Mizoram SLBC Meeting - Financial Review and Initiatives

The Mizoram SLBC Meeting for the quarter ending September, 2021 focused on financial inclusion and literacy initiatives. The agenda included review of credit disbursement, priority sector advances, and PMMY. Public and private sector banks were urged to improve performance in various sectors.

Uploaded on Feb 20, 2025 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

MIZORAM SLBC MEETING FOR THE QUARTER MIZORAM SLBC MEETING FOR THE QUARTER ENDED SEPTEMBER, 2021 ENDED SEPTEMBER, 2021 & & SPECIAL SLBC TO REVIEW FINANCIAL SPECIAL SLBC TO REVIEW FINANCIAL INCLUSION AND FINANCIAL LITERACY INCLUSION AND FINANCIAL LITERACY INITIATIVES INITIATIVES DATE: 30.11.2021 DATE: 30.11.2021 TIME: 12.00 NOON TIME: 12.00 NOON

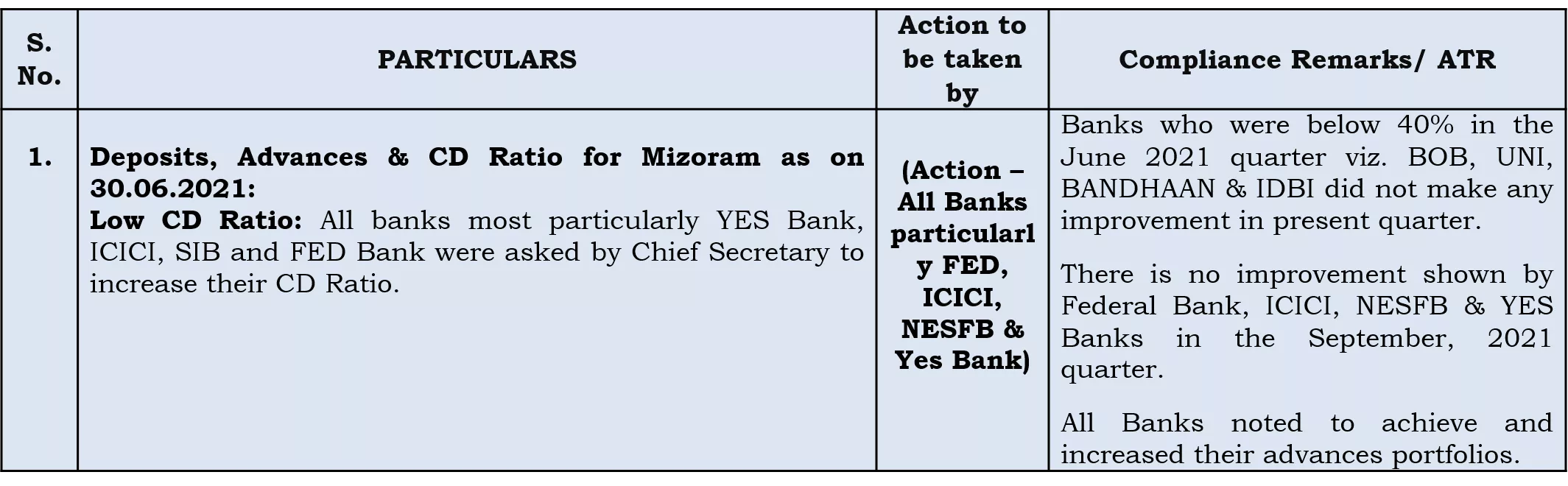

AGENDA FOR MIZORAM SLBC MEETING FOR QUARTERS ENDED SEPTEMBER 2021 ADOPTION OF MINUTES The minutes of State Level Bankers Committee meeting held on 31.08.2021 for the quarter ended June, 2021 was circulated to all members. Since there was no request for amendment from members received the house may adopt the minutes. AGENDA NO.1 The Action points emerging out of SLBC meeting held on 31.08.2021 and the ATR compliances is summarized below. Action to be taken by S. No. PARTICULARS Compliance Remarks/ ATR Banks who were below 40% in the June 2021 quarter viz. BOB, UNI, BANDHAAN & IDBI did not make any improvement in present quarter. 1. Deposits, Advances & CD Ratio for Mizoram as on 30.06.2021: Low CD Ratio: All banks most particularly YES Bank, ICICI, SIB and FED Bank were asked by Chief Secretary to increase their CD Ratio. (Action All Banks particularl y FED, ICICI, NESFB & Yes Bank) There is no improvement shown by Federal Bank, ICICI, NESFB & YES Banks in the September, quarter. 2021 All Banks noted to achieve and increased their advances portfolios.

