Secretarial Audit compliance under Companies Act, 2013

Secretarial Audit ensures compliance with laws and regulations, enhances corporate governance, and fosters transparency. Mandatory for certain companies, it builds trust, mitigates risks, and safeguards corporate integrity, providing confidence to di

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

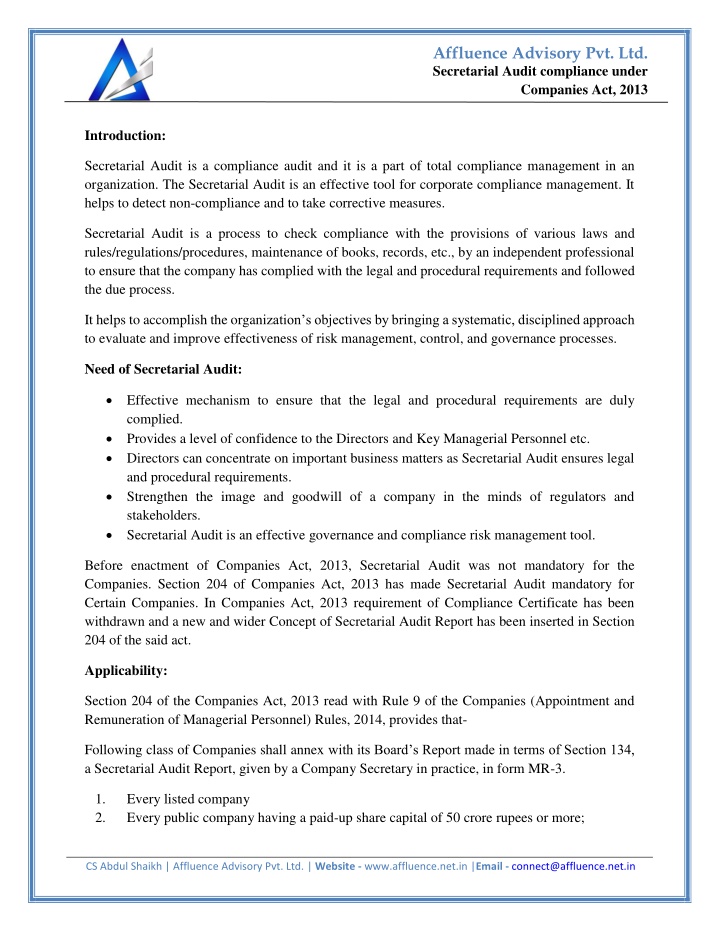

Affluence Advisory Pvt. Ltd. Secretarial Audit compliance under Companies Act, 2013 Introduction: Secretarial Audit is a compliance audit and it is a part of total compliance management in an organization. The Secretarial Audit is an effective tool for corporate compliance management. It helps to detect non-compliance and to take corrective measures. Secretarial Audit is a process to check compliance with the provisions of various laws and rules/regulations/procedures, maintenance of books, records, etc., by an independent professional to ensure that the company has complied with the legal and procedural requirements and followed the due process. It helps to accomplish the organization s objectives by bringing a systematic, disciplined approach to evaluate and improve effectiveness of risk management, control, and governance processes. Need of Secretarial Audit: Effective mechanism to ensure that the legal and procedural requirements are duly complied. Provides a level of confidence to the Directors and Key Managerial Personnel etc. Directors can concentrate on important business matters as Secretarial Audit ensures legal and procedural requirements. Strengthen the image and goodwill of a company in the minds of regulators and stakeholders. Secretarial Audit is an effective governance and compliance risk management tool. Before enactment of Companies Act, 2013, Secretarial Audit was not mandatory for the Companies. Section 204 of Companies Act, 2013 has made Secretarial Audit mandatory for Certain Companies. In Companies Act, 2013 requirement of Compliance Certificate has been withdrawn and a new and wider Concept of Secretarial Audit Report has been inserted in Section 204 of the said act. Applicability: Section 204 of the Companies Act, 2013 read with Rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, provides that- Following class of Companies shall annex with its Board s Report made in terms of Section 134, a Secretarial Audit Report, given by a Company Secretary in practice, in form MR-3. 1. 2. Every listed company Every public company having a paid-up share capital of 50 crore rupees or more; CS Abdul Shaikh | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Secretarial Audit compliance under Companies Act, 2013 3. 4. Every public company having a turnover of 250 crore rupees or more; or Every company having outstanding loans or borrowings from banks or public financial institutions of 100 crore rupees or more. Annual Secretarial Audit Report: The listed entity and its unlisted material subsidiaries shall continue to use the same Form no. MR- 3 for (secretarial audit report) as required under the Companies Act, 2013 and the rules made thereunder for the purpose of compliance with Regulation 24A of the SEBI (LODR) Regulations, 2015 as well. Here Material Subsidiary means a subsidiary whose income or net worth exceeds ten percent of the consolidated income or net worth, respectively, of the Company and its Subsidiaries in the immediately preceding accounting year. Format of Secretarial Compliance Report for listed company: While the annual secretarial audit covers a broad check on compliance with all laws applicable to the entity, listed entities additionally, on an annual basis, require a check by the PCS on compliance of all applicable SEBI Regulations and circulars/guidelines issued thereunder, consequent to which, the PCS need to submit annual secretarial compliance report to the listed entity in the format prescribed under said SEBI circular. Documents required for Secretarial Audit: MOA, AOA, shareholding agreements if any, JV Partner or any other material contract or document. Filings with ROC/RBI/Stock exchange or other regulatory authorities. Prospectus and related records. Statement of Related Party Transactions as per AS-18 and approval obtained from Board or shareholders. Statement for borrowings/investments/deposits. All Statutory Registers/Records. Financial Statement, Reports of Director s and Auditor s Disclosures made with Stock exchanges, Declarations, Newspaper Publications, Agreements, etc. Relevant approvals/correspondence or orders of regulatory authorities such as ROC/SEBI/NCLT. Notices, Agenda, Minutes and Attendance Registers of meetings. Observation /instruction of Judicial /Quai judicial body/Regulators. CS Abdul Shaikh | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Secretarial Audit compliance under Companies Act, 2013 Document evidencing Board processes/compliance dashboards. Process of Secretarial Audit: Appointment of Secretarial Auditor by passing resolution in Board Meeting. A formal letter of appointment should be issued by the company to the secretarial auditor along with the copy of board resolution. The secretarial auditor should confirm the acceptance of appointment in writing. The Secretarial Auditor id expected to take general overview of the company. He may opt for surveys for generating information about the company. The preliminary meeting with the senior management and the administrative staff involved in the audit will give fair idea of what is expected and the manner in which audit activities are to be undertaken. Detailed checklist for each aspect of secretarial audit should be prepared and audit staff should be properly sensitized before commencement of audit. The secretarial auditor shall determine whether the controls identified during the preliminary review are operating properly, and in the manner described by the company. It is recommended that the findings during the course of audit are summarized and presented for initial discussions with the management for their views/clarifications/replies. After considering the clarifications/replies of the management, the secretarial auditor shall prepare the secretarial audit report in MR-3. The report is addressed to the members but is to be submitted to the Board. Conclusion: It fosters transparency, mitigates risks, and enhances stakeholder confidence. The appointment of qualified professionals and meticulous scrutiny of requisite documents are integral to the efficacy of secretarial audits, ensuring the integrity and sustainability of corporate entities. Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement CS Abdul Shaikh | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in