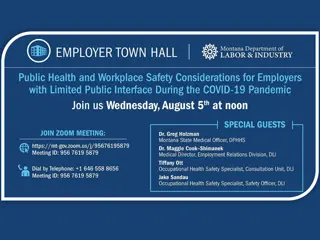

Montana DLI COVID-19 Resources and Relief Programs

Explore a comprehensive list of resources provided by the Montana Department of Labor and Industry (DLI) to help employers, workers, and businesses navigate challenges brought on by the COVID-19 pandemic. Access information on unemployment insurance, Workers' Compensation, relief programs like the CARES Act and SBA funding options, as well as specific grants available in Montana to support businesses during these uncertain times. Stay informed and find assistance through various programs to help you weather the impact of the crisis.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

DLI COVID Resources 1.COVID Main Webpage: http://dli.mt.gov/employer-covid-19 2.COVID Employer FAQ: http://dli.mt.gov/Portals/57/Documents/covid-19/employer- FAQ.pdf?ver=2020-03-26-155412-040 3.Town Hall Info & Recordings: http://dli.mt.gov/town-halls DLI Unemployment Insurance 4.Unemployment Insurance Employer Handbook: http://uid.dli.mt.gov/Portals/55/Documents/Contributions-Bureau/dli-uid-ui010.pdf 5.Employer Sign-Up for Sides: https://uieservices.mt.gov/_/ 6.Unemployment Insurance Claimant Handbook: http://uid.dli.mt.gov/Portals/55/Documents/Claims-Processing/dli-uid-cl001.pdf 7.Unemployment Benefit Calculator a.Full-time: http://uid.dli.mt.gov/benefits-estimator b.Part-time: http://uid.dli.mt.gov/partial-benefit-calculator Workers Compensation 8.COVID-related Work Comp FAQ: http://dli.mt.gov/Portals/57/Documents/covid- 19/workers-comp-coverage.pdf?ver=2020-03-19-155319-430 Families First Coronavirus Response Act (FFCRA) 9.FFCRA FAQ: https://www.dol.gov/agencies/whd/pandemic/ffcra-questions 10.FFCRA Required Posters: https://www.dol.gov/sites/dolgov/files/WHD/posters/FFCRA_Poster_WH1422_Non- Federal.pdf Coronavirus Aid, Relief & Economic Security (CARES) Act 11. CARES Act FAQ: http://dli.mt.gov/cares-act Small Business Association (SBA) 12.SBA Coronavirus Relief - Summary of Funding Options: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options 13.SBA - Paycheck Protection Program: https://www.sba.gov/funding- programs/loans/coronavirus-relief-options/paycheck-protection-program-ppp PUA Benefits PUA Benefits 14. 14. PUA Benefits Link PUA Benefits Link (Self-Employed, Independent Contractors & Others Web Page) http://dli.mt.gov/self-employed-contractors 15. 15. File for PUA Benefits File for PUA Benefits https://mtpua.mt.gov/ 16. MTDLI Return to Work 16. MTDLI Return to Work http://www.dli.mt.gov/return-to-work 17. Governor's Directiv 17. Governor's Directive https://covid19.mt.gov/ 18. MT Coronavirus Relief Emergency Grants Available https://commerce.mt.gov/Coronavirus-Relief

Governor's Directive Governor's Directive https://covid19.mt.gov/ MT Coronavirus Relief MT Coronavirus Relief Emergency Grants Available Emergency Grants Available COVIDRELIEF.MT.GOV Montana Business Stabilization Grant program Montana Business Stabilization Grant program Montana Innovation Grant program Montana Food and Agriculture Adaptability Program Emergency Housing Assistance Program Public Health Grants Stay Connected Grants Food Bank and Food Pantry Assistance Social Services Nonprofit Grants Telework Assistance Grants The Montana Business Stabilization Montana Business Stabilization Grant Grant For Small Businesses to support: Payroll, rent, accounts payable, debt Payroll, rent, accounts payable, debt service and expenses related to shifts in service and expenses related to shifts in operations in order to retain existing operations in order to retain existing businesses, retain current employees or businesses, retain current employees or retain business viability for future re retain business viability for future re- - employment employment. Child Care Grants Child Care Grants BESTBEGINNINGS.MT.GOV To prepare for the application: o prepare for the application: Businesses and non-profits should have their tax ID, proof of business registration, a brief description of how the grant will be spent, brief description of how COVID-19 has impacted operations.

