Navigating Tax Considerations When Managing an SCO Plot

If you're looking to Buy SCO plots in Gurgaon, Microtek Success Hub is your trusted partner. Known for its expertise in real estate, Microtek Success Hub helps investors and entrepreneurs find premium SCO plots in prime locations. The demand for SCO

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

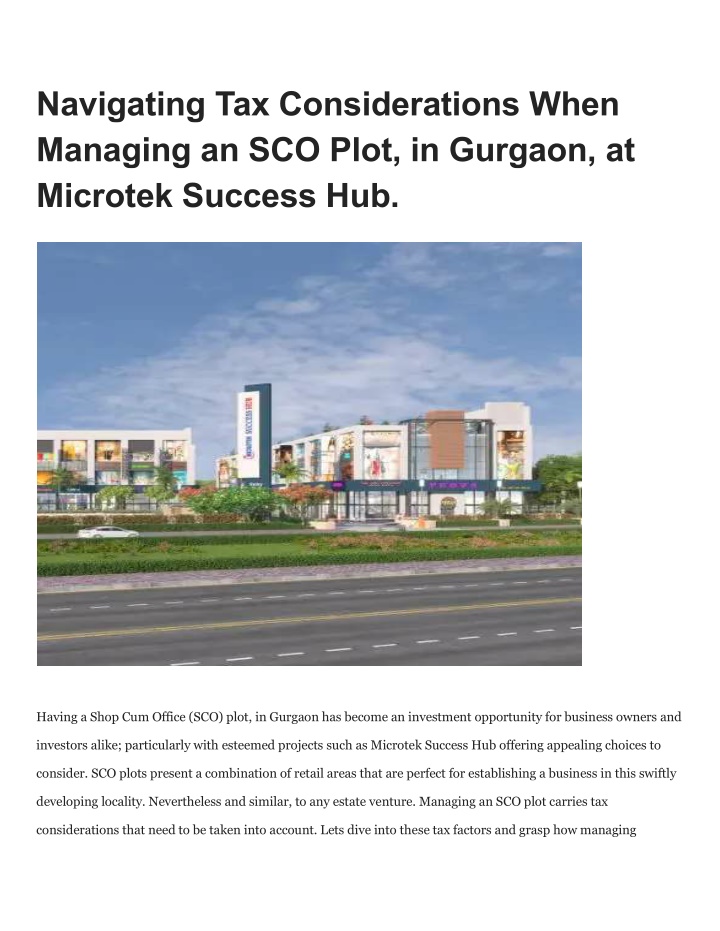

Navigating Tax Considerations When Managing an SCO Plot, in Gurgaon, at Microtek Success Hub. Having a Shop Cum Office (SCO) plot, in Gurgaon has become an investment opportunity for business owners and investors alike; particularly with esteemed projects such as Microtek Success Hub offering appealing choices to consider. SCO plots present a combination of retail areas that are perfect for establishing a business in this swiftly developing locality. Nevertheless and similar, to any estate venture. Managing an SCO plot carries tax considerations that need to be taken into account. Lets dive into these tax factors and grasp how managing

investments, in SCO Plots in Gurgaon, with Microtek Success Hub can be strategically handled to maximize tax advantages. 1. Understanding the Tax Structure on SCO Plots in Gurgaon When an SCO plot is developed it merges office areas together which leads to a tax treatment, unlike that of solely residential or commercial properties in Indias tax system. Income generated from these properties is categorized as either Income from House Property or Income, from Business based on the propertys usage. Here are the typical taxes that a property owner can anticipate; Property Tax: This is levied by the municipal authority and is an annual obligation for property owners. Gurgaon has a favorable property tax regime, making it attractive for commercial real estate investment. GST (Goods and Services Tax): If the SCO plot is leased or rented, the rental income may attract GST. Generally, the current GST rate applicable for commercial leasing is 18%. This tax is applicable if the turnover from the rental income exceeds 20 lakh in a financial year. Stamp Duty and Registration Charges: These are one-time charges paid at the time of purchase. In Gurgaon, stamp duty rates vary but are usually in the range of 5 7%. Registration fees may also apply. 2. Income Tax on Rental Income from SCO Plots When a commercial property, in Gurgaon is sold off with a profit at places like Microtek Success Hub . The income generated from this transaction is typically liable, to capital gains tax obligations. If the property is sold within two years of purchase and a profit is made from it the tax applied will be based on the owners income tax slab rate, as Short Term Capital Gains (STCG).

For assets held for, than two years under the Long Term Capital Gains (LTGC) category should pay a 20 percent tax rate on real estate gains after factoring in indexation benefits that adjust the properties acquisition cost, for inflation. Thereby decrease the tax burden effectively. 3. Claiming deductions and exemptions, for SCO plots Section 54f Exemption pertains to situations where the profits made from selling a plot in an SCO are put back into buying another property and the exemption amount is linked to the reinvestment sum made. Section 54EC Exemption states that investors can claim an exemption, on gains up to 50 lakh by investing in designated bonds, like REC or NHAI within six months of the sale transaction; this benefit remains applicable even if one opts to invest in estate ongoingly. 4. Benefit of Depreciation, for Business Owners When a business uses the SCO plots in Gurgaon at Microtek Success Hub for activities, like office establishment or operations as part of their trade or profession income declaration process in tax filing procedures, in consideration of this aspect. 5. Benefits, for Leasing Operations and Companies For companies renting offices at Microtek Success Hub; When a business leases an SCO plot, for its operations and pays rent, for it the rent amount can be considered as a business expense that reduces the companies income.

Businesses that are registered under the GST system and utilize the SCO location, for their operations could potentially qualify to receive input credit for the GST they have paid on expenses.This could help in lowering their tax dues. 6. Considerations for Investors and Entrepreneurs The commercial real estate market, in Gurgaon is. Presents an opportunity for investment in SCO plots at Microtek Success Hub with promising growth prospects ahead. When it comes to maximizing tax savings in this venture it is important to organize ownership and operational strategies. Seek advice, from a tax consultant to tune your tax planning process. Take advantage of the various deductions and exemptions provided by Indian tax regulations. In summary. Considering an SCO plots in Gurgaon with Microtek Success Hub can provide not an income source but also opportunities for tax benefits and savings. By exploring the income potential and depreciation advantages along with planning for capital gains implications effectively can help investors maximize their returns on this property investment. As Gurgaons commercial sector flourishes and evolves rapidly over time understanding and managing these tax regulations strategically can set you up for success while ensuring compliance, with tax requirements.

![Town of [Town Name] Real Estate Tax Rates and FY 2024 Budget Summary](/thumb/62211/town-of-town-name-real-estate-tax-rates-and-fy-2024-budget-summary.jpg)