Review of The Sekunjalo Group Presentation to Parliament Standing Committee on Finance

The Sekunjalo Group presented a review of the Mpati Commission Report to the Parliament Standing Committee on Finance. The presentation highlighted concerns regarding the reliance on unreliable witnesses, lack of supporting evidence for findings, and perpetuation of unsubstantiated narratives intended to harm the group's reputation. The Mpati Commission Report focused on investments made by the Sekunjalo Group and addressed specific companies without adverse findings against Sekunjalo Investment Holdings, Ayo Technology Solutions, Independent Media, or Sagarmatha.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

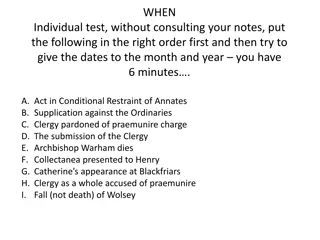

Presentation Transcript

The Sekunjalo Group Presentation to Parliament Standing Committee on Finance (SCOF) Wednesday 12 MAY 2021 Presented by : Adv Wallace Mgoqi Dr Iqbal Surv Takudzwa Hove

OUTLINE OF THE PRESENTATIONATION SECTION 1: INTRODUCTION & BACKGROUND SECTION 2: SEKUNJALO INVESTMENT HOLDINGS SECTION 3: AYO TECHNOLOGY SOLUTIONS SECTION 4: INDEPENDENT MEDIA & SAGARMATHA SECTION 5: PREMIER FISHING AND BRANDS LIMITED SECTION 6: OVERVIEW & CONCLUSION

SECTION 1: INTRODUCTION & BACKGROUND

INTRODUCTION March 17 2021 presentation to SCOF focused on the investment by the PIC and the hostile environment we currently face. SCOF subsequently requested that we deal with the Mpati Commission report. We are here to present our review of the Mpati Commission Report. We emphasise the following: The Commission relied heavily on evidence from unreliable witnesses. The Commission made findings without supporting evidence. Whilst the Commission made no adverse findings against any entity within the broader Sekunjalo Group, there were statements in the report which implied improper conduct or wrong doing with no supporting evidence in the body of the report. The Commission ultimately perpetuated an unsubstantiated narrative that was intended to harm the Sekunjalo Group, Ayo Technology Solutions, Independent Media, Sagarmatha Technologies and every other company within the Sekunjalo Group.

MPATI COMMISSION REPORT According to its Terms of Reference, the Mpati Commission was established to look into companies which were reported on in the media during 2017 and 2018 and that contained references of alleged impropriety within the PIC. Independent Media s media competitors and detractors intentionally made companies that Sekunjalo had invested in newsworthy for their own, subjective reasons. It is important to note the following: It was extremely unusual that out of the 11 companies interrogated at the PIC, 4 of those companies were companies that the Sekunjalo Group had invested in. 97% of equity investments by the PIC in JSE listed companies, are with companies that are not black owned. None of these companies were investigated. Notwithstanding these facts, we, as the Sekunjalo Group, voluntarily went to the Commission and encouraged our executives to appear at the Commission to enhance transparency.

MPATI COMMISSION REPORT SUMMARY The Report dealt with investments made by the Sekunjalo Group. Note: Sekunjalo Investment Holdings was not part of the terms of reference: Sekunjalo has invested in the four companies interrogated by the Commission; The PIC has never made an investment in Sekunjalo Investment Holdings itself; No adverse findings were made by the Commission against Sekunjalo Investment Holdings; Ayo Technology Solutions - no adverse findings were made by the Commission; Independent Media - no adverse findings were made by the Commission; Sagarmatha - no financial investment was made and no adverse findings were made by the Commission; Premier Fishing Brands - no adverse findings were made by the Commission; We have not dealt with allegations for or against the PIC itself or its employees as this is not for us to comment on.

