Insights into Private Sector HIV Self-Testing in Kenya

A mystery shopper study was conducted to assess the private sector's effectiveness in providing high-quality HIV self-testing services to adolescents and young people in Kenya. The study focused on pharmacies and private health facilities participating in an HIV self-testing demonstration project. Mystery shoppers aged 18-30 visited various outlets to assess the availability and quality of HIV self-testing kits and services. The study aimed to identify key elements needed for a sustainable private sector HIV self-test market and improve access to targeted end-user groups such as adolescents.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

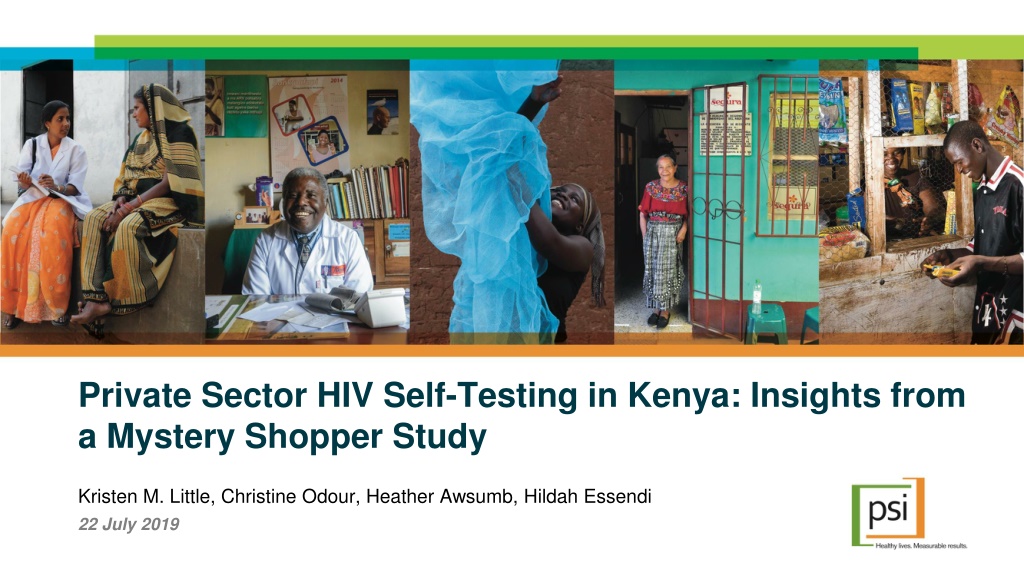

Private Sector HIV Self-Testing in Kenya: Insights from a Mystery Shopper Study Kristen M. Little, Christine Odour, Heather Awsumb, Hildah Essendi 22 July 2019

Conflicts of Interest I have no conflicts of interest to declare page 2

HIVST Demonstration Project 1. Introduce HIV self-testing to private sector in Kenya Private pharmacies & clinics Provided self-testing service delivery training to all outlets Nairobi and Mombasa Blood-based & oral-fluid test kits 2. Understand elements needed for a sustainable private sector self-test market 3. Ability to reach targeted end-user groups with HIVST in the private sector Adolescents Young adult men and women page 3

Mystery Shopper Study Background Research Objective: To understand the private sector s ability to reach adolescents and young people with high quality HIV self-testing (HIVST) services We conducted a mystery shopper study at pharmacies and private health facilities participating in an HIVST demonstration project page 4

Methods Outlets carrying HIVST kits as part of the demonstration project were randomly selected for the study Facility owners provided verbal consent Were not informed about the date or time of visits Mystery shoppers ages 18-30 recruited for study Provided a two day training and pilot testing of survey instrument Visited facilities and attempted to purchase a quality- assured HIVST kit page 5

Methods Used one of 14 pre-defined mystery shopper scenarios Shopper s age (range: 16-24 years) Reason for testing Type of kit to be purchased Questions to ask the provider. Immediately after the visit, shoppers were interviewed about their experiences using a structured guide administered by a trained data collector Quantitative and some qualitative data collected Analyzed using Stata 15.0 page 6

Majority of visits made to pharmacies Mystery Client Visits by County & Facility Type, Sept 2018 Visits evenly split between facilities in Nairobi (n=27) and Mombasa (n=28) 60 Pharmacy Health Facility 50 40 Most visits (n=41) were to pharmacies, though some visits (n=14) to private health facilities 30 20 75% 86% 10 63% 0 Nairobi Mombasa Total page 8

Self-test kits frequently stored out of sight Where were the self-tests kept in the outlet? Test kits most commonly stored in storage or back rooms in both pharmacies (41%) and health facilities (57%) Less than a quarter of the pharmacies had test kits displayed on the shelves (24%) 7 facilities (13%) did not have any quality-assured HIVST kits in stock at the time of the visit 7% Other 0% 7% In the lab 0% Health Facility Pharmacy 0% On top of the counter 0% 21% None in facility 10% 7% On the shelf 24% 0% Under the counter* 24% 57% Store room/backroom 41% 0% 10% 20% 30% 40% 50% 60% page 9