Review of Current Year Credit Disbursement of Banks under ACP (Priority Sector) as on 30.06.2021: Sector-Wise Summary under ACP (Priority Sector): There was an achievement of 15.64% under ACP Priority Sector during the 1st quarter compared to 12.45% of first quarter in FY 2020-21. The Chief Secretary asked all banks to step up priority sector advances through various schemes and achieve the ACP target of 2021-22. He also asked BOB, Indian Bank, PSB, and Union Bank to improve their performance especially in Crop loan. (Action All Banks esp. BOB, Indian Bank, PSB and UNI) Except IOB, UNI, SIB &YES Banks, all other Banks have reported improvement in ACP achievements. MSME Sector as on 30.06.2021: There was a YOY growth of Rs.311.10 crores under Finance to MSME as on June, 2021 vis-a-vis June, 2020. The Chairman asked all banks with negative growth in MSME viz. BOM, CBI, IOB, FED and ICICI to wipe out negative growth and achieve positive growth in the next quarter. (Action All Banks esp. BOM, CBI, IOB, FED & ICICI) All BANDHAAN, FED & SIB have shown improvement in September, 2021 quarter. Banks except BOM, IOB, 2 (i) Priority Sector Advances as on 30.06.2021: Sectoral Growth under Priority Sector Advances: There was a positive growth of 24.72% in Sectoral growth under Priority Sector Advances. However, there are few banks which need to improve their lending viz. FED, ICICI, SIB & YES Banks. The Chairman asked all banks to highlight the problems faced by them in sanctioning loans under the government sponsored schemes. (Action NIL sanction Banks) All Banks except SIB have shown improvement. reported that 2 applications under Priority Sector are under process However, SIB

Public Sector Banks have shown improvement in PMMY. However, there is decline of sanction of Mudra loan by private sector banks. Banks like CBI, IND, IOB, UNI, AXIS, NESFB, SIB & YES did not sanction any Mudra loan in the second quarter. (ii) Pradhan Mantri Mudra Yojana (PMMY) as on 30.06.2021: There was a YOY -ve growth of Rs.19.52 crores in MUDRA as on 30.06.2021 which is mainly attributed due to covid- 19 pandemic. There are Banks who have not sanctioned any loan under MUDRA like Axis, NESFB and YES Bank. The chairman urged these banks to sanction MUDRA during next quarter. sanctioning of (Action All Banks) (iii) Govt. Sponsored Schemes (GSS): There was disbursement of Rs. 15.38 crores under Govt. Sponsored Schemes during the first quarter with an outstanding amount of Rs. 192.60 crores. Though the chairman expressed satisfaction over the performance of banks during first quarter, he urged the banks to achieve the target by end of FY 2021-22. Sanction Scheme has improved considerably. of Govt. Sponsored (Action All Banks) Review of Financial Inclusion initiatives, Expansion of banking Network, financial Literacy, Social Security Schemes & digitization Out of 109 unbanked villages, major portion of pertains to SBI 32, MRB 49 respectively. the villages (Action All allotted Banks) 3 a) Roadmap for providing banking services villages with population below 2000. The remaining unbanked villages latest by December, 2021. allotted banks to cover All allotted banks to complete coverage of unbanked villages under roadmap by 30th September, 2021.

b) National Strategy for financial Inclusion (NSFI). (Action UCO Bank/Since BoB is unable to cover Daido village, it is reallocated to MRB to cover the village.) UCO appointment of CSP is held up due to unavailability of Police verification. Bank reported that Progress of Universal Access to Financial Service which focusses on providing services to villages within 5kms radius/hamlets of 500 households in hilly areas. The undernoted banks are to ensure coverage of remaining 2 villages within 30th September, 2021. MRB reported that BC at Zohmun village has been allocated to cover Zokhawthiang Village verbal approval of RBI. Steps will be taken to cover Daido village as well. Sl. No. 1 2 Name of village Zokhawthiang Daido Allotted bank UCO BoB as per c) Status of Financial Literacy Camps (FLCs). Status of Financial Literacy conducted during June, 2021 quarter Rural branches of Banks have conducted 35 1stquarter of 2021. Banks noted to conduct FLC once in a month in their rural branches. FLCs during (Action All rural Branches) Quarter June No. of FLCs NIL All Banks are requested to comply with the RBI instructions of ensuring conduct of one FLC meeting by each rural Branch on monthly basis as mandated by RBI.

