Understanding Mortgage Points: Calculate, Compare, Decide

Explore the world of mortgage points by learning how to calculate discount points, determine breakeven time, and evaluate if buying points is a wise decision. Through examples, understand how purchasing points can affect your interest rate and overall cost, helping you make informed decisions when financing your home.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

7-5 Mortgage Points OBJECTIVES Calculate discount points for a mortgage. Determine the breakeven time for discount points. Calculate negative points. Slide 1

Key Terms mortgage points breakeven negative points Slide2

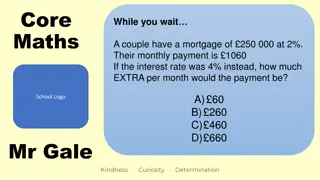

Is buying points a wise decision? Will the discount be worth it? Compare costs with and without. Slide 3

Example 1 Elizabeth and Nicholas want to buy a new home in Sunset Park. They need to borrow $350,000. Their bank offers an opportunity for the couple to buy down the quoted interest rate of 4.5% by 0.125% per point purchased. Each point will cost 1% of the amount borrowed. What will be the new interest rate if 2 points are purchased? What will be the cost to purchase 2 points? Slide 4

Example 1 Elizabeth and Nicholas want to buy a new home in Sunset Park. They need to borrow $350,000. Their bank offers an opportunity for the couple to buy down the quoted interest rate of 4.5% by 0.125% per point purchased. Each point will cost 1% of the amount borrowed. What will be the new interest rate if 2 points are purchased? What will be the cost to purchase 2 points? Slide 5

Example 1 Elizabeth and Nicholas want to buy a new home in Sunset Park. They need to borrow $350,000. Their bank offers an opportunity for the couple to buy down the quoted interest rate of 4.5% by 0.125% per point purchased. Each point will cost 1% of the amount borrowed. What will be the new interest rate if 2 points are purchased? What will be the cost to purchase 2 points? Slide 6

Example 2 How can Elizabeth and Nicholas (from Example 1) determine whether or not the purchase of the points makes sense for their situation if they have a 15 year lease? Slide 7

Example 2 How can Elizabeth and Nicholas (from Example 1) determine whether or not the purchase of the points makes sense for their situation if they have a 15 year lease? Slide 8

Example 2 How can Elizabeth and Nicholas (from Example 1) determine whether or not the purchase of the points makes sense for their situation if they have a 15 year lease? Slide 9

Example 2 How can Elizabeth and Nicholas (from Example 1) determine whether or not the purchase of the points makes sense for their situation if they have a 15 year lease? Slide 10

Example 2 How can Elizabeth and Nicholas (from Example 1) determine whether or not the purchase of the points makes sense for their situation if they have a 15 year lease? Slide 11

Example 3 How much will Elizabeth and Nicholas (from Example 1) save over the life of their loan from the purchase of the 2 points? Slide 12

Example 3 How much will Elizabeth and Nicholas (from Example 1) save over the life of their loan from the purchase of the 2 points? Slide 13

Example 3 How much will Elizabeth and Nicholas (from Example 1) save over the life of their loan from the purchase of the 2 points? Slide 14

Example 4 Suppose Elizabeth and Nicholas had received an estimate of their closing costs in the amount of $10,500 excluding prepaid interest and homeowners insurance. Their lender offered them the option of reducing those costs by raising their mortgage interest rate according to the following plan: How can they determine if it is worth taking the 4.875% APR in exchange for zero closing costs? Slide 15

Example 4 Suppose Elizabeth and Nicholas had received an estimate of their closing costs in the amount of $10,500 excluding prepaid interest and homeowners insurance. Their lender offered them the option of reducing those costs by raising their mortgage interest rate according to the following plan: How can they determine if it is worth taking the 4.875% APR in exchange for zero closing costs? Slide 16

Example 4 Suppose Elizabeth and Nicholas had received an estimate of their closing costs in the amount of $10,500 excluding prepaid interest and homeowners insurance. Their lender offered them the option of reducing those costs by raising their mortgage interest rate according to the following plan: How can they determine if it is worth taking the 4.875% APR in exchange for zero closing costs? Slide 17