Guidance on Managing HR Challenges with CA Firms/Clients during and post Lockdown

Explore solutions to HR issues faced by CA firms and clients amid and after the lockdown period, including updates on Central Govt. orders, practical tips for handling HR matters during lockdown, and strategies for addressing employee queries effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Solutions to HR Issues with CA firms/Clients during and post Lockdown period Intero Solutions P Limited Speaker: R.K.Kedia, M.M.S (H.R.)LLB Presenter: Kapil Goel, Chartered Accountant

Updates on Central Govt. orders Central Dated Issued by Key Context Extension of last date of payment of ESI for Feb (to 15th May) and Mar 2020 (to 15th May) contribution 16th March 2020 ESI New Delhi Government will pay EPF contribution of both employer and employee (12 percent each) for the next three months for those establishments that have upto 100 employee and 90 percent of whom earn under Rs. 15,000 monthly wage 27th March 2020 Provident Fund Withdrawal of PF by Members upto 75% of 3 months wages or 75% of member's fund whichever is less 27th March 2020 Provident Fund Extension of last date of payment of PF by 1 month for Mar 2020 contribution which has disbursed Mar'20 wages 15th April,2020 Provident Fund Ministry of Labour and Employment Extension in last dates of Annual Labour Returns to 30th April 2020 20th March 2020 Declares Lockdown period for 21 days w.e.f. 25th March 2020 24th March 2020 Ministry of Home Affairs Addendum to organisations to Guidelines issued on 24th March, 2020 25th March 2020 Ministry of Home Affairs Second addendum to organisations to Guidelines issued on 24th March, 2020 27th March 2020 Ministry of Home Affairs All employers to pay wages on due dates at work places without any deductions 29th March 2020 Ministry of Home Affairs Continuation of Previous orders of MHA till 3rd May 2020 14th April 2020 Ministry of Home Affairs Opening up of Few Industries with conditions during Lockdown and miscellaneous matters 15th April 2020 Ministry of Home Affairs

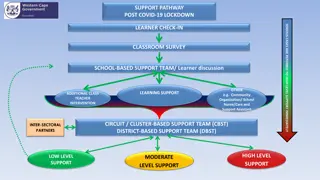

IN LOCKDOWN Practical guide on HR Issues with CA firms/clients Frame Work from Home policy for functions capable of being performed from Home Pay full Salaries and Statutory dues for ALL staff during lockdown as Paid Shutdown Leaves For the employees coming to workplaces during lockdown - ensure workplaces are clean and hygienic, regular supply of hand sanitizers, soap and running water in the washrooms. Replace bio-metric machines with Manual or Facial recognition machines Be continuously transparent and impartial to all employees and it should be distinctly visible Arrange Thermal screening, if possible, at all entrances of establishments Display of Covid 19 safety measures at employee entrance Maintain all Government orders and employee related communications In Separate File for Labour inspections, inquiries Understand Pros and Cons of tough decisions Join Industry association for support and decision making

How to tackle Employees queries during lockdown Single point of contact to reply on HR Lockdown matters Take all Partners into confidence before replying to employee Keep ready FAQ(s) to answer employees Keep patience and calm while listening to queries Answer keeping yourself in shoes of the aggrieved employee Never resist any question keenness to hear and support

POST LOCKDOWN Practical guide on HR Issues with CA firms/clients Employers may re-evaluate their stance, provided there are no subsequent order prohibiting such action Signed Appointment letters to be reviewed Replace bio-metric machines with Manual or Facial recognition machines Industrial Standing Orders review is a must Resorting to Lay-off (@ 50% of salary) or retrenchment/termination as per Industrial Disputes Act Differentiate between Probationers and Confirmed employees Change in terms of Employment contract after written consent from employees and following notice conditions Rationalization of Contractual Manpower Review Appraisals Policy for Year 2020 - 21

Threadbare analysis of ID Act Definition of Industry : Business Trade Undertaking Service Employment Industrial Occupation Workman as per Section 2 (s) means : Any Person Apprentice Contractor employed in any industry to do any manual, unskilled, skilled, technical, operational, clerical or supervisory work for hire or reward who is employed mainly in a managerial or administrative capacity who is employed in a supervisory capacity drawing wages more than Rs. 10,000 per month and who exercises functions mainly of a managerial or administrative nature but does not include: Lay-off as per Section 2(kkk) means the failure, refusal or inability of an employer to give employment due to following reasons, to a workman whose name appears on the muster-rolls of his industrial establishment and who has not been retrenched: shortage of coal, power or raw materials for any other connected reason accumulation of stocks break-down of machinery natural calamity Lay-off : Occurs in a continuous business, is temporary stoppage and within a reasonable period of time where permission had to be obtained the employer expects that his business would continue the contract of employment is not broken but goes under suspended animation