As on 30.09.2021, progress under various social security schemes are as under: PMJDY: 3,36,144 PMJJBY: 1,43,477 PMSBY: 2,49,300 APY: 12,205 HDFC Bank reported that presently their bank does not participate in RSETI initiative as a part of the broad strategy. They will explore the option of participating in RSETI segment at an juncture. To that extent they will continue the on-ground activity and support the state govt. in every way by providing credit access to the financially excluded members. d) Details of enrolment under Social Security Schemes (Cumulative nos. as on Dt. 30.06.2021) (Action All Banks) The progress under Social Security Scheme was reviewed and discussed, banks were requested to improve and enrol maximum account holders making them aware of these schemes. Allotment of New RSETI RSETI at Lunglei District: (Action HDFC Bank) SLBC had allotted HDFC Bank to find ways to sponsor RSETI in Lunglei District. However, HDFC Bank has not done any progress for setting up of RSETI. HDFC bank was asked to set up the RSETI by December, 2021. appropriate 4 Opening of a New RSETI at Kolasib District sponsored by Mizoram Rural Bank: MRB has reported that new RSETI at Kolasib is ready for opening since last January, 2021, they are awaiting approval from Ministry of Rural Development, Govt. of India, New Delhi. Tripartite Agreement between MoRD- Director RSETI Bangalore and Chairman MRB is yet to be executed. MRB agreement Bangalore, Chairman, MRB and DC Kolasib is awaited. informed that Tripartite MoRD between (Action MRB)

As on September, 2021, there is a pending claim amount of Rs. 27,38,499/- (Rupees twenty-seven lacs thirty-eight thousand four hundred ninety-nine reported by RSETI. Pending Claims for reimbursement of training expenses of RSETI: (Action MZSRLM) The Committee requested MzSRLM to clear all pending claim submitted by RSETI amounting to Rs. 102,92,912/-. only) as Insurance of Livestock: The representative of AH & Vety. Department has reported that there is no Insurance Company to do the livestock insurance. The AH &Vety Dept. and SLBC to explore the possibility of insurance of livestock. (Action AH & Vety. Dept. SLBC) The matter is being taken up with the Insurance Companies. 5 / AGENDA 2: a) DEPOSITS, ADVANCES & CDR FOR MIZORAM AS ON 30.09.2021: (Amount in Rs. Crores) Sept 20 March 21 13904.42 6678.76 Sept 21 14183.46 6994.14 49.31 % 13615.89 5287.49 38.83% Deposits Advances CD Ratio 48.03 %

b) BANK-WISE PERFORMANCE HIGHLIGHTS IN CD RATIO AS ON 30.09.2021: - Banks with the Highest CD Ratio (in %) IndusInd Bank Indian bank Canara Bank Bank of Maharashtra Bank of India Banks with the Lowest CD Ratio (in %) YES Bank SIB FED NESFB ICICI 293 226 134 131 91 4 12 13 16 16 c) BANK-WISE CD RATIO AS ON 30.09.2021: CD Ratio No. of Banks 5 2 6 Name of Banks Below 20% 20% to 30% 30% to 40% YES Bank, SIB, FED, NESFB, ICICI Axis &IDBI Bank BoB, PNB, UNI, SBI, BANDHAAN &HDFC BOI, BOM, CAN, CBI, INDIAN, IOB, PNB, PSB, UCO, INDUS, MRB & MCAB Above 40% 11 d) DISTRICT-WISE CD RATIO AS ON 30.09.2021:- Between 40% to 60%: 4 Districts District Saitual Serchhip Champhai Khawzawl CD Ratio below 40%: 2 Districts District Aizawl Hnahthial CD Ratio 60% and above: 5 Districts District Lawngtlai Siaha Mamit Kolasib Lunglei As on Sept 21 Qtr. 85.87% 75.91% 69.62 60.28 60.05% As on Sept 21 58.97% 54.31% 50.13% 44.62% As on Sept 21 Qtr. 38.89% 39.47% Only 3 Districts viz., Hnahthial, Khawzawl & Lunglei did not have progress in CD Ratio during Sept 2021 quarter over June 2021.

