Porter Analysis and Firm Objectives

Porter Analysis and Firm Objectives delve into evaluating financial decisions, corporate strategy, and maximizing firm value. Explore the interaction of financial decisions with non-financial decisions to enhance strategic operating decisions and competitive advantage within the business environment through Porter's Five Forces model and resource-based approaches.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Porter Analysis, Financial Decisions and Corporate Strategy A framework for evaluating the interaction of financial decisions and non-financial decisions in terms of their impact on firm value P.V. Viswanath Financial Strategy and Business Decisions

Firm Objectives The objective of a firm is often held to be firm value maximization. For that, it s important to have a good understanding of what the firm is, its strengths, where it is, who its competitors are, and their strengths. A firm does not operate in a vacuum; in order to know what maximizes firm value, it is necessary to understand the environment. Decisions on how a firm interacts with its environment are often strategic.

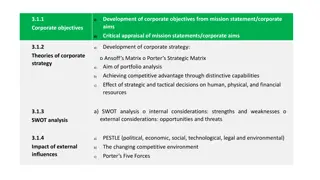

Porter Analysis Porter s Five Forces model Analysis is a systematic way of analyzing the industry environment in which the firm finds itself. Following this, it is necessary to do a SWOT-type analysis to evaluate the firm within this environment. One aspect of such a firm-level analysis is the Resource-Based Approach. We start with traditional Porter Analysis and then discuss the Resource-Based Approach.

Using Porter Analysis Porter Analysis is a tool for strategic analysis, and is often used in this way, particularly in selecting acquisition targets. Its main function is in the analysis of strategic operating decisions, i.e. how the firm can best interact with its competitors, its suppliers, customers and other actors in the business environment. The following slides will follow the Porter Five Forces model as it is often used in the analysis of corporate operating strategy. Nevertheless, this structure will allow us to identify areas for the strategic use of specific financial decisions; you should use these hints to imagine how these financial decisions might affect specific operating decisions and thus add value. These slides will be used for the identification of potential strategic uses of financial decisions. The precise strategic nature of the financial decisions will be discussed in future modules.

Five Forces model of Porter Ease of entry of competitors How easy or difficult is it for new entrants to start to compete, which barriers do exist? Threat of substitutes How easily can the product or service be substituted, especially cheaper? Bargaining power of buyers How strong is the position of buyers, can they work together to order large volumes? Bargaining power of suppliers How strong is the position of sellers, are there many or only few potential suppliers, is there a monopoly? Rivalry among the existing players Is there a strong competition between the existing players, is one player very dominant or all all equal in strength/size? To which, we could add a sixth: Government Intervention Can government policies be used to the advantage of the firm? From http://www.valuebasedmanagement.net/methods_porter_five_forces.html

Porter: Five Strategic Forces New Entrants www-mime.eng.utoledo.edu/people/faculty/rbennett/engineering_management/Powerpoint%20Slides/ch09.ppt

New Entrants: Barriers to Entry Economies of Scale To the extent that there are economies of scale, it will be difficult for a new firm to come in and compete with established firms. Product Differentiation To the extent that the firm s products are distinct and non- copiable, new firms won t be able to come in and take away customers. Brand Identification To the extent that there is brand identification, customers will remember the firm s product and will resist switching. Switching Cost If it is costly for the customer to switch, new entrants won t be easily able to convince them to do so.

New Entrants: Barriers to Entry Access to Distribution Channels If the firm has preferential or monopolistic access to distribution channels, it is more resistant to competition. Capital Requirements If capital requirements are high, new under-capitalized firms won t be able to enter the industry. Access to Latest Technology If technology is important in the industry, new firms are less likely to have access to them, which is good for established firms. Experience and Learning Effects If experience is necessary for a firm to figure out how to operate efficiently, established firms have a distinct advantage.

