Non-Banking Financial Institutions

Non-Banking Financial Institutions (NBFCs) are specialized financial institutions that mobilize savings and provide lending services to individuals and corporations. They are registered under the Companies Act, engage in lending for specialized purposes, and invest in various financial assets. NBFCs must be registered with the RBI, have a minimum owned fund, and meet specific criteria regarding assets and income composition. They are classified into different categories such as Asset Financing Companies, Investment Companies, and Loan Companies based on their activities and focus areas.

Uploaded on Mar 02, 2025 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

NON BANKING FINANCIAL INSTITUTION / NON BANKING FINANCIAL CORPORATION (NBFCS)

NON BANKING FINANCIAL INSTITUTION / NON BANKING FINANCIAL CORPORATION (NBFCS) A Non Banking Financial Institution popularly called as Non Banking Financial Company (NBFC) refers to a specialized financial institution other than a banking institution that mobilizes the savings of a certain segment of the public and lends the same to the individual and corporate customers to meet their specialized needs. It is registered under the Companies Act, and is engaged in the business of lending to specialized purposes and investing in shares, debentures, bonds, etc. As per section 45(1)(f) of the Reserve Bank of India Act, a non banking financial company is a non banking institution which is a company and which has its principal business the receiving of deposits under any scheme or lending in any manner. It is compulsory for a NBFC to get itself registered with RBI as a deposit accepting company. A company intending to do the business as a NBFC must have a minimum of Rs. 25 lakhs as owned fund. It should have more than 50% of assets in the form of financial assets and more than 50% of income as income from financial assets.

TYPES OF NON BANKING FINANCIAL COMPANIES (NBFCS) NBFCs are classified in two ways (1) Classification as per RBI and (2) Classification on the basis of activities performed or General Classification

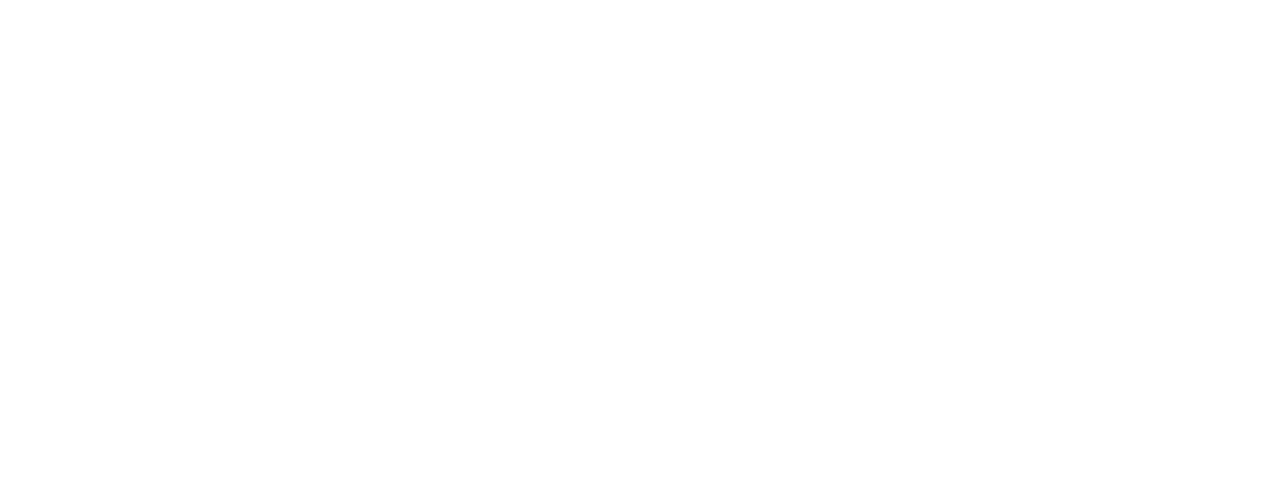

CLASSIFICATION AS PER RBI According to RBI, the NBFCs are classified into three categories viz., (1) Asset Financing Companies, (2) Investment Companies and (3) Loan Companies

ASSET FINANCING COMPANIES These are the companies whose business is to provide finance for purchase of physical assets like automobiles, tractors, earth moving and material handling equipments, etc. (Example - Bajaj Auto Finance Corporation, Fullerton India).

INVESTMENT COMPANIES These are the companies whose business is to acquire and trade in industrial as well as government securities like shares, stocks, bonds, debentures etc., mainly in the capital market. (Example Stock Broking Companies, Gilt Firms)

LOAN COMPANIES These are the companies whose business is to give loans to activities other than their own. They givedifferent kinds of loans like housing loans, gold loans, etc. (Example Mannappuram Gold Finance, Muthoot Finance, Atica Gold Finance, HDFC, etc.)

CLASSIFICATION ON THE BASIS OF ACTIVITY PERFORMED OR GENERAL CLASSIFICATION On the basis of activities performed or according to general classification, the NBFCs are classified into four categories viz., (1) Development Institutions (2) Specialized Institutions (3) Investment Institutions (4) Other Institutions

DEVELOPMENT INSTITUTIONS They are the institutions that provide long term finance for agriculture and industrial development purposes. These are multipurpose institutions that provide not only credit facility but also assist in discovering investment projects, preparing project reports, arranging technical advice, managing industrial units, underwriting, promotional activities, etc. Basically they are intended to develop backward regions as well as small and new entrepreneurs. They provide medium and long term finance to business units mainly for acquisition / development of basic facilities like land and buildings, plant and machinery, etc. These institutions generally do not accept deposits from the public. IDBI, ICICI, IFCI, SIDBI, SFCs & SIDC fall under this category.

THE MAIN FEATURES OF DEVELOPMENT INSTITUTIONS ARE: They are specialized financial institutions They provide medium and long term finance Generally they do not accept deposits from the public They provide multipurpose financial assistance Their primary objective is to promote the economic development of the country They encourage small and new entrepreneurs and work in the general interest of the country

SPECIALIZED INSTITUTIONS They are the institutions that provide assistance to special sectors like housing, infrastructure, agriculture, etc. These institutions generally do not accept deposits from the public. NABARD, NHB, NHAI & EXIM Bank fall under this category.

INVESTMENT INSTITUTIONS They are the institutions that acquire and trade in securities mainly in the capital market. They mobilize savings of public in various forms other than in the form of demand deposits and utilize the same for investment activities mainly in the capital market. LIC, GIC & UTI fall under this category.

OTHER INSTITUTIONS They are the institutions that carry a particular activity like Core Investment, Micro Financing, Equipment Leasing, Hire Purchasing Finance, Housing Finance, Mutual Benefit (Nidhi) Company, Chit Fund Company, etc.

undefined

undefined