Understanding Operating Costing in Service Industries

Operating costing is a method utilized by service-oriented businesses to ascertain the costs of providing services. Industries such as transportation services, welfare services, utility suppliers, and municipal services find operating costing beneficial. The method involves classifying costs into three categories: operating and running charges, maintenance charges, and fixed or standing charges. Different formulas are applied based on factors like run kilometers, passenger kilometers, and ton kilometers in transport costing scenarios.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

OPERATING COSTING M.VIJAYASEKARAM

Operating Costing Operating Costing is a method of ascertaining the costs of providing or operating a service. This method of costing is applied by those undertakings which provide services rather than the production of goods. Such undertakings, for example, are; Transport concerns, Gas agencies; Electricity suppliers; Hospitals; Theatres, etc. Because of the varied nature of activities carried out by the service undertakings, the cost system used is different from that followed in manufacturing concerns.

Industries which are suitable or applicable for operating costing are; Transport service: Bus, taxi, truck, railways, etc. Welfare services: Canteens, hospitals, libraries. Utility suppliers: Gas, Electricity, water. Municipal services: Street lighting, road maintenance.

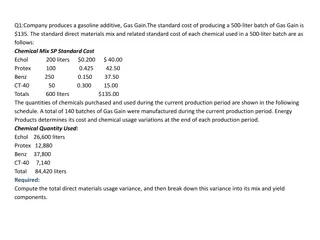

Classification of Operating Cost The operating costs can be classified into three categories. For example in the case of transport undertaking these three categories are as follows: Operating and running charges It includes expenses of variable nature. For example: expenses on petrol, diesel. lubricating oil, and grease, etc. Wages of the driver, conductor, etc (If payment is based on time or distance of trips). Commission taking on the bridge (Toll). Depreciation (If allocated based on mileage run and treated as variable expenses).

Maintenance charges These expenses are semi-variable and include the cost of: tires and tubes, repairs and maintenance, spares and accessories, overhaul, etc.

Fixed or standing charges These costs are fixed in nature though the operation is on standing position, which includes: garage rent, insurance, road license, depreciation, interest on capital, administrative overheads motor vehicle tax garage rent general supervision salary of an operating manager, supervisor, etc. In the case of transport costing the following formulas are applicable: Run Kilometers = (No. of vehicle x Distance x NO. of Trips x Working Days) Passenger Kilometers = (No. of vehicle x Distance x NO. of Trips x Working Days x Actual Passenger Carried) Ton Kilometers = (No. of vehicle x Distance x NO. of Trips x Working Days x Goods Carried)