IPO of IdeaForge Technology Ltd.: Leading Indian UAS Market Pioneer

IdeaForge Technology Ltd. is a top player in the Indian unmanned aircraft systems market, boasting a 50% market share in 2022. With a strong product portfolio, the company aims to utilize IPO proceeds for debt repayment, working capital, product development, and general purposes. Recognized globally, IdeaForge stands out for its advanced UAVs and software solutions, offering surveillance, mapping, and surveying applications. Backed by a skilled team and solid customer relationships, the company's IPO offers an opportunity to invest in a market leader with significant growth potential. Closing date: June 29, 2023.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

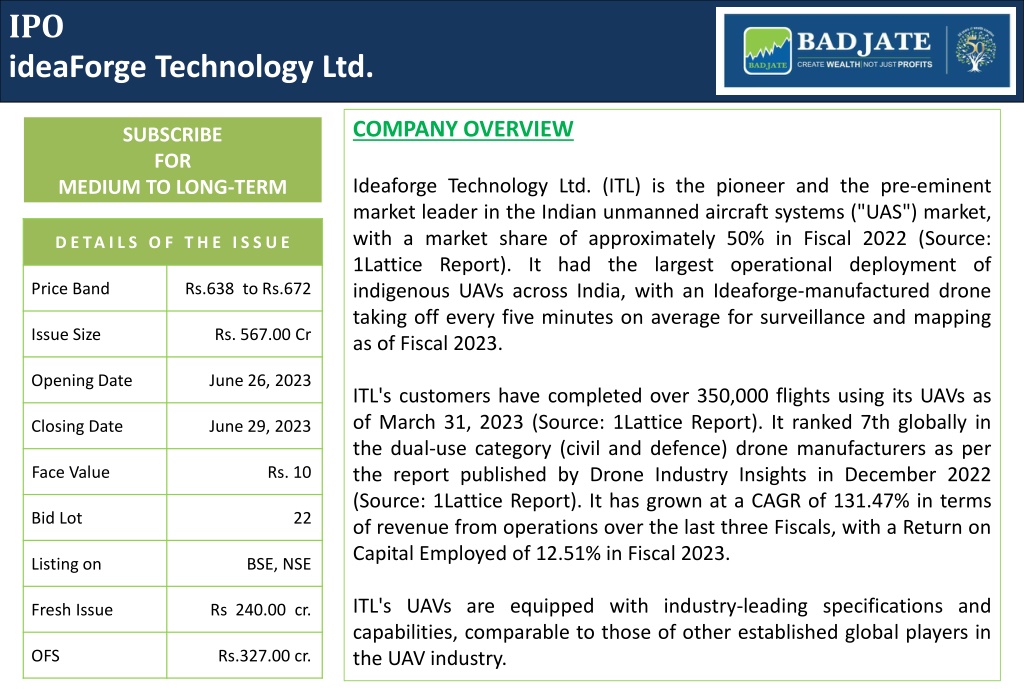

IPO ideaForge Technology Ltd. COMPANY OVERVIEW SUBSCRIBE FOR Ideaforge Technology Ltd. (ITL) is the pioneer and the pre-eminent market leader in the Indian unmanned aircraft systems ("UAS") market, with a market share of approximately 50% in Fiscal 2022 (Source: 1Lattice Report). It had the largest operational deployment of indigenous UAVs across India, with an Ideaforge-manufactured drone taking off every five minutes on average for surveillance and mapping as of Fiscal 2023. MEDIUM TO LONG-TERM D ETA IL S O F TH E ISSU E Price Band Rs.638 to Rs.672 Issue Size Rs. 567.00 Cr Opening Date June 26, 2023 ITL's customers have completed over 350,000 flights using its UAVs as of March 31, 2023 (Source: 1Lattice Report). It ranked 7th globally in the dual-use category (civil and defence) drone manufacturers as per the report published by Drone Industry Insights in December 2022 (Source: 1Lattice Report). It has grown at a CAGR of 131.47% in terms of revenue from operations over the last three Fiscals, with a Return on Capital Employed of 12.51% in Fiscal 2023. Closing Date June 29, 2023 Face Value Rs. 10 Bid Lot 22 Listing on BSE, NSE ITL's UAVs are equipped with industry-leading specifications and capabilities, comparable to those of other established global players in the UAV industry. Fresh Issue Rs 240.00 cr. OFS Rs.327.00 cr.

OBJECTS OF THE ISSUE The company intends to utilize the net proceeds from the issue towards the funding of the following objects: 1.Repayment/prepayment of certain indebtedness availed by the company; 2.Funding working capital requirements, 3.Investment in product development, and 4.General corporate purposes.

COMPANYS PRODUCT PORTFOLIO Hardware, which primarily includes UAVs, payloads, batteries, chargers and communication system (which enables communication between the ground control station and the UAVs), Software and embedded sub-systems, which includes the GCS software, which enables the controlling and management for their UAVs and autopilot sub-system, which enables remote control and autonomous completion of flights, Solutions, which enables industry/ application specific software that enhances the value of their UAVs to the end customer. Their wide range of products gives them the necessary flexibility to meet the evolving demands of diverse customers across industries. The company primarily cater to customers with applications for surveillance, mapping, and surveying. Though they do not enter into long-term contracts with their customers, they have developed long- standing relationships with certain of them. As of May 31, 2023, they had about 100 channel partners and 3 national distributors. The company is one of the top vendors globally for dual use drones.