Barriers to Entry: Examples Regulatory restrictions (e.g. banking license) Brand names e.g. McDonalds, Starbucks, Apple can develop customer loyalty; hard to develop and/or imitate Patents (illegal to exploit without ownership; e.g. IBM has many AI patents and patents on improving the security of blockchain networks) Unique know-how e.g. WalMart s logistics systems, which link to vendors Accumulated experience (cf. learning curve)

New Entrants/ Industry Competition: Government Action Government policies also affect entry into the industry. Industry Protection Industry Regulation Consistency of Policies Capital Movement Amongst Countries Custom Duties Foreign Exchange Foreign Ownership Assistance Provided to Competitors

Finance and Industry Entry How can financial strategies make it more difficult for new firms to enter the industry and compete with your firm? We will see that aggressive debt policies of existing firms in an industry can make it more difficult for new entrants. Debt tends to increase a firm s appetite for risk and provide credence to aggressive operating strategies. Easy access to capital and consequent flexibility can matter; this may be why Microsoft, e.g. usually keeps a lot of cash on hand.

Porter: Five Strategic Forces Industry Competition www-mime.eng.utoledo.edu/people/faculty/rbennett/engineering_management/Powerpoint%20Slides/ch09.ppt

Industry Competition: Rivalry Among Competitors Concentration and Balance among Competitors To the extent that there is no single large competitor, the firm is better off Industry Growth If the industry is growing, there s more room for everybody; less pressure on the firm Fixed Costs The higher the operating leverage, the more competitors are going to be hungry for revenue downside risks are greater

Industry Competition: Rivalry Among Competitors Product Differentiation If products are differentiated, markets are in a sense, segmented, and there are no competitors. (However, this is only apparent because the same need can be satisfied by other products, viz. substitutes.) Intermittent Overcapacity The extent to which firms have overcapacity from time to time, leading them to find additional sources of orders to keep resources fully employed. Switching Costs The extent to which it s easy for customers to switch from this firm to other firms products will also determine how much other firms will exert themselves to get them to switch.

Industry Competition: Barriers to Exit Asset Specialization If assets are specialized, firms will not want to exit quitting the industry can be costly in terms of lower prices for assets no longer in use. Cost of Exit For example, if businesses are required to pay for any environmental costs before they exit or if they have to set aside funds to pay for potential future lawsuits, they are less likely to exit a business Strategic Interrelationships with Other Businesses Emotional Barriers Government and Social Restrictions

Finance and Fighting Competitors How can the right financial decision help overwhelm or outgun existing competitors? Just as capital structure helps against new entrants, it can also can have implications for success against existing competitors. For example, using equity rather than debt can provide firms with breathing room to accommodate a long-term focus, which is crucial for innovation.

Porter: Five Strategic Forces Suppliers www-mime.eng.utoledo.edu/people/faculty/rbennett/engineering_management/Powerpoint%20Slides/ch09.ppt

Bargaining Power of Suppliers Number of Important Suppliers The fewer the number of important suppliers, the more power they have over the firm, and the greater their ability to extract producer surplus. Availability of Substitutes for the Suppliers Products This would reduce supplier power. Differentiation or Switching Costs of Suppliers Products If it s difficult for the firm to switch to other suppliers, the current suppliers can charge more. Suppliers Threat of Forward Integration To the extent that suppliers might potentially themselves become competitors, they are less reliable and need to be looked at strategically

Bargaining Power of Suppliers Industry Threat of Forward Integration To what extent is it possible that the entire supplier industry might integrate forward? Suppliers Contribution to Quality or Service of the Industry Products How crucial are suppliers in the maintenance of the quality of industry products? Clearly, this will determine supplier power. Also, if this is an important factor, then the supplier industry might be more important, and might integrate forward. Total Industry Cost Contributed by Suppliers This goes to the same issue as above, but from a more quantitative perspective. Importance of the Industry to Suppliers Profits The more important the industry is, the less will suppliers flex their muscles.

Finance and Suppliers How can financial decisions help redress the balance of power between the firm and its suppliers? Debt policy and accounts receivable can be used to create bargaining advantages with suppliers. Planning access to financial resources is necessary to have a comparative advantage in the provision of credit to suppliers. In order to understand this, we need to investigate the reasons for the existence of trade credit.

