Key Points on Trade and Brexit Impact

"Explore key insights on trade dynamics, Brexit implications, and the UK's trade balances with the EU and other global partners. Understand the significance of trade integration, surpluses, deficits, and the role of financial services in the UK economy."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

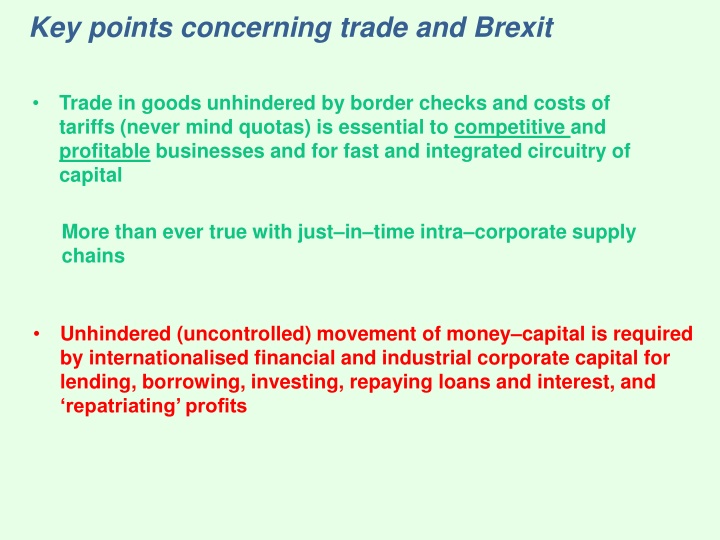

Key points concerning trade and Brexit Trade in goods unhindered by border checks and costs of tariffs (never mind quotas) is essential to competitive and profitable businesses and for fast and integrated circuitry of capital More than ever true with just in time intra corporate supply chains Unhindered (uncontrolled) movement of money capital is required by internationalised financial and industrial corporate capital for lending, borrowing, investing, repaying loans and interest, and repatriating profits

Key points concerning trade and Brexit In trade, EU is divided into surplus and deficit countries: Germany has, overwhelmingly the largest surplus in the EU Followed (at a distance) by Holland, Italy, Denmark, Spain, Sweden, and Ireland The surpluses of surplus countries are mirrored by the deficits of deficit countries The UK has, overwhelmingly, the largest trade and current account deficits in the EU It also has, overwhelmingly, the largest surplus in services largely the result of its surplus in financial services

Key points concerning trade and Brexit Out of all EU members, Britain has the lowest percentage of trade with other EU countries About 45% of its trade is with other EU countries About 55% with non EU countries Compare with Germany: nearly 60% with EU countries; just over 40% with non EU Britain is, nevertheless, highly integrated into the EU through its trade 45% is a very high proportion of its trade!

Key points concerning trade and Brexit The next largest trading partner apart from the EU is the USA nearly 15% of UK exports went to the US in 2016 Trade with other countries accounts for very small percentages of total UK trade E.g., 2016 trade with China = 4.4% Canada = 1.5% India = less than 1.5%

Key points concerning trade and Brexit Overall, the UK has a very large trade deficit in goods both globally and with the EU However, it has a large surplus in services again both globally and with the EU This surplus comes from surpluses in financial services and business services essentially investment banking and insurance, and accountancy etc. The business of the City of London the City Add to this, the revenues from interest on loans, and various speculative gains (or losses!) from investment banking Financial services and insurance account for for almost a quarter of total UK exports

Some Brexit conclusions: 1. The UK won t lose all its trade with the EU even with a hard Brexit Even if we lose only 2%, this means a loss greater than UK s total trade with countries such as Japan, Canada, and India Compensating for this would require a major shift in markets and breaking into established markets Is the UK competitive enough? Implications: either large increases in productivity, or significant cost reductions. Implications for wages and deregulation .. 2. Major UK MNCs (multinational corporations) are integrated across the EU through disaggregated production and supply chains. They are essentially embedded in the EU as a market Cheaper and simpler for them to move their UK production facilities to another EU country?

Some Brexit conclusions (cont.) 3. The UK s trade deficit with the rest of the EU The very large trade and current account deficits mean that the UK is important to the rest of the EU especially Germany This is an important bargaining counter in negotiations? The EU will not want to lose too much of the UK market for its exports This gives the UK a chance to gain on issues important to itself e.g., financial services ..

Some Brexit conclusions (cont.) 4. Regarding financial services and the City : Hard Brexit = loss of the EU financial passport Relatively easy for banks and financial services to move HQs to other EU countries to keep the passport Other EU countries and cities (Frankfurt, Paris, Amsterdam, Dublin) see an opportunity to get jobs, income, and trade surpluses . However, outside EU lighter regulation of banking and finance = competitive access to other markets? Remember 59% of UK financial services are already exported non EU