Threadbare analysis of ID Act the lay-off should not be mala fide in which case it will not be layoff (Ref: M.A. Veirya v. C.P. Fernandez, 1956-I, L.L.J. 547 Bomb) the Tribunal cannot sit in judgment over the acts of management and investigate whether a more prudent management could have avoided the situation which led to lay-off (Tatanagar Foundry vs. Their Workmen, A.I.R. 1962 S.C. 1533). No specific period for LAY OFF is mentioned in any statute. Lay-off and closure cannot stand together. Prohibition on Lay offs- when power to LAY OFF is neither given in Standing Orders nor in the Appointment Letter Retrenchment means : termination by the employer of the service of a workman for any reason whatsoever, otherwise than as a punishment inflicted by way of disciplinary action but does not include termination of the service due to expiry of period of contract termination of the service due to ill health voluntary retirement of the workman Retirement by Super-annuation

Threadbare analysis of ID Act Difference between lay-off Vs lock-out Vs Retrenchment Employing Less than 50 workman Free to decide on Workman matters Ready reckoner Lay-offs and Retrenchment to be governed by Appointment letters or Standing Orders Employing > 50 < 100 workman to obtain government permission for layoffs, retrenchments and closures Employing more than 100 workman Conditions for retrenchment (Section 25N) Minimum service of not less than one year can be retrenched after giving 3 months notice or pay in lieu thereof + Government approval (case: National Engineering Industries Limited vs. Kishan Bhageria (1988, Supreme Court) Deemed automatic approval after 60 days from the date of application Retrenchment compensation to be paid equal to 15 days salary for every completed year of service or part thereof in excess of 6 months Exclusions of cases in Lay-offs and retrenchments from applicability of ID Act- it is not applicable on NON- INDUSTRY OR NON WORKMAN

. What you should legally know The effected establishments have to follow the Central Government orders which has been issued by the Home Ministry on 29th March 2020 and the establishment cannot go for layoff as per the provisions of the I D Act,1947 /similar State Acts or non-payment of wages during lock-down period failing which the action may be taken by the Government Authorities. The relevant penal sections are as under : Section 188 of IPC : Talks about Disobedience to order duly promulgated by a public servant. Section 186 of IPC : Whoever voluntarily obstructs any public servant in the discharge of his public functions, shall be punished. Section 269 of IPC : Whoever unlawfully or negligently does any act which is, and which he knows or has reason to believe to be, likely to spread the infection of any disease dangerous to life, shall be punished. Section 270 IPC : Whoever malignantly does any act which is, and which he knows or has reason to believe to be, likely to spread the infection of any disease dangerous to life, shall be punished. Section 271 IPC: Knowingly disobeying any quarantine rule. Section 51 to 54 of the Disaster Management Act, 2005.: Non-compliance of the MHA s order or State Government s order or District Administration s order during lock-down period , the concerned DM/ Police Commissioner may take legal action. For Challenging the order of the MHA (supra) or any order passed by the State Government or District Magistrate or Police Commissioner by misusing the legislative power without jurisdiction one may resort to Section 71 of DM Act,2005 which says that if any person is aggrieved with any order which is going to prejudice at large to the persons/employers /establishment /company or order by violating any provisions of the law or any Article of the Indian Constitution of India , may challenge before the Supreme Court or concerned High Court by filing a writ petition along with an application for seeking stay order. As of now, the Employer cannot hold the benefits of employees for not paying the salary of the employees or to terminate the services of the employees . There can be grounds to challenge the orders of MHA or other order of the State Government by issuing directions to pay full wages during lock-down period or not to lay-off by ignoring the provisions of the I D Act,1947. authorities have passed any other

FAQ(s) during and post Lockdown period Q: Are wages to be paid if my office/factory is under shut down due to Covid 19 and employees are barred from coming to work? A: There is no provision for deduction and Current Government Advisory is that mandatorily full wages have to be paid. Q: Can establishment retrench during lockdown? A: No, As per current Government Advisory, no employee is to be terminated during lockdown. Q: Can establishment retrench post lockdown? A: Retrenchment compensation to be paid to workmen with approval from government as per provisions of Industrial Disputes Act, 1947 Q: What about paying the contribution under PF and ESIC? A: As Per Law : Mandatory to pay unless extended or benefits provided by Government as per announcements. Q: What would be the Sick Leave Policy for infected employees? A: As Per Law : Currently, Karnataka and Uttar Pradesh are the only two States which have specifically passed Orders stating that all Covid-19 infected employees are required to be provided 28 days of additional paid sick leave over and above their existing leave entitlement. Employers may potentially be additionally liable for medical expenses if the employee contracted the infection specifically while in the course of employment, though there are no specific guidelines on the same.