SECTION 2: THE SEKUNJALO GROUP

SEKUNJALO REFERENCE IN MPATI COMMISSION REPORT CASE A REFERENCE FACTS The Ayo transaction demonstrates the malfeasance of the Sekunjalo Group Para 127, Page 341 This reference is false and misleading; Malfeasance - The legal definition of malfeasance is described as intentional conduct that is wrongful or unlawful, especially by officials or public employees. Malfeasance is at a higher level of wrongdoing than nonfeasance (failure to act where there was a duty to act) or misfeasance (conduct that is lawful but inappropriate); No evidence leading to the inclusion of this sentence in the report; No irregularity shown in the report therefore no basis for using the term; The term Malfeasance seems to have been an afterthought and was maliciously added to inflict damage to the Group; It is defamatory and contradictory as there are no adverse findings against Sekunjalo. Regardless of this non- servicing of the debt, which amounts to around R1.5 billion, the PIC continued to invest in Premier Fishing, Ayo and almost in Sagarmatha Para 84, Page 317 This reference is false; At the time of the Premier Fishing and Brands and Ayo listings, no loans were due or overdue to the PIC/ GEPF; Independent Media s loans were only due as of August 2018, yet Premier Fishing listed in February 2017 and Ayo in December 2017; In addition, the PIC was in discussions with the Sekunjalo Group on an exit strategy for its investment in Independent Media well before the Independent Media loans became due.

SEKUNJALO - CASE STUDY A REFERENCE FACTS The Sekunjalo Group influenced companies in which it had invested to support Independent Media - Media allegations This reference is partially true; The Sekunjalo Group took substantial resources from other investments, for a number of reasons: 1,600 people are employed within the Independent Media Group; Independent Media was contributing to a constitutional imperative, being media freedom and media diversity; This was done in a completely legal and ethical manner which did not have any negative impact on the other Sekunjalo Group companies. The Sekunjalo Group is well within its rights, legally, ethically and morally considering the mass unemployment in South Africa to support investments in the group as a means of social good and good business sense. board members within the boards of the Sekunjalo Group of companies are not independent. It was a PIC requirement that the Ayo board be strengthened with independent non-executive directors board members are related to Dr Surv , are long- serving employees, long-time friends or are non-executive directors on other Sekunjalo Group company boards Para 107, Page 321 This reference is partially true, but misleading; The Sekunjalo Group nominates and appoints its directors at the individual company s AGM as is standard practice; All shareholders, including the PIC/GEPF voted unanimously for the appointment of these directors; Reference partially correct as it is not unusual in South Africa for directors to serve on multiple boards; The Sekunjalo Group s highly competent and experienced directors just happen to be black and is therefore unfairly criticised; A maximum of two Sekunjalo Group nominated non-executive directors serve on the board; The PIC was involved in the nomination of 4 independent, non-executive directors, who were subsequently approved and appointed; The King Code of Governance is adhered to and stringent governance measures are in place across all Sekunjalo Group companies; AEEI was previously a recipient of JSE awards for Sustainability and Governance as a matter of fact.

SECTION 3: AYO TECHNOLOGY SOLUTIONS

AYO REFERENCE IN THE MAPTI COMMISSION REPORT CASE B REFERENCE FACTS This reference is false, a valuation was done by the PIC team; Testimony and statements from senior analysts at the Commission confirmed this, including Lebogang Molebatsi and Sunil Varghese; Ayo = Special Purpose Acquisition Vehicle (SPAC) - its strategy was to use the funds for acquisitive growth; Ayo was valued on a forward multiple of 16 times; Ayo provided a detailed PLS / Prospectus to the PIC; PIC senior analysts came to a share price valuation of between R43 and R47. No proper valuation to back the investment was done, and therefore the question remains as to whether the PIC subscribed for the shares at a fair and reasonable value. At the listing date, the shares were R43 per share, while as at 23 October 2019 the share price was R5.60 per share, a decrease in value per share of 87% Para 94, Page 318 This reference is partially true; AEEI had a relationship with BTSA for more than 10 years, and it was a highly profitable business; To meet the B-BBEE requirements of BTSA s customers, Ayo was to acquire the operations of BTSA and continue to service its customers; This revenue base was the foundation of the significant revenue growth in the forecast; This is why the BTSA management (lead by Kevin Hardy) moved to Ayo to drive this strategy; The full migration eventually didn t happen as BTSA didn t go ahead with the Ayo sale due to toxic media reports. BTSA formed a critical part of the valuation of Ayo as it was considered a key strategic relationship that would aggressively grow its business. Revenue was projected to increase by 825% premised on the assumptions that existing BTSA customers would transition across to Ayo and Ayo would be targeting an increase in market share between 1-2% for the periods forecasted owing to its superior B-BBEE credentials Para 97, Page 319 It is true that the BTSA financials were not provided, but false as regards the allegation that BTSA did not agree with the assumption made in the Ayo PLS; Financial statements of BTSA could not be provided to the PIC because BTSA did not give consent for its financial information to be made public; This is normal in the case of multinational companies as they report centrally; The BTSA acquisition was to be valued by an independent, professional organisation; The BTSA acquisition could only be voted on by the PIC as AEEI was a related party to the transaction; The CEO and 200 of its staff left BTSA to join Ayo showing clear support for the intended transaction; The BTSA transaction ultimately did not materialize due to toxic media publicity, recalcitrance of the PIC. Key to its evaluation of Ayo was the BTSA historical annual financial statements which the PIC did not have in its possession, nor was it included in the draft or final PLS a letter from BTSA to Mr Kevin Hardy (Mr Hardy), former CEO of Ayo clearly showed that BTSA did not agree with the assumptions made in the PLS Para 95, Page 319

