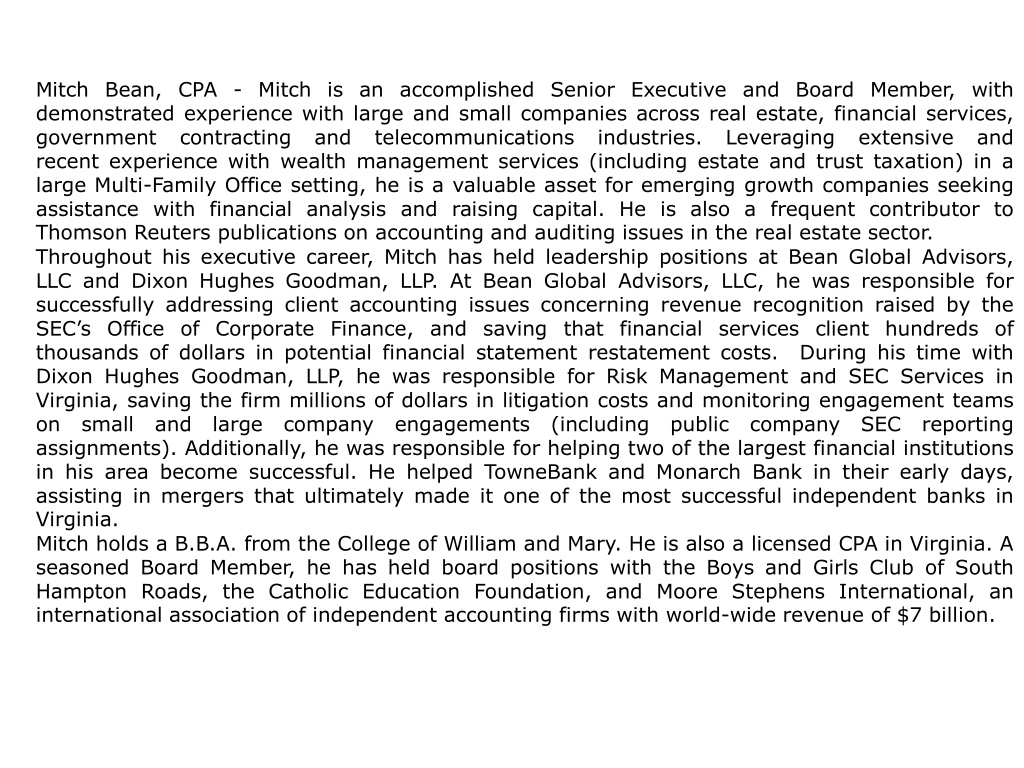

Mitch Bean, CPA: Experienced Senior Executive & Board Member

Mitch Bean, a licensed CPA in Virginia, is an accomplished Senior Executive and Board Member with vast experience in real estate, financial services, government contracting, and telecommunications industries. His expertise in wealth management services and financial analysis makes him a valuable asset for emerging growth companies. With leadership roles at Bean Global Advisors, LLC, and Dixon Hughes Goodman, LLP, Mitch has successfully addressed client accounting issues and saved firms significant costs. His board positions include the Boys and Girls Club and the Catholic Education Foundation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Mitch Bean, CPA - Mitch is an accomplished Senior Executive and Board Member, with demonstrated experience with large and small companies across real estate, financial services, government contracting and telecommunications industries. Leveraging extensive and recent experience with wealth management services (including estate and trust taxation) in a large Multi-Family Office setting, he is a valuable asset for emerging growth companies seeking assistance with financial analysis and raising capital. He is also a frequent contributor to Thomson Reuters publications on accounting and auditing issues in the real estate sector. Throughout his executive career, Mitch has held leadership positions at Bean Global Advisors, LLC and Dixon Hughes Goodman, LLP. At Bean Global Advisors, LLC, he was responsible for successfully addressing client accounting issues concerning revenue recognition raised by the SEC s Office of Corporate Finance, and saving that financial services client hundreds of thousands of dollars in potential financial statement restatement costs. Dixon Hughes Goodman, LLP, he was responsible for Risk Management and SEC Services in Virginia, saving the firm millions of dollars in litigation costs and monitoring engagement teams on small and large company engagements (including public company SEC reporting assignments). Additionally, he was responsible for helping two of the largest financial institutions in his area become successful. He helped TowneBank and Monarch Bank in their early days, assisting in mergers that ultimately made it one of the most successful independent banks in Virginia. Mitch holds a B.B.A. from the College of William and Mary. He is also a licensed CPA in Virginia. A seasoned Board Member, he has held board positions with the Boys and Girls Club of South Hampton Roads, the Catholic Education Foundation, and Moore Stephens International, an international association of independent accounting firms with world-wide revenue of $7 billion. During his time with