COMPETITIVE STRENGTHS Pioneer and the pre-eminent market leader in the Indian UAS industry, with first-mover advantage Well educated and experienced team Diversified product portfolio with a robust technology stack and track record of successful outcomes in critical use cases Strong relationships with a diverse customer base Significant product development capabilities powering the software and solutions and product differentiators In-house design to delivery capabilities Strong management capabilities with a demonstrated track record of delivering robust financial performance

BUSINESS STRATEGIES Continue to invest in product innovation, engineering and design Expanding into international markets Expand the product portfolio and cater to new end-use applications and industries Focus on indigenisation Expand business services and software revenue through as a Service offerings Pursue strategic investment and acquisition opportunities

FINANCIAL DETAILS As at Mar 31, Particular (In Crore) 2023 2022 2021 Equity Share Capital 21.34 0.09 0.09 Instruments entirely equity in nature 0.07 0.04 0.04 Reserves 303.12 163.18 59.62 Net worth as stated 324.72 163.30 59.75 Revenue from Operations 186.01 159.44 34.72 Revenue Growth (%) 16.66% 359.22% - EBITDA as stated 57.49 75.13 (9.25) EBITDA (%) as stated 30.91% 47.12% (26.65%) Profit Before Tax 40.80 50.18 (14.50) Net Profit for the period 31.99 44.01 (14.63) EPS Basic ( ) 8.55 13.84 (5.03) RONW(%) as stated 9.85% 26.95% (24.48)% NAV ( ) as stated 86.81 51.36 20.57

CONCLUSION / INVESTMENT STRATEGY Company is a leading player in the Indian Unmanned Aircraft Systems (UAS) market with approximately 50% market share in Fiscal 2022. These drones are capable of diverse applications, aiding in mining area planning, mapping, construction and real estate operations, as well as assisting defence forces in ISR operations. It has posted growth in its top lines but for FY23, its bottom line marked decline due to ESOP impact. Though based on FY23 performance, the issue appears aggressively priced. Investors may park funds for medium to long-term rewards.

CREATE WEALTH NOT JUST PROFITS www.badjategroup.com Head Office: 207,Mangalam Arcade, Above Venus Book centre, towards Ramnagar, Dharampeth Nagpur Maharashtra 440010 India. Phone: 0712 6604201-230 Email: info@badjategroup.com Nagpur | Kolkata | Aurangabad | Jalgaon | Jalna | Jabalpur |

DISCLAIMER This e-mail /message may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this message, please delete it immediately and notify the sender. The recipient acknowledges that Badjate Stock and Shares Pvt. Ltd.* (Badjate)#and or its affiliate companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in e-mail or its attachment, and further acknowledges that any views expressed in this message are those of the individual sender and no binding nature of the message shall be implied or assumed unless the sender does so expressly with due authority of Badjate# and or its affiliate companies, as applicable. Information mentioned in the email or in its attachment is for personal information of the intended recipient and does not construe to be any investment advice, legal or taxation advice to you. The above information does not constitute an offer, invitation or inducement to invest in securities or other investments and Badjate# is not soliciting any action based upon it. Information in the email or its attachment is not for public distribution and has been furnished to you solely for your purpose and should not be reproduced or redistributed to any other person in any form. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt Badjate# or any of its affiliates or employees from, any O use and agrees not to hold Badjate# or any of its affiliates or employees responsible for any such misuse and further agrees to hold Badjate# or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. All efforts will be made to update the in format ion herein on reasonable basis, Badjate# and/or its affiliates/ employees are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent Badjate# and/or its affiliates / employees from doing so. Badjate# or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this email. Badjate# or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. The information above may be distributed to institutional investors or to recipients who are not institutional investors, Badjate# does not conduct a suitability analysis prior to dissemination of such information, Each recipient, should therefore seek advice of their independent financial advisor prior to taking any investment decision based on information given above or for any necessary explanation of its contents. Badjate# and/or its affiliates and/or employees/ analyst may have interests/positions, financial or otherwise in securities mentioned herein above Badjate# and its affiliates are a full-service, investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships and may deal in the securities mentioned herein as a broker or for any other transaction as a Market Maker, Investment Advisor, etc. to the issuer company or its connected persons. In addition, Badjate# has other business units with independent research teams separated by 'Chinese walls' catering to different sets of customers having varying objectives, risk profiles, investment horizon, etc. and therefore, may at times have, different and contrary views on stocks, sectors and markets. Badjate# generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, Badjate# generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflict of interest. Third Party Links Badjate# NEITHER MAKES REPRESENTATIONS, WARRANTIES REGARDING THE ACCURACY OF INFORMATIONIN THIRD NEITHER PARTY SITES NOR DO WE RECOMMEND OR SECOND THEIR VIEWS CONTAINED IN THIRD PARTY SITES. Badjate# suggests that you always verify the information obtained from linked sites before acting upon this information. Badjate# is not an agent for linked third parties nor do we endorse or guarantee their performance. The information or advice offered by linked third parties may not be products of Badjate#. Also, please be aware that the security and privacy policies on linked sites may be different from our policies, so please read third party privacy and security policies closely. If you have any questions or concerns about the products and services offered on linked third party sites, please contact the third party directly. *Deemed to associate, holding, subsidiary Companies of Badjate Stock and Shares Pvt. Ltd. # Means and Includes Badjate Stock and Shares Pvt. Ltd. and Badjate Commodities Pvt. Ltd.