Measuring Lengths and Metric Units

The concept of measuring lengths using appropriate metric units such as kilometers, meters, centimeters, and millimeters. Learn about the relationship between prefixes and units, rules for converting between units, and practical examples. Understand the significance of the meter as the basic unit of length in the metric system.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

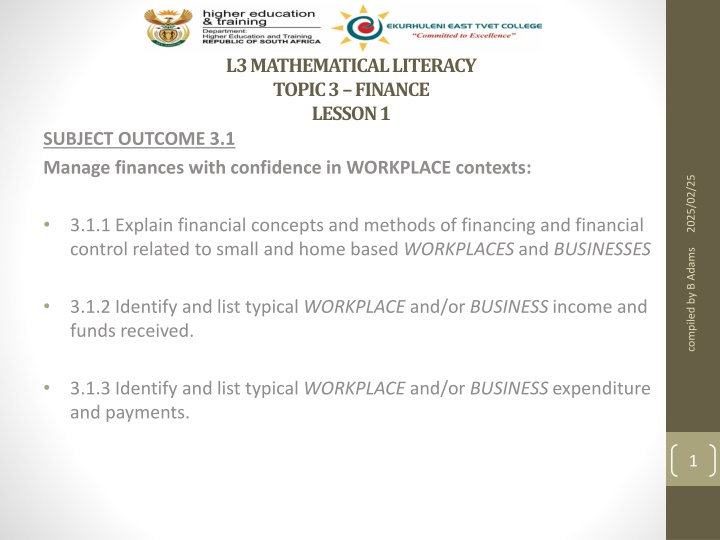

L3 MATHEMATICAL LITERACY TOPIC 3 FINANCE LESSON 1 SUBJECT OUTCOME 3.1 Manage finances with confidence in WORKPLACE contexts: 2025/02/25 3.1.1 Explain financial concepts and methods of financing and financial control related to small and home based WORKPLACES and BUSINESSES compiled by B Adams 3.1.2 Identify and list typical WORKPLACE and/or BUSINESS income and funds received. 3.1.3 Identify and list typical WORKPLACE and/or BUSINESS expenditure and payments. 1

3.1.1 EXPLAIN FINANCIAL CONCEPTS AND METHODS OF FINANCING AND FINANCIAL CONTROL RELATED TO SMALL AND HOME BASED WORKPLACESAND BUSINESSES FINANCIAL DOCUMENTS DESCRIPTION Financial document given to a client as proof of payment made by client RECEIPTS If you buy something at a store, you should receive a till slip or cash invoice. Both are types of receipts and proof of income. INVOICE 2025/02/25 Document given to employee as evidence that a specified amount has been paid. If a person earns a salary (not a wage) it is called a salary advice: Following information appears on the payslip: Employer and employee details Salary amount Taxable amount UIF contribution Company contributions PAYSLIP compiled by B Adams This is a plan on how the Business intends to spend its money. It lists all projected income and expenses for the month. BUDGET OR CASH FLOW PROJECTION Estimated cost is indicated and specified for client (items or services) to be rendered. QUOTATION Form to be used by Business for employee to complete a claim for kilometers travel during the month. The Business would pay back at a specific standard rate per kilometer. Expenses such as Business lunches with clients, parking fees and telephone calls could also be claimable. TRAVEL ALLOWANCE CLAIM FORM Actual income and expenditure for the month specified . INCOME AND EXPENDITURE STATEMENT 2