AGENDA 3: REVIEW OF CURRENT YEAR CREDIT DISBURSEMENT OF BANKS UNDER ACP (PRIORITY SECTOR) AS ON 30.09.2021: (I) SECTOR-WISE SUMMARY UNDER ACP (PRIORITY SECTOR): (Amount in Rs. Crores) FY 2020-21 Q-2 Achieved Amount FY 2021-22 Q-2 Achieved Amount 131.93 21.954 373.41 104.10 609.44 Target Amount 559.98 136.09 926.91 339.13 1826.02 Achieve- ment % Target Amount 748.67 116.18 928.40 292.53 1969.60 Achieve- ment % Sector Agri Total Crop Loan* MSME Other Priority Total* 77.30 20.71 334.35 218.80 630.45 13.80 15.21 36.07 64.51 34.52 17.62 18.54 40.22 35.62 30.94 (* Crop Loan is included in agriculture. Ref. Page Nos. 24-25) (II) MSME SECTOR AS ON 30.09.2021:- (Ref. Page No. 20) (Amount in Rs. Crores) Sub-Segment Micro Small Medium Other Total Outstanding as on Sept 20 Outstanding as on Sept 21 YoY Growth 738.68 300.95 23.06 2.28 1064.97 916.42 415.65 41.12 29.22 1402.41 177.74 114.70 18.06 26.94 337.44 There is a YoY growth of Rs. 351.86 crores under Finance to MSME as on September, 2021 vis- -vis September, 2020. However, the negative growth of some banks in MSME in September, 2021 quarter over the September, 2020 quarter have impacted the growth in MSME. These banks are: YES (0.00), BOM (-3.67cr.), CAN (-197.88), IOB (-1.00), PNB (-1418.90), UNI (-22.10), AXIS (-42.40), BANDHAAN (-34.82cr), FED (0.00), INDUS (-3.29).

(III) PRIORITY SECTOR ADVANCES AS ON 30.09.2021: SECTORAL GROWTH UNDER PRIORITY SECTOR ADVANCES: - (Ref. Page No. 16) (Amount in Rs. Crores) Sector OS as on Sept.,2020 OS as on Sept., 2021 YoY Growth 1118.11 YoY Growth % 246.804 46.90 31.68 18.16 63.04 Agri Total Crop loan (out of Agri loan) * MSME Other Priority Sector Total 453.03 65.96 1064.97 1111.09 2629.09 1571.14 96.90 1402.41 1312.86 4286.41 30.94 337.44 201.77 1657.32 (IV) PRADHAN MANTRI MUDRA YOJANA (PMMY) as on 30.09.2021 (Ref. Page No. 54) (Amount in Rs. Crores) As on Sept, 2020 No 11545 7730 1136 16696 As on March, 2021 No. 6730 8317 1224 16271 As on Sept, 2021 No. 5506 8073 1579 15158 Amount 25.12 124.25 62.44 211.81 Amount. Amount. Shishu Kishore Tarun Total 14.54 137.40 70.36 222.30 11.92 131.31 79.41 222.64 Shishu Kishore Tarun Total Shishu Kishore Tarun Total There is a YoY +ve growth of Rs. 10.83 Cr in MUDRA as on 30.09.2021 over last year September, 2020 amidst Covid-19 pandemic.

(V) GOVERNMENT SPONSORED SCHEMES (GSS): (Ref. Page No. 46, 50, 52, 58, 60, 62) (Amount in Rs. Crores) a) Performance as on 30.09.2021 is given below. Disbursement No. during the period from April-Sept., 2021 244 105 581 585 72 Disbursement Amount during the period from April-Sept., 2021 Existing O/S Amount. GSS Existing O/S No. PMEGP NULM NRLM SHG SUI 7.54 1.25 16.08 16.24 10.09 3279 1285 2734 4189 404 75.61 16.56 41.96 57.75 59.85 b) Banks with NIL Outstanding in the Govt. Sponsored Schemes as on Sept, 2021 Qtr. are as follows: Sl No. RRB/ Co- operative Bank Scheme Public Bank Private Bank AXIS, ANDHAAN, FED,INDUS, NESFB, & YES AXIS, BANDHAAN, FED, HDFC, ICICI,INDUS, NESFB, SIB & YES. AXIS, BANDHAAN, FED, ICICI, IDBI, INDUS, NESFB, SIB & YES. AXIS, BANDHAAN, FED, HDFC, ICICI, IDBI, INDUS, NESFB, SIB & YES AXIS, BANDHAAN, FED, INDUS, ICICI, NESFB, SIB & YES IND - 1 PMEGP CAN, IND, IOB, PSB & UCO - 2 NULM BOI, BOM, CAN, CBI, IND, IOB, PSB & UNI 3 NRLM - 4 SHG BOI, BOM, IND, IOB,PSB & UNI - 5 SUI CBI, IND, IOB, PSB & UNI MCAB. MRB

