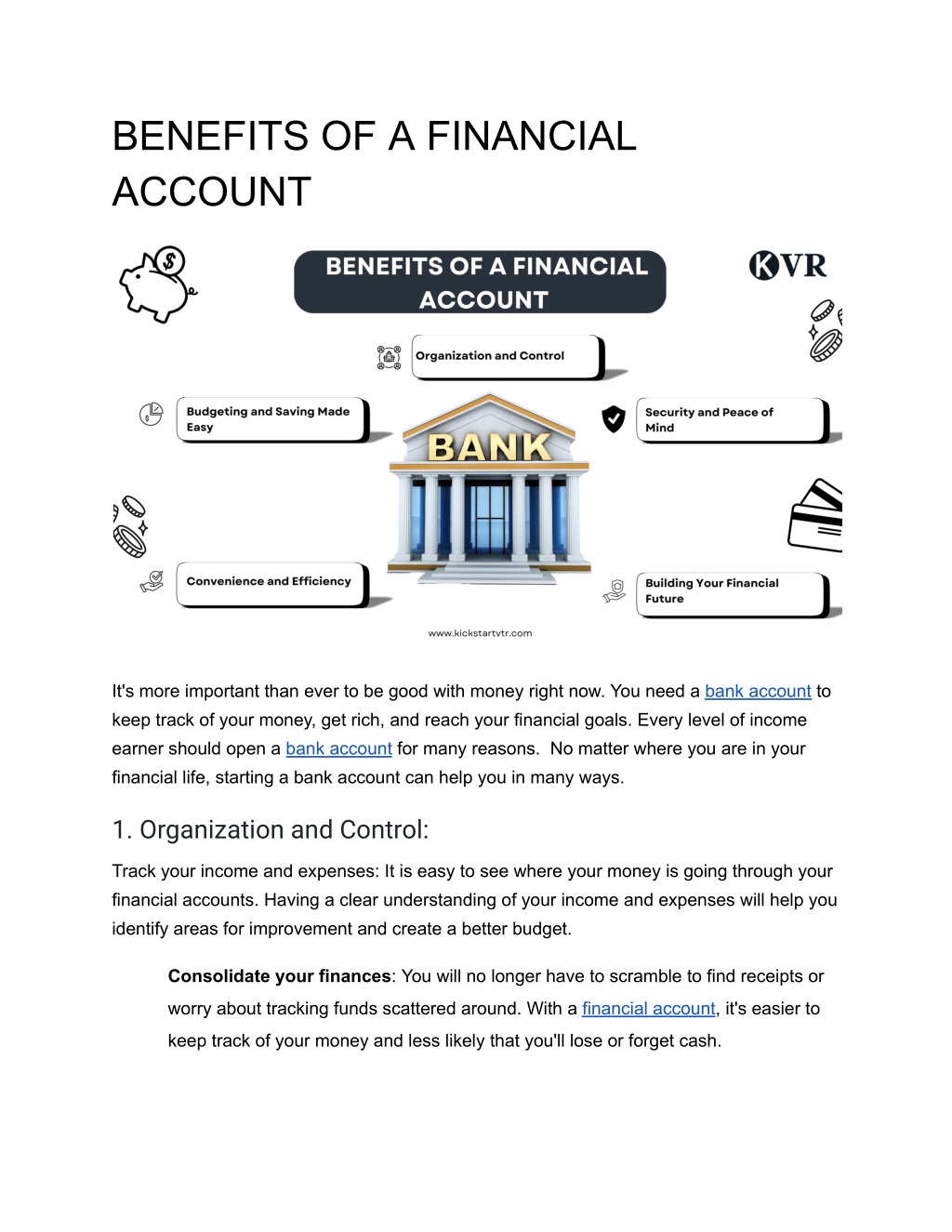

BENEFITS OF A FINANCIAL ACCOUNT

It's more important than ever to be good with money right now. You need a bank account to keep track of your money, get rich, and reach your financial goals. Every level of income earner should open a bank account for many reasons. No matter where y

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

BENEFITS OF A FINANCIAL ACCOUNT It's more important than ever to be good with money right now. You need a bank account to keep track of your money, get rich, and reach your financial goals. Every level of income earner should open a bank account for many reasons. No matter where you are in your financial life, starting a bank account can help you in many ways. 1. Organization and Control: Track your income and expenses: It is easy to see where your money is going through your financial accounts. Having a clear understanding of your income and expenses will help you identify areas for improvement and create a better budget. Consolidate your finances: You will no longer have to scramble to find receipts or worry about tracking funds scattered around. With a financial account, it's easier to keep track of your money and less likely that you'll lose or forget cash.

Access account information 24/7: Banks offer online and mobile banking, so you can check balances, transfer funds, and pay bills from anywhere you have an Internet connection. 2. Security and Peace of Mind: FDIC insurance (US): The Federal Deposit Insurance Corporation (FDIC) protects your savings up to a certain amount if a bank fails. Reduced risk of theft: Monetary accounts are significantly safer than holding large amounts of cash Most intelligent people safeguard their debit cards against loss and misfortune. 3. Building Your Financial Future: Only two of the various types of accounts: allowing you to earn interest are savings accounts and certificates of deposit (CDs).Two likely outcomes of this strategy are increased wealth building and financial stability. Access to financial products: Financial accounts can provide access to a variety of financial products and services, such as loans, mortgages, and investments. 4. Budgeting and Saving Made Easy: Automated features: Most financial accounts allow automatic transfers, which simplifies saving for particular objectives or bill payment. Budgeting tools: Financial institutions sometimes offer budgeting tools integrated with your account so you can stay on track with your financial goals. 5. Convenience and Efficiency: Bill pay: Having the ability to pay your bills electronically directly from your account will save you time and eliminate the hassle of writing checks or mailing payments. Mobile banking: Mobile banking apps make it easier to keep track of your money while you're on the go.

Getting a bank account is the first thing you need to do to get control of your money. Getting the above perks can help you make your future financially secure, which will make it easier for you to reach your future financial goals.