Lithium-Ion Batteries Dominate BESS Market with 53.3% Revenue Share Amid Cost Re

Battery Energy Storage Systems Market By Battery Type(Lithium-Ion Battery, Lead Acid Battery, Flywheel Battery, Other Battery Types), By Connection Type(On-grid, Off-grid), By Ownership (Customer-Owned, Third-Party Owned, Utility-Owned), By Energy Capacity(Below 100 MWh, Between 100 to 500 MWh, Above 500 MWh), By Application (Residential, Commercial, Utility) as well as By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2023-2033

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

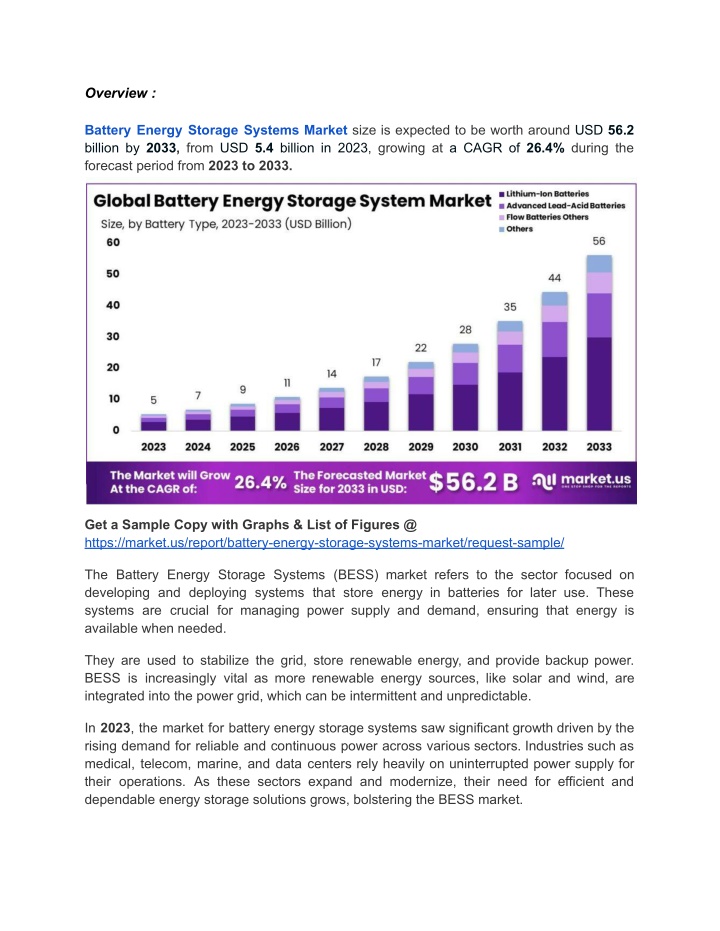

Overview : Battery Energy Storage Systems Market size is expected to be worth around USD 56.2 billion by 2033, from USD 5.4 billion in 2023, growing at a CAGR of 26.4% during the forecast period from 2023 to 2033. Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/battery-energy-storage-systems-market/request-sample/ The Battery Energy Storage Systems (BESS) market refers to the sector focused on developing and deploying systems that store energy in batteries for later use. These systems are crucial for managing power supply and demand, ensuring that energy is available when needed. They are used to stabilize the grid, store renewable energy, and provide backup power. BESS is increasingly vital as more renewable energy sources, like solar and wind, are integrated into the power grid, which can be intermittent and unpredictable. In 2023, the market for battery energy storage systems saw significant growth driven by the rising demand for reliable and continuous power across various sectors. Industries such as medical, telecom, marine, and data centers rely heavily on uninterrupted power supply for their operations. As these sectors expand and modernize, their need for efficient and dependable energy storage solutions grows, bolstering the BESS market.

Key Market Segments : By Battery Type : Lithium-Ion Battery Lead Acid Battery Flywheel Battery Other Battery Types By Connection Type : On-grid Off-grid By Ownership ; Customer-Owned Third-Party Owned Utility-Owned By Energy Capacity : Below 100 MWh Between 100 to 500 MWh Above 500 MWh By Application : Residential Commercial Utility The battery energy storage systems (BESS) market is driven by lithium-ion batteries, which held a 53.3% market share in 2023 due to their low weight and cost. Lead-acid batteries are the second-largest segment, although their growth may slow due to competition from lithium-ion technology. Flywheel battery technology is expected to grow rapidly due to its

continuous power supply capabilities. On-grid connections dominated the market, with over 63% share, essential for grid stability and renewable integration. Customer-owned, third-party, and utility-owned systems each offer unique advantages. Data centers and telecom sectors are key applications, with rising telecom subscriptions boosting demand. Market Key Players : EnerSys BYD Company Limited EVE Energy Siemens AG LG Energy Solutions Kokam Narada Asia Pacific ABB Ltd. Tesla Fluence Energy General Electric TotalEnergies Tata Power Company Limited Samsung SDI Nissan Motor VRB Energy and Black & Veatch Holding Company Driver : The accelerated deployment of grid energy storage systems in grid modernization projects is driving the BESS market. These systems stabilize power supply by storing excess energy from renewable sources like solar and wind, ensuring reliability and flexibility in power generation, transmission, and distribution. Restraint : High initial investment costs for battery energy storage systems pose a significant barrier. Technologies like lithium-ion and flow batteries require substantial upfront expenses for their

high energy capacity and performance, making it challenging for smaller enterprises to adopt these systems. Opportunity : The reduction in lithium-ion battery prices presents a major growth opportunity for the BESS market. Technological advancements and increased production efficiency have made these batteries more affordable, enabling businesses to invest in larger and more powerful energy storage systems. Challenge : Installing battery energy storage systems in remote and isolated locations is challenging due to limited grid power, maintenance difficulties, and harsh environmental conditions. These factors necessitate additional measures for system protection and reliability, complicating deployment in such areas.