AGENDA 4: SPECIAL REVIEW ON FINANCIAL INCLUSION INITIATIVES, EXPANSION OF BANKING NETWORK, FINANCIAL LITERACY, SOCIAL SECURITY SCHEMES &DIGITISATION: (a) Roadmap for providing banking services villages with population below 2000: (Ref. Page No. ____) All allotted banks to complete coverage of unbanked villages under roadmap by 31st December, 2021. Major portion of the villages pertains to SBI 32, MRB 49 respectively. (b) DFS inadequately Uncovered villages: (Ref. Page No. ____) As on 30.09.2021 there are 10 remaining uncovered villages received from DFS for deployment of banking outlets within 5 Km radius. The allotted banks i.e. BOB-1, HDFC-1, IPPB-1, MRB-3, SBI-3 and UCO-1 are to deployed banking outlets in the remaining 10 unbanked villages latest by December, 2021. (c) National Strategy for Financial Inclusion (NSFI): Progress of Universal Access to Financial Service which focuses on providing services to villages within 5 km radius/hamlets of 500 households in hilly areas. The undernoted banks are to ensure coverage of remaining 2 villages within 30th September, 2021. Sl.No. Name of village Allotted bank 1 Zokhawthiang UCO Bank CSP appointed and Police verification is awaited. Since BoB expressed inability to cover it was reallocated to MRB and they will cover the village shortly. Remarks 2 Daido BoB (d) Status of Financial Literacy Camps (FLCs): Status of Financial Literacy conducted during September, 2021 quarter Quarter September No. of FLCs 4 All Banks are requested to comply with the RBI instructions of ensuring conduct of one FLC meeting by each rural Branch on a monthly basis.

(e) Details of enrolment under Social Security Schemes (Cumulative nos. as on Dt. 30.09.2021) Enrolment under PMJJBY 143477 Enrolment under PMSBY 249300 Enrolment under APY 12205 (Ref. Page No. 79) PMJDY: Status of enrolment under PMJDY is as under: Male 161162 Female 174982 Total 336144 (Ref. Page No. 77) AGENDA 5: A. RSETI: There is one (1) RSETI in Mizoram. The performances of the RSETI for the FY (2021-22) as on 30.09.2021, is given as under: Spon- soring Bank Annual Training Target Training Actual up to date Nos. of Credit Linkage Credit Linkage in % Nos. of Settlement Settlement rate in % Location of RSETI C/o MTDC KVIB, Zemabawk, Thingkhim Veng, Aizawl, Mizoram. SBI Nil Nil Nil Nil Nil Nil *Training could not be conducted from April to September, 2021 due to Covid restriction.

B. ALLOTMENT OF NEW RSETI: RSETI at Lunglei District: The meeting had allotted HDFC Bank to find ways to sponsor RSETI in Lunglei District. However, HDFC Bank has not done any progress for setting up of RSETI. Opening of a New RSETI at Kolasib District sponsored by Mizoram Rural Bank: MRB has reported that RSETI at Kolasib is ready for opening since last January, 2021. They informed that tripartite agreement between MoRD Bangalore, Chairman MRB and DC Kolasib is awaited. C. Pending Claims for reimbursement of training expenses of RSETI: MzSRLM reported that there is no claim pending with them. However, SBI-RSETI reported year-wise claims pending as follows: Sl.No. Financial Year Claims Pending amount in Rupees 1 2017-18 2 2018-19 3 2019-20 4 2020-21 482,025.00 705,368.00 735,102.00 816,004.00 AGENDA 6: ASPIRATIONAL DISTRICT (AD) PROGRAMME, MIZORAM: STATUS AS ON 30.09.2021 Mizoram FY (2021-22) ACP Achieved % Q-1 (2021- 22) O/S Amount in Rs. Crore PMEGP CD Ratio-1 KCC MUDRA Q-2 (2021- 22) Mar. '21 Sept 2 1 Mar. '21 Sept '21 Mar. '21 Sept. '21 Mar. '21 Sept '21 Sl. Dist. 69.64 % 1 Mamit 62.85% 1.52% 26.60% 22.40 30.80 9.16 9.90 13.72 13.54

