UTRF Institutional Revenue Sharing Policy

UTRF follows specific policies for revenue sharing, intellectual property ownership, and royalty distributions. The revenue sharing policy outlines how net revenues are distributed after deducting legal fees. Intellectual property created by UT employees belongs to UTRF. Royalty distributions are handled directly to inventors or department heads. The Q&A section addresses common queries related to the usage and distribution of royalties.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

UTRF INSTITUTIONAL REVENUE SHARING Richard Magid UTRF Vice President March 2020

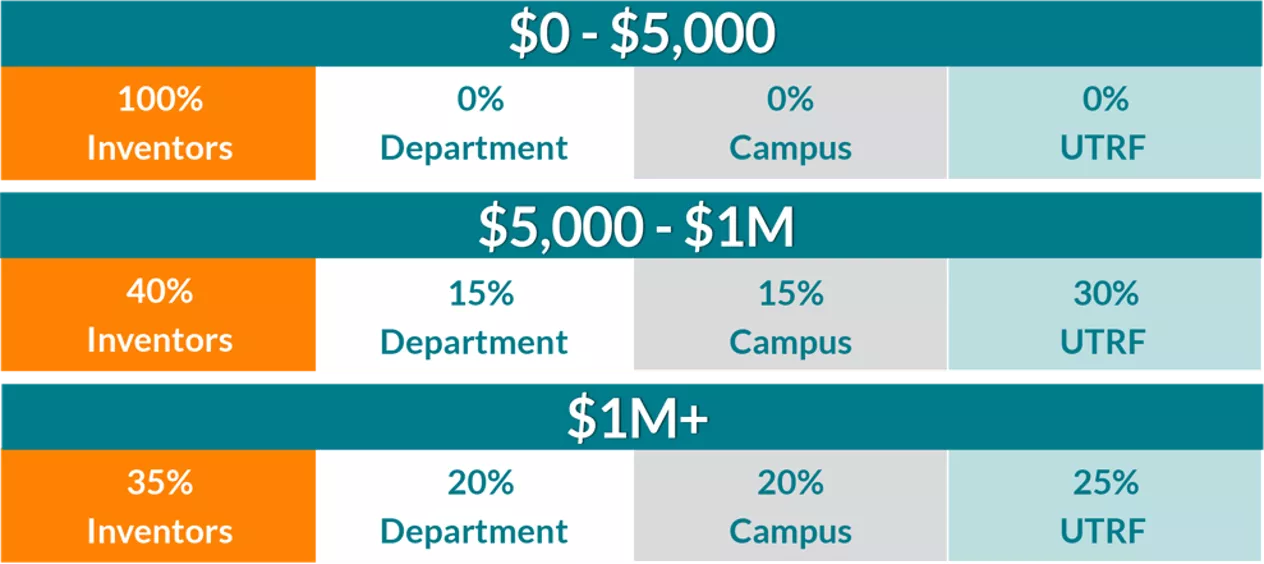

UTRF IP & REVENUE SHARING POLICIES Intellectual Property Policy: Inventions made by UT employees in the course of their duties or using UT resources and facilities are owned by UT and assigned to UTRF. Revenue Sharing Policy Note: After the first $5,000, distributions are made on net revenues remaining after legal fees have been deducted.

ROYALTY DISTRIBUTIONS Individuals UTRF sends checks directly to each inventor. These are not UT salary or benefits, UTRF sends a separate 1099 each tax year. Individuals responsible for all tax liability Departments UTRF sends checks to Business Manager with an explanatory cover letter. Department Head receives copy of cover letter. Deans also receive a copy of cover letter (new SOP). Campus UTRF sends checks to Chancellor s office with an explanatory cover letter.

ROYALTY Q&A What can Department/Campus royalties be used for? A: Institutional royalties are basically unrestricted funds for use by the recipient unit. Royalties will be utilized for the support of scientific research or education; 37 CFR 401.14(k)3 Do we have to report back to UTRF how the funds are used? A: No, UTRF does not need a report on how the funds are used by the Department or Campus. Does UTRF know how much my unit will receive next year? A: It depends. Some UTRF licenses have fixed fees (predictable), while others generate royalties based on sales or milestones (unpredictable). Dr X left UTHSC, does s/he still receive royalties? A: Yes. Royalties are vested at the time of invention, and the inventor(s) will receive their share whether or not they remain at UTHSC.