Porter: Five Strategic Forces Customers www-mime.eng.utoledo.edu/people/faculty/rbennett/engineering_management/Powerpoint%20Slides/ch09.ppt

Bargaining Power of Customers Number of Important Buyers The greater the number of important buyers, the less power does the firm have to manipulate/determine prices Availability of Substitutes for the Industry Products The impact of this on price elasticity of demand for the industry s products is obvious. Buyer s Switching Costs This is relevant both in terms of switching to competitors products and switching to products manufactured by other industries. Buyer s Threat of Backward Integration The buyer might choose to integrate backward and manufacture his input goods, himself. This means that buyers have to be looked at strategically; they also have more power over the prices they are charged.

Bargaining Power of Customers Industry Threat of Backward Integration The entire buyer industry might integrate backward. Contribution to Quality or Service of Buyer s Products The greater the contribution of the firm s product to the quality of the product, the greater the power of the firm. On the other hand, this might also impel the buyer to integrate backward. Total Buyer s Cost Contributed by the Industry This is similar to the previous point, but in a more quantitative fashion. Buyer s Profitability The more profitable buyers are, the more amenable they are to paying more for their input products.

Finance and Customers How can financial decisions help increase the firm s economic power vis- -vis its customers? This is the reverse of the supplier problem. What can a supplier firm do to prevent being outflanked by its customers? How can it use accounts receivable as a strategy to keep buyers? For example, consider how General Electric created a financing subsidiary, GE Capital, to retain customers. Access to cash can make it easier for a firm to make trade credit available. Capital structure can, therefore, also be useful.

Porter: Five Strategic Forces Substitutes www-mime.eng.utoledo.edu/people/faculty/rbennett/engineering_management/Powerpoint%20Slides/ch09.ppt

Substitutes Some of these points have already been addressed in looking at buyers/suppliers. However, it s useful to consider it again from the product perspective, rather than from the perspective of other economic actors. Availability of Close Substitutes User s Switching Costs Substitute Producer s Profitability and Aggressiveness Where is the substitute product located on the Price/Value dimensions?

Finance and Competition from Substitutes Can financial decisions help the firm ward off substitutes competing against its products? Research suggests that financial slack may be required in order to sustain innovation. Higher leverage may also magnify cashflow volatility, which may constrain the required consistent investment in R&D. Jonathan P. O'Brien, The Capital Structure Implications of Pursuing a Strategy of Innovation, Strategic Management Journal, Vol. 24, No. 5 (May, 2003), pp. 415-431

The Resource Based View The Resource-Based View looks at what distinguishes one firm from another in the same industry, particular in terms of what gives the firm its comparative advantage. While a firm can work at changing its tangible and intangible resources, this cannot be done in the short-run and hence the firm must choose its resource strengths ahead of time, i.e. make the right strategic decisions. Financial resources and financial policies are one of these distinguishing marks of a firm, in addition to the other tangible and intangible resources that it might possess.

Resource-based Views of the Firm: Tangible Assets Tangible assets are the easiest to value, and often are the only resources that appear on a firm s balance sheet. They include real estate, production facilities, and raw materials, among others. Although tangible resources may be essential to a firm s strategy, due to their non-specialized nature, they rarely are a source of competitive advantage. Nevertheless, it is important to look at non- financial resources so as to be able to evaluate the extent to which they can be supplemented or replaced by financial resources/assets. Source: David Collis and Cynthia Montgomery

Resource-based Views of the Firm: Intangible Assets Intangible assets include such things as company reputation, brand names, Corporate culture, technological knowledge, patents and trademarks, and accumulated learning and experience.

Firm Resources: Organizational Capabilities Organizational capabilities are not factor inputs like tangible and intangible assets They are complex combinations of assets, people, and processes that organizations use to transform inputs into outputs. This includes a set of abilities describing efficiency and effectiveness: low-cost structure, lean manufacturing, high quality production, fast product development. A coherent and far-seeing financial strategy can be one of the strengths and resources of a firm. This is the viewpoint of this course.

