Payroll Updates for 2024_2025_ A Quick Guide

Payroll management is an important part of running a business since it ensures that employeesnare paid accurately and on time while adhering to tax requirements. This paper provides ancomplete overview of payroll adjustments for the UK in 2024 and 2025, including changes in taxnrates, law, and payroll software.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

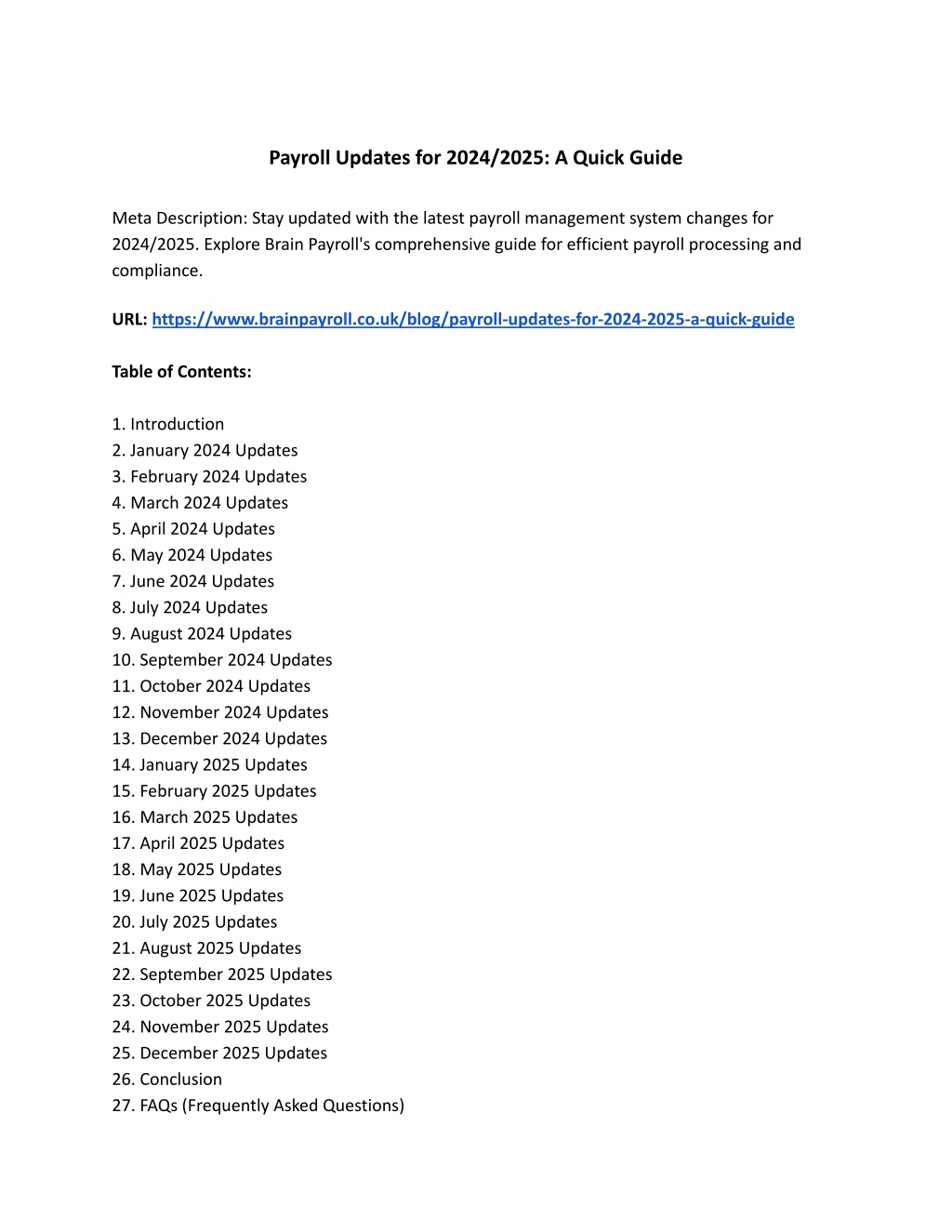

Payroll Updates for 2024/2025: A Quick Guide Meta Description: Stay updated with the latest payroll management system changes for 2024/2025. Explore Brain Payroll's comprehensive guide for efficient payroll processing and compliance. URL: https://www.brainpayroll.co.uk/blog/payroll-updates-for-2024-2025-a-quick-guide Table of Contents: 1. Introduction 2. January 2024 Updates 3. February 2024 Updates 4. March 2024 Updates 5. April 2024 Updates 6. May 2024 Updates 7. June 2024 Updates 8. July 2024 Updates 9. August 2024 Updates 10. September 2024 Updates 11. October 2024 Updates 12. November 2024 Updates 13. December 2024 Updates 14. January 2025 Updates 15. February 2025 Updates 16. March 2025 Updates 17. April 2025 Updates 18. May 2025 Updates 19. June 2025 Updates 20. July 2025 Updates 21. August 2025 Updates 22. September 2025 Updates 23. October 2025 Updates 24. November 2025 Updates 25. December 2025 Updates 26. Conclusion 27. FAQs (Frequently Asked Questions)

1. Introduction: Payroll management is an important part of running a business since it ensures that employees are paid accurately and on time while adhering to tax requirements. This paper provides a complete overview of payroll adjustments for the UK in 2024 and 2025, including changes in tax rates, law, and payroll software. 2. January 2024 Updates: - Date: January 6, 2024 - Update: HMRC has announced new tax codes for the tax year 2024/2025, which would influence employee PAYE calculations. The changes are intended to reflect adjustments in income tax rates and allowances. 