortgages in San Diego: Your Path to Homeownership San Diego, which has extraordinary landscapes and topographic features, is culturally diverse, economically buoyant, and has a job market base, is one of the best places to live in the United States of America. Still, it comes at a high-stakes real estate market that makes buying a home an adventure all on its own. Understanding San Diego s Housing Market San Diego real estate is active, and its median prices fairly represent the affordability of homes. According to data available from the San Diego Association of Realtors for the month ending April 2023, the median sale price of the homes in San Diego County is $ 832,250. However, many home mortgages in San Diego exist so people can afford homes easily, even if they cost so much. Home Mortgage Options in San Diego FHA Loans: Those are useful in making the homeownership dreams of many people come true because they cannot afford to pay for their homes in cash. VA Loans: Military members and veterans have a unique opportunity through VA loans with no down payment and reasonable interest rate, thus enabling even ordinary soldiers to build homes in San Diego. Conventional Loans: Conventional loans suit people with good credit since they can be tailored to meet the needs of a given client financially. These loans are helpful when acquiring a first home, an investment home, a second home, etc. Getting Pre-Approved: It highlighted the hitherto unseen competitive advantage. Conclusion Therefore, new homes were available in the market with only 16% fewer numbers of listings than the previous year. to be 74% between March and April of 2023, so getting pre-approval for a mortgage is helpful to one to have an upper hand in acquiring a mortgage. So, for those individuals considering purchasing homes in San Diego or any other city, or for those who have never bought a

home but are thinking about it, it is important to consider the home mortgage in San Diego products available so that they are in a position to be able to own a home in Americas Fanciest city.