Financial concepts Business - Workplace FINANCIAL CONCEPTS DESCRIPTION The price that someone pays for something he/she is going to sell COST PRICE The cost of producing something without profit added COST OF PRODUCTION The cost of producing a product/service, including resources used. REAL COST A Cost that stays the same every month. FIXED COST The price at which an item is sold (cost price + profit) SELLING PRICE 2025/02/25 The rate at which currency is converted to another Rand to Dollar EXCHANGE RATE Unemployment Insurance Fund assist employees should they become Unemployed for reasons beyond their control (retrenchment, maternity, and so on). Both employee and Employer each contribute 1% to fund = 2% UIF Amount that every person and business earning more than a certain income have to pay to SARS(South African Revenue Service) INCOME TAX Tax (PAYE) paid on personal income, usually collected on a pay-as-you-earn basis, with correction at the end of the year. PERSONAL INCOME TAX compiled by B Adams Amount used to calculate income tax due by a person or Business usually consisting of income minus any tax deductions allowable for the tax year. TAXABLE INCOME PAYE tax is deducted from employee s salary by employee and paid to SARS PAYE (PAY-AS-YOU-EARN) Money paid back to a person or Business when more than specified amount is paid to government. Tax rebates Primary, secondary and tertiary rebates depending on age. A rebate is a set amount that SARS takes off from your total tax liabilities. TAX REBATE Salary deductions such as pension fund contributions that is deducted from taxable income. Contributions to charities by Businesses could also be non-taxable. NON-TAXABLE DEDUCTION Salary deduction, such as accommodation, low interest loans, meal vouchers CANNOT be deducted from taxable deductions TAXABLE DEDUCTION Period within which loan has to repaid to bank or financial institution. REPAYMENT PERIOD Income is greater that expenditure. INCOME EXPENSES = POSITIVE (PROFIT) PROFIT Expenses is greater than Income . INCOME EXPENSES = NEGATIVE (LOSS) LOSS Income of a person or Business BEFORE tax and deductions GROSS INCOME Income of a person or Business AFTER tax and deductions NET INCOME Point where total expenses and total income are equal. BREAK-EVEN POINT Value Added Tax charged on purchase price of items and services VAT 3 Final amount has already VAT added. VAT INCLUSIVE Amount of good or services excluding VAT (VAT must still be ADDED to the price) VAT EXLCUSIVE Amount a bank pays into a customer s account for saving money. Interest money is a percentage % of the amount in the bank account = Interest rate INTEREST The rate that the back or Financial institutional determine on positive and negative bank accounts. It can be determined by dividing the interest by the amount of money. INTEREST RATE

3.1.2 IDENTIFY AND LIST TYPICAL WORKPLACEAND/OR BUSINESS INCOME AND FUNDS RECEIVED. BUSINESS INCOME DESCRIPTION Income received by selling a product or rendering a service SALES AND/OR SERVICES 2025/02/25 Business could earn income from interest received on a POSITIVE balance in its saving account. INTEREST RECEIVED Business could own Property or equipment from which rental or lease income is received RENT OR LEASE RECEIVED compiled by B Adams Business applies for to use for a specific purpose. Business could receive grants from government to cover cost of training their employees GRANTS Non-profit organisations or charity could receive sponsorships from private companies or people. SPONSORSHIPS Donations is money or goods given to Business unconditionally (No repayment or payment is expected) DONATIONS Business could take out a loan to fund its activities. Borrowed amount is seen as income. Loan has to be repaid within a time limit, and repayment limit. The amount that is repaid is called the repayment amount. This consist of original loan amount plus interest, calculated at a specific interest rate. LOANS 4

3.1.3 IDENTIFY AND LIST TYPICAL WORKPLACEAND/OR BUSINESSEXPENDITURE AND PAYMENTS Business Expenses DESCRIPTION SALARIES It is paid to employees on a monthly basis. It is fixed monthly amount, paid directly into employee s bank account. Additional benefits: housing and car allowances are sometimes added 2025/02/25 GROSS SALARY Cost to company, more that the amount the employee receive at the end of month. Benefits such as medical aid contributions, pension, PAYE have to be deducted from GROSS before it is paid into the employee s bank account. compiled by B Adams NET SALARY This is the Take-home salary, that is paid into the bank account of the employee. GROSS SALARY COMPANY DEDUCTIONS = NET SALARY WAGES Employee paid on a weekly basis. Usually paid in cash. Wage differs slightly from week to week as it is often calculated on a rate system (hours worked) COMMISSION Employees received this on items sold or services provided. OPERATING OR RUNNING EXPENSES Ongoing expenses such as electricity, water, telephone line rentals, maintenance on Business vehicles and insurance. Some costs are fixed and other variable. LOAN OR CREDIT CARD REPAYMENTS Business takes out loan in order to establish expansion. It needs to be paid back instalments agreed on between the business and loan provider. Credit card debt has to be paid back as well. 5 PAYMENT TO CREDITORS Depending on the type of business, businesses may have several creditors. INCOME TAX Income tax is an amount that every person or business earning more that a certain income has to pay to SARS. It is calculated as a percentage of the earnings, using a sliding scale. The more you earn, the more tax will be paid.