AYO REFERENCE IN THE MAPTI COMMISSION REPORT CASE B REFERENCE FACTS Dr Surv and Dr Matjila had both indicated at the Commission that the monies received from the PIC are still in Ayo s bank accounts. This is partly correct, due to the fact that the results are published at a point in time and indicate that the monies were transferred back to Ayo just before the interim and year end cut-off periods (28 February and 31 August respectively). The evidence gleaned from various bank statements show that there has been significant movement of the funds between different related parties. This created the impression of funds in bank accounts but, in reality, this was only the case at specific moments in time Para 58, Page 33 This reference is false, all monies were accounted for and are in Ayo s control; As part of Ayo s treasury function, funds were invested with various asset managers; This was done because a higher return on investment would be achieved through investment rather than the monies being left in a bank account; R1,6 billion was invested with prominent asset managers and R400 million was invested with 3 Laws Capital South Africa; All funds, with growth, were returned to Ayo and no losses were realised. Funds were transferred back from asset managers to Ayo as the mandate by the Ayo CFO/Treasury was limited to the financial year. This was at the explicit request of the Ayo CEO and CFO. the question remains as to whether the PIC subscribed for the shares at a fair and reasonable value. At the listing date, the shares were R43 per share, while as at 23 October 2019 the share price was R5.60 per share, a decrease in value per share of 87% Para 7, Page 412 We assert that the PIC did subscribe for the Ayo shares at a fair and reasonable value; Many factors determine a valuation on the stock market; The implosion of Steinhoff and Tongaat Hulett, the EOH malfeasance resulted in a crash of all stocks on the JSE; The JSE is riddled with companies who have self-admitted to fraud and corruption; The focus on Ayo was due to detractors of the Sekunjalo Group, which included well known asset managers and hedge funds working in cahoots with some journalists; The CIPC application to nullify the PIC investment, the PIC court case, PIC Statements about the Ayo investment, and the highly defamatory statement to parliament, all contributed to the dramatic reduction of the Ayo share price; The PIC and CIPCs actions were therefore the primary drivers as regards the negative publicity experienced by Ayo and the resulting reduction of the share price; Asset managers and hedge funds were shortening the share; It was the Sekunjalo Group that contacted the JSE and the FSCA to investigate this.

AYO REFERENCE IN THE MAPTI COMMISSION REPORT CASE B REFERENCE FACTS Ayo transaction had no rationale - Media Allegation This reference is false; Ayo had existed more than 20 years prior to listing on the JSE; The listing of Premier Fishing and Brands plus that of an ICT company (which would later evolve into Ayo) had been part of AEEI s Vision 2020 plan to unbundle these investments through listing; The rationale for Ayo raising capital and listing was that a strong BEE player was needed and had great potential for success in the ICT sector; ICT customers needed to improve their BEE scorecard and Ayo would be well positioned to meet this requirement; Ayo had lined up a pipeline of service providers to supplement the BTSA value chain; The toxic media resulted in these service provider companies putting on hold these transactions. The outright manipulation by Dr Surv of the valuation numbers to increase the Ayo valuation Para 82, Page 316 This reference is both false and defamatory; Dr Surv was not involved in the final determination of the Ayo valuation; His only involvement was at the beginning of the conceptualisation of the Ayo listing and the inclusion of BTSA, this is corroborated by Malick Salie s testimony at the Commission; Dr Surv s involvement in the conceptualisation of the Ayo listing was not unusual as he had history and knowledge of the businesses of both Ayo and BTSA; As soon as Ayo and AEEI put in place a formal listing team comprising of Corporate Finance, Legal, JSE Sponsors and Auditors, he was no longer involved; Dr Surv s involvement is completely reasonable if compared in the context of all PIC investments made; The initial valuation based on the core business of Ayo; Dr Surv s input was needed in relation to the customers and service providers of BTSA to consider in modelling; Dr Surv was the Chairman of British Telecom SA; Dr Surv has every right to give input to senior executives in the Group; Nevertheless. AEEI and its executives are completely independent; The final PLS submitted to the PIC was compiled without the involvement of Dr Surv .

