Interpretation of the term ‘as is’ or as is, where is basis’ for regularizing

The CBIC has clarified the application of GST for past transactions based on the 'as is' or 'as is, where is basis.' This means that taxpayers who paid GST at a lower or nil rate won't be required to pay additional tax, while those who paid a higher

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

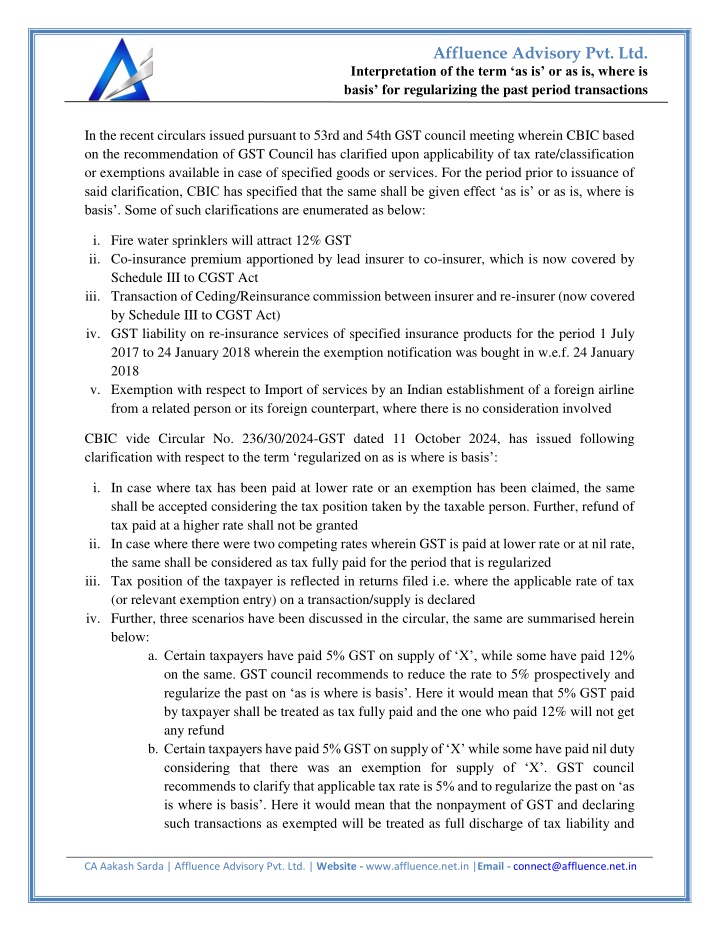

Affluence Advisory Pvt. Ltd. Interpretation of the term as is or as is, where is basis for regularizing the past period transactions In the recent circulars issued pursuant to 53rd and 54th GST council meeting wherein CBIC based on the recommendation of GST Council has clarified upon applicability of tax rate/classification or exemptions available in case of specified goods or services. For the period prior to issuance of said clarification, CBIC has specified that the same shall be given effect as is or as is, where is basis . Some of such clarifications are enumerated as below: i.Fire water sprinklers will attract 12% GST ii.Co-insurance premium apportioned by lead insurer to co-insurer, which is now covered by Schedule III to CGST Act iii.Transaction of Ceding/Reinsurance commission between insurer and re-insurer (now covered by Schedule III to CGST Act) iv.GST liability on re-insurance services of specified insurance products for the period 1 July 2017 to 24 January 2018 wherein the exemption notification was bought in w.e.f. 24 January 2018 v.Exemption with respect to Import of services by an Indian establishment of a foreign airline from a related person or its foreign counterpart, where there is no consideration involved CBIC vide Circular No. 236/30/2024-GST dated 11 October 2024, has issued following clarification with respect to the term regularized on as is where is basis : i.In case where tax has been paid at lower rate or an exemption has been claimed, the same shall be accepted considering the tax position taken by the taxable person. Further, refund of tax paid at a higher rate shall not be granted ii.In case where there were two competing rates wherein GST is paid at lower rate or at nil rate, the same shall be considered as tax fully paid for the period that is regularized iii.Tax position of the taxpayer is reflected in returns filed i.e. where the applicable rate of tax (or relevant exemption entry) on a transaction/supply is declared iv.Further, three scenarios have been discussed in the circular, the same are summarised herein below: a.Certain taxpayers have paid 5% GST on supply of X , while some have paid 12% on the same. GST council recommends to reduce the rate to 5% prospectively and regularize the past on as is where is basis . Here it would mean that 5% GST paid by taxpayer shall be treated as tax fully paid and the one who paid 12% will not get any refund b.Certain taxpayers have paid 5% GST on supply of X while some have paid nil duty considering that there was an exemption for supply of X . GST council recommends to clarify that applicable tax rate is 5% and to regularize the past on as is where is basis . Here it would mean that the nonpayment of GST and declaring such transactions as exempted will be treated as full discharge of tax liability and CA Aakash Sarda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. Interpretation of the term as is or as is, where is basis for regularizing the past period transactions they will not be required to pay differential of 5%. The who have paid 5%, no refund shall be available c.In case where there is interpretational issue i.e. whether GST would apply @ 5% or 12% on supply of X i.e. certain taxpayers have paid 5% and others have paid 12%. Further some taxpayers have not paid GST. GST Council recommends to clarify that applicable rate is 12% and regularize the past on as is where is basis . Here it would mean that the 5% paid by taxpayer shall be treated as fully paid. For those who have paid 12%, no refund shall be available. However, the regularization shall not apply to cases where no tax has been paid. In such cases, the applicable tax shall be recovered at 12%. While the above clarification to an extent may put to rest issues related to interpretation of the term as is or as is, where is basis , the last illustration discussed in the circular herein at (c) may bring certain challenges. Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement CA Aakash Sarda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in