FAQ(s)continued Q: Whether the time off being given right now can be considered as paid leave and if no leave is available is to be considered as Leave on Loss Of Pay? A: No provision given in law but Current Government Advisory is to Mandatorily consider "On Duty . Q: Can employees be laid off as the business is staring at a slow down and reduction in revenue is drastic beyond manageable limits? A: Post Lockdown - Layoff is permitted due to lack of business requirement and 50% wages to the workmen till such time that business recovers with approval from government as per provisions of Industrial Disputes Act, 1947. Q: What about payment of stipend to Apprentices? All establishments to pay full stipend as applicable to the apprentices engaged in their respective Further, reimbursement of stipend to establishments under National Apprenticeship Promotion Scheme (NAPS) shall be paid by the Government for the lock down period as per the NAPS guidelines. Q: Can employers ask employees for medical tests and reports? A: Employers may require employees who are coming into work or even working from home to undergo medical tests or A: temperature screenings with consent of the employee. Employers may also require employees to report any medical symptoms to the Employer. If an employee is found to be infected with Covid-19, then the Employer may make it mandatory to disclose to all the people within the organization who may have encountered the infected employee. These potential employees would also need to be intimated. Q: Is MHA Order overriding over all other Statutes in India ? Yes. But there is power given in Disaster Management Act to appeal against the order which can be resorted to by the A: aggrieved person.

FAQ(s)...continued Q: Treatment of employees having last working day during Lockdown A: The employees whose last working day during the period of lockdown shall stand relieved on the due date and shall be paid wages till such day in terms of the EMPLOYMENT CONTRACT. Q: Treatment of employees who applied leaves for period under Lockdown A: It will depend on the nature of the industry, whether Work From Home resorted to, whether leave duration is co-terminus with the LOCKDOWN period and so on. Q: Treatment of employee who was absent on the penultimate day of Lockdown A: If the Employee was absent and absence remains un-regularized, he/she is not entitled for wages for Lock Down Period. Q: Treatment of the absence period for workmen affected or who are suspected to be affected A: Such employees who are kept in isolation shall be provided PAID LEAVE on production of Medical Certificate at the time of resuming duty

FAQ(s)continued Q: If an employer pays for the lockdown period and employee/ worker extends his leave beyond the lockdown period, then what should an organization do? A: Once the lockdown period is over, organizations may take steps under the applicable statutes and contracts to deal with the absence. These could range from the deduction in leave entitlement or leave without pay or other remedies as per the organizations policies. However, despite notice, if an employee refuses to join work, steps can be taken as per the Industrial Disputes Act 1947, and for non-workmen as per the terms of the appointment letter/ employment contract agreed between the employer and the employee. However, given the present scenario, it will be advisable for the employer to not deduct wages in the event an employee is suffering from COVID-19. Q: Can the employer defer/avoid payment of bonuses/raises to employees for the current year? A: Yes, but while observing the statutory obligations of an Employer under the Payment of Bonus Act, 1965. Payment of bonuses/raises to employees is at the discretion of the employer. However, bonus must be paid to employees who are eligible under the Payment of Bonus Act, 1965. The Payment of Bonus Act, 1965 regulates the payment of bonus of employees whose wage is below Rs. 21,000/- per month. The bonus provisions under the Act, applies to establishments (including factories) that employs or employed, on any day during an accounting year, 20 or more employees. Every eligible employee is statutorily entitled to receive a statutory bonus ranging from 8.33% to 20% of the wage. Under the Act, bonus is to be paid to employees within a period of 8 months from the close of the accounting year.

FAQ(s)continued Q: Principal Employer withholds payment to Contractor who in turn does not pay the Contract Workers. Who is liable? A: Both are liable. Q: The contract comes to an end during the intervening period of lockdown. Whether liable to pay wages for the entire lockdown period? A: There is no liability to pay wages Q: Whether any extra payment is to made to those who come to place of work vis a vis who work from home? A: There is no obligation on the employer Q: Whether Overtime is payable in cases of WORK FROM HOME? A: It will depend on circumstances. (Nevertheless Employee has to prove his claim) Q: Any additional wages to be paid for the HOLIDAYS- FESTIVAL, if any falling during this period to people who Work from Home? A: Yes, if the employee has been asked to work on the day

How to avoid/face adverse actions by Labour Office Documentation of communication to/from employees Single Point of Contact Clear Legal understanding of consequences of Penal actions Empathize with employees and basic needs Follow Industry practices

Thank You !!! Queries if any can be directed to info@intero.in or to : R . K. Kedia (Mobile: +91-9871021144) Kapil Goel (Mobile: +91-9818686123)