AYO REFERENCE IN THE MAPTI COMMISSION REPORT CASE B REFERENCE FACTS The close relationship between Dr Matjila and Dr Surv created top down pressures that the deal teams experienced to get the requisite approvals Para 88, Page 317 This reference is false; Dr Surv , when he volunteered to testify at the PIC Commission, indicated that he knew Dr Matjila on a professional level; Dr Surv has the utmost respect for Dr Matjila a seasoned professional; Dr Surv is the Chairman of the Sekunjalo Group and a member of the WEF New Champions and an investor in numerous multinationals across the continent; There is nothing unusual about someone in his position engaging with the CEO of the largest asset manager on the continent; Dr Surv has engagements with other captains of industry in South Africa and across the world; No evidence was presented at the Commission of any undue influence; The Commission's own report stated categorically that There is no evidence that the impropriety or contravention resulted in any undue benefit for any PIC director, or employee or any associate or family member of any PIC director or employee at the time . Emails provided to the Commission also indicate that PSG Capital, the transactional advisor and sponsor for the listing, received a generous bonus in the region of R4 million from Dr Surv for successfully listing Ayo Para 57, Page 33 This reference is false and misleading; Dr Surv never paid PSG Capital anything; PSG Capital was an advisor to Ayo, Ayo paid the fixed and variable portion of its advisor s fees, not Dr Surv ; The Commission questioned PSG Capital about the alleged bonus , to which they replied: As is normal for transactions of this nature, our mandate comprised of a fixed and variable portion. Without the variable portion, our fixed fee would have been much higher (clients generally prefer a lower fixed fee with a higher success based variable fee). The variable portion was based on a percentage of the capital raised and was effectively dependent on a successful transaction (if capital was not raised then it would not have been due and payable). The variable portion is in line with what we have charged in other non-related transactions. Para 109, Page 327 This statement is clearly a blatant lie and proves that the Commission prioritised unsubstantiated allegations over facts.

SECTION 4: INDEPENDENT MEDIA

INDEPENDENT MEDIA REFERENCE IN THE MAPTI COMMISSION REPORT CASE C REFERENCE FACTS The investment by the PIC in Independent Media was due to a relationship between Dr Matjila and Dr Surv - Media Allegations This reference is false; Dr Surv and Dr Matjila did not know each other prior to the Independent Media transaction; Elias Masilela was the CEO of the PIC at the time the Independent Media transaction took place; The PIC invested in Independent Media as it had invested in all other media houses at the time, including Tiso Blackstar (now Arena Holdings), Caxton and Media24 via Naspers. The deal was structured as follows: The PIC made an indicative, non-binding commitment to invest R2,4 billion; 36.1. The PIC Board meeting of 11 March 2013, resolved to participate in the 100% acquisition of INMSA to the maximum amount of R1,44 billion split up as follows: The PIC only invested R888 million in total and not R2.4bn, as follows: 36.1.1. A direct equity payment of R167 million for a minimum of 25% equity stake in INMSA; 36.1.2. A Shareholder loan of R773 million at an Internal Rate of Return (IRR) of 15% on INMSA s balance sheet; 36.1.3. An Equity loan to the Sekunjalo Consortium of R500 million to purchase 75% equity in INMSA. 36.2. These were, inter alia, to be secured by a R150 million corporate guarantee by Sekunjalo Investment Holdings (Pty) Ltd. 36.3. Repayments totaling R325.75 million were received the same day as a result of the equity restructuring and the Interacom Investment Holdings (a Chinese investment company) purchase of 20% equity. Para 36, Page 302 R253m - Term loan to SIM Consortium; R167m - 25% equity in Independent Media (PICs own account); R183m - to acquire pre-existing Shareholder loan (PICs own account); R285m - Preference Shares - Capital restructure (PICs own account); All these funds went to the Seller - Independent Media Ireland PLC.

