Understanding Cash Book, Pass Book, and Bank Reconciliation Statement

In accounting, cash book serves as both journal and ledger, while pass book maintains customer bank accounts. The bank reconciliation statement ensures consistency between customer and bank transactions. The cycle includes subsidiary books, double-entry, trial balance, and financial statements. Contra entries, petty cash system, and types of cash books are key components in financial record-keeping.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

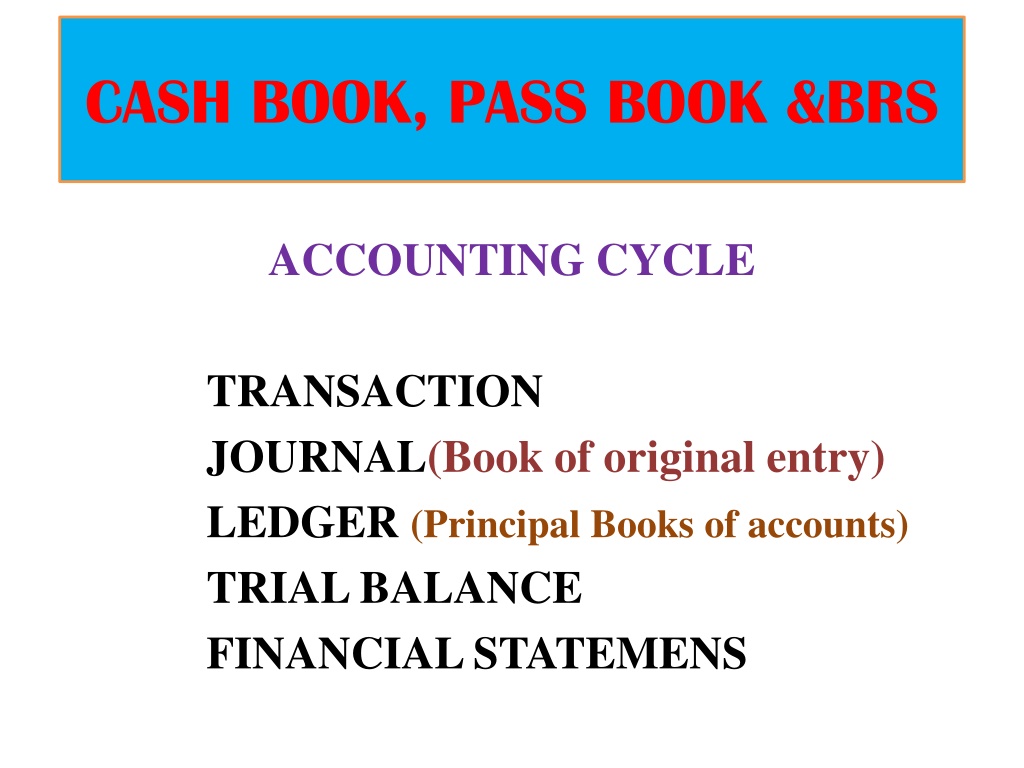

CASH BOOK, PASS BOOK &BRS ACCOUNTING CYCLE TRANSACTION JOURNAL(Book of original entry) LEDGER (Principal Books of accounts) TRIAL BALANCE FINANCIAL STATEMENS

SUBSIDIARY BOOKS DIFFERENT SUBSIDIARY BOOKS - Purchase Book - Purchase Return Book - Sales Book - Sales Return Book - Bills Receivable Book - Bills Payable Book - Cash Book (single column, Double Column, Triple Column & Petty cash Book) - Journal Proper

CASH BOOK CASH BOOK IS JOURNAL AS WELL AS LEDGER, i.e. Book of original entry as well as principal books of account. Prepared by the businessmen/trust/association, etc. Have debit and credit side (whatever received is debited and paid is credited) Accounts closure at the end of the year, it may have debit or credit balance (debit means assets credit means liabilities) Debit = Normal balance Credit = Abnormal balance single column cash book = Cash receipts and payments only Double column cash book = Cash and discount Triple Column Cash book = Cash, discount and bank column. Petty cash book = To record miscellaneous payments

CASH BOOK -Specimen Dr. SINGLE COLUMN CASH BOOK Cr. Date Particulars Amount Date Particulars Amount Dr. DOUBLE COLUMN CASH BOOK Cr. Discount Discount Cash Date Particulars Cash Date Particulars Dr. TRIPLE COLUMN CASH BOOK Cr. Discount Cash Bank Discount Cash Bank Date Particulars Date Particulars PETTY CASH BOOK Payments Receipt Date Particulars Total Date Particulars Printing Statio nery Conveya nce Tele phone Total

CASH BOOK Contra entry = Triple Column cash book cash deposited into bank or withdrawn from bank Appears on both the sides of cash book Marked with C = contra entry Imprest System = Petty Cash Book Fixed amount given to petty cashier at the beginning At the end of the month the amount will be recouped to the initial amount

PASS BOOK It is the accounts of customers maintained by bank. Money deposited, issued, withdrawn, collection, cheque payments, deposited, annual charges all are recorded. Receipts credited payments debited A copy of the statement given to the customers is called Pass Book. Normal Balance = Credit Abnormal Balance = Debit (overdraft) direct

BANK RECONCILATION STATEMENT (BRS) Same transactions recorded by customers in his book and bank in its book. Balance needs to be the same If difference arise, the reasons 1] Timing Difference A] Cheque issued but not presented for payment. B] Cheque paid into bank but not yet cleared.

BANK RECONCILATION STATEMENT (BRS) 2] Transactions recorded by bank: A] Interest credited by bank but not recorded in cash book B] Charges debited by bank but not recorded in cash book C] Interest and dividend collected by bank directly. D] Payment made by the bank as per customer instructions. E] Bills discounted with bank and later dishonoured. F] Bills collected by bank on behalf of customers. 3] Errors A] Errors committed by bank. B] Errors committed by customers

BANK RECONCILATION STATEMENT (BRS) BRS only a statement Prepared by customer whenever required No fault finding mechanism Only to list the reasons for difference Purpose /use Identify the reason for difference find out the mistake on either side Find out any embezzlement of cash Reason for delay in clearing cheque Reason for delay in realisation of cheque

TEMPLATE PARTICULARS AMOUNT (Rs.) AMOUNT (Rs.) Balance as per Cash Book Add: Cheque issued but not presented Add: Amount deposited by customer directly in to bank A/c. Add: Income collected by bank directly Less: Cheque deposited but not collected Less: Expenses paid by bank directly Less: Annual maintenance charges, penalty, fine Balance as per Pass Book If balance as per pass book is the starting point plus items to be deducted minus items to be added Balance as per cash book in the end point

NON TRADING CONCERN Not for profit organisation Their purpose is to serve the society Trust, sport club, social club Accounts prepared: Receipts and payment account Income and expenditure account Balance sheet

Receipts & Payment account Its like cash account based on real account principle Record all types of receipts and payments capital as well as revenue relates to previous, current & future period the closing balance transferred to B/S.

Income & Expenditure account Its like Profit and loss account based on real Nominal account principle Record revenue transactions only Record current year income and expenditure If the income is in excess of expenditure, It is surplus If the expenditure is in excess of income, It is deficit.

TERMS The Main source of income is subscription If it is received annually or monthly, it is revenue receipts If it is received as life member ship, it is capital receipts Donation if it is general donation I & E A/c. - If it is specific donation shown on liabilities side of balance sheet Legacy - any amount or property received as per the will of a deceased person. Government grants