Rising Celiac Disease Diagnoses Fuel Demand for Gluten-Free Products

Gluten-Free Products Market By Product (Bakery Products, Desserts & Ice Creams, and Other Products), By Distribution Channel (Convenience Stores, Specialty Stores, Online, and Other Distribution Channels), By Region and Companies - Industry Segment O

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

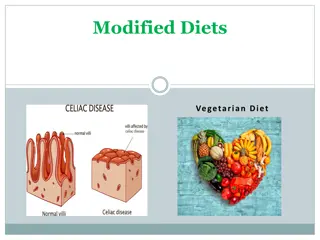

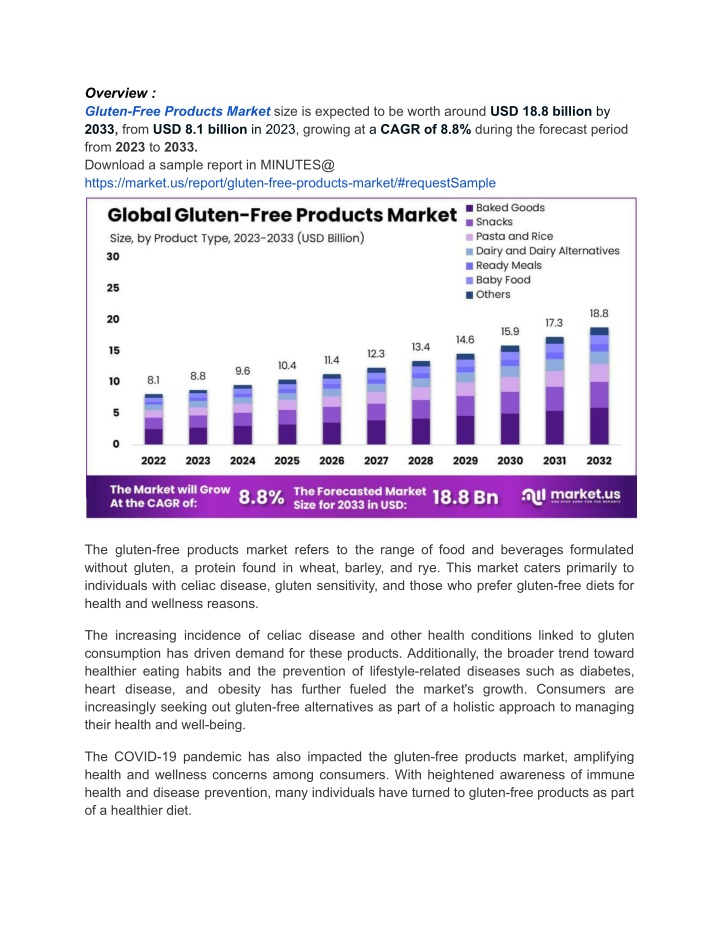

Overview : Gluten-Free Products Market size is expected to be worth around USD 18.8 billion by 2033, from USD 8.1 billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2023 to 2033. Download a sample report in MINUTES@ https://market.us/report/gluten-free-products-market/#requestSample The gluten-free products market refers to the range of food and beverages formulated without gluten, a protein found in wheat, barley, and rye. This market caters primarily to individuals with celiac disease, gluten sensitivity, and those who prefer gluten-free diets for health and wellness reasons. The increasing incidence of celiac disease and other health conditions linked to gluten consumption has driven demand for these products. Additionally, the broader trend toward healthier eating habits and the prevention of lifestyle-related diseases such as diabetes, heart disease, and obesity has further fueled the market's growth. Consumers are increasingly seeking out gluten-free alternatives as part of a holistic approach to managing their health and well-being. The COVID-19 pandemic has also impacted the gluten-free products market, amplifying health and wellness concerns among consumers. With heightened awareness of immune health and disease prevention, many individuals have turned to gluten-free products as part of a healthier diet.

This shift is expected to continue, with the market growing as more people adopt gluten-free diets to avoid potential health issues. The market's expansion is driven by innovations in product offerings, making gluten-free foods more accessible, tasty, and nutritionally balanced, thereby appealing to a wider audience beyond those with medical dietary restrictions. Key Market Segments By Product Bakery Products Desserts & Ice Creams Prepared Foods Pasta and Rice Other Products By Distribution Channel Convenience Stores Specialty Stores Online Supermarkets & Hypermarkets Other Distribution Channels Product Analysis In 2023, gluten-free baked goods, including bread, cookies, and cakes, dominated the gluten-free products market with over 31.5% share. This growth is driven by increased awareness of healthy eating and continuous product innovation. Major players like Warburton s in the U.K. and startups like NUCO in the U.S. are expanding their gluten-free offerings, leading the bakery segment to an expected fastest CAGR of 11.7% from 2023 to 2032. Distribution Channel Analysis Supermarkets and hypermarkets led the gluten-free products market in 2023, capturing over 27.3% of the market share. Their extensive product range and one-stop shopping convenience drive this dominance. The online segment, with benefits like home delivery

and discounts, is projected to grow at a 12.8% CAGR from 2023 to 2032, boosted by the COVID-19 pandemic and innovations like click-and-collect services. rk t l r Conagra Brands, Inc. Nestl SA The Hershey Company DR. SCH R AG/SPA ENJOY LIFE NATURAL General Mills, Inc. Kellogg Company The Kraft Heinz Company Genius Foods Amys Kitchen Inc. Bobs Red Mill Natural Foods Inc. Campbell Soup Co. The Hain Celestial Group, Inc. Drivers The increasing diagnosis of celiac disease and other gluten-related disorders is driving the growth of the gluten-free products market. Celiac disease, an autoimmune condition that damages the small intestine when gluten is consumed, requires a strict gluten-free diet. Restraints Despite their popularity, gluten-free products often lack sufficient dietary fiber, leading to potential digestive issues such as constipation. Gluten-free flours used in bread and pasta typically contain refined grains with a high glycemic index and low fiber content. Opportunity

Microencapsulation technology presents a significant opportunity in the gluten-free products market. This innovation helps extend the shelf life and improve the texture of gluten-free foods, which typically spoil faster without gluten. Challenge One of the biggest challenges in the gluten-free products market is replicating the taste and texture of gluten-containing foods. Achieving the same sensory qualities using alternative ingredients is difficult and often requires extensive research and development.