Overview - Revenue Recognition ASU 2014-09, Revenue from Contracts with Customers (Topic 606) Objective: to establish the principles to report useful information to users of financial statements about the nature, timing, and uncertainty of revenue from contracts with customers. 3

Scope of the Standard Scope Standard would apply to all industries and all firms The following contracts are excluded from the scope of revenue recognition: Financial instruments Insurance contracts Lease contracts Guarantees (excluding extended service warranties) 4

Scope of the Standard Scope of the standard is limited to revenue arising from contracts with customers CONTRACT Entity Customer Enforceable rights and obligations Customer party that has contracted with an entity to obtain goods and services that are the output of the entity s ordinary activities What about contracts with noncustomers? 5

Scope of the standard ASU 2017-05, Other Income Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20) Covers sales of nonfinancial assets to noncustomers (e.g. sale of an office or plant used in an entity s business) Many of the principles established in Topic 606, Revenue from Contracts with Customers, are carried over to sales of nonfinancial assets to noncustomers Primary difference is the location where the transactions fall within the income statement

Effective Date Both standards are effective as follows: Annual reporting periods beginning after December 15, 2018, and interim periods within that period For most non-public companies will first apply to calendar year 2019 financial statements Early application originally prohibited for US Organizations May now adopt for annual periods beginning after December 15, 2016 (on or after January 1, 2017 for non- public companies) 7

Overview - Revenue Recognition Core principle: Recognize revenue to depict the transfer of goods or services in an amount that reflects the consideration expected to be received in exchange for those goods or services Steps to apply the core principle: 5. Recognize revenue when a performance obligation is satisfied 1. Identify the contract(s) with the customer 2. Identify the separate performance obligations 3. Determine the transaction price 4. Allocate the transaction price Recognize revenue in the accounting period when the performance obligation is satisfied. 8

Step 1: Identify the Contract with the Customer The standard defines a contract as an agreement between two or more parties that creates enforceable rights and obligations. To be a contract with a basis for revenue recognition under the standard, the contract must meet the following criteria: Commercial substance; that is, a transfer of good or services will result in future cash flows Approval and commitment by each party to fulfil its obligations Identifiable payment terms and rights to goods or services and Probable collectability Probable: The future event or events are likely to occur. 9

Step 1: Basic Accounting Revenue cannot be recognized until a contract exists. Company obtains rights to receive consideration and assumes obligations to transfer goods or services Rights and performance obligations gives rise to an (net) asset or (net) liability. Contract asset = Rights received > Performance obligation Contract liability = Rights received < Performance obligation 10

Step 1 5. Recognize revenue when a performance obligation is satisfied 1. Identify the contract(s) with the customer 2. Identify the separate performance obligations 3. Determine the transaction price 4. Allocate the transaction price Key element: price interdependence Combine contracts if prices are interdependent Contract modifications accounted for separately if priced at stand alone selling prices 11

Step 1: Contract Combinations Contracts are combined if entered into by an entity (or related parties of the entity) with the same customer (or related parties of the customer) at or near the same time with: Interdependent sales prices or Single commercial objective or Promised goods or services are part of a single performance obligation 12

Step 1: Contract Modifications Contract Modifications Change in contract terms while it is ongoing. Companies determine: Whether a new contract (and performance obligations) results or Whether it is a modification of the existing contract. 13

Step 1: Contract Modifications Separate Performance Obligation Account for as a separate performance obligation if both of the following conditions are satisfied: Promised goods or services are distinct (i.e., company sells them separately and they are not interdependent with other goods and services), and The company has the right to receive an amount of consideration that reflects the standalone selling price of the promised goods or services. 14