3. February 2024 Updates: - Date: February 15, 2024 - Update: The government implemented a new apprenticeship levy plan, which affects enterprises with an annual pay cost of approx more than 3 million. Employers must disclose their levy liability and pay the apprenticeship levy to HMRC using the PAYE mechanism. 4. March 2024 Updates: - Date: March 2, 2024 - Update: The national minimum wage for adults and apprentices is rising in lockstep with inflation. Employers must comply with the current minimum wage rates to avoid penalties. 5. April 2024 Updates: - Date: April 6, 2024 - Update: The new tax year has begun, with adjustments to tax thresholds, NI contributions, and student loan deductions. Employers must update their payroll systems to reflect the revised tax rates and allowances.

6. May 2024 Updates: - Date: May 10, 2024 - Update: HMRC introduces Making Tax Digital (MTD) for Income Tax, requiring self-employed individuals and landlords with income approx over 10,000 to use compatible software to report their income and expenses quarterly. 7. June 2024 Updates: - Date: June 22, 2024 - Update: The government has announced a consultation on IR35 legislation revisions, to address issues and improve compliance with off-payroll working norms in the private sector. 8. July 2024 Updates: - Date: July 8, 2024 - Update: HMRC has released new guidelines on the taxation of employee perks and expenses, clarifying reporting obligations and tax treatment for numerous employer-provided benefits. 9. August 2024 Updates: - Date: August 14, 2024 - Update: The government has established a trial program for Pay As You Earn (PAYE) real-time information (RTI) penalties, allowing companies to test the new penalty regime for late or inaccurate RTI submissions. 10. September 2024 Updates: - Date: September 5, 2024 - Update: HMRC has updated its guidelines on payroll software compliance with MTD for VAT, including information on software systems that enable VAT reporting under the MTD regime.