Non-quality assured HIVST also distributed Which HIV Self-Test Were You Given/Tested With? 8% (n=3) of HIVST kits given to mystery shoppers in pharmacies were not QA d kits Repackaged professional use tests Non PQ d kits manufactured in China & South Africa 70% Health Facility (N=11) 60% Pharmacy (N=37) 50% 40% 30% 20% 10% 64% 62% 36% 30% 0% 8% 0% OraQuick INSTI Other page 10

Most providers are explaining the testing process, but many need client prompting While roughly 1/3 of providers explained the testing process without prompting, this was not standard Few clients received no explanation at all Did the Provider Explain the Testing Process to You? 70% 60% Pharmacy Health Facility 50% 40% 30% 20% 10% 17% 44% 64% 39% 36% 0% 0% No Yes, Client-Initiated Yes, Provider-Initiated page 11

Most information is about test use & interpretation Were you provided an explanation of: Females more likely than males to receive all types of self-test information 0% Other 10% 10% Additional sources of information Female Male 5% 60% Where to seek support for a positive result 43% 35% Things to do to maintain status if negative result 33% 65% Seeking confirmatory testing for a positive result 52% Most information about test use, interpretation, and post-test actions 50% What to do with an invalid result? 43% 90% How to interpret the results 76% 95% Step-by-step guidance on conducting the test 76% 45% Counseling before doing the test 33% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% page 12

Price of test kits was not always consistent How much did you pay for the HIVST? Most test kits (~80%) were sold for suggested price of 500Ksh Actual price paid ranged from 0Ksh to 900Ksh Four pharmacies sold test kits for prices above 500Ksh, despite a 500Ksh price sticker on the box Pharmacy Health Facility 90% 80% 70% 60% 50% 40% 30% 16% 20% 5% 10% 78% 82% 18% 0% 0% Less than 500Ksh 500Ksh More than 500Ksh page 13

Providers Mediate End-Users Test Kit Choice [the provider] convinced me that it s cheaper and faster to use the [non-quality assured HIVST] costing 150Ksh [because] it s easy to interpret the result Provider prefers INSTI over OraQuick, stating that OraQuick is preferred for people with diabetes or those with a blood clotting problem. The provider preferred that I purchase the INSTI testing kit since it s blood-based. page 14

Conclusions page 15

Conclusions Mystery shopper survey provided a unique source of information about the quality of HIVST services in the private sector Identified important quality issues in service provision difficult to collect through routine monitoring systems Inconsistent price Non-quality-assured products Location of test kits Stock-outs Provider mediation of test kit choice Will be conducted quarterly as a form of monitoring in the second phase of the project Providers may need more ongoing support to answer client questions confidently and accurately page 16

Acknowledgements Colleagues at PSI and PS Kenya Children s Investment Fund Foundation Mystery shoppers Providers participating in the pilot project

Questions? Comments?

Extra Slides page 19

Limited information was provided about other sources of test support Did the provider refer to: Most test support information provided was about test performance, result interpretation, and IFU Other HIVST chatbot Female Male Gave HIST helpline # Referred to HIVST twitter handle Referred to HIVST facebook page Referred to beselfsure website Providers rarely mentioned the website, helpline, or other sources of information The instruction manual was enclosed How to interpret the results How the test is done 0% 20% 40% 60% 80% 100% page 20

End-user questions were usually answered, but not always satisfactorily Did the provider answer any questions you had regarding use of the kit? 49% of mystery shoppers in pharmacies and 57% of those in health facilities either did not have their questions answered, or the questions were not answered satisfactorily 60% Pharmacy Health Facility 50% 40% 30% 20% 10% 32% 21% 51% 43% 17% 36% 0% No Yes, satisfactorily Yes, unsatisfactorily page 21

Monitoring data collection was uneven Did the Provider: Providers asked to collect data on age, sex, and HIV testing history and to provide direct assistance to adolescents These activities conducted more frequently at health facilities 90% Pharmacy Health Facility 80% 70% 60% 50% 40% 30% 17% 20% 10% 64% 32% 64% 29% 43% 73% 86% 0% Ask your age** Ask if you'd ever tested for HIV before* Offer any pre-counseling Give you information about how to correctly use the kit? page 22

Indirect assistance with test performance was typically provided to consumers Did the Provider Assist you in Performing the Self-Test? Most clients received some form of assistance in both pharmacies and health facilities Roughly half had to explicitly request that assistance 60% Pharmacy Health Facility 50% 40% 30% 20% 10% 22% 43% 55% 35% 36% 0% 0% 9% 0% No Yes, Directly Yes, Indirectly (Client- Initiated) Yes, Indirectly (Provider-Initiated) page 23

Presence of HIVST signage varied significantly % of Facilities with HIVST Signage by County and Outlet Type Facilities provided with demand creation materials to display Presence of materials more common in health facilities (79%) compared to pharmacies (56%) 90% 80% 70% 60% 50% 40% 30% 20% 10% 41% 80% 67% 75% 56% 79% 0% Pharmacy Health Facility Pharmacy Health Facility Pharmacy Health Facility Nairobi* Mombasa Total page 24

Offers of professional use testing common at health facilities Did the provider offer to test you with something other than a self-test? 60% 50% 40% 30% 55% 20% 10% 16% 0% Pharmacy** Health Facility page 25