Step 1: Contract Modifications Example: Homebuilder, Inc. has a contract to build a custom home for Family A for $500,000. Family A owns the land. Half way through the construction Family A decides they would really like a pool for their new house. Homebuilder, Inc. agrees to build the pool for an additional $50,000 (which is the standalone selling price for a pool). Homebuilder, Inc. regularly provides this option for its custom homes. Homebuilder, Inc. uses the percentage of completion method for recognizing revenue. Given a new contract, Homebuilder, Inc. will recognize an additional: Original contract [($500,000) x 50%] = $250,000 Separate Contract for Pool = 50,000 Total revenue = $300,000 15

Step 1: Contract Modifications Example: Assume that Homebuilder, Inc. does not routinely build pools as an option for its custom homes and, therefore, cannot account for the change order as a separate contract. Homebuilder, Inc. also concludes the pool is not a distinct performance obligation and, when the pool is considered, that construction is now only 40% complete. Given the facts and circumstances, Homebuilder, Inc. will have to treat the old contract as terminated and a new contract created to complete the construction of the home with a pool. Therefore, future revenue to be recognized is: Original contract [$500,000 x 60%] = $300,000 Change order for pool = 50,000 Total revenue $350,000 16

Step 1: Contract Modifications Example: Assume that Homebuilder, Inc. does not routinely build pools as an option for its custom homes and, therefore, cannot account for the change order as a separate contract. Homebuilder, Inc. also concludes the pool is not a distinct performance obligation and, when the pool is considered, that construction is now only 40% complete. Given the facts and circumstances, Homebuilder, Inc. will have to treat the change order as a modification of the original contract created to complete the construction of the home with a pool. Therefore, revenue will be adjusted as follows: Modified contract [$550,000 x 40%] = $220,000 Amount recognized to date of modification = 250,000 Reduction if revenue (debit adjustment) ($30,000) 17

Step 1 - Contract Modifications If modification priced at stand alone selling prices and the product or service is distinct, account for the modification separately as a separate contract and performance obligation. Otherwise, account for the modification as if (1) the old contract was terminated and new contract created for undelivered goods or services (if distinct) or (2) the modification were part of the original contract (if not distinct) So how do we know a modification (i.e. performance obligation) is distinct? Not specifically defined in the standard. Marriam Webster s Definition: Distinct: Distinguishable to the eye or mind as being discrete or not the same.

Step 2 5. Recognize revenue when a performance obligation is satisfied 1. Identify the contract(s) with the customer 2. Identify the separate performance obligations 3. Determine the transaction price 4. Allocate the transaction price Key Element: distinct goods or services Separate performance obligation is a promise to transfer a distinct good or service to the customer So there is that term distinct again: Distinct: Distinguishable to the eye or mind as being discrete or not the same. 19

Step 2 - Separate Performance Obligations Are goods/services in the contract provided at the same time, resulting in the same amount and timing of revenue recognition? YES account for as a single PO NO Are promised goods & services distinct from other goods & services in the contract? If No account for as a single PO If YES Separate PO 20

Step 2 - Separate Performance Obligations To determine whether a company has to account for multiple performance obligations, it evaluates two conditions. Whether the product or service is distinct in the context of the contract Whether the product or service is capable of being distinct. 21

Identifying Separate Performance Obligations Separate performance obligations exist if the goods or services are: capable of being distinct because the customer can use the good or service on its own or together with resources readily available to the customer, and distinct in the context of the contract because the good or service is not highly dependent on, or highly interrelated with, other promised goods or services in the contract A firm should combine a good or service with other goods or services in the contract if they are not individually separable until a single performance obligation is identified 22

Step 2 Illustration 1 Separate Performance Obligations XYZ licenses customer-relationship software to LMN Company. In addition to providing the software itself, XYZ promises to provide consulting services by extensively customizing the software to LMN s information technology environment, for total consideration of $600,000. In this case, XYZ is providing a significant service by integrating the goods and services (the license and the consulting service) into one combined item for which LMN has contracted. In addition, the software is significantly customized by XYZ in accordance with specifications negotiated by LMN. Do these facts describe a single or separate performance obligation? The license and the consulting services are distinct but interdependent, and therefore should be accounted for as one performance obligation. 23

