How to Use Crypto Trading Signals to Maximize Your Profits?

In the fast-paced world of cryptocurrency trading, leveraging the right tools can make a significant difference. One such tool is the crypto trading signal, which provides insights and recommendations on when to buy or sell digital currencies. In the

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

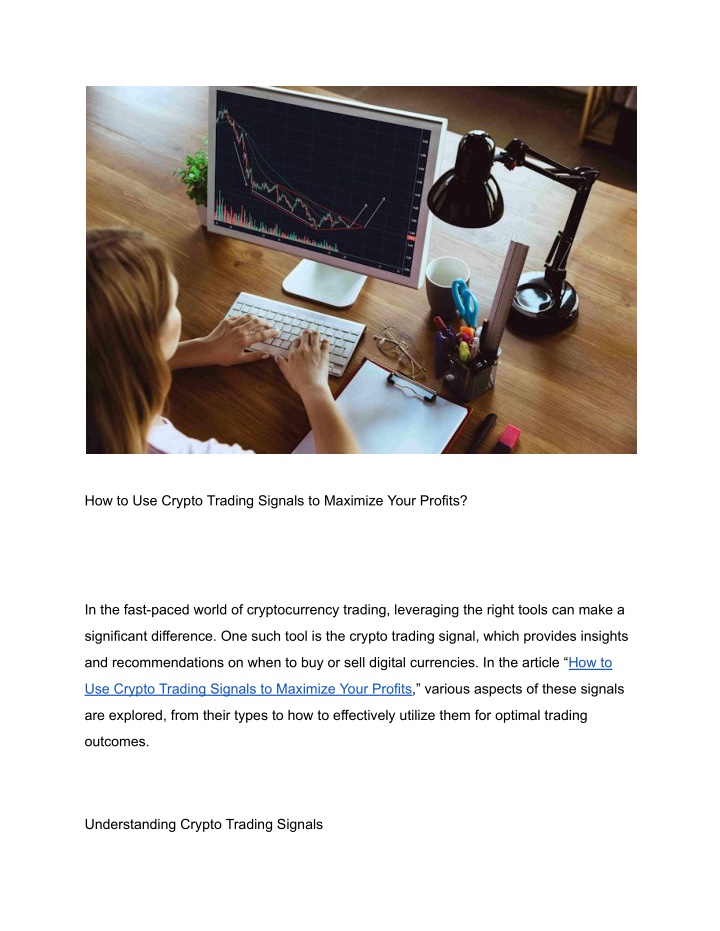

How to Use Crypto Trading Signals to Maximize Your Profits? In the fast-paced world of cryptocurrency trading, leveraging the right tools can make a significant difference. One such tool is the crypto trading signal, which provides insights and recommendations on when to buy or sell digital currencies. In the article How to Use Crypto Trading Signals to Maximize Your Profits, various aspects of these signals are explored, from their types to how to effectively utilize them for optimal trading outcomes. Understanding Crypto Trading Signals

Crypto trading signals are indicators or suggestions that help traders make informed decisions. These signals can be derived from: Technical Analysis: Utilizing charts and patterns to predict price movements.Fundamental Analysis: Evaluating news, events, and other market dynamics.Algorithms and Bots: Automated systems that analyze market data to provide recommendations.Community Feedback: Insights from experienced traders and forums. These signals offer data-driven decisions, save time, manage risks, and increase accuracy, making them indispensable for both novice and seasoned traders. Types of Crypto Trading SignalsTechnical Analysis Signals: Based on chart patterns and technical indicators like moving averages and RSI.Fundamental Analysis Signals: Influenced by news events and economic indicators.Sentiment Analysis Signals: Derived from social media trends and public opinion.Arbitrage Signals: Identifying price differences across exchanges.Automated Trading Signals: Generated by bots based on predefined strategies.Manual Signals: Provided by experienced traders through social media or private groups. Understanding these types helps traders select the best approach tailored to their strategy. How Crypto Trading Signals Work

Crypto trading signals typically include: Entry Point: When to buy a cryptocurrency.Exit Point: When to sell to maximize profits or minimize losses.Stop-Loss Levels: Limits to minimize potential losses.Technical Indicators: Charts and metrics to predict movements.Market Sentiment Analysis: Insights into overall market mood. By combining these elements, traders can make well-informed decisions that align with market conditions. Choosing the Right Crypto Trading Signal Provider Selecting a reliable signal provider involves evaluating: Reputation: User reviews and testimonials.Transparency: Clear strategy and performance information.Success Rate: Historical accuracy and profitability.Real-Time Alerts: Timely updates for market opportunities.Customer Support: Accessible and responsive assistance.Customization: Tailored alerts based on user criteria.Cost: Comparing subscription fees and potential hidden costs. A reputable provider can significantly enhance trading efficiency and profitability.

Advanced Strategies for Using Crypto Trading Signals For more effective trading, consider: Diversified Signal Sources: Cross-verify information from multiple providers.Signal Automation: Use trading bots for timely execution.Backtesting Signals: Validate signal effectiveness with historical data.Customized Alerts: Tailor signals to specific strategies.Risk Management: Implement stop-loss and take-profit orders.Signal Filtering: Use technical indicators to prioritize reliable signals. Integrating these strategies can optimize decision-making and improve trading outcomes. Future Trends in Crypto Trading Signals The future of crypto trading signals is bright, with advancements in: AI and Machine Learning: Improved accuracy through advanced algorithms.Blockchain Technology: Enhanced transparency and immutability.Decentralized Platforms: Increased accessibility and reduced reliance on centralized authorities.Customizable Signals: Tailored to individual strategies and risk tolerance.Automated Trading Bots: Seamless execution based on real-time signals.

These innovations promise to further revolutionize crypto trading, making it more efficient and profitable. Conclusion Crypto trading signals are invaluable for traders aiming to maximize profits and manage risks. As detailed in the article How to Use Crypto Trading Signals to Maximize Your Profits, understanding the various types of signals, choosing a reliable provider, and implementing advanced strategies can significantly enhance trading success. By staying informed about future trends, traders can continue to leverage these tools effectively in the dynamic world of cryptocurrency.

![Guardians of Collection Enhancing Your Trading Card Experience with the Explorer Sleeve Bundle [4-pack]](/thumb/3698/guardians-of-collection-enhancing-your-trading-card-experience-with-the-explorer-sleeve-bundle-4-pack.jpg)