Lithium Ion Battery Market Demand, Exclusive Profit, Rapid Growth and Strategic

Lithium Ion Battery Market size is expected to be worth around USD 307.8 billion by 2032, from USD 70.7 Billion in 2023, growing at a CAGR of 18.3% during the forecast period from 2023 to 2033.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

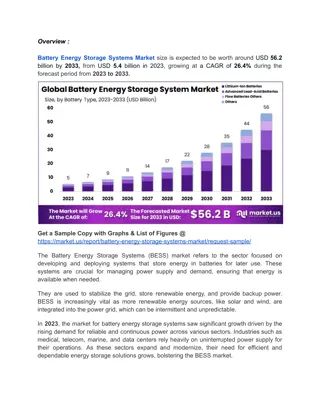

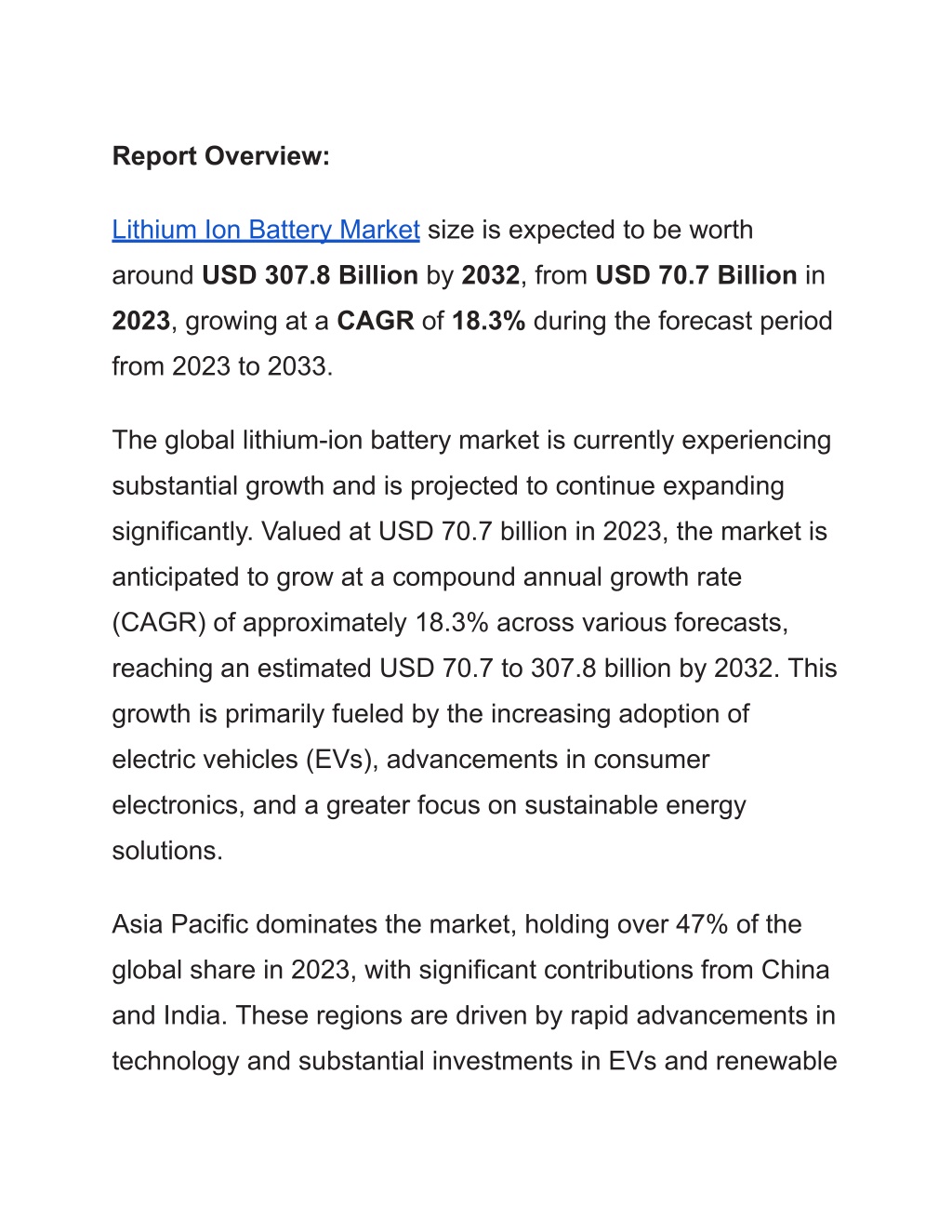

Report Overview: Lithium Ion Battery Market size is expected to be worth around USD 307.8 Billion by 2032, from USD 70.7 Billion in 2023, growing at a CAGR of 18.3% during the forecast period from 2023 to 2033. The global lithium-ion battery market is currently experiencing substantial growth and is projected to continue expanding significantly. Valued at USD 70.7 billion in 2023, the market is anticipated to grow at a compound annual growth rate (CAGR) of approximately 18.3% across various forecasts, reaching an estimated USD 70.7 to 307.8 billion by 2032. This growth is primarily fueled by the increasing adoption of electric vehicles (EVs), advancements in consumer electronics, and a greater focus on sustainable energy solutions. Asia Pacific dominates the market, holding over 47% of the global share in 2023, with significant contributions from China and India. These regions are driven by rapid advancements in technology and substantial investments in EVs and renewable

energy applications. Europe is also witnessing growth, particularly due to the expanding use of lithium-ion batteries in energy storage, automotive, and other high-tech applications. The industry is marked by intense competition and continuous innovation, with major players like LG Chem, Panasonic, Samsung SDI, and BYD actively expanding their market presence through strategic alliances and technological advancements. For example, efforts in improving battery components to enhance safety and efficiency are critical given the high energy density of lithium-ion batteries and associated safety concerns.