Step 2 Illustration 2 Separate Performance Obligations ABC manufactures and sells computers that include a warranty to make good on any defect in its computers for 120 days (often referred to as an assurance warranty). In addition, it sells separately an extended warranty, which provides protection from defects for three years beyond the 120 days (often referred to as a service warranty). In this case, two performance obligations exist, one related to the sale of the computer and the assurance warranty, and the other to the extended warranty (service warranty). The sale of the computer and related assurance warranty are one performance obligation as they are interdependent and interrelated with each other. However, the extended warranty is separately sold and is not interdependent, and should be treated as a separate performance obligation. 24

Step 3 5. Recognize revenue when a performance obligation is satisfied 1. Identify the contract(s) with the customer 2. Identify the separate performance obligations 3. Determine the transaction price 4. Allocate the transaction price Key element: expected amount Transaction price is the expected (probability-weighted) or most likely consideration from the customer, and reflects: Reasonable estimates of contingent amounts Implicit financing 25

Step 3: Determine the Transaction Price Transaction Price Amount of consideration that company expects to receive from a customer. In a contract it is often easily determined because customer agrees to pay a fixed amount. Other contracts, companies must consider: Variable consideration Time value of money Consideration paid or payable to the customer 26

Step 3 - Determining the Transaction Price Variable Consideration Price dependent on Future events May include discounts, rebates, credits, performance bonuses, or royalties. Companies estimate amount of revenue to recognize. Expected value Most likely amount 27

Step 3 - Determining the Transaction Price Estimating Variable Consideration Expected Value: Probability-weighted amount in a range of possible consideration amounts. May be appropriate if a company has a large number of contracts with similar characteristics. Can be based on a limited number of discrete outcomes and probabilities. Most Likely Amount: The single most likely amount in a range of possible consideration outcomes. May be appropriate if the contract has only two possible outcomes. 28

Step 3 - Determining the Transaction Price Estimating Variable Consideration Facts: Construction Company Z enters into a contract with a customer to build a warehouse for $100,000, with a performance bonus of $50,000 that will be paid based on the timing of completion. The amount of the performance bonus decreases by $5,000 per week for every week beyond the agreed-upon completion date. The contract requirements are similar to contracts that Company Z has performed previously, and management believes that such experience is predictive for this contract. Management estimates that there is a 60% probability that the contract will be completed by the agreed-upon completion date, a 30% probability that it will be completed 1 week late, and only a 10% probability that it will be completed 2 weeks late. Question: How should Company Z account for this revenue arrangement? 29

Step 3 Estimating Variable Consideration Question: How should Company Z account for this revenue arrangement? Management has concluded that the probability-weighted method is the most predictive approach: 60% chance of $150,000 = 30% chance of $145,000 = 10% chance of $140,000 = $ 90,000 43,500 14,000 $147,500 Most likely outcome, if management believes they will meet the deadline and receive the $50,000 bonus, the total transaction price would be? $150,000 (the outcome with 60% probability) 30

Step 3 Variable Consideration Only allocate variable consideration if it is reasonably assured that it will be entitled to the amount Companies only recognizes variable consideration if 1. they have experience with similar contracts and are able to estimate the cumulative amount of revenue, and 2. based on experience, they do not expect a significant reversal of revenue previously recognized. If these criteria are not met, revenue recognition is constrained. 31

Step 3 - Determining the Transaction Price Time Value of Money When contract (sales transaction) involves significant financing component. Interest accrued on consideration to be paid over time. Fair value determined either by measuring the consideration received or by discounting the payment using an imputed interest rate. Company reports as interest expense or interest revenue. 32

