Understanding Interest and Its Implications

Learn about interest, a vital concept in finance where money is paid for the use of money. Discover how interest can work for or against you, considerations when borrowing or investing, and the difference between simple and compound interest. Explore examples and formulas to calculate interest on loans.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Money Matters Topic 4 Interest

What is interest? MONEY PAID FOR THE USE OF MONEY. USUALLY A PERCENTAGE OF THE ORIGINAL AMOUNT. ANALOGY-IF YOU RENT A TUXEDO FOR THE PROM, YOU HAVE TO PAY MONEY TO USE SOMEONE ELSE S TUXEDO. INTEREST IS THE MONEY PAID TO USE SOMEONE ELSE S MONEY.

It can work for and against you. IF YOU BORROW MONEY, YOU PAY INTEREST, AND THUS IT WORKS AGAINST YOU. HOWEVER, IF YOU LEND MONEY, SOMEONE ELSE WILL PAY YOU TO USE YOUR MONEY, AND THUS IT WORKS FOR YOU.

Considerations WHEN BORROWING, YOU WANT INTEREST AS LOW AS POSSIBLE. WHEN INVESTING, YOU WANT INTEREST AS HIGH AS POSSIBLE.

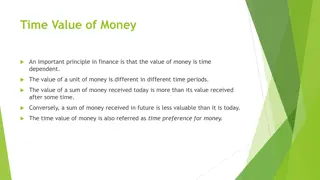

Compounding REFERENCES HOW INTEREST IS CALCULATED. THIS CAN BE DONE IN 1 OF 2 WAYS. SIMPLE INTEREST IS CALCULATED ONCE. COMPOUND INTEREST IS COMPOUNDED MORE OFTEN (USUALLY MONTHLY) AND THE INTEREST ACCRUED EACH MONTH IS FACTORED INTO THE NEXT MONTH S TOTAL.

Interest Examples SIMPLE INTEREST FORMULA I = PRT WHERE I IS INTEREST, P IS PRINCIPAL, R IS RATE, AND T IS TIME. COMPOUND INTEREST FORMULA A = P(1 + R/N)^NT WHERE A IS AMOUNT, P IS PRINCIPAL, R IS RATE, N IS NUMBER OF TIMES INTEREST IS APPLIED PER ANNUAL PERIOD (IF MONTHLY, 12), T IS THE NUMBER OF TIME PERIODS ELAPSED (COULD BE MONTHS OR YEARS) EXAMPLE-CALCULATE BOTH THE SIMPLE AND COMPOUND INTEREST ON AN AUTO LOAN OF $30,000 AT 2.25% FOR 4 YEARS. FOR COMPOUND PART, USE COMPOUNDED MONTHLY.