Implications of Behavioral Study on Digitalization in Retail Financial Services

Presentation at the conference focusing on the digitalization of marketing and distance selling in retail financial services. The study aims to identify commercial practices, test their effectiveness, gather consumer perceptions, and make policy recommendations based on findings from experiments, interviews, and surveys. The impact of representative examples in loan advertising and the importance of upfront information presentation are discussed.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Behavioural study on the digitalisation of the marketing and distance selling of retail financial services Presented at the conference Protecting consumers taking credit in the digital era: Can we do better?, jointly organised by CEPS-ECRI and the European Commission, Brussels, 18 June 2019 James Suter, LE Europe

Overview of the study Aim: To identify commercial practices present in the market, assess and test these, including versus remedies, and thus draw conclusions and make policy recommendations Literature review & desk research: Gathered evidence from secondary sources and identified commercial practices present in the market Interviews: Used to gather views and insights from stakeholders Focus groups: Gathered preliminary insights into consumers perceptions Assessment of EU legislation: Assessment of whether identified practices may be problematic from a legal perspective Behavioural experiments: Test the effects of commercial practices and remedies in a realistic simulated purchasing setting, current accounts and personal loans, 8,451 respondents across six Member States FI, FR, DE, LT, RO and ES Consumer survey: Coupled with the experiment; examined consumers perceptions of commercial practices 2

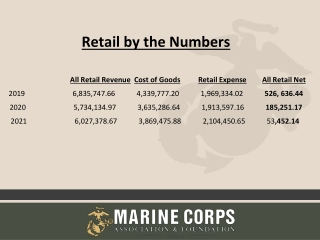

Effectiveness of the representative example in loan advertising Treatments at the advertising stage: Practice : Only the key selling point of the advertised loan is shown Remedy : Representative example is shown Remedy : Representative example & APR are shown Remedy : Representative example & message Warning! Borrowing money also costs money are shown Share of respondents who clicked on advertised loan: Treatment Practice : Key selling points only Remedy : Representative example shown Remedy : Example & APR Remedy : Example & warning Result 42% 30% *** 29% *** 31% *** Key take-away: The representative example significantly improved consumers decision-making at the advertising stage (they were less likely to click on the advert, which was suboptimal choice at that stage) 3

Impact of showing information upfront and in a neutral lay-out and order Treatments at the precontractual stage: Practice : Only the best features of the advertised loan are shown upfront, with the order of the features favouring the advertised loan Other information was not shown up-front. It was behind a more information button The best features of the advertised loan were shown upfront 4

Impact of showing information upfront and in a neutral lay-out and order Treatments at the precontractual stage: Practice : Only the best features of the advertised loan are shown upfront, with the order of the features favouring the advertised loan Remedy : All loan information is shown upfront, with a neutral lay-out and order All loan characteristics shown upfront and the lay-out is neutral (taking the SECCI as inspiration) 5

Impact of showing information upfront and in a neutral lay-out and order Treatments at the precontractual stage: Practice : Only the best features of the advertised loan are shown upfront, with the order of the features favouring the advertised loan Remedy : All loan information is shown upfront, with a neutral lay-out and order Remedy : All loan information is shown upfront, with a neutral lay-out and order, and additional explanations are available via pop-up boxes Explanations available via pop-up boxes 6

Impact of showing information upfront and in a neutral lay-out and order Treatments at the precontractual stage: Practice : Only the best features of the advertised loan are shown upfront, with the order of the features favouring the advertised loan Remedy : All loan information is shown upfront, with a neutral lay-out and order Remedy : All loan information is shown upfront, with a neutral lay-out and order, and additional explanations are available via pop-up boxes Share of respondents who chose the correct loan: Treatment Practice : Highlights benefits over costs Remedy : Upfront & neutral Remedy : Upfront & neutral + explanations .via pop-up boxes Result 36% 62% *** 61% *** Key take-away: Providing all information upfront, with a neutral lay-out and order (taking inspiration from the SECCI) significantly increased the likelihood that consumers chose the best loan 7

Conclusions The representative example in advertising: We see that the representative example in advertising works well The effect may be different in different channels, and this is something that could be examined in further studies Presenting information upfront and in a neutral way: The experiment results show that presenting information upfront and in a neutral way improves choices The question is, how do we use these findings to improve the Directive? 8

Thank you James Suter, Divisional Director, jsuter@le-europe.eu 9