SAGARMATHA REFERENCE FACTS THE PIC had invested R4 billion in Sagarmatha Technologies - Media Allegations This reference is false; The PIC did not invest financially in Sagarmatha; Sagarmatha had raised more than R4 billion from other International Investors prior to the listing being cancelled. In late 2017, Sagarmatha offered the PIC to subscribe for shares worth between R3 billion and R7.5 billion. The price for the shares was R39.62 per share. The deal team valued the shares at R7.06 per share. It is clear from the evidence of the members of that team that they did not support the transaction. Para 39 40, Page 29 This reference is false; The PIC deal team supported the transaction, however differed in the valuation of the transaction; Sagarmatha is an MSP - Multi-Sided-Platform hence the valuation methodology was unique and unknown in South Africa; The JSE insisted on an independent valuation and this was done by Silicon Valley based Redwood Valuation Partners and the University of the District of Columbia; The PIC s valuation team differed in their valuation of Sagarmatha;; The PIC valued Sagarmatha at approximately R8 billion; The transaction made sense for the PIC as it offered an exit from Independent Media, a legacy print media company; Sagarmatha provided the PIC the opportunity to repeat its Naspers success, as per Dr Matjila in parliament; The Sekunjalo Group did not dismiss the PIC s offer to buy the Sagarmatha shares at an R8 billion valuation and was open to exploring ways to allow PIC to participate at a discounted valuation; Toxic media exposure of detractors of Sagarmatha and Independent Media resulted in the JSE pulling the listing at the last minute.

SAGARMATHA REFERENCE FACTS Sagarmatha listing did not go ahead due to the withdrawal of the PIC - Media Allegation This reference is false; The Sagarmatha listing was based on a minimum capital raise which was insisted on by Sagarmatha itself of R3 billion; Through commitments, Sagarmatha raised R4 billion therefore had enough investment commitment to meet the minimum capital raise; It was after extensive lobbying by detractors of Independent Media augmented by toxic media reports that the JSE pulled the listing. The JSE withdrew the listing four days before it was supposed to list, after 8 months of preparation, based on a technicality disclosed by the CIPC relating to one of the subsidiaries of Sagarmatha.

SECTION 4: PREMIER FISHING AND BRANDS LIMITED

PREMIER FISHING BRANDS REFERENCE FACTS This transaction is merely included for the sake of completeness of the transactions that the PIC undertook within the Sekunjalo Group Page 30 The PFB investment as with the Ayo investment was welcomed by the JSE and investors on listing; Ayo only became problematic for the PIC as a result of toxic media reporting; Premier Fishing shows the investment acumen and the strong governance of the Sekunjalo Group.

SECTION 5: OVERVIEW AND CONCLUSION

TOXIC MEDIA Orchestrated smear campaign to undermine Sekunjalo Group businesses; Significant harmful effect on the Sekunjalo Group Companies; Since the acquisition of Independent Media, more than 3 000 articles targeting Dr Surv , Independent Media and the Sekunjalo Group have been published, in print, radio, television and online accompanied by lots of vitriol; Social media reports that show how the Sekunjalo Group and Dr Surv have been targeted by amongst others Daily Maverick, News24, Primedia and Arena Holdings; It cannot be ignored that the propaganda perpetuated by the toxic media resulted in the false and misleading narrative that was ultimately published in the Mpati Commission Report. This is not only unconstitutional, illegal, defamatory and discriminatory but goes against all values of democracy. Sekunjalo supports a free and independent media but the abuse of the Group by its detractors in the media is not only defamatory but unlawful.

CONCLUSION: The PIC Commission was established specifically to lift the corporate veil on the PIC s policies and procedures; We have established that 4 out of 11 companies which were investigated were companies linked to the Sekunjalo Group; No adverse findings in relation to these companies were made;. Certain allegations and findings, such as the use of the word malfeasance to describe the conduct of the Sekunjalo Group, were not corroborated by any factual evidence. TOXIC MEDIA It appears that there was a deliberate attempt to tarnish the reputation of the Sekunjalo Group and its investee companies. The Commission was used to achieve this. It is clear that the detractors of the Sekunjalo Group, working with competitor media companies, selectively quoted parts of the Mpati Commission Report to portray a negative image, in line with the narrative that they have been driving. The Mpati Commission Report was established from these toxic media narratives, as per its Terms of Reference. The Sekunjalo Group of companies prides itself on maintaining the highest levels of integrity - all our listed companies have Board Charters in line with the King Code of Governance and the JSE Listing Requirements. Our ability to comply with good corporate governance standards should not be questioned simply because we are a highly transformed group of companies. The Sekunjalo Group of Companies is accountable to its relevant stakeholders including shareholders and its employees as well as regulatory bodies. It is known for its strong commitment to economic transformation and social justice.

The Sekunjalo Group Thank you for the opportunity to present Wednesday 12 MAY 2021