Why Your Bureau Needs Payroll Software Now More Than Ever

Payroll software has become an integral part of modern businesses. The software\nautomates payroll processing and simplifies compliance with the HM Revenue and\nCustoms (HMRC) regulations in the United Kingdom (UK). The software reduces the\ntime and effort required for payroll processing, increases

6 views • 7 slides

How HMRC Payroll Software Can Streamline Your Tax Compliance Process

Payroll management and compliance with HMRC laws may be complex and time-consuming for\nbusinesses of all sizes. However, with the correct HMRC payroll software, this process may be\nautomated to save time, reduce errors, and ensure tax compliance. In this blog, we'll look at\nhow HMRC payroll softw

11 views • 6 slides

HM Government Border Delivery Group - RoRo Business Requirements

The HM Government's Border Delivery Group outlines the Day 1 No Deal RoRo Business Requirements to prepare for potential scenarios post-Brexit. Businesses are encouraged to adhere to these guidelines to mitigate disruptions at the border. For detailed information, contact queriesattheborder@hmrc.gsi

0 views • 81 slides

A Guide to Making Tax Digital (MTD) for VAT Regulations

The new Making Tax Digital (MTD) for VAT regulations came into effect from April 1, 2019. Businesses with a taxable turnover over £85,000 must keep digital records and file VAT returns using HMRC-approved software. The Government Gateway for VAT returns will be disabled, and businesses need to regi

0 views • 10 slides

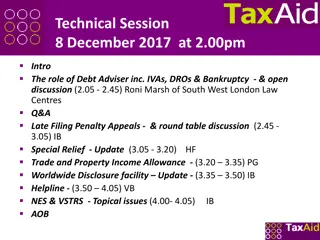

Understanding Late Filing Penalty Appeals and Reasonable Excuses

Explore the process of appealing late filing penalties with HMRC, including what constitutes a reasonable excuse. Learn about common scenarios accepted as reasonable, as well as those that won't be considered valid reasons. Understand the importance of taking reasonable care in meeting tax obligatio

0 views • 21 slides

UK Sanctions and Financial Crime: Interplay, Types, Enforcement, and Offences

The UK sanctions landscape post-Brexit, governed by the Sanctions and Anti-Money Laundering Act 2018, focuses on financial sanctions, human rights, anti-corruption measures, immigration, trade, and transport sanctions. The system allows for the issuance of licenses for specific activities under sanc

0 views • 13 slides

HMRC Exports CHIEF/CDS Cut-Over Strategy

This document outlines the proposed IT cut-over strategy from customers' use of CHIEF to a dual running system of CDS and CHIEF Exports. The strategy includes migration milestones, phases, CSP involvement, traders' migration processes, declarations, consolidations, movements, and milestones. It deta

0 views • 5 slides

Step-by-Step Set Up Process for Making Tax Digital in SAP Business One

In this comprehensive guide, you will learn the detailed process of setting up SAP Business One Integration Framework to communicate with HMRC for Making Tax Digital (MTD). This step-by-step approach covers actions required in SAP Business One, Integration Framework, and HMRC's systems, ensuring you

0 views • 10 slides