Mizoram Social Security Schemes (in Cumulative Nos.) PMJJBY Mar. '21 '21 21 8091 12410 12658 PMJDY Mar. 21 28733 PMSBY APY Sept '21 29285 Sept Mar. Sept '21 20610 Mar. '21 597 Sept '21 627 District Mamit AGENDA 7: Annual Target of PMEGP The proposed District-wise &Agency-wise Annual Target under PMEGP for the FY 2021-22 has been received from the State Director, KVIC, Mizoram for approval of the house. The proposal, if approve, will be forwarded to the Lead District Managers/District Task Force Committees of each district for eventual distribution among the banks. The proposal is given below: DISTRICT WISE & AGENCY WISE PMEGP TARGET(MIZORAM) FOR THE YEAR 2021-22 NAME OF DISTRICT KVIC (Rural Area) KVIB (Rural Area) DIC (Urban & Rural Area) Sl.No Total M.M Project Emp M.M Project Emp M.M Project Emp M.M 897.02 174.73 279.18 148.66 281.67 185.27 130.31 224.46 104.34 120 344.44 2890.08 Project 344 67 107 57 108 71 50 86 40 46 132 1108 Emp 2752 536 856 456 864 568 400 688 320 368 1056 8864 1 2 3 4 5 6 7 8 9 10 11 Aizawl Champhai Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Hnahthial Khawzawl Serchhip TOTAL 240.12 15.66 130.50 13.02 13.02 26.14 52.20 146.16 - - 229.68 866.50 92 6 50 5 5 10 20 56 - - 88 332 736 48 400 40 40 80 160 448 - - 704 2656 78.30 101.79 86.13 78.30 138.33 96.57 - 78.30 65.25 80.91 57.42 861.30 30 39 33 30 53 39 - 30 25 31 22 332 240 312 264 240 424 312 - 240 200 248 176 2656 578.6 57.34 62.55 57.34 130.32 57.34 78.11 - 39.09 39.09 57.34 1157.12 222 22 24 22 50 22 30 - 15 15 22 444 1776 176 192 176 400 176 240 - 120 120 176 3552

AGENDA 8: INSURANCE OF LIVESTOCK: Bankers have reported that they are facing problems in insuring Livestock which were purchased/ reared out of Bank s finance. Insurance company may be requested to comment. The SLBC Sub-Committee on Improving Rural Infrastructure/ Credit Absorption Capacity decided to put up campaign on financing of Fisheries/Animal Husbandry launched by the Govt. of India by Bank branches to cover maximum farmers. AGENDA 9: SPECIAL SLBC ON FINANCIAL INCLUSIONFINANCIAL INCLUSION AND FINANCIAL LITERACY PROGRESS AND ASSESSMENT UNDER NATIONAL STRATEGY OF FINANCIAL INCLUSION (NSFI).

Agenda I: Quantitative Parameters (State, Districts, Aspirational Districts vis- -vis State Average) Data as on March 2019, March 2020 and March 2021 A. Access (a) Physical Access Indicators i. Number of Bank Branches per One Lakh Population No. of Bank Branches per One Lakh Population March 2019 March 2020 27.97 25.00 19.09 5.57 0.00 14.05 0.00 19.24 22.63 19.06 11.03 10.18 16.22 5.84 10.49 10.49 13.10 11.46 0.00 11.86 24.66 6.17 No. of Bank Branches per One Lakh Population March 2019 March 2020 18.72 15.01 Sl. No. District March 2021 25.99 13.52 14.05 16.49 20.25 10.18 12.33 12.83 11.46 15.82 21.58 Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip 1. 2. 3. 4. 5. 6. 7. 8. 9. 10 11 Sl. No. State March 2021 18.14 Mizoram 1.

ii. Number of BC Outlets per One Lakh Population No. of BC Outlets per One Lakh Population March 2019 3.46 9.54 0.00 0.00 14.29 19.51 12.33 10.49 3.28 0.00 15.41 No. of BC Outlets per One Lakh Population March 2019 8.33 Sl. No. District March 2020 3.46 0.80 0.00 0.00 14.29 19.51 3.89 10.49 3.28 0.00 0.00 March 2021 9.90 12.72 7.03 21.99 22.63 28.84 13.63 19.82 18.02 13.84 20.04 Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Sl. No. State March 2020 5.52 March 2021 15.50 Mizoram 1. b) Digital Access Indicators Number of ATM cum Debit Cards i. Number of ATM cum Debit Cards March 2019 March 2020 - Sl. No. District March 2021 295023 Aizawl 202306 1.

ii. Number of Internet Banking Subscribers Sl. No. District Number of Internet Banking Subscribers March 2019 March 2020 - March 2021 114382 1. Aizawl - iii. Number of Mobile Banking Subscribers Sl. No. District Number of Mobile Banking Subscribers March 2019 - March 2020 March 2021 168839 1. Aizawl - iv. Number of ATMs per One Lakh Population No. of ATMs per One Lakh Population March 2019 March 2020 31.18 10.34 0.00 0.00 10.72 4.24 11.03 4.66 6.55 0.00 7.71 No. of ATMs per One Lakh Population March 2019 March 2020 15.09 Sl. No. District March 2021 32.42 7.95 3.51 5.50 11.91 5.09 10.38 4.66 8.19 3.95 7.71 Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip 29.45 4.77 3.51 5.50 10.72 5.09 5.84 4.66 8.19 3.95 6.17 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Sl. No. State March 2021 15.83 Mizoram 13.77 1.

