Mathematical Transformations and Applications in Finance

Explore mathematical transformations including stretches, reflections, and exponential growth models. Dive into real-world applications like forecasting swan populations and compound interest calculations. Understand concepts such as growth factors, decay, and exponential models in a comprehensive manner.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

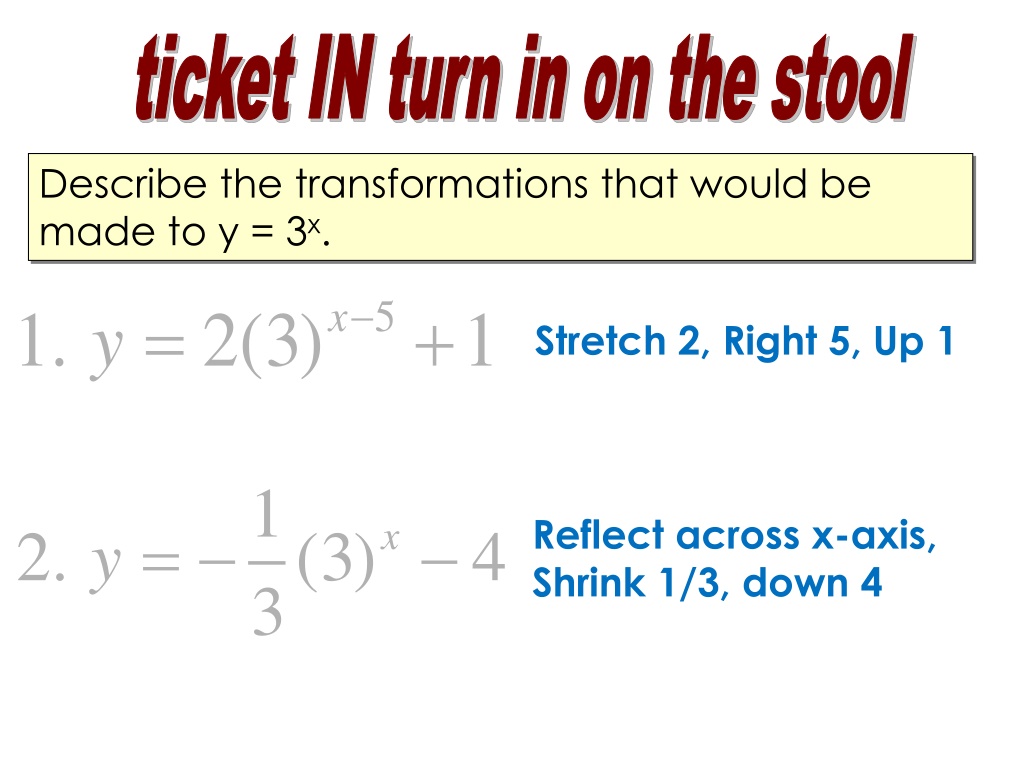

ticket IN turn in on the stool Describe the transformations that would be made to y = 3x. = + y 5 x 1. 2(3) 1 Stretch 2, Right 5, Up 1 1 3 Reflect across x-axis, Shrink 1/3, down 4 = x 2. (3) 4 y

Opener The swans on Elsworth Pond have been increasing in number each year. Felix has been keeping track and so far he has counted 2, 4, 7, 17, and 33 swans each year for the past five years. 1) Make a scatter plot of the data. 2) Is this a linear or exponential model? Exponential 3) How many swans should Felix expect next year? 64

Growth or Decay ( ) ( ) f x a b = x h + k b>1 0<b<1

Growth Or Decay? 4 + = x 1) ( ) f x 3 5 x = = = = 2 5 2) ( ) f x x 5 3 3) ( ) f x + x 4) ( ) 4 5) ( ) f x 8 f x x 2(8) 16 x 1 9 4 2 = 6) ( ) f x

Exponential Models ( ) 1 + r ( ) t t = = 1 y P r y P y = balance y = balance P = initial P = initial t = time in years t = time in years r = % of increase r = % of decrease 1+r = growth factor 1-r = decay factor

In 2000, the cost of tuition at a state university was $4300. During the next 8 years, the tuition rose 4% each year. Write a model the gives the tuition y (in dollars) t years after 2000. y = 4300(1 + .04)t 1.04 What is the growth factor? How much would it cost to attend college in 2010? In 2015? f(10) = 6365.05 f(15) = 7744.06 How long it will take for tuition to reach $9000? 19 years, 2019, $9059.45

Finance Application Write a compound interest function to model each situation. Then find the balance after the given number of years. $1000 invested at a rate of 3% compounded quarterly for 5 years. nt r n = + 1 A P

Finance Application Write a compound interest function to model each situation. Then find the balance after the given number of years. $18,000 invested at a rate of 4.5% compounded annually for 6 years. nt r n = + 1 A P

A 2010 Honda Accord depreciates at a rate of 11% per year. The car was bought for $25,000. Write a model the gives the value of the car y (in dollars) t years after 2010. y = 25,000(1 .11)t What is the decay factor? .89 How much is the car worth now? In 2015? f(4) = 15,685.56 f(5) = 13,960.15 How long will it take for my car to be worth half? 6 years, 2016, $12,424

Extension What r value would be used if the principal is being doubled every year? 1 What about if it is tripled every year? 2

Suppose you start work at $600 a week. After a year, you are given two choices for getting a raise: Opt. 1: 2% per week Opt. 2: a flat $15 a week raise for each successive year. y = 600(1 + .02)t y = 15x + 600 Which option is better? Option 1 gets you more money

Which option has the greatest ROC from [3, 6]? Option A Option B An investment of $1,000 earns interest at a rate of 3.75%, compounded monthly. y = 1000(1.0375)t 1247 18 1116 77 1200 1100 6 33 3 m = 3 . . m = . m = 6 3 m 43 47 = . Option A has a greater ROC from [3, 6].

Classwork Practice Worksheet 5 problems ( ) ( ) t t = = + 1 y P r 1 y P r

Homework Worksheet 7 problems ( ) ( ) t t = = + 1 y P r 1 y P r