Is the market rally fuelled by PE expansion or Earning Expansion

the current market rally, analyzing whether it's propelled by P/E or earnings expansion. It explores factors like economic conditions, liquidity influx, and investor strategies, offering insights and suggestions for navigating the evolving financial landscape.

- #MarketAnalysis

- #InvestmentInsights

- #FinancialStrategy

- #EconomicTrends

- #StockMarket

- #InvestorTips

- #MarketRally

- #PEExpansion

- #EarningsGrowth

- #LiquidityInflux

- #FinancialPlanning

- #MarketDynamics

- #InvestmentStrategy

- #EconomicOutlook

- #FinanceNews

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

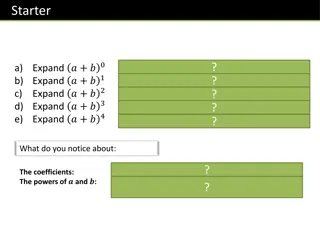

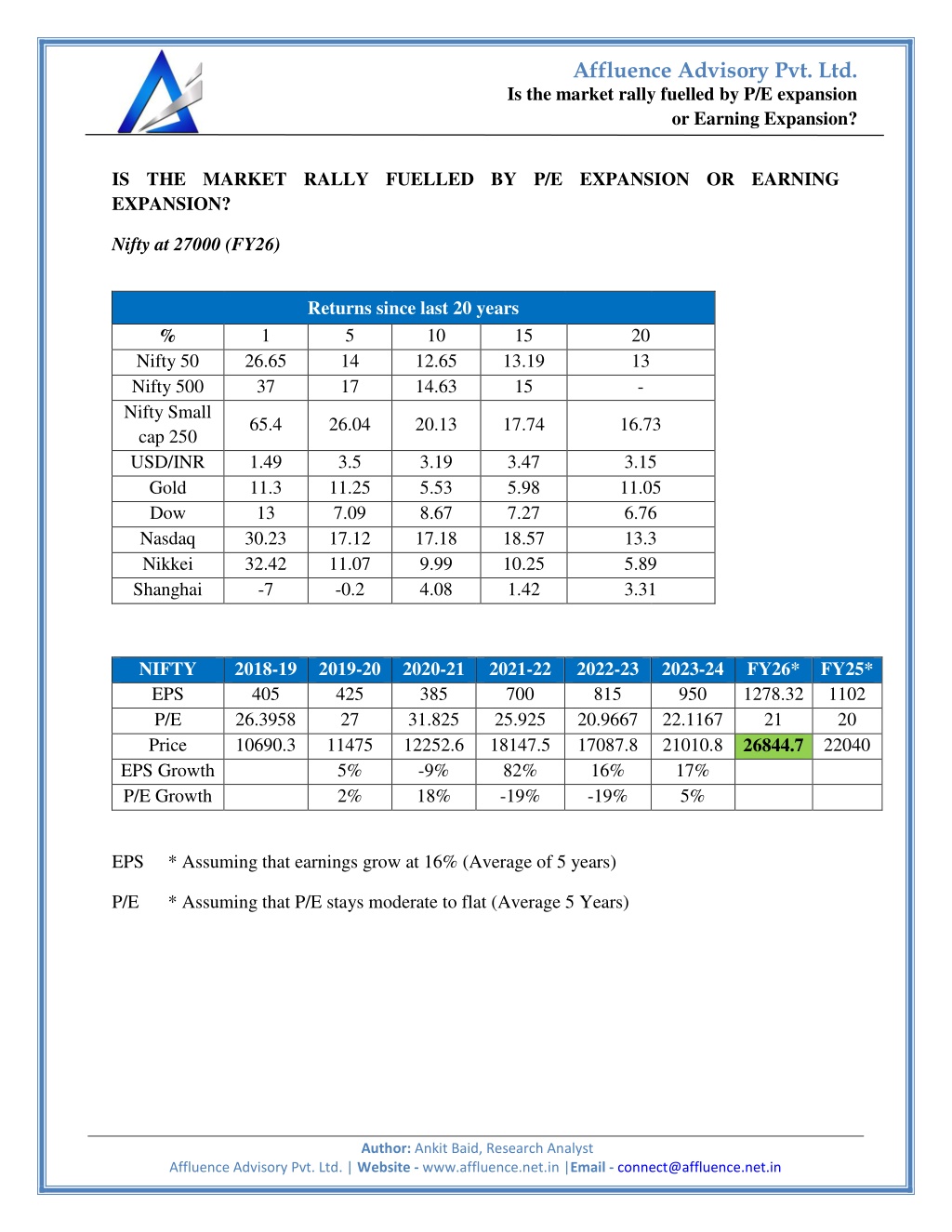

Affluence Advisory Pvt. Ltd. Is the market rally fuelled by P/E expansion or Earning Expansion? IS THE MARKET RALLY FUELLED BY P/E EXPANSION OR EARNING EXPANSION? Nifty at 27000 (FY26) Returns since last 20 years 5 14 12.65 17 14.63 % 1 10 15 13.19 15 20 13 - Nifty 50 Nifty 500 Nifty Small cap 250 USD/INR Gold Dow Nasdaq Nikkei Shanghai 26.65 37 65.4 26.04 20.13 17.74 16.73 1.49 11.3 13 30.23 32.42 -7 3.5 11.25 7.09 17.12 11.07 -0.2 3.19 5.53 8.67 17.18 9.99 4.08 3.47 5.98 7.27 18.57 10.25 1.42 3.15 11.05 6.76 13.3 5.89 3.31 NIFTY EPS P/E Price EPS Growth P/E Growth 2018-19 405 26.3958 10690.3 2019-20 425 27 11475 5% 2% 2020-21 385 31.825 12252.6 -9% 18% 2021-22 700 25.925 18147.5 82% -19% 2022-23 815 20.9667 17087.8 16% -19% 2023-24 950 22.1167 21010.8 26844.7 22040 17% 5% FY26* FY25* 1278.32 21 1102 20 EPS * Assuming that earnings grow at 16% (Average of 5 years) P/E * Assuming that P/E stays moderate to flat (Average 5 Years) Author: Ankit Baid, Research Analyst Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Is the market rally fuelled by P/E expansion or Earning Expansion? Let s screen some data and see that if at all the rally which the market has experienced was due to P/E expansion if not Earnings expansion or both. What we can make out is the rally was majorly earning driven thanks to rejig and favourable environment due to Covid and not much of P/E expansion also noting that expansion to happen the economy has to grow at an even higher pace. When compare to major DM, the rally was driven due to P/E expansion except Magnificent Seven stocks. And if at all in the near term if interest rates stabilizes (it will) we could see P/E re-rating as prices would be driven due to: 1)Lower interest rates 2)Favourable demand environment 3)Rosy future Earning consistency Risk factors: 1)Crude at 110 2)Geopolitical uncertainty 3)Policy continuity 4)Eco growth should be higher than