Smart Money Management Guide for Financial Well-being

Learn how being smart about managing money can make life easier by following tips, activities, and resources provided in this comprehensive guide. Discover the importance of intentions, tricks to save money, and habits to secure financial stability. Explore topics such as updating your will, saving on daily expenses, and investing for a secure future. Empower yourself with the knowledge to achieve your financial goals and navigate unexpected challenges effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Being smart about managing money makes life a little easier. The following pages contain verbiage, tips, a printable poster and other articles and resources that you can reference and share with your co- workers and employees.

WHAT AND WHY We have aspirations of buying a home, taking a dream vacation, of a footloose and fancy-free retirement, but we are also limited by our income and those little curveballs life throws at you. Being smart with your money can help make some aspirations come to fruition and can help temper those inevitable curveballs. You don t have to have a big salary to live like a king. Being intentional about where you spend your money can serve you well in both the short and long run. Let s give it a try.

IDEAS FOR ACTIVITIES Invite a financial advisor in for a lunch and learn. Be sure they cover the benefits of and variety of ways to invest. Ask each team member to share one or two tricks or hacks to save money. This information can be shared at a lunch and learn or by having team members jot their thoughts down on a post-it note on the breakroom wall. Have team members keep a spending journal for a week, or ask them to pull a monthly spending report from their banking institution. It is a good chance to really see where your money goes. If team members are up for it, have them share one thing that surprised them or one area where they can decrease spending.

RESOURCES Articles 6 Smart Money Habits of Millennials Prepare Now for These 5 End-of-Year Expenses 54 Ways to Save Money Videos Saving More Tomorrow Shlomo Benartzi When money isn t real: the $10,000 experiment -Adam Carroll

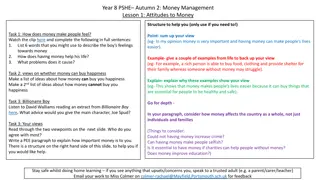

TIPS 1. 2. Update your will. No matter how little or how much you own, you need a will. Dedicate time each week to thinking, talking and learning about money management. Discussing your financial plan with your spouse for just 30 to 60 minutes a week can make a big difference. Whenever you re considering making an unnecessary purchase, wait thirty days and then ask yourself if you still want that item. Quite often, you ll find that the urge to buy has passed and you ll have saved yourself some money by simply waiting. Take your lunch to work or school. It is much less expensive to cook at home than to eat out daily. Borrow books from your library, don t purchase them. This puts an imperative on you to actually read your books. Pay off all of your debts starting with your smallest high interest debt. 3. 4. 5. 6.

MORE TIPS 7. Buying a used car rather than a new one can literally save you tens of thousands of dollars in some cases. If the company you work for offers a 401(k) plan, sign up at your first opportunity. If there's no such plan, divert some of your paycheck into an IRA. Pay yourself first. Take 10 percent or so off the top of your income and save it before you even start paying bills. 10. When creating an ideal budget, spend 40 percent on house and utilities, 20 percent on paying debt and saving, 15 percent on food, 10 percent on clothing and entertainment, 10 percent on transportation and 5 percent on car insurance and personal expenses. 11. Plan for expenses that do not occur monthly, such as birthdays, holidays, annual taxes, vacations, etc. 12. Always choose federal student loans over private loans. Federal loans typically have better interest rates. 8. 9.

MORE TIPS 13. Consumers who drink one cup of Starbucks coffee per day can save $70/month by brewing their own Starbucks brand coffee at home instead of buying it in the store. That s $840 per year! 14. Assess clothing in terms of quality as well as price. An inexpensive shirt or coat is a poor bargain if it wears out in less than a year. 15. Heading to the grocery store with a fabric bag in tow not only cuts down on paper and plastic waste, it can save you money. Stores including Hy-Vee, Target, Whole Foods and Trader Joes offer incentives for reusable bags, like money back (5-10 cents). 16. If you are a two income family, try living off the smaller salary and dedicate the larger salary to paying off debt and saving. 17. If a person invested $10,000 at age 20, and if it earned a six percent rate of return, the investment would double every 12 years. At age 65, the investor would have $80,000.

MORE TIPS 18. To save money on your energy bill, lower your thermostat in winter and bump it up in summer before you go to bed or head out for the day, or get a programmable thermostat to do it automatically. 19. Set a good example for your children by paying bills on time each month, not spending money on foolish things you don t really need, etc. If you are extravagant with your spending, they will be too, but if you are frugal, they will learn this instead. 20. Avoid paying interest on your credit card purchases by paying the outstanding balance in full each monthly billing cycle. 21. Locate your most recent bank and credit card statements to see an itemized list of your spending. Be sure to note everything you bought and how much it cost. Include rent, car insurance, groceries, small purchases such as coffee or snacks and fees from your bank or credit card. 22. Make a budget. It's how you control your money and not the other way around. That means you spend every dollar on paper, on purpose. You're either giving, saving or spending.

MORE TIPS 23. Schedule an energy audit for your home. There are energy and cost savings to be had and tools to help you make the changes. 24. Create a $1,000 emergency fund. 25. Refinance your mortgage to lower interest charges. Consider refinancing your mortgage to lower the rate and term. On a 15-year $100,000 fixed-rate mortgage, lowering the rate from seven percent to 6.5 percent can save you more than $5,000 in interest charges over the life of the loan. For each $100,000 you borrow at a seven percent rate, you will pay over $75,000 less in interest on a 15-year than a 30-year fixed rate mortgage. 26. There are things that everyone wants and then there are the things that everyone actually needs. You need to be able to distinguish wants from needs and then teach your kids how to do the very same thing. 27. Automate your savings. Use direct deposit to put a certain amount directly from your paycheck into a savings account. You won t miss the money and it will be there when you really need it.

APPENDIX Financialplan.about.com Daveramsey.com Smartaboutmoney.org Kfi.ky.gov Thesimpledollar.com Pinterest.com Lifehack.org Bankrate.com Mymoneycoach.ca Learnvest.com Nationwide.com Community.today.com Jsonline.com Americasaves.org Greatlist.com Consumer.ftc.gov