The Evolution of Retail and Its Implications on Communities

The future of retail is shaped by online giants like Amazon, leading to a shift in consumer habits and urban development. A saturation of retail outlets in the market has led to excess square footage and competition among cities for growth. This shift impacts land use, community planning, and municipal revenues, prompting a reevaluation of traditional retail models to adapt to changing consumer demands.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

THE FUTURE OF RETAIL What it means for the land use environment, community planning, and municipal revenues

The Backstory General Retail Amazon changed the world of US retailing Niche businesses copied Amazon s model Savvy retailers watched Amazon, created good websites, created more convenient delivery and return options, and upped their online game quickly to compete with Amazon with easier returns.

The Backstory General Retail In some instances, development was spurred by competition between cities and public financing incentives were used to create development that might otherwise may not have happened Retailers built stores that local markets often couldn t support because population growth didn t support the square footage being built Decisions to build a new store were often rooted in a market assumption that a portion of the sales could be stolen from competition instead of market growth ( survival of the fittest approach to retailing )

The Backstory General Retail Similar retail concepts proliferated in various categories all selling the same things: Small appliances and soft goods (Bed Bath & Beyond, Home Goods, Linen & Things) Electronics (Best Buy, Circuit City, Ultimate Electronics, HH Gregg) Books & music (Barnes & Noble, Borders) although online sales and reading (again Amazon & Kindle) was already creating a hit to this category Home Improvements (Home Depot, Lowe s, Home Quarters, Builders Square) Apparel (Gap, A&E, Limited and others) Result was too many retailers serving a given market According to Credit Suisse, the US has more retail square footage per capita than any other developed country by a wide margin

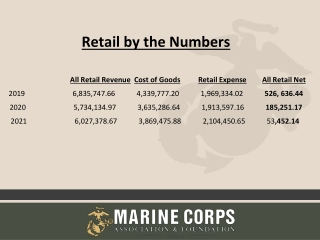

The Backstory General Retail Data in this table is 2018; Updated 2020 information from various sources indicate US at about 23,500; Canada (not in this table and only other country even close to US) at about 17,500

The Backstory - Restaurants Changing consumer habits also impacted chain restaurants They also suffer from market overcrowding and people s eating habits have changed Restaurants that have local connection, unique & popular menu items, and are destinations (local microbreweries for example) were doing fine pre- COVID and have been bouncing back Certain fast food and fast casual were doing well and growth in prepared foods from the grocery deli counter has been surprising (these did surprisingly well during COVID lockdowns)

The Backstory - Grocery The proliferation of grocery store venues will result in the same type of overbuilding that has negatively impacted other retailers Lucky s, Trader Joes, Fresh Thyme, Whole Foods, 365, Ruler, were non- entities to most people 10 years ago Wal-Mart s Neighborhood Market is a recognition that, on average, 58% of the sales from their Super Centers is from the grocery store/pharmacy side of a 120-130,000 sq. ft. building The other side of their Super Store is primarily selling merchandise that doesn t represent repeat shopping or represents merchandise that people are buying online. Wal Mart has essentially laid off their real estate staff and isn t building new stores

The Backstory Department Stores and Malls Department stores have been losing customers for years, struggled to define themselves to younger demographics, and were locked into mall locations with high costs of operation and more space than they needed Like everything else about US retail, there were too many malls in market areas that were not growing. The St. Louis region is a classic example of too many malls, changing demographics, and changing shopping habits: Every north county mall is gone (River Roads, Northland, Jamestown, St. Louis Mills) Crestwood is gone; Chesterfield is transforming This was happening pre-COVID

The Backstory Department Stores and Malls The evolution of mall development is amazing. This data from an early 2000 Smithsonian article shows the picture Source: Smithsonian Magazine

The Backstory Other Trends As the department stores stopped bringing in the traffic the mall stores began dying as well The mall was no longer a destination and once it became the place for kids to hangout, it lost its appeal to the shoppers really spending money Once the department stores are gone, the mall either reinvents itself or is visited by the wrecking ball (or a combination of both)

The Fallout The retailers costs of operating and maintaining stores (often because there are too many in a given market) is creating losses (including those related to debt load) This has impacted the mall and strip center owners with property- based debt They are just giving the properties to the lenders Some have declared bankruptcy

The Fallout Changing demographics and shopper trends have rendered some types of development and some types of stores no longer relevant; i.e.: The enclosed mall Strip centers anchored by big boxes and junior anchors (although those anchored by grocery stores are the gold standard ) Gordman s and maybe Big Lots and others selling close out or manufacturer excess inventory thanks to Overstock.com Furniture stores may be impacted by online retailers such as Wayfair Regional malls and strip centers often fuel retail development a mile in either direction of their location The loss of these big stores which drive traffic can have a major ripple effect within a retail corridor

The Fallout Crestwood Plaza offers a great example of how the presence of major retail fuels other retail development 1988 Expansion of the mall caused new retail to locate along this entire corridor of about 2 miles As the anchors at the mall closed, vacancies occurred up and down the corridor (36% increase by 2016)

The Fallout Mall and strip center owners are often left holding the bag from the retailer closures and bankruptcies; therefore, the loan default rate on developments continues to rise CBL, now in bankruptcy; gave some properties back to the lender Westfield has a portfolio that has been in foreclosure for years Simon spun off some of their undesirables to a separate corporation anticipating failure of those properties Outlet malls cannibalize sales from the department stores more than other retail types

The Future The bankruptcies and closures aren t over Typical mall retailers that lived off the department store traffic are failing Vacant spaces will be difficult to fill (particularly in multi-level malls) Mall traffic has been picking up in locations where the department stores still exist but: They are in weakened positions (particularly Penney s, Macy s, and Dillard s) because: They are in too many locations in many metro markets They don t need the floor space they have

The Future High-end retailers in metro markets with more than one location will probably close one In many metro markets (STL included) there are too many malls with too many of the same retailers The survivors will be in demographic sweet spots; consider: Brentwood represents 5% of all retail sales in STL County Brentwood, Richmond Heights, and Maplewood about double that figure The demographic diversity within 3 miles of I-64 and Hanley includes two universities (students, faculty, and staff), two hospital/research complexes, the Cortex Innovation Center complex, significant office employment A wide range of housing types Incomes spanning lower middle to upper ranges Access to MetroLink

The Future Mall owners will look to convert buildings or redevelop Mixed-Use is the future of mall reinvention Replacement uses won t produce revenues at the same level (or in the case of institutional uses such as medical uses and schools and universities, won t produce direct revenue at all) Office uses will generate RET and PPT dollars (but COVID has disrupted that market) These uses will bring people to a site and can support retention of retail elements Northwest Plaza is a good example but there are many variations that are succeeding

Thank You John Brancaglione Senior Director PGAV PLANNERS LLC 200 N Broadway Suite 1000 Saint Louis, MO 63102 314-231-7318 (office main) 314-655-4308 (direct) www.pgavplanners.com www.pgav.com