c) Provision of Banking Services in every village within a radius of 5 KMs/ hamlets of 500 households Status Banking Services in every village within a radius of 5 KMs/ hamlets of 500 households March 2019 March 2020 4 - 2 - - - - - 1 - 10 - 15 - 2 - 5 - - - 0 - Banking Services in every village within a radius of 5 KMs/ hamlets of 500 households March 2019 March 2020 39 - Sl. No. District March 2021 1 0 0 0 0 0 0 0 0 1 0 1. 2. 3. 4. 5. 6. 7. 8. 9. 10 11 Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip Sl. No. State March 2021 2 1. Mizoram

B. Usage (a) Savings Account Indicators i. Number of BSBDA per One Lakh Population ii. Number of PMJDY Accounts per One Lakh Population Number of PMJDY Accounts/One Lakh Population March 2019 March 2020 21927 29616 - - 24920 36670 38974 24518 33952 - 26311 Number of PMJDY Accounts/One Lakh Population March 2019 236890 Sl. No. District March 2021 26967 24548 26121 57788 24293 56368 46958 33505 63352 41074 36990 Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip 26573 25891 42866 55556 33611 55457 46750 42346 54026 40196 39658 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. State Sl. No. March 2020 462931 March 2021 36252 Mizoram 1.

iii. Number of Women BSBDA per One Lakh Women Population iv. Number of Women PMJDY Accounts per One Lakh Women Population Number of Women PMJDY Accounts per One Lakh Women Population March 2019 March 2020 Sl. No. District March 2021 20387 19075 - - 28206 44497 34613 39772 44454 - 30533 Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Number of Women PMJDY Accounts per One Lakh Women Population March 2019 March 2020 Sl. No. State March 2021 32380 Mizoram 1.

v. Number of SHGs having Savings Bank Account Sl. No. District Number of SHGs having Savings Bank Account March 2019 March 2020 March 2021 153 156 6 63 122 238 46 129 119 40 97 1. 2. 3. 4. 5. 6. 7. 8. 9. 10 11 Sl. No. Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip State Number of SHGs having Savings Bank Account March 2019 March 2020 March 2021 1169 1. Mizoram

b) Out of no. v above, number of women-SHGs with Savings Bank Account Providing a Basic Bouquet of Financial Services (Micro Insurance and Micro Pension) c) Credit Indicators i. Number of Credit Accounts per One Lakh Population ii. Number of active/operative PMJDY accounts out of which accounts availing OD facility iii.Kisan Credit Card (KCC) Total No. of KCC issued Number Amount O/S (in Lakhs) 10386.93 1386.17 587.28 1118.9 2004.6 1370.67 1945.15 939.56 1051.69 1241.74 2286.31 District Year Ending Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip State Mizoram Mar 2021 Mar 2021 Mar 2021 Mar 2021 Mar 2021 Mar 2021 Mar 2021 Mar 2021 Mar 2021 Mar 2021 Mar 2021 Year ending Mar 2021 5990 2952 560 1189 2092 2878 3529 1274 2919 1253 1838 27474 24318.79

iv. Micro Credit (Self Help Groups (SHG) & Joint Liability Groups (JLG) Average Ticket Size of SHG Loan O/S (Total Credit O/S to SHG/ Number of Credit Linked SHGs) (III) Average Ticket Size of JLG Loan O/S (Total Credit O/S to JLG/ Number of JLGs) (III) 0.31 Total Numbe r of JLG Out of (I), Number of SHGs Credit Linked Total Number of SHG Loan O/S to JLGs District/ State Name Year ending District/ State Name Year ending (I) (II) (I) (II) Mar-21 620.73 Aizawl Mar-21 153 281.83 2.82 Aizawl Mar-21 272.73 1.18 Champhai Mar-21 156 607.17 1.73 Champhai Mar-21 50.3 1.86 Hnahthial Mar-21 Mar-21 Mar-21 6 1.75 263.63 687.97 0.44 1.39 2.2 Hnahthial Khawzawl Kolasib Mar-21 1.22 0.61 Khawzawl 63 122 Mar-21 Mar-21 Mar-21 319.61 263.61 360.69 0.21 1.06 1.17 Kolasib Lawngtlai Lunglei Mar-21 238 193.1 1.17 Lawngtlai Mar-21 46 122.6 2.4 Lunglei Mar-21 46.56 0.7 Mamit Mar-21 129 523.22 1.39 Mamit Mar-21 306.26 1.27 Saiha Mar-21 119 189.24 1.12 Saiha Mar-21 Mar-21 40.04 26.4 2 Saitual Serchhip Mar-21 Mar-21 40 97 117.51 505.4 1.28 1.91 Saitual Serchhip 1.2 State Year ending State Year ending Mar-21 1169 3493.42 1.68 Mizoram Mar-21 2308.15 0.49 Mizoram