Step 3 Time Value of Money Example EXTENDED PAYMENT TERMS Facts: On July 1, 2019, SEK Company sold goods to Company Y for $900,000 in exchange for a 4-year, zero-interest-bearing note with a face amount of $1,416,163. The goods have an inventory cost on SEK s books of $590,000. Questions: (a) How much revenue should SEK Company record on July 1, 2019? Entry to record SEK s sale to Company Y on July 1, 2019, is as follows. Notes Receivable Sales Revenue Discount on Notes Receivable 1,416,163 900,000 516,163 Cost of Goods Sold Inventory 590,000 590,000 33

Step 3 Time Value of Money Example EXTENDED PAYMENT TERMS Facts: On July 1, 2019, SEK Company sold goods to Company Y for $900,000 in exchange for a 4-year, zero-interest-bearing note with a face amount of $1,416,163. The goods have an inventory cost on SEK s books of $590,000. Questions: (b) How much revenue should it report related to this transaction on December 31, 2019? Entry to record interest revenue at the end of the year, December 31, 2019. Discount on Notes Receivable 54,000 Interest Revenue (12% x x $900,000) 54,000 Companies are not required to reflect the time value of money if the time period for payment is less than a year. 34

Step 3 Consideration Paid or Payable VOLUME DISCOUNT Facts: X Corp offers its customers a 3% volume discount if they purchase at least $2 million of its product during the calendar year. On March 31, 2019, X Corp made sales of $700,000 to a customer. In the past 2 years, X Corp sold over $3,000,000 to the same customer in the period April 1 to December 31. Questions: How much revenue should X Corp recognize for the first 3 months of 2019? X Corp makes the following entry on March 31, 2019. Accounts Receivable Sales Revenue 679,000 679,000 X Corp should reduce its revenue by $21,000 ($700,000 x 3%) because it is probable that it will provide this rebate. 35

Step 4 Allocating the Transaction Price 5. Recognize revenue when a performance obligation is satisfied 1. Identify the contract(s) with the customer 2. Identify the separate performance obligations 3. Determine the transaction price 4. Allocate the transaction price Key Elements: relative selling price allocation Transaction price allocated to the separate performance obligations on relative stand-alone selling price basis Based on their relative fair values. Best measure of fair value is what the company could sell the good or service for on a stand-alone basis. If not available, companies should use their best estimate of what the good or service might sell for as a stand-alone unit. 36

Allocation of Transaction Price to Separate Performance Obligations 37

Allocation of Transaction Price to Multiple Performance Obligations The allocation would be based on relative selling price of all performance obligations Allocation of variable consideration and discounts to one (or more) performance obligations is permitted 38

Step 4 Allocation of Transaction Price Questions: How should a real estate developer allocate the transaction price in the following example? Assume that a real estate developer is selling residential homes in a golf course community, and part of the transaction price can cover a golf membership in a country club owned and operated by the developer. Similar homes are sold for $900,000 in the community without the golf membership. The developer is also offering standalone golf memberships for $100,000 in the community. The real estate developer determines that developing and managing golf course communities is part of its ordinary activities, and further concludes that golf membership is not considered an incentive. A home with a golf course membership closes with an unrelated third party for a selling price of $950,000, which represents a discount allocated in accordance with FASB ASC 606-10-32-36 (that is, on the basis of relative stand-alone selling prices). How should the developer allocate the transaction price? 39

Step 4 Allocation of Transaction Price Questions: How should a real estate developer allocate the transaction price in the following example? The developer allocates the transaction price (TP) on a standalone selling price (SP) basis, as follows: Stand Alone Selling Prices Percentage Allocation TP Allocation Golf membership $ 100,000 10% $ 95,000 Residential home 900,000 90% 855,000 Total standalone SP basis $1,000,000 100% $950,000 40

Step 5 Recognize Revenue 5. Recognize revenue when a performance obligation is satisfied 1. Identify the contract(s) with the customer 2. Identify the separate performance obligations 3. Determine the transaction price 4. Allocate the transaction price Key Element: transfer based on control 41

Step 5: Recognize Revenue When (or as) Each Performance Obligation is Satisfied Company satisfies its obligation when the customer obtains control of the goods or service. Change Control Indicators: 1. Company has a right to payment for asset. 2. Company has transferred legal title to asset. 3. Company has transferred physical possession of asset. 4. Customer has significant risks and rewards of ownership. 5. Customer has accepted the asset. 42