Request for Sample Report: https://market.us/report/lithium-ion-battery-market/ Key Takeaways: Lithium Ion Battery Market size is expected to be worth around USD 307.8 Billion by 2032, from USD 70.7 Billion in 2023, growing at a CAGR of 18.3% Lithium Cobalt Oxide (LCO) held a dominant market position, capturing more than a 29.8% share. 3,001-10,000 mAh segment dominates the market and is expected to be the fastest-growing segment. Consumer Electronics held a dominant market position, capturing more than a 31.0% share. With a revenue share exceeding 36.4%, Asia Pacific dominated the market. Market Growth: The global Lithium-ion Battery Market is experiencing rapid growth, driven primarily by the surging demand for electric vehicles (EVs) and the expanding renewable energy sector. Key factors contributing to this expansion include rising EV adoption across regions like Asia-Pacific, Europe, and North America, where government incentives and environmental

policies are propelling the shift toward sustainable transportation solutions. Lithium-ion batteries, known for their high energy density and efficiency, have become essential for EVs and energy storage systems, helping to stabilize renewable energy sources such as solar and wind. Consumer electronics, including smartphones and laptops, also drive demand due to the batteries compact, high-capacity nature, accounting for a substantial portion of the market share. As a result, battery manufacturers are investing heavily in production capacity and innovations, including advanced chemistry variants like Lithium Nickel Cobalt Aluminum Oxide (NCA) and Lithium Iron Phosphate (LFP), which offer improved longevity and safety features suitable for EVs and grid storage systems. In regions like Asia-Pacific, which holds over 47% of the market share, lithium-ion battery demand is further bolstered by policies targeting emissions reductions and electrified transport. In the U.S., government support for battery manufacturing and infrastructure, alongside growing consumer awareness, is expected to solidify lithium-ion batteries role in the global shift toward a low-carbon

economy, underscoring their centrality in future energy solutions and technological advancements. Market Demand: The demand for lithium-ion batteries is expanding rapidly, primarily driven by the growth in electric vehicles (EVs) and renewable energy storage needs. Lithium-ion batteries, known for their high energy density and efficiency, are essential in powering EVs and stabilizing renewable energy from sources like solar and wind. Consumer electronics, including smartphones and laptops, also significantly boost demand, as lithium-ion batteries provide compact and powerful energy solutions needed in modern devices. Furthermore, demand is bolstered by a global shift toward reducing emissions and achieving net-zero goals, with large investments being made to scale production and advance battery technology. Countries like China, the U.S., and Japan are key players in this market, investing heavily in battery production capacity and technology improvements to meet both domestic and global demands.

Segments: Key Market Segments Based on Type Cerium Lanthanum Neodymium Samarium Other Types Based on Application Magnet Metals Alloys Polishing Catalysts Glass & Ceramics Other Applications The Rare Earth Metals market is divided into Cerium, Lanthanum, Neodymium, and Samarium. Neodymium is the most profitable, accounting for 26.2% of the market in 2022 and expected to grow at a CAGR of 10.9% from 2023 to 2032. Its high magnetization is crucial for creating permanent magnets used in electronic devices, wind turbines, and electric vehicles. Cerium, the fastest-growing segment, is

driven by its unique properties in clean energy production, electronics manufacturing, and automotive catalysts. Rare Earth Metals market is divided into various applications, with magnets holding the largest share at 24.4% of total revenue in 2022. Magnets are crucial in electric vehicles, wind turbines, and consumer electronics due to their efficient energy conversion and high-performance motors. Catalyst applications, with a CAGR of 10.0%, are second largest, primarily used in speeding up chemical reactions and producing fuels and plastics. These catalysts rely on rare earth metals for their effectiveness, leading to high demand. Rare Earth Metals are also essential for advanced technologies like electronics, magnets, and renewable energy systems. Companies: Iluka Resource Ltd. Neo Performance Materials Inc. Lynas Rare Earths Ltd. MP Materials Canada Rare Earth Corporation Australian Strategic Materials Ltd.

Arafura Resources Ltd. Avalon Advanced Materials Inc. Energy Fuels Aclara Resources Ucore Rare Metals Other Key Players Conclusion: In conclusion, the lithium-ion battery market is set to play an increasingly central role in powering the future, thanks to its high energy efficiency and adaptability across various sectors. The strong demand driven by electric vehicles, consumer electronics, and renewable energy storage solutions reflects a global shift toward cleaner energy and sustainable technology. With a projected market size of around USD 307.8 billion by 2032, and a compound annual growth rate of over 18.3%, lithium-ion batteries are well-positioned to support innovations in both transportation and grid energy storage. As manufacturers work to scale up production and improve battery performance, lithium-ion technology is expected to continue evolving to meet diverse needs, from portable devices to large-scale power storage solutions.