expected 5)Major payments and projects getting delayed due to election leads to slower movement of the economy now The Liquidity Influx Institutional Control FY SIP contribution 96,080.00 1,24,566.00 1,55,972.00 1,99,219.00 DII FII FY 2020-21 FY 2021-22 FY 2022-23 FY 2023-24 FY21 FY22 FY23 FY24 -1,32,389.13 2,21,659.89 2,55,236.11 2,06,716.72 2,01,377.26 -2,74,244.23 -1,98,639.42 -14,393.64 Valuation play Author: Ankit Baid, Research Analyst Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Is the market rally fuelled by P/E expansion or Earning Expansion? Indian Financial market and economy Nifty at 22000+ level Mutual fund AUM grew from 8.25 trillion as on March 31, 2014 to 53.40 trillion as on March 31, 2024 The monthly gross SIP inflows that used to be Rs 8000 Cr in FY20 have now reached 19271 Cr in FY24 GST Collection April @ 2.1 lac crore FPI holding of Indian equities hits decadal low even as fundamentals approach historical best - the lowest level in a decade at 16.2% from 20.5% and look at our Index and market levels The core, PMI both services and manufactures are on expansion phase Demat accounts as of Feb 2024 14.8 Cr In January 2024, the average daily turnover in the equity cash segment was at 1.15 lakh crore, up over 10 percent from December 2023 Growing economy, subtle inflation, government polices focused more on supply side The policy pivot not following the western school methodology and more focus on maintaining the domestic strength and sovereignty The market would experience tremendous influx of liquidity as the household savings could touch ~8% Vs the household savings in the US surging from 19% to nearing double of that figure. the dowjones surged by a factor of ten during that period. Author: Ankit Baid, Research Analyst Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Is the market rally fuelled by P/E expansion or Earning Expansion? 65% 66% 64% 62% 62% 60% 60%61%62%61% 62% 61% 62% 60% 58% 58% 57%56% US 58% 54%55%55%55%56% 54%55% 56% 54%53%52% 54% 52% 52% 50% The data screams only one thing, the only risk at this current juncture is not staying invested. What should investors do? Invest in Real Assets Optimal portfolio diversification Depending upon one's risk profile Invest across decadal theme Will cover that in our next newsletter Oneiromancy (FY26) Given the low-interest rate environment and an influx of private capes, one could see P/E re-rating assuming a peak of 24x vs a 10-year average of 20.08. One could see the index trading at 30679 Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement Author: Ankit Baid, Research Analyst Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in