Step 5: Recognize Revenue When (or as) Each Performance Obligation is Satisfied Recognize revenue from a performance obligation over time if one of three criteria are met: Customer simultaneously receives and consumes the benefits provided by the seller as the entity performs The seller s performance creates of enhances an asset that the customer controls The seller s performance does not create an asset with an alternative use AND the seller has an enforceable right to payment for performance completed. 43

Step 5: Recognize Revenue When (or as) Each Performance Obligation is Satisfied Recognize revenue from a performance obligation over time Measure progress toward completion Method for measuring progress should depict transfer of control from company to customer. Input methods (e.g. percentage of costs incurred to total estimated costs) Output methods (percentage of project complete according to an architect s certification) 44

Step 5: Recognizing Revenue Example For purposes of illustrating these concepts, assume a developer constructs an asset but title of the land and/or building transfers to the customer only upon completion. In this situation, the first two criteria for recognizing revenue over time are generally not met, as the customer does not have the ability to consume the benefits from or control the asset until closing. Therefore, revenue recognition depends on whether (1) performance creates an asset with an alternative use to the developer, and (2) the entity has an enforceable right to payment for completion to date. 45

Step 5: Recognizing Revenue Example Scenario A Scenario A: The customer makes a deposit when the contract is signed. The remainder is paid upon completion of the construction when physical possession is obtained (generally, at closing). If the customer defaults on the contract, the developer keeps the deposit but has no right to payment for construction completed to date. Because the developer does not have an enforceable right to payment for work performed to date, the developer may not recognize revenue over a period of time. Instead, the developer would recognize the revenue upon completion and closing of the property. 46

Step 5: Recognizing Revenue Example Scenario B Scenario B: The customer makes progress payments during construction. If the customer defaults on the contract, the developer has an enforceable right to payment, and the legal practices in the area have upheld this right. The contract includes terms that prevent the developer from directing the property to another customer. Because the developer may not direct the property to another customer, it is not creating an asset with an alternative use but, as the developer does have an enforceable right to payment for completion to date, the developer may recognize revenue over a period of time. 47

Step 5: Recognizing Revenue Example Residential Condominiums Under current FASB 360-20-40-50 to 40-59, a developer of residential condominiums is allowed to use the percentage-of-completion method to recognize revenue provided certain criteria are met. Under the new revenue standard for contracts with customers at FASB 606-10-25-27, revenue can be recognized over time only if one of three criteria above are meet. As the customer (the buyer of condominium unit), does not generally simultaneously receive and consume benefits from owning a condominium unit and does not control the unit until the sale of the unit is closed, developers would only be able to use the percentage-of-completion input method if the two requirements of the third criterion are met. Meeting the second requirement of the third criterion could be difficult in the United States, as many state and local laws prevent developers from enforcing payment on residential condominiums until the sale closes. 48

Summary of the Five-Step Revenue Recognition Process Step in Process Description Implementation 1. Identify the contract with customers. A contract is an agreement that creates enforceable rights or obligations. A company applies the revenue guidance to contracts with customers and must determine if new performance obligations are created by a contract modification. A company cannot get around the rules by separating contracts if there is a single commercial objective or the prices in the separate contracts are interdependent. 49

Summary of the Five-Step Revenue Recognition Process Step in Process Description Implementation 2. Identify the separate performance obligations in the contract A performance obligation is a promise in a contract to provide a product or service to a customer. A performance obligation exists if the customer can benefit from the good or service on its own or together with other readily available resources. A contract may be comprised of multiple performance obligations. Accounting is based on evaluation of whether the product or service is distinct within the contract. If each of the goods or services is distinct, but is interdependent and interrelated, these goods and services are combined and reported as one performance obligation. 50

Summary of the Five-Step Revenue Recognition Process Step in Process Description Implementation 3. Determine the transaction price. Transaction price is the amount of consideration that a company expects to receive from a customer in exchange for transferring goods and services. In determining the transaction price, companies must consider the following factors: 1. variable consideration, 2. time value of money, 3. noncash consideration, and 4. consideration paid or payable to customer. 51