Interim Final Rule on Loan Forgiveness Interim Final Rule on Loan Forgiveness - https://home.treasury.gov/system/files/136/PPP-IFR-Loan- Forgiveness.pdf [home.treasury.gov] This document includes information on, but not limited to: (be sure to check the full document for all details) Loan Forgiveness Process Payroll Costs Eligible for Loan Forgiveness Nonpayroll Costs Eligible for Loan Forgiveness Reductions to Loan Forgiveness Amount Documentation Requirements I Interim Final Rule on SBA Loan Review Procedures and Related Borrower and Lender nterim Final Rule on SBA Loan Review Procedures and Related Borrower and Lender Responsibilities Responsibilities - https://home.treasury.gov/system/files/136/PPP-IFR-SBA-Loan-Review-Procedures-and- Related-Borrower-and-Lender-Responsibilities.pdf [home.treasury.gov] This document includes information on, but not limited to: (be sure to check the full document for all details) SBA Reviews of Individual Loans (what will be reviewed and when) The Loan Forgiveness Process for Lenders (what should be reviewed and timeline) Lender Fees (clawback information) PPP Loan Forgiveness Application PPP Loan Forgiveness Application - https://home.treasury.gov/system/files/136/3245-0407-SBA-Form- 3508-PPP-Forgiveness-Application.pdf [home.treasury.gov] SBA Policy Guidelines SBA Policy Guidelines https://home.treasury.gov/policy-issues/cares/assistance- for-small-businesses [home.treasury.gov] Paycheck Protection Program: Paycheck Protection Program: https://www.sba.gov/funding-programs/loans/coronavirus- relief-options/paycheck-protection-program [sba.gov]

For SIDES E SIDES E- -Response participants Response participants, to amend your response: Log into uieservices.mt.gov Navigate to the SIDES Request tab SIDES Request tab Select View/Amend Select View/Amend to launch the SIDES E-Response portal On the UI SIDES E-Response Switchboard, select Separation Information For the claimant you wish to amend, select Create Amendment On the Amended Response page Amended Response page please provide as much detail as possible: employee s refusal of work, including: the claimant s name, the employee s refusal of work, including: the claimant s name, the date(s) they refused work, what type of work was offered, how was the work date(s) they refused work, what type of work was offered, how was the work offered and by whom, and what was the reason given for not accepting the offered and by whom, and what was the reason given for not accepting the work. work. Or Or Submit Submit by a secure web message via uieservices.mt.gov or by email to uieservices@mt.gov. select Separation Information select Create Amendment Include a much detail as possible about the claimant s refusal and include the Claimant ID of the refusing employee, as well as the employer s name and Claimant ID of the refusing employee, as well as the employer s name and contact person. contact person. Do not not include personal information such as the employee s social security number. If you have questions about the notification of refusal process, contact our eServices at (406) 444 (406) 444- -3834, select option 2. 3834, select option 2.

