Understanding Voluntary Surrender of Estate and its Benefits

Voluntary surrender of estate allows a natural person facing insolvency to apply for sequestration, providing legal protection against creditors. This process involves submitting an affidavit and court application, with applicants not required to appear in court. Different scenarios illustrate when applying for voluntary surrender is beneficial. Key differences between VSOE and debt review are highlighted.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

DCAS A Sequestration & Liquidation Specialist C O N F E R E N C E Pieter Van Zyl established Senator Group in 1996.And is a specialist in sequestration and liquidation. CALL US NOW 0877023216

Voluntary Surrender of Estate Presented by Senator Group s Mr Pieter van Zyl

What is Voluntary surrender of estate refers to the process whereby a natural person can make an application to place him/herself under an order for sequestration. A person is insolvent if his/her liabilities exceed his/her assets. In such a case he/she can apply for voluntary surrender of their estate. Anybody can apply for voluntary surrender at any stage as soon as he/she is insolvent, even if they have been or are under debt counselling, for example. The person who wants to sequestrate him/herself, will depose to an Affidavit which explains why he/she claims he/she is insolvent. This will be drafted by the Attorneys who will bring the application on behalf of the Applicant. As soon as the Affidavit is signed, the application will be issued at Court and a Court date is assigned. The Applicant does not have to appear in Court as the Advocate appears on his/her behalf.

WHO SHOULD APPLY FOR VOLUNTARY SURRENDER OF ESTATE? A client under debt review can no longer afford to make his/her debt review repayment due to unforeseen financial crisis. The client still requires legal protection against his creditors even thou he/she can no longer make the agreed upon repayments. A voluntary surrender of estate application would be in the client's best interest. Upon assessment of a client's financial circumstances, you as the debt counsellor discovers that the client will not be able to afford a debt review repayment. This client has no vehicle or property in his name In this scenario a Voluntary surrender can assist the client in writing off the debt by way of an application to the high court A client approaches you for assistance under debt review. Most of the client s debt have or are in process of Sec 130 court procedures. These debts cannot be included under a debt review application but would be included with a voluntary surrender of estate application. An application for voluntary surrender of estate includes all debt ( incidental debt, unsecured debt, secured debt, judgement debt) Scenario 1 Scenario 2 Scenario 3

MORE SCENARIOS Clients restructuring assessment results in a debt review term that exceeds 7 years Would it not then be in the client's best interest to rather have the debt written off over 2 years

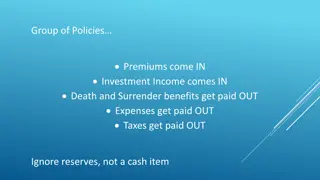

WHAT ARE THE DIFFERENCES BETWEEN VSOE AND DEBT REVIEW DEBT REVIEW Magistrate application for the restructuring of debt agreements Debt agreements are negotiated for lower premiums, lower interest rates extended terms to make it more affordable for the client. Interest is calculated over the extended terms increasing the total debt. A consumer must have a stable income to qualify for the debt review process The debt is paid monthly via a PDA or by the consumer, convenience of only one payment via the PDA Once all debt is settled the debt counsellor will proceed with the clearance certificate After clearance, the consumers credit record reverts to what it was prior to the debt review

VOLUNTARY SURRENDER OF ESTATE High court application for insolvency The client pays a percentage towards the insolvent estate which will be allocated as a benefit to the creditors of the estate, 22- 25 c on the rand and the repurchasing of any movable assets. No future interest for debt is applicable on such applications Full time employment is not a requirement for a voluntary surrender of estate application Fees towards the estate is held in the attorneys account until appointment of a trustee. It is the appointed trustee responsibility to distribute funds to the creditors and finalize the insolvent estate A consumer can apply for rehabilitation which brings the insolvency to an end and expunges from the client s record all debt information prior to the insolvency ( consumer credit score reverts to 0 and the consumer can rebuild his credit score, essentially a blank slate)

What can a consumer expect when applying for Voluntary surrender of estate ALL THE CONSUMERS DEBT IS WRITTEN OFF including the debt already blacklisted on ITC. (The consumer will not have to pay back any of their creditors and the consumer will be completely debt free). The consumer will no longer be liable towards his/her creditors, including banks, personal loans, TAX etc. the consumer will no longer need to communicate with any of his/her creditors. The facilitator to the application we will handle all communications. After the consumers voluntary surrender their FULL income will remain their own. All garnishee orders against their salary will be stopped. All other orders or deductions from their bank accounts shall stop. The consumer will NOT need to appear in court or communicate with their creditors. The consumer will be able to keep their furniture and other movable assets as this will be bought back from the insolvent estate. The consumer will be able to keep their vehicle/s if it is paid up provided that the value does not exceed the contribution of the estate or is under a lease agreement. WHAT HAPPENS TO THE CONSUMERS VEHICLE? If the consumers vehicle is under hire purchase, the Rules of Court stipulate that the Curator may repossess the vehicle as it forms part of the insolvent estate. Vehicles registered in another person, or legal persons, name will not form part of the estate.

What happens to Property SHORT PROSEDURE IF A PROPERTY IS INVOLVED. If the consumers property has already been scheduled for auction, it is of utmost urgency to proceed with the application for sequestration. All legal action will cease as soon as the notice is published in the Government Gazette. A valuator will contact the consumer to make an appointment to evaluate their property. The Master of the High Court appoints a Curator after the voluntary surrender application was granted. The Curator normally attempts to sell the property to ensure a better selling price and will appoint an agent to market the consumers property. The appointed agent is very professional and will take the consumers' needs into consideration. The consumer may occupy the property until the Curator is appointed. The consumers will still have to pay municipality bills to avoid a blackout . A copy of the last municipal account will have to be provided by the consumer to lodge their application for voluntary surrender of estate. The curator will give the consumer 30 days to vacate the property after the selling date. It will not be advisable to vacate the property before then as a property sells easier while occupied. This will also minimize vandalism and unnecessary costs to the insolvent estate. If the property is sold for less than the bond amount, the consumer will not be held responsible for the short fall. That means if the bond is R1million and the property is sold for R800 000.00 the difference will be written off.

What does it cost? An application fee is payable for processing the consumers application in the High Court. Fees towards the contribution of the estate is calculated from the total outstanding debt. For example, The Court Rules determine that the consumer must pay about 22c to 25 c in every rand owed to the creditors. In other words, if the consumers owes FNB, R1-00, the consumer will have to pay back at least 22c to 25c back. If the consumers total debt is R200 000, they would have to pay R44 000.00 back to the Curator who will distribute it to the creditors (Please note that these are approximate figures). FUNDS TOWARDS THE APPLICATION CAN BE PAID OFF OVER A TERM OF 24 MONTHS.

What happens after Application for rehabilitation can be made after completion of the voluntary surrender, the rules are as follows. A person will be fit for the rehabilitation after 6 months from the date that he/she has been sequestrated permitted that if there have been no claims against the estate. In this case the Master must consent to the Rehabilitation process. If there are claims against the estate, a person will be able to apply for Rehabilitation 12 months after the Master confirmed the estate account. (Liquidation- and Distribution Account). The Master must confirm this account and consent before we can commence with the Rehabilitation process, if it has not already been 4 years from the date that you have been sequestrated. Usually when there has been vehicles and/or a property, claims is proved against the estate.

OUR GOAL Facilitate the application on behalf of the consumer Guide them through the insolvency process Educate consumers and debt counsellors with regards to such applications Provide clients with the means to become free from their worries and debts