Jewelry Industry Rebounding and Evolving Amid Pandemic Challenges

The jewelry industry faced a significant decline in sales during the pandemic, leading to store closures and transformations. However, through strategies like store closures, use of technology, and adapting to changing consumer behaviors, the industry has shown signs of recovery. Millennial consumer insights and shifting shopping preferences have also influenced the industry's evolution towards online platforms and virtual events. Despite challenges, independent jewelry retailers have seen improvements in sales and average retail values, highlighting resilience and adaptation in a changing market landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

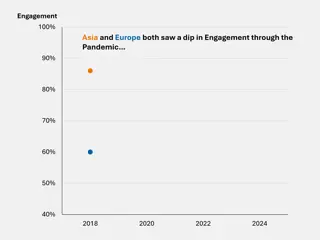

Rebounding, Recovering and Re-opening When the pandemic emergency struck during March, jewelry was at the bottom of the list of essential merchandise, resulting in US jewelry store sales decreasing 41.9% from February s total of $2.65 billion to March s $1.54 billion. April was the bottom, with sales totaling a very dismal $470 million, a 69.5% decrease from March. The industry began to shine again during May, as stores reopened and total sales rebounded 227.7% to $1.54 billion, but that only equaled March s sales. According to The Edge Retail Academy, independent jewelry retailers experienced a 2% YOY increase of their June 2020 sales, with strong performances from diamonds, increasing 12% YOY, and the average retail sale increasing 25% YOY, from $345 to $432.

Survival Strategies Signet Jewelers announced during June 2020 it plans to close almost 400 of its 3,200 stores, and most will be in B- and C-class malls, another indication of the troubles plaguing the shopping mall industry. Other jewelry industry companies, such as Kendra Scott, have turned to advanced technologies. The brand now offers an AR tool on its Website, allowing customers to preview and try products online. Although an early July 2020 survey of independent jewelers from INSTORE found 90% said they were opened, a May 2020 survey revealed 74% of retailers said their businesses would transform because of the pandemic, and 20% of those said the changes will be significant.

2019: Some Industry Sectors Shine, Others Were Dull According to US Census Bureau data, 2019 sales at jewelry stores totaled $32.22 billion, a negligible decrease of 0.04% from 2018 s $32.37 billion, but a significant decline compared to the 7.6% increase from 2017 to 2018. The Census Bureau also reported a 2.7% increase in jewelry store sales ($11.19 billion) during the critical fourth quarter while Mastercard SpendingPulse data (Nov. 1 Dec. 24) indicated a 2% YOY increase for total jewelry sales and a 9% increase for online sales. According to The Edge Retail Academy data, independent jewelry retailers total 2019 gross sales ($2 billion) increased 3.6%, including a 5% increase during Q4. The average retail sale increased 10% from $301 to $332.

Jewelry Consumer Insights According to Provoke Insights June 2020 report, Luxury: Jewelry & the New Age of Shopping, 77% of consumers said they were wearing less jewelry, with Millennials first (81%), followed by Gen Xers (78%), Gen Zers (74%) and Baby Boomers (70%). The research also found 10% of consumers were much more/slightly more likely to purchase fine jewelry & watches online, with Millennials the largest age group at 18%, while 22% of consumers were much less/slightly less likely, with 29% of Gen Xers. Among the 27% of consumers who said they were interested in scheduling an appointment to avoid other shoppers, Gen Zers were the largest group at 49%. The same percentage (the largest) of Gen Zers were also interested in attending virtual shopping events.

Millennials Are the Center of the Target According to a January 2020 report, The Modern Millennial Jewelry Buyer, from Bread, an online customer-financing company for retailers, Millennials are the primary driver of diamond-purchases in the US. Although many Millennials (usually younger) are the majority of newlyweds, Millennials are buying jewelry for other purposes. The report s survey found most of them first decide from which store they will buy jewelry, and then focus on a specific purchase. The research also revealed 59% of Millennials were unable to afford the jewelry item they selected and 69% were more likely to shop at a jeweler with an interest-free financing option, and 65% would spend more if they could finance their purchases.

The Wedding Market WeddingWire revealed in its 2020 Newlywed Report (based on more than 25,000 couples married during 2019) that 40% of them purchased a ring from a local retailer, 30% from a national chain and 10% from an online retailer. WeddingWire also reported the partner making the engagement proposal, on average, visited three retailers stores and inspected 15 different rings prior to choosing one. The Knot s 2019 Jewelry & Engagement Study found 45% of engagement rings were designed with some custom options and, although diamonds are the still most popular stone (83%), such stones as moissanite and sapphire had increased in popularity, to 10%.

Advertising Strategies Because the research indicates Millennials, the primary jewelry buyers, decide on a store before their specific purchase, branding is extremely important, and TV is the best branding ad medium, especially when sharing links to Websites, social media and e-commerce sites. Jewelers may want to consider promoting the use of virtual shopping events as a preliminary step to help customers narrow their selection from the safety of their home, which would reduce the amount of time they would have to spend in the store. Allocate some portion of ad budgets and ad messages to stress jewelers support for ethical and sustainable business practices and acquisition of inventory from ethical sources. It s an increasingly important message to engage with Millennials, and Gen Zers.

New Media Strategies Because buying jewelry in a store, which most customers prefer, is a very hands-on experience and requires close interaction with store associates, it s important for stores to use social media to explain in detail how they are making the shopping experience safe. Research from DeBeers indicates many diamond jewelry owners have continued to wear their pieces even when stuck at home. Ask diamond jewelry customers and social media visitors to post short videos showing them wearing their jewelry, and explaining why. The data table on page 3 of the Profiler reveals variety of designs is the top consideration for Millennials for choosing a jeweler, which matches well with social media. Create posts, each featuring a different design, and post at least three times per week.