International Wine Trade: Prospective Insights Based on Porter's Diamond

The international wine trade industry is a growing market facing significant challenges such as climate change and emerging new players. This study explores Europe's dominance in wine trade and the potential shift towards the New World countries. It questions whether Europe will maintain its leadership position in the future or if other regions like North Europe, Asia, or America will emerge as wine-exporting leaders. The analysis is based on data showing export volumes and growth rates between the Old World (France, Italy, Spain) and the New World (USA, Argentina, New Zealand, South Africa, Chile, Australia).

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

International Wine Trade: International Wine Trade: A A Prospective Approach based Prospective Approach based on Porter s on Porter s Diamond Diamond Olivier Bargain LAREFI - Bordeaux University Jean-Marie Cardebat LAREFI - Bordeaux University INSEEC Business School Raphael Chiappini LAREFI - Bordeaux University Corentin Laffitte LAREFI - Bordeaux University 12th Annual AAWE Conference 2018 - Ithaca, New York, USA - June 10-14, 2018

1. Context The international trade of wine: a rapidly growing market (almost 300 billions USD in 2016) Yet, the topic is poorly documented (excepted Anderson and Wittwer, 2013, 2017, 2018) Especially given the huge challenges to come in the next decades (climate change, change of consuming habits, emergence of new players, etc.) World wine export volume and value 1995 to 2017 120 35 30 100 25 80 20 60 15 40 10 20 5 0 0 1995 2000 2005 2010 2015 Volume (millions hl -left scale) valeur (billions Euros - right scale) Source: OIV

1. Context Is Europe the immutable wine trade leader? Europe is the current leader about 50% of the wine produced 2/3 of the exported volume Export volume (1000hl) in 1995 and 2017, with growth rate 1995 to 2017 25,000 253% 35% 20,000 34% 15,000 660% 10,000 589% 532% 65% 5,000 148% 3065% 12% 739% 0 1995 2017 Source: OIV

1. Context Is Europe the immutable wine international trade leader? Europe is the current leader but there is a catch-up phenomenon So, what to expect? Export volume (1000hl) old world vs new world 1995 to 2017 70,000 35,000 60,000 30,000 50,000 25,000 40,000 20,000 30,000 15,000 Will the New World lead the international wine market in the future, following the catch-up theory? Morrison & Rabellotti (2017). Research Policy. 20,000 10,000 10,000 5,000 0 0 1995 2000 2005 2010 2015 Old World (left scale) New world (right scale) Note: old world (France, Italy, Spain), new world (USA, Argentina, New Zealand, South Africa, Chile, Australia) Source: OIV

1. Context Is Europe the immutable wine international trade leader? Europe is the current leader but there is a catch-up phenomenon What about the situation in 20 years? Export volume (1000hl) old world vs new world 1995 to 2017 70,000 35,000 60,000 30,000 50,000 25,000 40,000 20,000 30,000 15,000 20,000 10,000 Do we have to look in new directions for finding the future wine-exporting leaders? North-Europe, Asia, America ? 10,000 5,000 0 0 1995 2000 2005 2010 2015 Old World (left scale) New world (right scale) Note: old world (France, Italy, Spain), new world (USA, Argentina, New Zealand, South Africa, Chile, Australia) Source: OIV

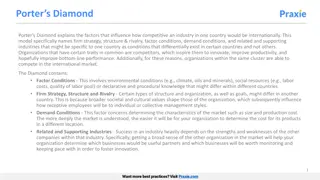

2. The drivers of international trade performance The Porter s diamond Porter (1990). The competitive advantage of nations. Harvard Business Review. The Porter s diamond Firm strategy, structure, and rivalry Demand conditions Factors conditions Related and supporting industries

2. The drivers of international trade performance The Porter s diamond Porter (1990). The competitive advantage of nations. Harvard Business Review. The Porter s diamond Firm strategy, structure, and rivalry New trade theory (differentiation) Ricardo, Neo- Ricardian theory (Vernon) and the theory of international trade Linder s theory Demand conditions Factors conditions Clusters theory (Marshall, Porter) HOS, Neo-factorial theory Related and supporting industries New trade theory (economies of scale), New economic geography Economic geography

3. An application of the diamond to the wine industry List of countries studied (16 countries): Old world (3) New World (6) Challengers (7) France Italy Spain Argentina Australia Chile New Zealand South-Africa USA Brazil China Georgia Germany India Portugal U-K Method: Desk research - literature search to find relevant proxies for providing a reliable trend calculation of variables scoring via quintiles (from -2 to +2) Google survey (wine economic experts) https://docs.google.com/forms/d/e/1FAIpQLSfbq26aSo-jfsE0ZDRS31Rtss8to3-ontUGG2j5tEXIuvhgJA/viewform?c=0&w=1

3. An application of the diamond to the wine industry The 4 factors of the Porter s diamond: Factors conditions (6) Related industries (4) Market structure (6) Demand conditions (4) Agricultural land area, (vineyard area / agricultural area) Number of wine professionals (# of places giving level 3 awards in wine identified by the WSET (Wine and Spirit Education Trust) for 1 million inhabitants Number of procedures to create a firm Annual domestic consumption per capita Variations of vineyard area (over the 20 last years) Time in days to create a firm Its evolution between 2004 and 2014, Firm size Number of wineries for 1000 hectares of vineyard Evolutions of yields Annual domestic consumption Productivity level (divided by the average monthly salary) Number of wine retailers for 1000 hectares of vineyard Cooperation intensity Its evolution between 2004 and 2014 Capacity of the domestic industry to create a competitive advantage (composed statistic based on the wines value and the volume exported) revealed comparative advantage Capital intensity (number of tractors for 1000 hectares of agricultural land) Wine intensity of the domestic agriculture Vineyard area / agricultural land area Climate evolutions at a 2050 horizon Research in wine (# of wine related research institutions for 1000 hectares of vineyard)