Occupational Safety and Health Administration (OSHA) Occupational Safety and Health Administration (OSHA) 6. OSHA Act - Right to Refuse Dangerous Work https://www.osha.gov/right-to-refuse.html 1. Safety and Health Topics COVID-19 (includes information on relevant OSHA standards) https://www.osha.gov/SLTC/covid-19/standards.html 7.OSHA Industry Specific guidance on COVID control and prevention https://www.osha.gov/SLTC/covid- 19/controlprevention.html 2. Guidance on Preparing Workplaces for COVID-19. https://www.osha.gov/Publications/OSHA3990.pdf American College of Occupational & American College of Occupational & Envir 3. COVID-19 Resource Center (includes links to webinars, Q&A, and other resources) https://acoem.org/COVID-19-Resource-Center Envir Medicine Medicine 8. How to Help Your Company Develop a Complete COVID-19 Return-to-Work Plan http://www.allthingsadmin.com/covid-19- return-to-work-plan/ Centers for Disease Control and Prevention (CDC) Centers for Disease Control and Prevention (CDC) 4.. Interim Guidance for Businesses and Employers to Plan and Respond to Coronavirus Disease 2019 (COVID-19). (includes guidance on maintaining a healthy work environment, reducing transmission among employees, etc.) https://www.cdc.gov/coronavirus/2019- ncov/community/guidance-business-response.html 9. Risk-informed decision-making guidelines for workplaces and businesses during the COVID-19 pandemic https://www.canada.ca/en/public- health/services/diseases/2019-novel- coronavirus-infection/guidance- documents/risk-informed-decision-making- workplaces-businesses-covid-19- pandemic.html 5. Request a Free Safety Consultation Free Safety Consultation MTDLI Employment Relations Division http://erd.dli.mt.gov/safety-health/onsite- consultation

Pandemic Pandemic Unemployment Assistance (PUA) Unemployment Assistance (PUA) Expanded UI benefits for individuals who are not traditionally covered, including the self-employed, gig-workers, independent contractors, and workers with irregular work history, etc. Federal Pandemic Unemployment Compensation (FPUC) Federal Pandemic Unemployment Compensation (FPUC) The additional $600 weekly unemployment compensation benefit. Pandemic Emergency Unemployment Compensation (PEUC) Pandemic Emergency Unemployment Compensation (PEUC) Additional 13 weeks of benefits for workers who exhaust the typical duration of UI compensation available 14. PUA Benefits Link 14. PUA Benefits Link (Self-Employed, Independent Contractors & Others Web Page) http://dli.mt.gov/self-employed-contractors

Who Is Eligible for PUA? You may be eligible for PUA unemployment benefits if you are not covered under regular unemployment and you are otherwise able and available to work but due to specified COVID-19 related reasons, are currently unable or unavailable to work. You are self are self- -employed, an independent contractor, or not otherwise eligible for regular employed, an independent contractor, or not otherwise eligible for regular unemployment benefits. unemployment benefits. You had a previous unemployment overpayment or something similar had a previous unemployment overpayment or something similar. You have been diagnosed with COVID been diagnosed with COVID- -19 or have symptoms of it and are trying to get 19 or have symptoms of it and are trying to get diagnosed. diagnosed. A member of your household has been diagnosed member of your household has been diagnosed with COVID-19. You are providing care for someone in your household diagnosed providing care for someone in your household diagnosed with COVID-19. You are providing care for a child or other household member who can't go to school or a care providing care for a child or other household member who can't go to school or a care facility because it's closed due facility because it's closed due to COVID-19. You are quarantined or have been advised by a healthcare provider to self You are quarantined or have been advised by a healthcare provider to self- -quarantine You were scheduled to start a job and no longer have the job due to COVID were scheduled to start a job and no longer have the job due to COVID- -19, the offer was rescinded, or you can t reach the job rescinded, or you can t reach the job. You have become the primary earner for a household because the head of household died as a have become the primary earner for a household because the head of household died as a direct result of COVID direct result of COVID- -19 19. You had to quit your job as a direct result had to quit your job as a direct result of COVID-19. Your place of employment is closed as a direct result place of employment is closed as a direct result of COVID-19. You meet other criteria set meet other criteria set forth by the Secretary of Labor forth by the Secretary of Labor. quarantine. 19, the offer was

undefined

undefined