d) CD Ratio (State, Aspirational Districts and Districts having CD Ratio less than 40% consecutively for last three financial year 2019, 2020 and 2021 CD Ratio March 2020 34.01 44.49 26.27 60.56 49.18 82.08 52.12 50.56 68.14 61.94 42.24 CD Ratio March 2020 39.38 Sl. No. District March 2019 32.78 52.66 - - 45.19 86.81 54.04 45.12 83.17 - 46.27 March 2021 37.62 44.53 33.55 69.88 56.33 80.16 61.01 62.85 74.95 58.71 48.11 1. 2. 3. 4. 5. 6. 7. 8. 9. 10 11 Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip Sl. No. State March 2019 38.78 March 2021 43.61 1. Mizoram

II. Qualitative Parameters (State, Districts, Aspirational Districts vis- -vis State Average) Data as on March 2019, March 2020 and March 2021 (a) Financial Literacy Indicators i) Number of Financial Literacy Centres (FLCs) No. of Financial Literacy Centres (FLCs) Sl. No. District March 2019 March 2020 March 2021 1. 2. 3. 4. 5. Aizawl Champhai Hnahthial Khawzawl 1 1 - - 1 1 1 1 1 1 1 1 1 1 1 Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip 6. 7. 8. 9. 10 11 1 1 1 1 - 1 1 1 1 1 1 1 1 1 1 1 1 1 No. of Financial Literacy Centres (FLCs) Sl. No. State March 2019 March 2020 March 2021 1. Mizoram 8 11 11

ii. Number of Financial Literacy Camps conducted by FLCs and Number of Beneficiaries Sl. No. District Number of Financial Literacy Camps Number of Beneficiaries conducted by FLCs March 2020 March 2019 March 2021 March 2019 March 2020 March 2021 1. 2. 3. 4. 5. 6. 7. 8. 9. 10 11 9 1 - - 5 1 1 22 1 - 12 15 4 1 0 2 0 8 1 0 1 12 12 6 4 0 11 7 13 6 0 8 8 601 43 - - 142 15 14 1802 35 - 707 1085 108 45 0 32 0 484 59 0 45 756 530 222 54 0 256 22 274 202 0 326 256 Aizawl Champhai Hnahthial Khawzawl Kolasib Lawngtlai Lunglei Mamit Saiha Saitual Serchhip Number of Financial Literacy Camps Number of Beneficiaries conducted by FLCs March 2020 Sl. No. State March 2019 March 2021 March 2019 March 2020 March 2021 1. Mizoram 52 44 75 3359 2614 2142

iii. Implementation of Centre for Financial Literacy (CFL) at Block Level. Sl. No. Block District Implementation of Centre for Financial Literacy (CFL) 1. 2. 3. 4. 5. Zawlnuam Lawngtlai Aibawk Champhai East Lungdar Mamit Lawngtlai Aizawl Champhai Serchhip III: Enabling Infrastructure for furthering financial Inclusion and Digital Payments Ecosystem a) Physical Infrastructure Inadequacies Road/Power/Telecom Connectivity (Writeup on State level inadequacies wrt Road connectivity, Availability of Power and Telecom Connectivity substantiate with relevant data, if any) b) Digital infrastructure (State Data as on March 2019, March 2020 and March 2021) IV: Progress in Pilot Project on Expanding and Deepening of Digital Payments undertaken in the identified district(s) for the State/ UT (as per format -Annex III) and way forward for scaling up the same in other districts of the State/ UT as per format -Annex III (attached in the booklet) V: Any other specific issue relating to FI/FL/Digital Payments

V: Any other specific issue relating to FI/FL/Digital Payments AGENDA 10: Any other Business with permission from the Chair. Closure of Bank Branches by Local Level Task Force declaration of certain area as a Containment Zone during Covid-19 pandemic. Progress in Increasing Digital modes of Payment in the State: Serchhip District has been identified as the 2nd district for 100% digitization. The House may approve the 2nd district identified by SLBC for 100% digitization.

STATE LEVEL BANKERS COMMITTEE MIZORAM