3. An application of the diamond to the wine industry Scores by factors: Countries India New Zealand China UK Chile South Africa Brazil USA Germany Georgia France Spain Australia Italy Argentina Portugal Factors' Conditions Countries France New Zealand Germany UK Italy Australia Portugal Spain USA China Chile Georgia South Africa Brazil India Argentina Related Industries Countries 4,3 3,7 3,3 3,0 2,7 2,3 1,7 1,3 0,7 -0,7 -1,0 -1,3 -2,0 -2,3 -3,7 -4,3 Market Structure Countries 6,3 5,0 5,0 4,3 3,7 3,0 3,0 3,0 0,7 0,3 -0,3 -1,0 -1,3 -2,3 -2,7 -3,0 Demand conditions 2,8 2,4 2,2 1,8 1,6 0,6 0,4 0,0 -0,2 -0,4 -0,8 -0,8 -0,8 -1,2 -1,2 -1,6 8,0 5,0 5,0 5,0 3,0 1,0 1,0 0,0 0,0 -1,0 -3,0 -3,0 -3,0 -4,0 -4,0 -4,0 Georgia France New Zealand Italy Chile Spain Australia Portugal China UK Argentina USA South Africa India Germany Brazil Australia China USA Germany Georgia India New Zealand Argentina Chile Portugal France Italy UK South Africa Brazil Spain

3. An application of the diamond to the wine industry Global scores: expected evolution of the wine export performance Aggregated score 15.0 10.0 5.0 0.0 -5.0 -10.0

3. An application of the diamond to the wine industry Survey results: first statistics Score (Survey) 1 0.8 0.6 0.4 0.2 0 -0.2 -0.4 -0.6

3. An application of the diamond to the wine industry Survey results: comparison with the desk research Spearman corr. = 0.21 (ns) Score (desk research) Score (Survey) 15.0 1 0.8 10.0 0.6 5.0 0.4 0.2 0.0 0 -0.2 -5.0 -0.4 -10.0 -0.6

3. An application of the diamond to the wine industry Survey results: comparison with the desk research Spearman corr. = 0.21 (ns) / 0.40 w/o Argentina (significant 14%) Score (desk research) Score (Survey) 15.0 1 0.8 10.0 0.6 5.0 0.4 0.2 0.0 0 -0.2 -5.0 -0.4 -10.0 -0.6

4. Discussion Interpretation of the results: HOS vs Linder HOS: Factors conditions play a prominent role climate change and land availability will be crucial (NZ) Linder s theory: the main driver of trade performance is the domestic demand large and growing market will give a significant advantage (Chinese domination? USA?) Comparison to the existing literature: (1) economic models CGEM (Anderson and Wittwer) confirm the emergence of China and stress the role Exchange rate Macro-model (OECD-FAO, 2017; EU agri. outlook, 2017) give interesting indications of trade evolution depending on the macroeconomic conditions but never predict huge changes (prolong trends)

4. Discussion Interpretation of the results: HOS vs Linder HOS: Factors conditions are prominent climate change and land availability will be crucial Linder: the main driver of trade performance is the domestic demand large and growing market will have a significant advantage (Chinese domination? USA? UK?) EU Agricultural Outlook, 2017, p8. This report presents the medium-term outlook for the major EU agricultural commodity markets and agricultural income to 2030, based on a set of coherent macroeconomic assumptions. The baseline assumes normal agronomic and climatic conditions, steady demand and yield trends, and no particular market disruption. Comparison to the existing literature: (1) economic models CGEM (Anderson and Wittwer) confirm the emergence of China and stress the role Exchange rate Macro-model (OECD-FAO, 2017; EU agri. outlook, 2017) give interesting indications of trade evolution depending on the macroeconomic conditions but never predict huge changes (prolong trends)

4. Discussion Interpretation of the results: HOS vs Linder HOS: Factors conditions play a prominent role climate change and land availability will be crucial Linder: the main driver of trade performance is the domestic demand large and growing market will have a significant advantage (Chinese domination? USA? UK?) Comparison to the existing literature: (2) Business and management literature Morrison and Rabellotti (2017): based on a thorough analysis of the trade trends They offer a complex picture of the wine industry the challengers might become the major players in the future

4. Discussion Interest and limitation of the paper: Prospective method seems the best approach to anticipate a breakdown Despite extensive sensitivity analysis, results are subject to personal interpretation, data availability and researchers choices (like for models) Future research: Extend the survey to wine professionals Refine the variables used to proxy the diamond factors Investigate the gap between the survey and the desk research (Argentina)

International Wine Trade: International Wine Trade: A A Prospective Approach based Prospective Approach based on Porter s on Porter s Diamond Diamond Olivier Bargain LAREFI - Bordeaux University Jean-Marie Cardebat LAREFI - Bordeaux University INSEEC Business School Raphael Chiappini LAREFI - Bordeaux University Corentin Laffitte LAREFI - Bordeaux University 12th Annual AAWE Conference 2018 - Ithaca, New York, USA - June 10-14, 2018