Overview of Carbon Pricing in Canada

Carbon pricing in Canada includes various provincial and federal systems aimed at reducing carbon pollution. The Pan-Canadian approach sets a federal benchmark with flexibility for explicit pricing systems or cap-and-trade. The system includes legislated increases in stringency and a federal backstop for jurisdictions not meeting the benchmark. The approach encourages cooperation and knowledge-sharing in the Americas region to combat climate change effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

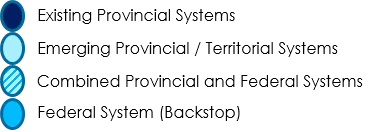

Carbon pollution pricing in Canada Existing Provincial Systems Emerging Provincial / Territorial Systems Combined Provincial and Federal Systems Federal System (Backstop) Output-based pricing system - January 2019 Fuel Charge April 2019 Territories July 2019 Increase by $10/tonne annually Yukon Federal Backstop Northwest Territories Carbon Tax $20/t+ Newfoundland & Labrador Carbon Tax + OBPS $20/t + Nunavut Federal Backstop British Columbia Carbon Tax $35/t + Prince Edward Island Fuel Levy + Federal OBPS $20/t + Manitoba Federal Backstop Quebec Cap-and-Trade Alberta Levy + OBPS $30/t Nova Scotia Cap-and-Trade Ontario Federal Backstop Saskatchewan OBPS + Federal Backstop, $20/t + New Brunswick Federal Backstop

Pan-Canadian Approach to Carbon Pollution Pricing (the federal benchmark) Timely introduction Common scope - broad set of sources Two systems - flexibility for explicit pricing system or cap-and-trade Legislated increase in stringency explicit pricing system: $10/t in 2018, rising by $10 each year to $50/t in 2022 cap-and-trade system: 2030 emission reduction target at least matching Canada s; and declining caps that correspond at minimum to projected reductions resulting from the carbon price Federal backstop - apply in jurisdictions that do not meet the benchmark Revenues remain in the jurisdiction of origin Five-year review Reporting

Declaration of Carbon Pricing in the Americas Adopted on December 12, 2017 Unprecedented regional effort Government-led initiative Inclusive at all levels (national, subnational, private sector, civil society, etc.) Creates cooperation platform in the region exclusively on carbon pricing Knowledge and best practice sharing Open for other jurisdictions to join!

Recent progress 2018 Co-Chairs: Canada and Mexico Priority Issues and Working Groups: -Chile / Columbia (UNEP, UNFCCC, GIZ) 1. Common standards/ accounting/ MRV 2. Linkages by degrees -Canada / California (Woirld Bank, IETA, ICAP) 3. Competitiveness / carbon leakage -Mexico / Chile / Qu bec (ICAP, World Bank) 4. Complementary policies -Chile / Alberta (UNEP, World Bank) 5. Stakeholder engagement -Mexico/ Chile (IETA, EDF) 6. Review of current work environment -Canada / Mexico (ECLAC, CDP) 7. Governance -Columbia / California Convergence and compatibility of carbon pricing remains as an area of opportunity for the Americas.