Putting things together Now that we have looked at the firm s environment and its assets, we need to look at the firm s strategy within this environment and how this relates to the other parties identified in the five forces model. In valuing a firm using the Porter model, the focus is on understanding its current and potential strategy in order to better forecast future cashflows Evaluate investment risks A useful place to find relevant information is the firm s 10-K filing, particularly the Risk Factors section. If our goal is to craft new strategy, we can still use this information, but we need to imagine what might be, instead of simply looking at what is.

The impact of finance The following slides provide examples of a Porter-style Analysis of Starbucks. As you peruse the slides, think about capital structure, about working capital management, about financial risk management, about dividend policy and how they might affect all the issues relating to value creation in those contexts.

Porter Analysis: Starbucks Power of Competitors Starbucks faces strong competition in the food service and coffeehouse industry. Large number of firms (strong force) Moderate variety of firms (moderate force) Low switching costs (strong force) The large number of firms is an external factor that intensifies competitive rivalry. Starbucks has many competitors of different sizes. The moderate variety of competitors further strengthens the level of competition in the industry. Competition is strengthened because of the low switching costs faced by customers in moving to competitors. Starbucks Corporation s generic strategy and intensive growth strategies are a reflection of strategic responses to competition. This analysis is based on http://panmore.com/starbucks-coffee-five-forces-analysis-porters-model

Bargaining power of buyers Starbucks experiences strong bargaining power of customers. Low switching costs (strong force) High substitute availability (strong force) Small size of individual buyers (weak force) Customers can easily shift from Starbucks to other brands. In addition, there are many substitutes like instant beverages from vending machines. These factors overshadow the fact that individual purchases are small and so each customer might seem insignificant. The bargaining power of customers is a top-priority strategic issue. Starbucks Corporation s marketing mix or 4Ps provide support for brand strengthening to partially address the bargaining power of consumers.

Bargaining Power of Suppliers The bargaining power of suppliers vis- -vis Starbucks is weak. Moderate size of individual suppliers (moderate force) High variety of suppliers (weak force) Large overall supply (weak force) Individual suppliers are small in size and hence have less power vis- -vis Starbucks. In addition, the high variety of suppliers weakens their bargaining power. Suppliers have various strategies and competencies that they use to compete against each other, with the aim of gaining more revenues by supplying more materials, such as coffee beans, to Starbucks Corporation. The large number suppliers of coffee and tea around the world also weakens supplier power. This external factor limits the influence of individual suppliers. Overall, they have weak bargaining power. The company s response to this environment is to diversify its supply chain as a way of addressing the trends identified in the PESTLE analysis of Starbucks Coffee Company.

Threat of Substitutes Starbucks experiences a strong threat of substitutes. High substitute availability (strong force) Low switching costs (strong force) High affordability of substitute products (strong force) The high availability of substitutes makes it easy for consumers to buy these substitutes instead of Starbucks products. For example, substitutes like ready-to-drink beverages, instant beverage powders and purees, and food and other beverages are readily available from various outlets, such as fast food and fine-dining restaurants, vending machines, supermarkets and grocery stores, and small convenience stores. Consumers can easily buy substitutes instead of Starbucks products. Moreover, many of these substitutes are affordable and cost less than the company s products. Thus, threat of substitutes is a high-priority strategic management concern.

Threat of New Entrants Starbucks faces a moderate threat of new entry. Moderate cost of doing business (moderate force) Moderate supply chain cost (moderate force) High cost of brand development (weak force) The moderate cost of doing business is associated with the variability of the actual cost of establishing and maintaining operations in the coffeehouse industry. For example, the cost of operating a small coffeehouse is lower compared to the cost of operating a coffeehouse chain. In relation, smaller caf s have lower supply needs and corresponding lower supply chain costs. These external factors enable smaller firms to compete against Starbucks Corporation. On the other hand, brand development is costly. For example, small coffeehouses do not have enough resources to develop their brands. Also, brand development typically requires years to reach the level of strength of the Starbucks brand. Hence the threat of new entrants is relatively small.