11. October 2024 Updates: - Date: October 18, 2024 - Update: The Chancellor of the Exchequer announces adjustments to income tax bands and thresholds for the fiscal year 2025/2026, which may impact individuals' tax liabilities and payroll computations. 12. November 2024 Updates: - Date: November 7, 2024 - Update: HMRC starts a campaign to raise awareness about the benefits of payroll software for small businesses, focusing on efficiency, accuracy, and tax compliance. 13. December 2024 Updates: - Date: December 20, 2024 - Update: The government modifies the Construction Industry Scheme (CIS) to make compliance standards easier to understand and improve tax administration for contractors and subcontractors. 14. January 2025 Updates: - Date: January 3, 2025 - Update: The new tax laws and thresholds for the fiscal year 2025/2026 take effect, reflecting changes in income tax rates, allowances, and NI contributions. 15. February 2025 Updates: - Date: February 14, 2025 - Update: HMRC has launched an online portal where firms can receive payroll management guidance and tools, such as tax duties, reporting requirements, and payroll software.

16. March 2025 Updates: - Date: March 9, 2025 - Update: The government announces a consultation on employee share program reforms, seeking opinions on simplifying the taxation of share awards and employee options. 17. April 2025 Updates: - Date: April 6, 2025 - Update: The new tax year begins with changes to tax rates, thresholds, and allowances. Employers must upgrade their payroll systems and practices to ensure compliance with the latest tax requirements. 18. May 2025 Updates: - Date: May 22, 2025 - Update: HMRC has updated its guidelines on taxing business cars and fuel benefits, clarifying how to calculate tax liabilities and reporting requirements for employers who provide company vehicles to their employees. 19. June 2025 Updates: - Date: June 11, 2025 - Update: The government reveals ideas to alter National Insurance contributions, including options for simplifying the NI system and ensuring fair contributions across income levels. 20. July 2025 Updates: - Date: July 7, 2025 - Update: HMRC starts a campaign to encourage small businesses to utilize cloud-based payroll software, emphasizing cloud technology's benefits for payroll management, data security, and compliance.

21. August 2025 Updates: - Date: August 19, 2025 - Update: The government announced legislation to expand the Employment Allowance system, providing qualifying employers with additional relief on their employer National Insurance obligations. 22. September 2025 Updates: - Date: September 14, 2025 - Update: HMRC has updated its payroll reporting guidance for firms, which includes information on filing Real Time Information (RTI) reports, P11D forms, and other payroll-related paperwork. 23. October 2025 Updates: - Date: October 10, 2025 - Update: The Chancellor of the Exchequer presents the Autumn Budget, which includes changes to tax rates, thresholds, and allowances for the fiscal year 2026/2027, affecting payroll calculations and liabilities. 24. November 2025 Updates: - Date: November 8, 2025 - Update: HMRC has launched an online tool to help firms assess their eligibility for Employment Allowance and determine the amount of allowance they can claim depending on their payroll liabilities. 25. December 2025 Updates: - Date: December 23, 2025 - Update: The government has issued new guidance on the tax treatment of termination payments, clarifying the tax consequences of redundancy payments, notice pay, and other termination-related benefits.

26. Conclusion: Businesses must stay current on payroll developments and compliance standards to handle payroll accurately and avoid penalties. By staying current on the newest modifications and utilizing payroll software solutions, businesses may efficiently satisfy their tax requirements. 27. FAQs (Frequently Asked Questions): Q1: How do I learn about the latest payroll updates in the UK? A1: To stay current on payroll updates, check HMRC's website frequently, subscribe to HMRC email notifications, and speak with payroll professionals or consultants. Q2: What are the benefits of using cloud-based payroll software? A2: Cloud-based payroll software provides advantages such as remote access with internet connectivity, automatic updates, data security, scalability, and interaction with other company systems. Q3: How do changes in tax rates and thresholds affect payroll calculations? A3: Changes in tax rates and thresholds impact employees' tax liabilities, NI contributions, and take-home pay. Employers must update their payroll systems to reflect the revised rates and allowances. Q4: What is the Employment Allowance scheme, and how does it benefit employers? A4: The Employment Allowance plan enables qualifying employers to lower their employer National Insurance contributions by up to a set level, resulting in cost savings and support for small enterprises. Q5: How can payroll software help with Making Tax Digital (MTD) compliance? A5: Payroll software that meets MTD criteria enables businesses to transmit payroll information to HMRC online, guaranteeing compliance with MTD regulations for income tax reporting.