Key Features to Look for in Employee Payroll Management Software!

Employee Payroll Management Software streamlines payroll processes, ensuring accurate and timely salary disbursements, tax deductions, and compliance with regulations. It automates calculations, reduces errors, and simplifies record-keeping. Payeaze

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Key Features to Look for in Employee Payroll Management Software!

In today's fast-paced business world, effective payroll management is crucial for startups and growing enterprises alike. With numerous payroll software options available, selecting the right one can be overwhelming. At PayEaze, we offer Employee Payroll Management Softwareto your needs. In this article, we ll highlight the essential features to consider when choosing payroll software.

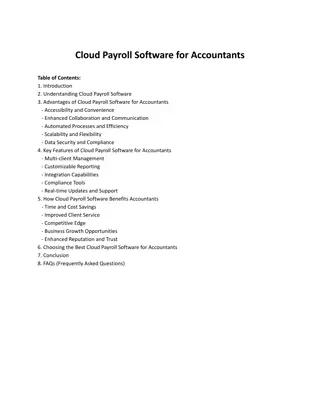

What is Employee Payroll Management Software? Employee Payroll Management Software automates the payroll process, simplifying employee payments, tax deductions, and compliance. By handling calculations, tax filings, and time tracking with speed and accuracy, this software takes the hassle out of payroll management, ensuring everything runs smoothly Benefits of Using Payroll Software Payroll software offers businesses a range of benefits that make the investment worth it: Saving Time and Reducing Errors: Manual payroll processing is prone to human error, which can lead to overpayment, underpayment, or compliance issues. Payroll software Automates these tasks, minimising mistakes and saving hours of manual work. Ensuring Compliance with Tax Regulations: Payroll software stays up-to-date with local, state, and federal tax laws. This ensures that your business remains compliant and avoids penalties.

Key Features to Look for in Employee Payroll Management Software Ease of Use The first feature to prioritize in payroll software is ease of use. Look for a user-friendly interface that simplifies payroll tasks and offers quick implementation without lengthy setup times. Automated Tax Calculations Payroll taxes can be complex, but good payroll software should automatically calculate them based on current regulations. It should manage federal, state, and local taxes, ensuring compliance with the latest laws. Direct Deposit Capabilities In today's world, paper checks are outdated. Choose payroll software that offers direct deposit, allowing employees to receive payments directly in their bank accounts. This feature simplifies payroll and ensures timely payments.

How to Choose the Best Payroll Software for Your Business Choosing the right payroll software requires some thought. Here are a few steps to guide your decision: Assess Your Business Needs: What features are most important to your business? Do you need tax support, scalability, or integration with other software? Identifying your must-have features will help narrow your options. Compare Software Options: Once you know your needs, start comparing different software solutions. Look at their features, pricing, and reviews from other users to find the best fit.

Conclusion Investing in Employee Payroll Management Software can streamline your payroll process, ensuring accuracy, compliance, and employee satisfaction. By choosing the right software, your business can save time, reduce errors, and stay ahead of ever-changing regulations. Make sure to assess your needs and carefully evaluate your options to find the best payroll solution for your business. Source Blog: https://ext- 6605692.livejournal.com/704.html

FAQs What is the cost range for payroll management software? Payroll software costs range from $1 per employee, per month For attendance to $10 per pay run plus $3 per employee for advanced payroll features, depending on your business size and needs. Can small businesses benefit from payroll software? Absolutely! Payroll software can simplify payroll tasks, reduce erors, and save time for small businesses, allowing them to focus on growth. How secure is payroll management software? Most modern payroll software includes strong security features like data encryption and multi-factor authentication, ensuring that your data remains safe.